MrKerbe

Belum ada konten

MrKerbe

Analisis #SIL

SOL telah berbohong selama beberapa hari (kami mengembalikan meme tentang 5: 2 dan sisanya) dan transaksi di blockchain tidak dieksekusi, yang juga berdampak negatif terhadap tingkat aset.

Ada desas-desus tentang spot SOL ETF, yang saya belum benar-benar percaya. Tetapi beberapa harapan untuk spot SOL ETF mulai dibangun sekarang. Aset ini memiliki banyak pemicu pertumbuhan - meme, token pada blockchain SOL, pengembangan teknis jaringan, analisis teknis bullish dalam istilah global. Proyek ini sangat kuat dan token pada blockchain-nya menunjukkan dinamika terbaik saat ini.

Sekaran

SOL telah berbohong selama beberapa hari (kami mengembalikan meme tentang 5: 2 dan sisanya) dan transaksi di blockchain tidak dieksekusi, yang juga berdampak negatif terhadap tingkat aset.

Ada desas-desus tentang spot SOL ETF, yang saya belum benar-benar percaya. Tetapi beberapa harapan untuk spot SOL ETF mulai dibangun sekarang. Aset ini memiliki banyak pemicu pertumbuhan - meme, token pada blockchain SOL, pengembangan teknis jaringan, analisis teknis bullish dalam istilah global. Proyek ini sangat kuat dan token pada blockchain-nya menunjukkan dinamika terbaik saat ini.

Sekaran

SOL0,09%

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

MrKerbe :

:

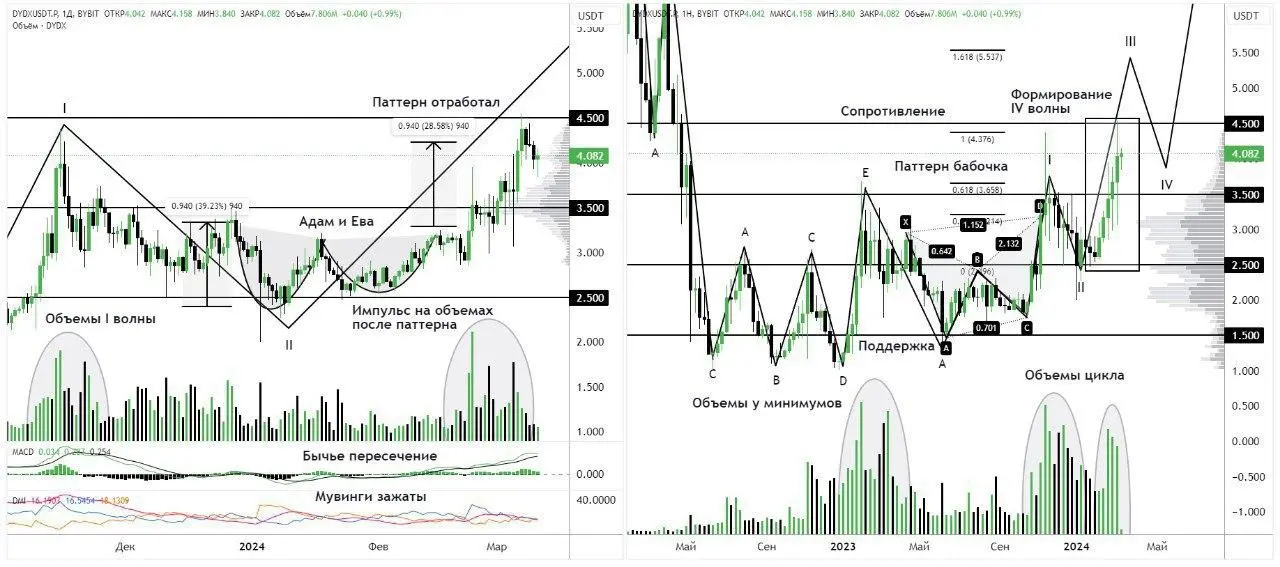

Membeli Kembali Musim Gugur 🤑🔎 Analisis #DYDX

Ada tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Harga mulai bereaksi terhadap level support $1,5 dan menemui resistance di $2,5. Setelah peningkatan volume muncul, harga mencoba untuk mendapatkan pijakan di atas $2,5, tetapi sekali lagi turun ke arah support. Pada akhir perdagangan pendek, volume muncul lagi dan harga membentuk gelombang pertama siklus. Pola kupu-kupu yang harmonis telah terbentuk dalam bentuk pembalikan berbentuk W, yang menunjukkan selesainya koreksi koin. Wave I menemui resistance di $3,5.

Kemunduran dalam bentuk gelomban

Lihat AsliAda tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Harga mulai bereaksi terhadap level support $1,5 dan menemui resistance di $2,5. Setelah peningkatan volume muncul, harga mencoba untuk mendapatkan pijakan di atas $2,5, tetapi sekali lagi turun ke arah support. Pada akhir perdagangan pendek, volume muncul lagi dan harga membentuk gelombang pertama siklus. Pola kupu-kupu yang harmonis telah terbentuk dalam bentuk pembalikan berbentuk W, yang menunjukkan selesainya koreksi koin. Wave I menemui resistance di $3,5.

Kemunduran dalam bentuk gelomban

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

Earn50WithABang :

:

