Kingbest

Aucun contenu pour l'instant

Kingbest

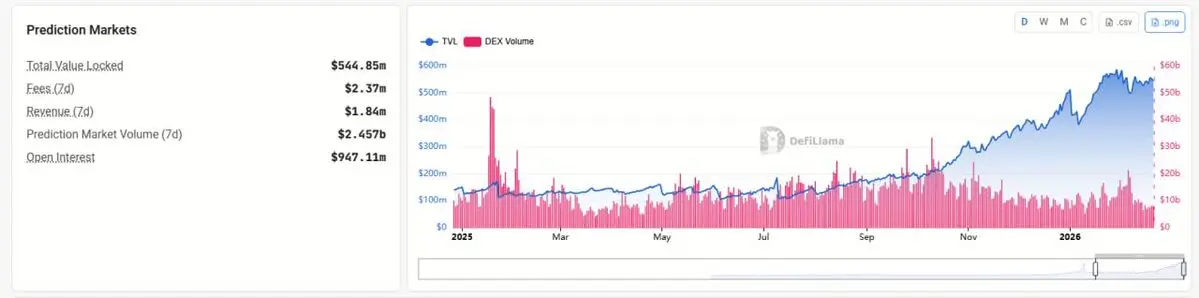

Le volume cumulé en hausse de +56 % par rapport à l'année précédente.

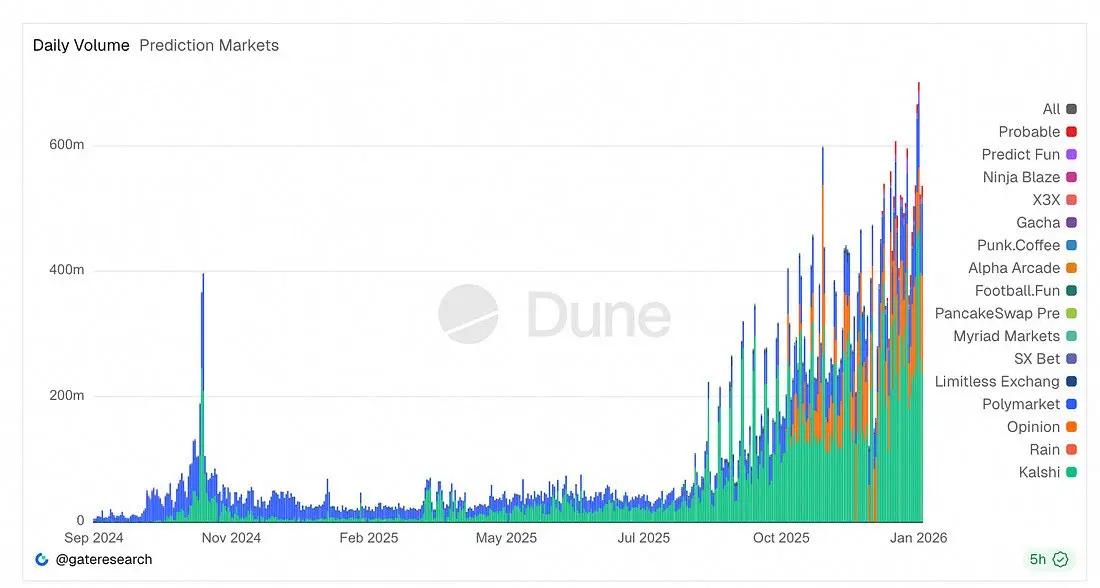

Les marchés de prédiction ne sont plus réservés à l'élection. Les gens couvrent leurs vies réelles, intègrent l'IPC, et parient sur la culture en temps réel. Les résultats binaires sont la seule façon de trouver la vérité lorsque tout le reste n'est que bruit.

2024 était les mèmes.

2025 était l'infrastructure.

2026 est l'année de la percée du marché de prédiction.

La liquidité devient l'oracle. Ne sous-estimez pas la machine à vérité.

Voir l'originalLes marchés de prédiction ne sont plus réservés à l'élection. Les gens couvrent leurs vies réelles, intègrent l'IPC, et parient sur la culture en temps réel. Les résultats binaires sont la seule façon de trouver la vérité lorsque tout le reste n'est que bruit.

2024 était les mèmes.

2025 était l'infrastructure.

2026 est l'année de la percée du marché de prédiction.

La liquidité devient l'oracle. Ne sous-estimez pas la machine à vérité.