Koin sial, jangan membelinyaLihat Lebih Banyak

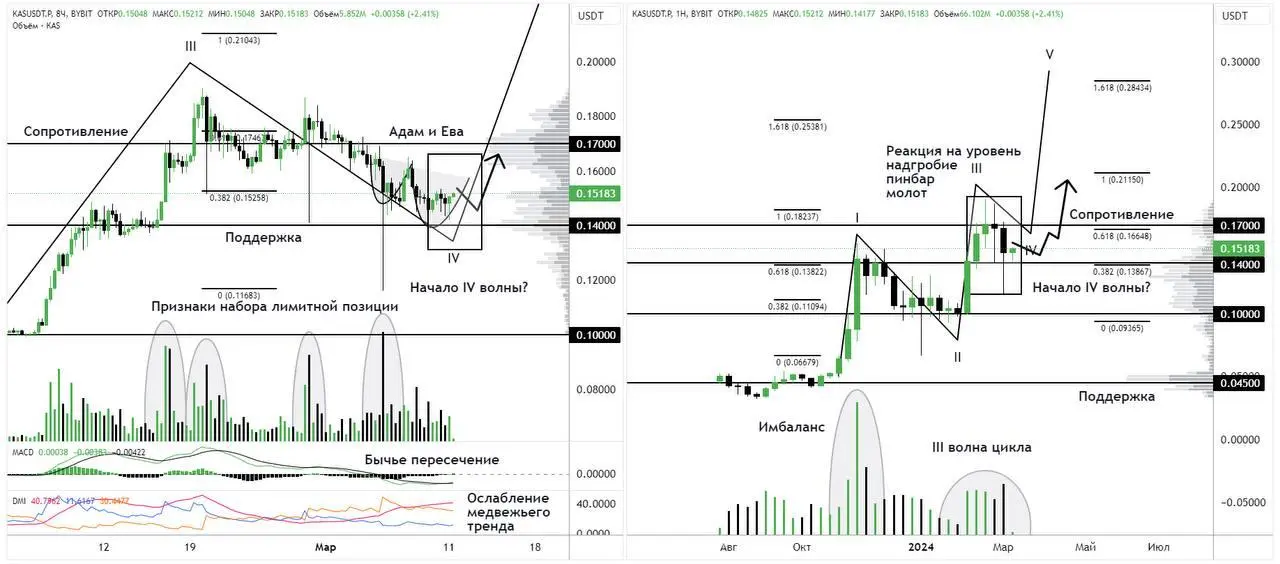

🔎 Analisis #KAS

Dari level support $0,045, harga mulai menguat dan volume yang tidak seimbang tampak lebih dekat ke level $1. Dengan semua indikasi, koin membentuk siklus lima gelombang ke atas menurut teori Elliott📈. Gelombang pertama siklus berakhir di sekitar $ 0,14. Gelombang korektif II mempertahankan struktur ke atas, ada upaya untuk pergi ke dukungan global, tetapi pembeli bereaksi dan gelombang berakhir pada $1. Dari level ini, volume wave III muncul dan harga menemui resistance di $0,17.

Sekarang gelombang telah berakhir dan gelombang turun IV mulai terbentuk. Adalah penting bahwa h

Lihat AsliDari level support $0,045, harga mulai menguat dan volume yang tidak seimbang tampak lebih dekat ke level $1. Dengan semua indikasi, koin membentuk siklus lima gelombang ke atas menurut teori Elliott📈. Gelombang pertama siklus berakhir di sekitar $ 0,14. Gelombang korektif II mempertahankan struktur ke atas, ada upaya untuk pergi ke dukungan global, tetapi pembeli bereaksi dan gelombang berakhir pada $1. Dari level ini, volume wave III muncul dan harga menemui resistance di $0,17.

Sekarang gelombang telah berakhir dan gelombang turun IV mulai terbentuk. Adalah penting bahwa h

- Hadiah

- 5

- Komentar

- Posting ulang

- Bagikan

🔎 Analisis #FLR

Harga koin menemui resistensi di $0,055, mencapai level tertinggi di $0,058. Agaknya, itu membentuk semua kemungkinan lima gelombang dari siklus ke atas menurut teori Elliott📈. Ini dimulai dari level $ 0,017, harga mulai menekan ke arahnya. Setelah itu, tiba-tiba meninggalkan segitiga turun ke atas.

Gelombang pertama dari siklus ke atas ternyata merupakan dorongan pada volume besar. Gelombang maksimum mencapai $0,0237 dan pergi ke koreksi jangka pendek gelombang II. Dalam gelombang, harga sedikit turun di bawah level $0,021 menjadi $0,02 dan mempertahankan struktur ke atas. G

Lihat AsliHarga koin menemui resistensi di $0,055, mencapai level tertinggi di $0,058. Agaknya, itu membentuk semua kemungkinan lima gelombang dari siklus ke atas menurut teori Elliott📈. Ini dimulai dari level $ 0,017, harga mulai menekan ke arahnya. Setelah itu, tiba-tiba meninggalkan segitiga turun ke atas.

Gelombang pertama dari siklus ke atas ternyata merupakan dorongan pada volume besar. Gelombang maksimum mencapai $0,0237 dan pergi ke koreksi jangka pendek gelombang II. Dalam gelombang, harga sedikit turun di bawah level $0,021 menjadi $0,02 dan mempertahankan struktur ke atas. G

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

🔎 Analisis #MANA

Ada tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Volume besar terlihat di tengah zigzag koreksi ABC dari level $0,3. Ini adalah reaksi pertama pembeli terhadap posisi terendah lokal koin. Harga terus menurun dalam wave C dan melewati level $0,3, yang sekarang menjadi support global.

Pada volume di atas rata-rata, harga membentuk gelombang pertama dari siklus naik. Itu berakhir pada $ 0,60 di atas level kunci $ 0,47. Gelombang korektif II mempertahankan struktur siklus ke atas dan berakhir di sekitar level $0,47. Dari level ini, harga memulai

Lihat AsliAda tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Volume besar terlihat di tengah zigzag koreksi ABC dari level $0,3. Ini adalah reaksi pertama pembeli terhadap posisi terendah lokal koin. Harga terus menurun dalam wave C dan melewati level $0,3, yang sekarang menjadi support global.

Pada volume di atas rata-rata, harga membentuk gelombang pertama dari siklus naik. Itu berakhir pada $ 0,60 di atas level kunci $ 0,47. Gelombang korektif II mempertahankan struktur siklus ke atas dan berakhir di sekitar level $0,47. Dari level ini, harga memulai

- Hadiah

- 3

- Komentar

- Posting ulang

- Bagikan

🔎 Analisis #MANA

Ada tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Volume besar terlihat di tengah zigzag koreksi ABC dari level $0,3. Ini adalah reaksi pertama pembeli terhadap posisi terendah lokal koin. Harga terus menurun dalam wave C dan melewati level $0,3, yang sekarang menjadi support global.

Pada volume di atas rata-rata, harga membentuk gelombang pertama dari siklus naik. Itu berakhir pada $ 0,60 di atas level kunci $ 0,47. Gelombang korektif II mempertahankan struktur siklus ke atas dan berakhir di sekitar level $0,47. Dari level ini, harga memulai

Lihat AsliAda tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Volume besar terlihat di tengah zigzag koreksi ABC dari level $0,3. Ini adalah reaksi pertama pembeli terhadap posisi terendah lokal koin. Harga terus menurun dalam wave C dan melewati level $0,3, yang sekarang menjadi support global.

Pada volume di atas rata-rata, harga membentuk gelombang pertama dari siklus naik. Itu berakhir pada $ 0,60 di atas level kunci $ 0,47. Gelombang korektif II mempertahankan struktur siklus ke atas dan berakhir di sekitar level $0,47. Dari level ini, harga memulai

- Hadiah

- 3

- Komentar

- Posting ulang

- Bagikan

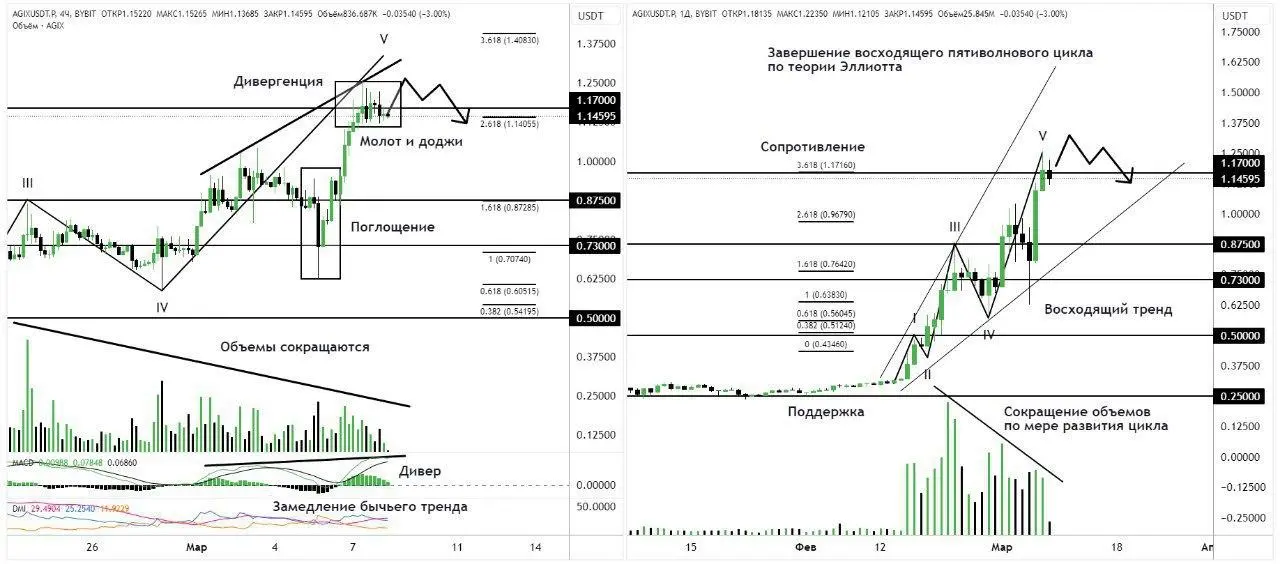

🔎 Analisis #AGIX

Harga koin mungkin membentuk semua kemungkinan lima gelombang siklus naik Teori Elliott📈. Harga mulai menyusut dari level support $0,25. Volume muncul dan gelombang pertama dari siklus ke atas terbentuk. Gelombang mencapai level maksimum $0,43 dan pergi ke koreksi pendek gelombang II. Ini sedikit turun di bawah level $ 0,5 menjadi $ 0,47 dan mempertahankan struktur ke atas. Level $0,5 telah bertindak sebagai resistance sejak Maret 2023.

Gelombang ketiga dari siklus berkembang pada volume besar. Ini bertemu resistensi lokal dan berakhir pada $ 0,8653. Koreksi gelombang IV tid

Lihat AsliHarga koin mungkin membentuk semua kemungkinan lima gelombang siklus naik Teori Elliott📈. Harga mulai menyusut dari level support $0,25. Volume muncul dan gelombang pertama dari siklus ke atas terbentuk. Gelombang mencapai level maksimum $0,43 dan pergi ke koreksi pendek gelombang II. Ini sedikit turun di bawah level $ 0,5 menjadi $ 0,47 dan mempertahankan struktur ke atas. Level $0,5 telah bertindak sebagai resistance sejak Maret 2023.

Gelombang ketiga dari siklus berkembang pada volume besar. Ini bertemu resistensi lokal dan berakhir pada $ 0,8653. Koreksi gelombang IV tid

- Hadiah

- 4

- Komentar

- Posting ulang

- Bagikan

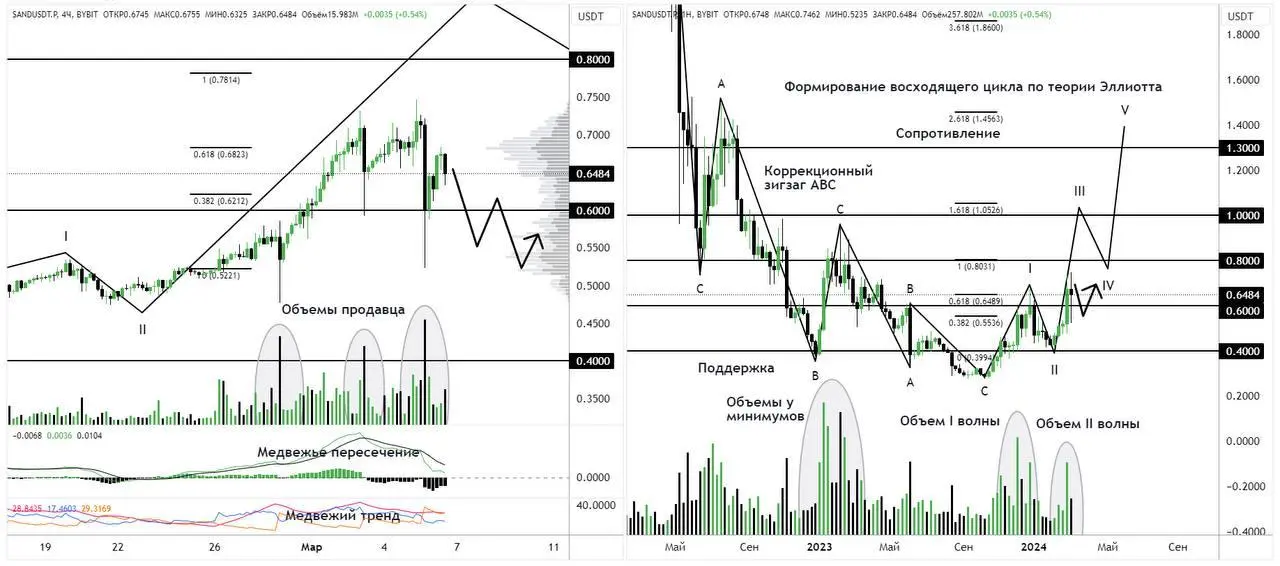

🔎 Analisis #SAND

Koin terkoreksi dalam ABC zigzag dan mencapai level $ 0,4, di mana peningkatan volume muncul. Setelah level ini dilewati, harga mungkin mulai membentuk siklus lima gelombang ke atas menurut teori Elliott📈. Siklus mulai terbentuk pada volume di atas rata-rata. Wave I berakhir pada $0,68 dan pindah ke wave II korektif. Itu berakhir tepat di atas dukungan $ 0,4.