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Lorsque l'effet de levier disparaît discrètement, le marché devient confus.

$ETH est en baisse, l'Open Interest a chuté à 10,19 milliards de dollars, un plus bas sur six mois.

Les portefeuilles des baleines ont réduit environ 1,5 % des réserves.

Le prix a dérapé sous 2 000 $ et brièvement en dessous du prix réalisé des adresses d'accumulation récentes.

Cela semble faible.

Mais faiblesse et réinitialisation ne sont pas la même chose.

𝐐𝐮𝐞 𝐝𝐞 𝐜𝐞 𝐩𝐡𝐚𝐬𝐞 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐞 𝐚𝐭𝐭𝐚𝐧𝐭

Chaque cycle a un moment où la conviction ne disparaît pas, elle s'amincit.

L'Open Interest qui s'eff

$ETH est en baisse, l'Open Interest a chuté à 10,19 milliards de dollars, un plus bas sur six mois.

Les portefeuilles des baleines ont réduit environ 1,5 % des réserves.

Le prix a dérapé sous 2 000 $ et brièvement en dessous du prix réalisé des adresses d'accumulation récentes.

Cela semble faible.

Mais faiblesse et réinitialisation ne sont pas la même chose.

𝐐𝐮𝐞 𝐝𝐞 𝐜𝐞 𝐩𝐡𝐚𝐬𝐞 𝐫𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐞 𝐚𝐭𝐭𝐚𝐧𝐭

Chaque cycle a un moment où la conviction ne disparaît pas, elle s'amincit.

L'Open Interest qui s'eff

ETH-3,45%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Je suis bullish sur l'espace RWA depuis un certain temps, et $MSVP est en tendance constante sur les DEX, maintenant ils sont en ligne sur @bingXofficial

C'est leur première inscription sur un CEX, et il semble que d'autres soient déjà en préparation.

Ils organisent également un méga airdrop et une campagne BingX en ce moment.

Lien ci-dessous

Voir l'originalC'est leur première inscription sur un CEX, et il semble que d'autres soient déjà en préparation.

Ils organisent également un méga airdrop et une campagne BingX en ce moment.

Lien ci-dessous

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

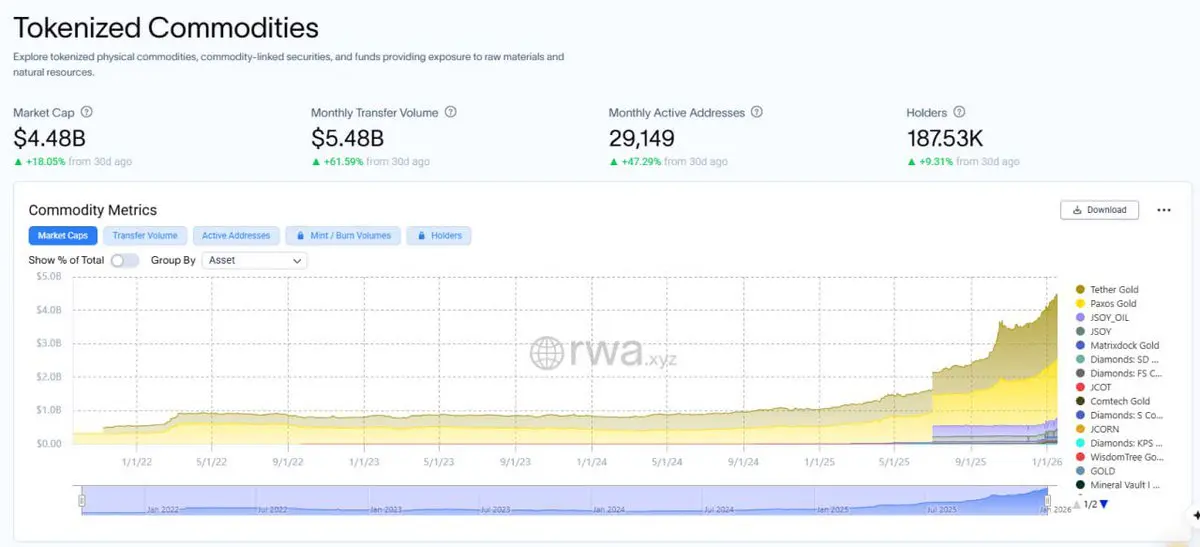

La rotation de cette semaine est mesurable.