Sekarang pembentukan gelombang ketiga mungkin sedang terjadi. Target perkiraan menurut tren ekstensi Fibo adalah $1. Agar gelombang terbentuk dengan benar, perlu untuk mengatasi maksimum gelombang I. Sekarang harga meng

Lihat AsliKoin terkoreksi dalam ABC zigzag dan mencapai level $ 0,4, di mana peningkatan volume muncul. Setelah level ini dilewati, harga mungkin mulai membentuk siklus lima gelombang ke atas menurut teori Elliott📈. Siklus mulai terbentuk pada volume di atas rata-rata. Wave I berakhir pada $0,68 dan pindah ke wave II korektif. Itu berakhir tepat di atas dukungan $ 0,4.

Sekarang pembentukan gelombang ketiga mungkin sedang terjadi. Target perkiraan menurut tren ekstensi Fibo adalah $1. Agar gelombang terbentuk dengan benar, perlu untuk mengatasi maksimum gelombang I. Sekarang harga meng

- Hadiah

- 3

- Komentar

- Posting ulang

- Bagikan

🔎 Analisis #AR

Harga juga berkonsolidasi di posisi terendah dan membentuk pola tiga gerakan turun, yang bekerja sedikit terlambat. Setelah angka tersebut, harga turun pada support $5. Saya ingin mencatat bahwa volume mulai muncul setelah pola dan setelah kerusakan, yang menandakan pergerakan ke atas yang akan segera terjadi, yang tidak lama datang. Harga membentuk gelombang pertama dari siklus lima gelombang ke atas menurut teori Elliott📈, yang berakhir pada $16.526.

Gelombang kedua korektif ternyata cukup pendek, tidak berada di bawah dasar gelombang I, yaitu mempertahankan struktur siklus

Lihat AsliHarga juga berkonsolidasi di posisi terendah dan membentuk pola tiga gerakan turun, yang bekerja sedikit terlambat. Setelah angka tersebut, harga turun pada support $5. Saya ingin mencatat bahwa volume mulai muncul setelah pola dan setelah kerusakan, yang menandakan pergerakan ke atas yang akan segera terjadi, yang tidak lama datang. Harga membentuk gelombang pertama dari siklus lima gelombang ke atas menurut teori Elliott📈, yang berakhir pada $16.526.

Gelombang kedua korektif ternyata cukup pendek, tidak berada di bawah dasar gelombang I, yaitu mempertahankan struktur siklus

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

🔎 Analisis #FTM

Harga telah berkonsolidasi di dekat posisi terendah global $ 0,2. Upaya pertama untuk pindah ke gerakan ke atas terjadi setelah peningkatan volume. Dari level $0,4 di zigzag ABC, volume yang tidak seimbang muncul, yang merupakan sinyal aktivitas dalam koin. Setelah itu, harga sekali lagi mencapai support $0,2, di mana volume juga muncul.

Sekarang koin telah membentuk 2 gelombang dari 5 kemungkinan dalam siklus lima gelombang ke atas menurut teori Elliott📈. Wave I dimulai dari level support $0,2, berkembang pada peningkatan volume dan mencapai level tertinggi di $0,57. Gelomba

Lihat AsliHarga telah berkonsolidasi di dekat posisi terendah global $ 0,2. Upaya pertama untuk pindah ke gerakan ke atas terjadi setelah peningkatan volume. Dari level $0,4 di zigzag ABC, volume yang tidak seimbang muncul, yang merupakan sinyal aktivitas dalam koin. Setelah itu, harga sekali lagi mencapai support $0,2, di mana volume juga muncul.

Sekarang koin telah membentuk 2 gelombang dari 5 kemungkinan dalam siklus lima gelombang ke atas menurut teori Elliott📈. Wave I dimulai dari level support $0,2, berkembang pada peningkatan volume dan mencapai level tertinggi di $0,57. Gelomba

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

GateUser-4fc4a3b5 :

:

Menyergap koin 📈 seratus kali lipat🔎 Analisis #BEAM

Harga koin mencapai level $0,01 setelah perdagangan singkat. Tingkat ini berfungsi sebagai titik awal untuk siklus lima gelombang ke atas menurut teori Elliott📈. Gelombang pertama siklus terbentuk pada peningkatan volume dan mencapai maksimum pada $0,027416. Setelah itu, harga pergi ke gelombang korektif kedua. Hampir di tengah gelombang, volume yang tidak seimbang muncul, setelah tekanan yang lama. Harga kembali ke nilai sebelumnya dan terus menarik gelombang kedua. Di ujungnya terbentuk cangkir dengan pola pegangan. Pola ini dibentuk sebagai dorongan untuk gelombang III. N

Lihat AsliHarga koin mencapai level $0,01 setelah perdagangan singkat. Tingkat ini berfungsi sebagai titik awal untuk siklus lima gelombang ke atas menurut teori Elliott📈. Gelombang pertama siklus terbentuk pada peningkatan volume dan mencapai maksimum pada $0,027416. Setelah itu, harga pergi ke gelombang korektif kedua. Hampir di tengah gelombang, volume yang tidak seimbang muncul, setelah tekanan yang lama. Harga kembali ke nilai sebelumnya dan terus menarik gelombang kedua. Di ujungnya terbentuk cangkir dengan pola pegangan. Pola ini dibentuk sebagai dorongan untuk gelombang III. N

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

MrKerbe :

:

Halving BTC akan menyebabkan penerbangan ke bulan 🚀Bitcoin lebih mahal dari $ 65.000, selamat untuk semua orang. Dan sekarang untuk analisis alts

🔎 #MKR Analisis

Koin bergerak dalam siklus lima gelombang ke atas menurut teori Elliott📈. Pada support $600, pola head and shoulders terbalik terbentuk, yang mendorong harga untuk berbalik. Setelah angka itu, ada pergantian, tetapi strukturnya dipertahankan. Dan dari support, harga memulai gelombang pertama pada kenaikan volume. Ini mengatasi dua level konsolidasi utama: $940 dan $1.245. Ini memuncak pada $ 1653.

Kemunduran gelombang II cukup cepat, yang menunjukkan kekuatan tren naik. Gelombang ko

Lihat Asli🔎 #MKR Analisis

Koin bergerak dalam siklus lima gelombang ke atas menurut teori Elliott📈. Pada support $600, pola head and shoulders terbalik terbentuk, yang mendorong harga untuk berbalik. Setelah angka itu, ada pergantian, tetapi strukturnya dipertahankan. Dan dari support, harga memulai gelombang pertama pada kenaikan volume. Ini mengatasi dua level konsolidasi utama: $940 dan $1.245. Ini memuncak pada $ 1653.

Kemunduran gelombang II cukup cepat, yang menunjukkan kekuatan tren naik. Gelombang ko

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

🔎 #BSV Analisis

Koin menyelesaikan koreksi besar pada $30. Ini membentuk gelombang pertama dari siklus lima gelombang naik menurut teori Elliott📈. Sebelum transfer, ada volume untuk membeli. Harga bereaksi terhadap penurunan ini dengan dorongan dan kembali ke level lokal $50. Setelah itu, jatuh ke level $30 dan menggunakannya sebagai support.

Gelombang ke atas dari siklus disertai dengan peningkatan volume dan berakhir pada $59. Gelombang kedua korektif mempertahankan struktur siklus ke atas, menandai titik terendah di $38,39. Gelombang ketiga dari siklus berkembang pada volume yang lebih be

Lihat AsliKoin menyelesaikan koreksi besar pada $30. Ini membentuk gelombang pertama dari siklus lima gelombang naik menurut teori Elliott📈. Sebelum transfer, ada volume untuk membeli. Harga bereaksi terhadap penurunan ini dengan dorongan dan kembali ke level lokal $50. Setelah itu, jatuh ke level $30 dan menggunakannya sebagai support.

Gelombang ke atas dari siklus disertai dengan peningkatan volume dan berakhir pada $59. Gelombang kedua korektif mempertahankan struktur siklus ke atas, menandai titik terendah di $38,39. Gelombang ketiga dari siklus berkembang pada volume yang lebih be

- Hadiah

- 2

- Komentar

- Posting ulang

- Bagikan

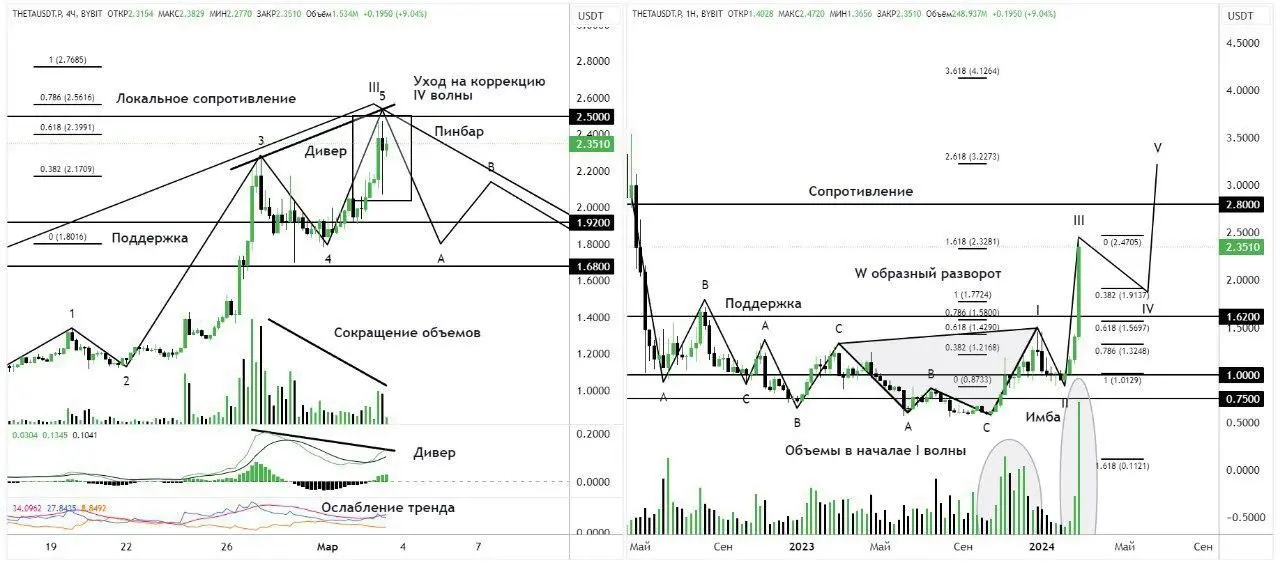

🔎 Analisis #THETA

Koin telah berkonsolidasi pada posisi terendah sepanjang tahun. Harga telah menguji level $0,75 dua kali. Volume muncul dan siklus lima gelombang ke atas mulai terbentuk sesuai dengan teori Elliott📈. Setelah mengatasi level $0,75, harga mencapai tertinggi lokal di $1,46, yang menyelesaikan gelombang pertama. Zigziag korektif ABC dan gelombang I dari siklus membentuk pola pembalikan berbentuk W. Pola ini mulai berhasil setelah gelombang korektif kedua. Potensinya berkontribusi pada pengembangan gelombang ke atas ketiga.

Pada gilirannya, wave II mempertahankan struktur siklus

Lihat AsliKoin telah berkonsolidasi pada posisi terendah sepanjang tahun. Harga telah menguji level $0,75 dua kali. Volume muncul dan siklus lima gelombang ke atas mulai terbentuk sesuai dengan teori Elliott📈. Setelah mengatasi level $0,75, harga mencapai tertinggi lokal di $1,46, yang menyelesaikan gelombang pertama. Zigziag korektif ABC dan gelombang I dari siklus membentuk pola pembalikan berbentuk W. Pola ini mulai berhasil setelah gelombang korektif kedua. Potensinya berkontribusi pada pengembangan gelombang ke atas ketiga.