Alors que $BTC et $ETH ont été négociés à la baisse en raison de l'incertitude macroéconomique, le capital n'a pas quitté les rails onchain. Il a tourné à l'intérieur.

Les matières premières tokenisées représentent désormais 4,4 milliards de dollars de valeur marchande totale, menées par :

- @tethergold ($XAUT) : 1,9 milliard de dollars

- @Paxos Gold ($PAXG) : 1,8 milliard de dollars

Au total, les tokens adossés à l'or représentent plus de 85 % de l'offre de matières premières tokenisées.

Ce changement a coïncidé avec :

- L'or au comptant atteignan

Voir l'originalAlors que $BTC et $ETH ont été négociés à la baisse en raison de l'incertitude macroéconomique, le capital n'a pas quitté les rails onchain. Il a tourné à l'intérieur.

Les matières premières tokenisées représentent désormais 4,4 milliards de dollars de valeur marchande totale, menées par :

- @tethergold ($XAUT) : 1,9 milliard de dollars

- @Paxos Gold ($PAXG) : 1,8 milliard de dollars

Au total, les tokens adossés à l'or représentent plus de 85 % de l'offre de matières premières tokenisées.

Ce changement a coïncidé avec :

- L'or au comptant atteignan

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

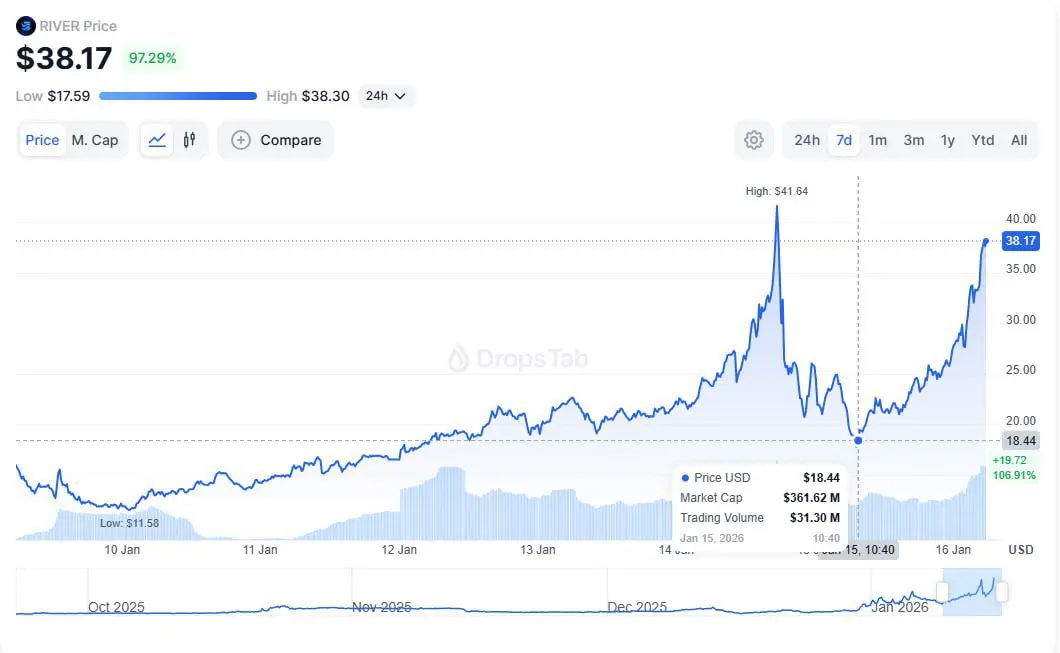

Quelqu'un sur Telegram a dit « River ressuscité plus vite que Jésus »

En regardant le graphique, il est difficile de contester.

Hier, nous avons assisté à une forte baisse, et aujourd'hui il se négocie à nouveau à 38 $.

$17 continue de couler. Une capitalisation de marché de 1 milliard de dollars semble possible.

En regardant le graphique, il est difficile de contester.

Hier, nous avons assisté à une forte baisse, et aujourd'hui il se négocie à nouveau à 38 $.

$17 continue de couler. Une capitalisation de marché de 1 milliard de dollars semble possible.

Voir l'original

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

L'activité de trading quotidienne sur les marchés de prédiction a atteint des sommets historiques, autour de $700 millions en une seule journée !