Pada gilirannya, wave II mempertahankan struktur siklus

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

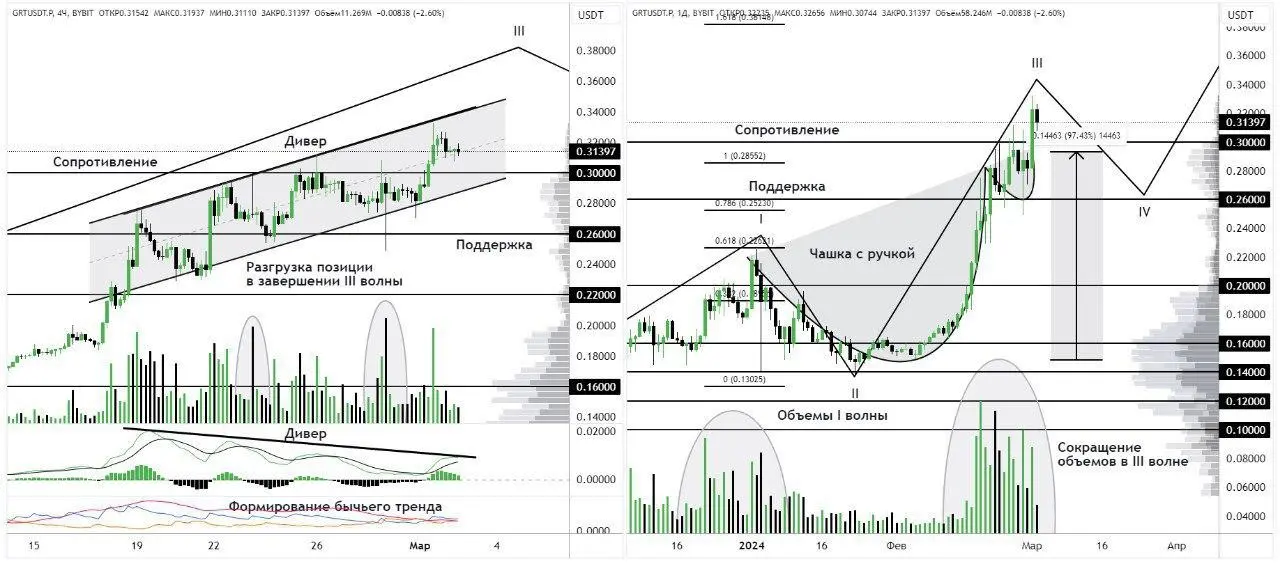

🔎 #GRT Analisis

Harga koin bergerak dalam siklus lima gelombang ke atas menurut teori Elliott📈. Sebelum dimulainya siklus, harga turun di bawah $0,1. Sifat koin yang oversold menarik pemain, dan volume muncul. Setelah itu, dorongan gelombang pertama terbentuk, di mana harga mengatasi level kunci dari perdagangan sebelumnya: $0,12, $0,14, $0,16.

Ini mematahkan resistensi tahap bearish dari siklus $0,2 dan mencapai level tertinggi di $0,2255. Sedikit kurang mencapai tertinggi sebelumnya, harga pergi untuk koreksi dalam kerangka gelombang II. Ia menemukan dukungan di tingkat lokal $ 0,14 dan m

Lihat AsliHarga koin bergerak dalam siklus lima gelombang ke atas menurut teori Elliott📈. Sebelum dimulainya siklus, harga turun di bawah $0,1. Sifat koin yang oversold menarik pemain, dan volume muncul. Setelah itu, dorongan gelombang pertama terbentuk, di mana harga mengatasi level kunci dari perdagangan sebelumnya: $0,12, $0,14, $0,16.

Ini mematahkan resistensi tahap bearish dari siklus $0,2 dan mencapai level tertinggi di $0,2255. Sedikit kurang mencapai tertinggi sebelumnya, harga pergi untuk koreksi dalam kerangka gelombang II. Ia menemukan dukungan di tingkat lokal $ 0,14 dan m

- Hadiah

- 3

- Komentar

- Posting ulang

- Bagikan

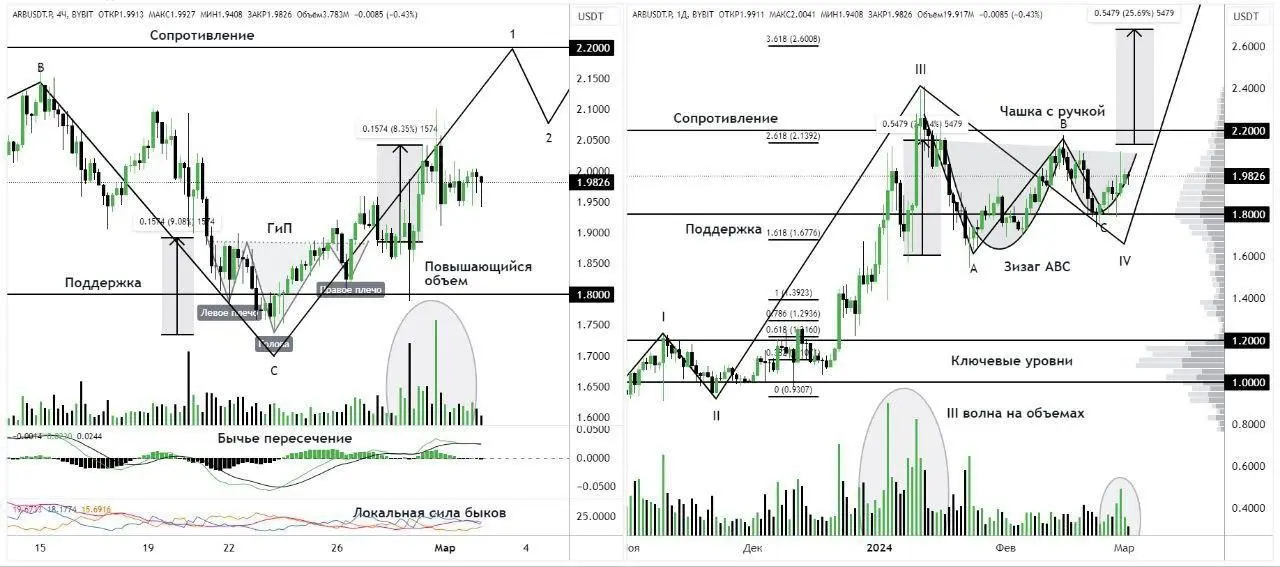

🔎 #ARB Analisis

Harga bergerak dalam siklus Elliott📈 lima gelombang ke atas. Saat ini, 3 gelombang dari 5 kemungkinan telah sepenuhnya dilaksanakan. Wave I terbentuk setelah level support global $1 dilewati. Pembentukan gelombang terjadi pada volume, yang menegaskan kebenaran pembentukan siklus ke atas. Harga mencapai level kunci $1,2 dan berguling kembali dalam wave II, sebentar berada di bawah level $1.

Tetapi struktur siklusnya tidak rusak, dan harganya naik membentuk gelombang ketiga. Meningkatnya volume berkontribusi untuk mengatasi level kunci $1,2 dan $1,8. ATH sebelumnya hanya sekita

Lihat AsliHarga bergerak dalam siklus Elliott📈 lima gelombang ke atas. Saat ini, 3 gelombang dari 5 kemungkinan telah sepenuhnya dilaksanakan. Wave I terbentuk setelah level support global $1 dilewati. Pembentukan gelombang terjadi pada volume, yang menegaskan kebenaran pembentukan siklus ke atas. Harga mencapai level kunci $1,2 dan berguling kembali dalam wave II, sebentar berada di bawah level $1.

Tetapi struktur siklusnya tidak rusak, dan harganya naik membentuk gelombang ketiga. Meningkatnya volume berkontribusi untuk mengatasi level kunci $1,2 dan $1,8. ATH sebelumnya hanya sekita

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

【OpportunityKnocks】 :

:

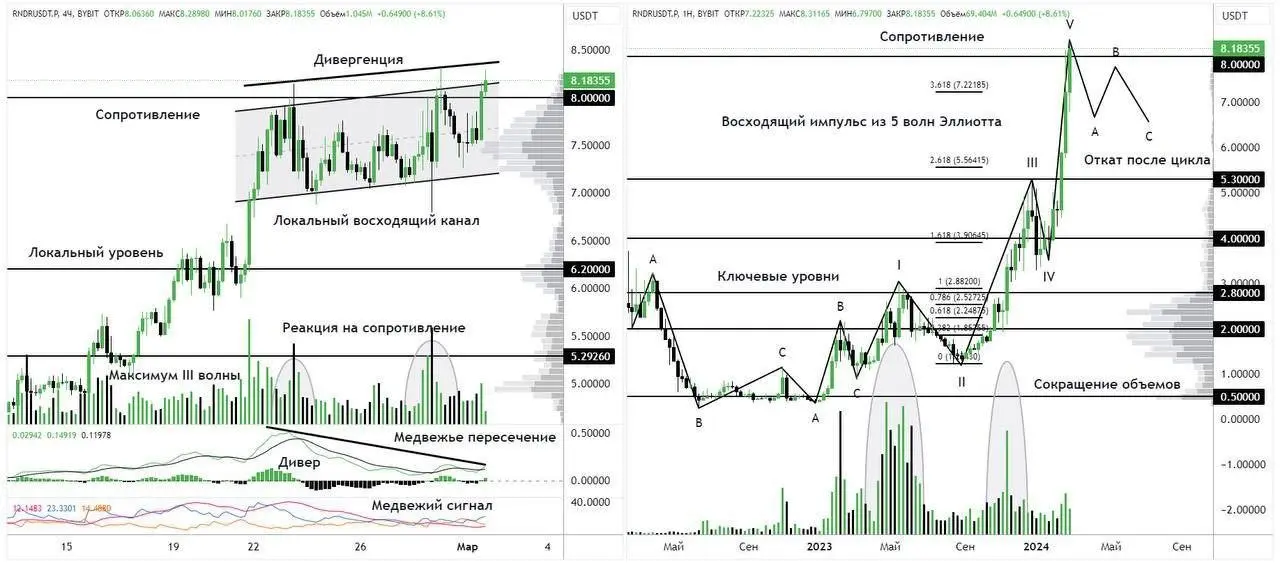

BTC menarik kembali ke 58000 dan semua gelombang terganggu🔎 #RNDR Analisis

Siklus lima gelombang ke atas menurut teori Elliott📈 telah terbentuk. Sampai saat ini, kelima gelombang siklus telah dilaksanakan. Perpanjangan tren level Fibonacci dan profil volume mengkonfirmasi hal ini. Wave I terbentuk setelah dorongan ke atas dari level $0,5. Setelah koreksi singkat, volume pembeli muncul dan harga naik menjadi $2,8. Gelombang korektif kedua berakhir pada $1,2. Dengan demikian, struktur naik telah dipertahankan.

Sebagai bagian dari wave III, harga menembus level kunci $2,8, yang menandai awal dari reli bullish. Harga menguat ke level $5,3, yang merupak

Siklus lima gelombang ke atas menurut teori Elliott📈 telah terbentuk. Sampai saat ini, kelima gelombang siklus telah dilaksanakan. Perpanjangan tren level Fibonacci dan profil volume mengkonfirmasi hal ini. Wave I terbentuk setelah dorongan ke atas dari level $0,5. Setelah koreksi singkat, volume pembeli muncul dan harga naik menjadi $2,8. Gelombang korektif kedua berakhir pada $1,2. Dengan demikian, struktur naik telah dipertahankan.

Sebagai bagian dari wave III, harga menembus level kunci $2,8, yang menandai awal dari reli bullish. Harga menguat ke level $5,3, yang merupak

ADX-0,3%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

FinancialAge :

:

Menyergap koin 📈 seratus kali lipat🔎 #LDO Analisis

Koin terkoreksi dalam pola ABC zigzag dan mencapai posisi terendah $ 0,875. Oversale koin menarik para pedagang, yang dapat dilihat dalam volume besar dari posisi terendah. Pada momentum, koin menembus level $ 1,5 dan sekarang menjadi support global. Dorongan ini adalah awal dari pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Gelombang momentum pertama berakhir pada $3. Gelombang korektif kedua berakhir di dekat support global $1,5. Struktur siklus belum terganggu, dan sekarang pembentukan gelombang ketiga siklus mungkin terus berlanjut.