Il est impressionnant de voir l'évolution des marchés de prédiction, passant de paris de niche sur le sport et la politique à une primitive financière majeure que Wall Street, les hedge funds et les régulateurs doivent désormais prendre au sérieux.

Lorsque les grands acteurs prêtent attention, cela vaut la peine de s'y intéresser aussi.

@xodotmarket présente un modèle unique où chacun peut créer et échanger des croyances sur des événements du monde

Voir l'originalIl est impressionnant de voir l'évolution des marchés de prédiction, passant de paris de niche sur le sport et la politique à une primitive financière majeure que Wall Street, les hedge funds et les régulateurs doivent désormais prendre au sérieux.

Lorsque les grands acteurs prêtent attention, cela vaut la peine de s'y intéresser aussi.

@xodotmarket présente un modèle unique où chacun peut créer et échanger des croyances sur des événements du monde

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Le retournement de sentiment vers la « cupidité » serait généralement un avertissement.

Cette fois, la structure ne concorde pas.

+ Le prix a été poussé de $89K à $97K alors que la participation diminuait.

+ Les soldes sur les échanges sont à leur plus bas depuis 7 mois.

+ Les portefeuilles non vides diminuent, ne croissent pas.

+ Octobre a déjà liquidé $19B .

Ce n’est pas une foule qui se précipite. Ce sont des mains faibles qui terminent leur sortie.

Ce qui importe, c’est l’ordre des opérations : la capitulation a eu lieu en premier → l’offre a quitté les échanges → le prix s’est stabilisé

Voir l'originalCette fois, la structure ne concorde pas.

+ Le prix a été poussé de $89K à $97K alors que la participation diminuait.

+ Les soldes sur les échanges sont à leur plus bas depuis 7 mois.

+ Les portefeuilles non vides diminuent, ne croissent pas.

+ Octobre a déjà liquidé $19B .

Ce n’est pas une foule qui se précipite. Ce sont des mains faibles qui terminent leur sortie.

Ce qui importe, c’est l’ordre des opérations : la capitulation a eu lieu en premier → l’offre a quitté les échanges → le prix s’est stabilisé

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Cela ressemble à un changement discret : la crypto mature au-delà de la phase d’expérimentation.

Les nouvelles aditions ne sont pas les narratifs les plus bruyants ; ce sont les systèmes sur lesquels les gens compteront lorsque le bruit s’estompera.

+ L’IA passe de la hype à la responsabilité (@NousResearch, Poseidon).

+ Les couches d’exécution évoluent de la vitesse brute à la fiabilité (@megaeth, @horizenglobal).

+ Les applications grand public passent de la nouveauté à une utilisation quotidienne (@Aria_Protocol, Playtron).

Ce schéma montre un marché qui mûrit.

Grayscale ne suit pas les ten

Voir l'originalLes nouvelles aditions ne sont pas les narratifs les plus bruyants ; ce sont les systèmes sur lesquels les gens compteront lorsque le bruit s’estompera.

+ L’IA passe de la hype à la responsabilité (@NousResearch, Poseidon).

+ Les couches d’exécution évoluent de la vitesse brute à la fiabilité (@megaeth, @horizenglobal).

+ Les applications grand public passent de la nouveauté à une utilisation quotidienne (@Aria_Protocol, Playtron).

Ce schéma montre un marché qui mûrit.

Grayscale ne suit pas les ten

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

La liquidité Bitcoin ne se compound pas en restant immobile.

Elle se multiplie en étant réutilisable à travers les systèmes sans modifier son profil de confiance.

C’est la différence entre le BTC enveloppé en tant qu’inventaire et le LBTC en tant qu’infrastructure, tel que mis en œuvre par @Lombard_Finance.

— 📌 Le Mécanisme Central

$LBTC fonctionne sur 14 chaînes, y compris Ethereum, Solana, Base, et plusieurs rollups. Le point important n’est pas le nombre de chaînes. C’est la composabilité sans fragmentation.

Chaque chaîne ajoute :

+ un nouvel environnement d’exécution

+ un nouvel ensemble

Voir l'originalElle se multiplie en étant réutilisable à travers les systèmes sans modifier son profil de confiance.

C’est la différence entre le BTC enveloppé en tant qu’inventaire et le LBTC en tant qu’infrastructure, tel que mis en œuvre par @Lombard_Finance.

— 📌 Le Mécanisme Central

$LBTC fonctionne sur 14 chaînes, y compris Ethereum, Solana, Base, et plusieurs rollups. Le point important n’est pas le nombre de chaînes. C’est la composabilité sans fragmentation.