Secara lokal, harg

Lihat AsliKoin terkoreksi dalam pola ABC zigzag dan mencapai posisi terendah $ 0,875. Oversale koin menarik para pedagang, yang dapat dilihat dalam volume besar dari posisi terendah. Pada momentum, koin menembus level $ 1,5 dan sekarang menjadi support global. Dorongan ini adalah awal dari pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Gelombang momentum pertama berakhir pada $3. Gelombang korektif kedua berakhir di dekat support global $1,5. Struktur siklus belum terganggu, dan sekarang pembentukan gelombang ketiga siklus mungkin terus berlanjut.

Secara lokal, harg

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

🔎 Analisis #NEAR

Koin terkoreksi dalam ABC zigzag dan menandai level support $1. Siklus lima gelombang ke atas menurut teori Elliott📈 sekarang mungkin terbentuk. Koin telah mengatasi level kunci pada volume yang meningkat dan sekarang mulai membentuk gelombang ketiga siklus.

Saat ini, dua gelombang dari siklus lima kemungkinan telah terbentuk. Wave I mengatasi level $3,5 dan mundur. Sekarang level ini bertindak sebagai dukungan lokal. Gelombang korektif kedua mungkin sudah berakhir, dan sekarang harga membentuk gelombang ketiga. Target perkiraan untuk gelombang ini adalah $5.8 Fibonacci retr

Koin terkoreksi dalam ABC zigzag dan menandai level support $1. Siklus lima gelombang ke atas menurut teori Elliott📈 sekarang mungkin terbentuk. Koin telah mengatasi level kunci pada volume yang meningkat dan sekarang mulai membentuk gelombang ketiga siklus.

Saat ini, dua gelombang dari siklus lima kemungkinan telah terbentuk. Wave I mengatasi level $3,5 dan mundur. Sekarang level ini bertindak sebagai dukungan lokal. Gelombang korektif kedua mungkin sudah berakhir, dan sekarang harga membentuk gelombang ketiga. Target perkiraan untuk gelombang ini adalah $5.8 Fibonacci retr

BCH0,21%

- Hadiah

- 1

- Komentar

- Posting ulang

- Bagikan

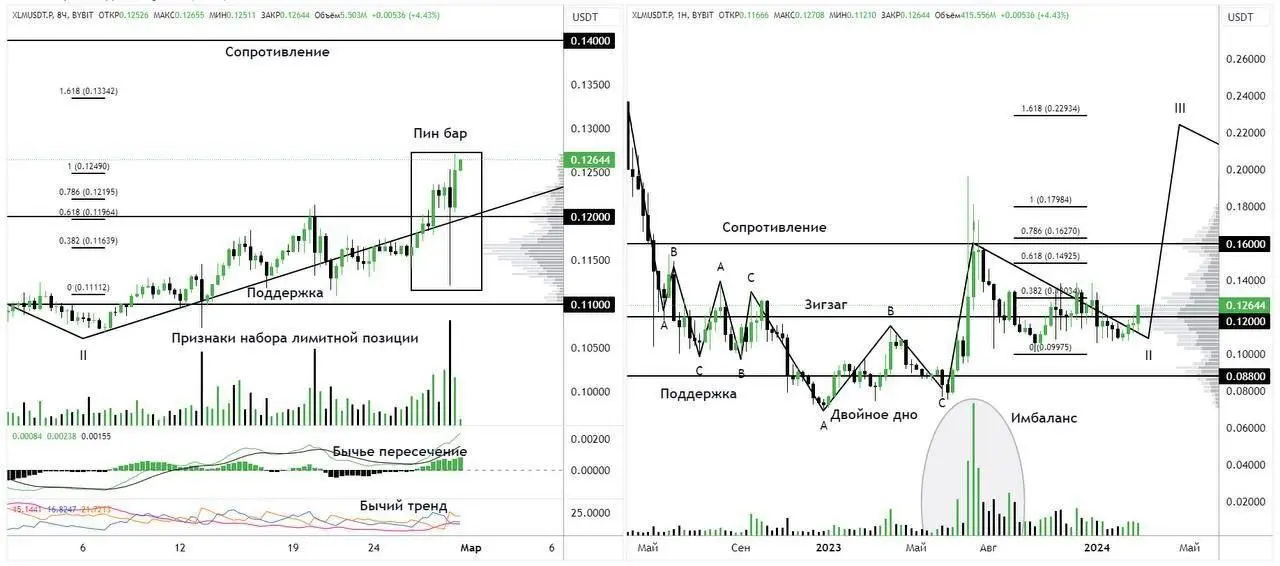

🔎 #XLM Analisis

Ada tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Koin terkoreksi dalam pola ABC zigzag dan menandai level support $0,088. Pada saat yang sama, pola pembalikan double bottom terbentuk. Harga turun dua kali di garis support. Setelah itu, volume yang tidak seimbang muncul dan harga mulai membentuk siklus naik.

Saat ini, dua gelombang dari siklus lima kemungkinan telah terbentuk. Wave I mencapai level $0,16 dan mundur. Sekarang level ini bertindak sebagai resistance. Gelombang korektif kedua tidak turun di bawah $0,11 dan sekarang mungkin sepenuh

Lihat AsliAda tanda-tanda pembentukan siklus lima gelombang ke atas menurut teori Elliott📈. Koin terkoreksi dalam pola ABC zigzag dan menandai level support $0,088. Pada saat yang sama, pola pembalikan double bottom terbentuk. Harga turun dua kali di garis support. Setelah itu, volume yang tidak seimbang muncul dan harga mulai membentuk siklus naik.

Saat ini, dua gelombang dari siklus lima kemungkinan telah terbentuk. Wave I mencapai level $0,16 dan mundur. Sekarang level ini bertindak sebagai resistance. Gelombang korektif kedua tidak turun di bawah $0,11 dan sekarang mungkin sepenuh

- Hadiah

- suka

- Komentar

- Posting ulang

- Bagikan

Topik Trending

Lihat Lebih Banyak55.89K Popularitas

32.52K Popularitas

26.27K Popularitas

9.33K Popularitas

20.18K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$3.4KHolder:10.00%

- MC:$3.69KHolder:21.00%

- MC:$3.77KHolder:21.27%

- MC:$3.41KHolder:10.00%

- MC:$3.46KHolder:20.05%

Sematkan