Chaque chaîne ajoute :

+ un nouvel environnement d’exécution

+ un nouvel ensemble

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

L'hélium en 2025 a prouvé que l'utilisation dans le monde réel stimule l'adoption.

La croissance régulière des inscriptions montre une demande croissante pour le réseau, et non de la spéculation.

Avec l'expansion au Brésil et de nouveaux partenariats à venir, @helium dépasse les premiers adopteurs.

Si cette dynamique se poursuit, le nombre total d'inscriptions pourrait atteindre des millions cette année.

La plupart des projets mesurent le succès par le prix du jeton et le battage médiatique à court terme. DePIN mesure le succès par l'utilisation, les frais, la disponibilité et la demande dans

La croissance régulière des inscriptions montre une demande croissante pour le réseau, et non de la spéculation.

Avec l'expansion au Brésil et de nouveaux partenariats à venir, @helium dépasse les premiers adopteurs.

Si cette dynamique se poursuit, le nombre total d'inscriptions pourrait atteindre des millions cette année.

La plupart des projets mesurent le succès par le prix du jeton et le battage médiatique à court terme. DePIN mesure le succès par l'utilisation, les frais, la disponibilité et la demande dans

HNT-8,31%

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

$JupUSD ne doit pas être analysé comme « un autre dollar sur Solana ».

De mon point de vue, il s’agit d’une décision au niveau du plan de contrôle concernant l’endroit où réside l’autorité de règlement dans un système financier multi-produits.

Cette distinction est structurelle, pas cosmétique, et elle importe plus que la stablecoin elle-même.

— 📌 Comment @JupiterExchange a fait s’effondrer sa pile monétaire

Avant $JupUSD, la pile de Jupiter était intégrée horizontalement mais fragmentée sur le plan monétaire.

• Spot exécuté contre $USDC liquidité

• Perps garantis par $USDC

• Positions de prê

Voir l'originalDe mon point de vue, il s’agit d’une décision au niveau du plan de contrôle concernant l’endroit où réside l’autorité de règlement dans un système financier multi-produits.

Cette distinction est structurelle, pas cosmétique, et elle importe plus que la stablecoin elle-même.

— 📌 Comment @JupiterExchange a fait s’effondrer sa pile monétaire

Avant $JupUSD, la pile de Jupiter était intégrée horizontalement mais fragmentée sur le plan monétaire.

• Spot exécuté contre $USDC liquidité

• Perps garantis par $USDC

• Positions de prê

- Récompense

- 3

- 1

- Reposter

- Partager

PumpSpreeLive :

:

Rush 2026 🚀Je ne pense pas que le marché célèbre. Je pense qu’il se repositionne.

L’action des prix en début d’année indique généralement moins de narration et plus d’intention.

$BTC tenir la plage de prix entre le haut-$80Ks et $90K est pour moi une consolidation, pas une cassure. C’est une acceptation. Le prix reste élevé sans stress de levier, sans cascades de liquidations, et sans expansion de la volatilité. Cela se lit comme un contrôle, pas une exhaustion.

$ETH tenir au-dessus de 3 000 $ est encore plus significatif à mon avis. Lorsque $ETH bouge parallèlement à BTC, le marché intègre la demande

Voir l'originalL’action des prix en début d’année indique généralement moins de narration et plus d’intention.

$BTC tenir la plage de prix entre le haut-$80Ks et $90K est pour moi une consolidation, pas une cassure. C’est une acceptation. Le prix reste élevé sans stress de levier, sans cascades de liquidations, et sans expansion de la volatilité. Cela se lit comme un contrôle, pas une exhaustion.

$ETH tenir au-dessus de 3 000 $ est encore plus significatif à mon avis. Lorsque $ETH bouge parallèlement à BTC, le marché intègre la demande

- Récompense

- J'aime

- Commentaire

- Reposter

- Partager

Sujets populaires

Afficher plus381.22K Popularité

126.18K Popularité

437.14K Popularité

17.81K Popularité

136.82K Popularité

Hot Gate Fun

Afficher plus- MC:$2.4KDétenteurs:20.00%

- MC:$2.38KDétenteurs:20.00%

- MC:$0.1Détenteurs:10.00%

- MC:$2.41KDétenteurs:20.13%

- MC:$2.39KDétenteurs:10.00%

Épingler