Crescent1

SOL Evening Market Analysis and Trading Strategy

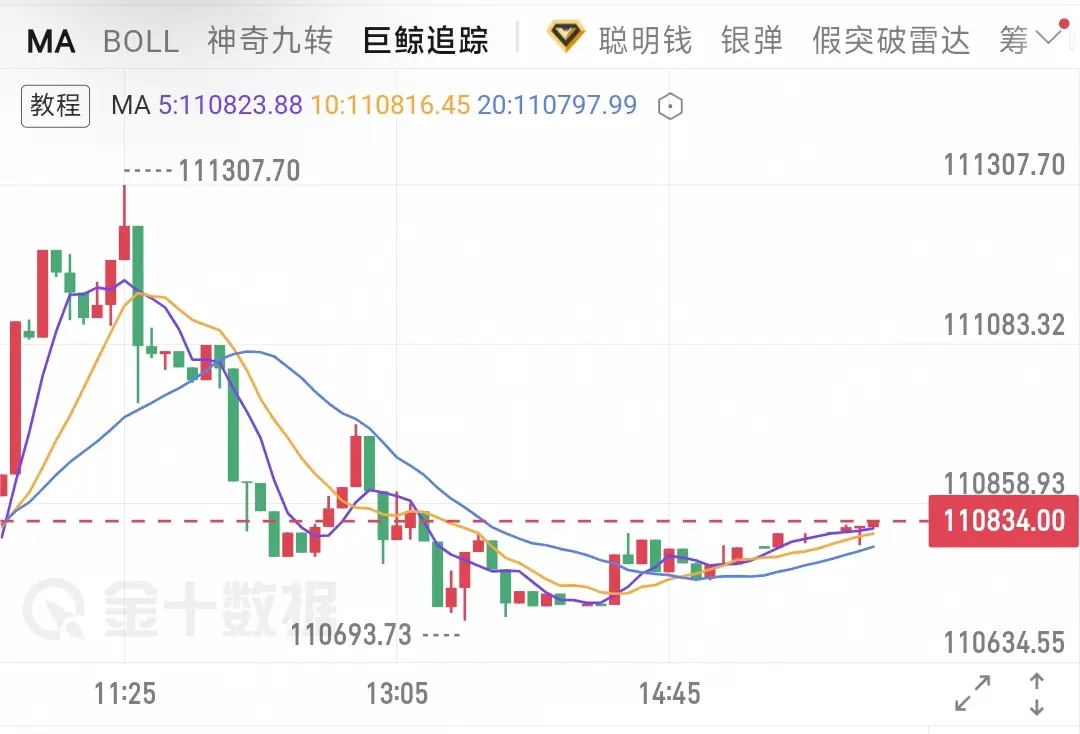

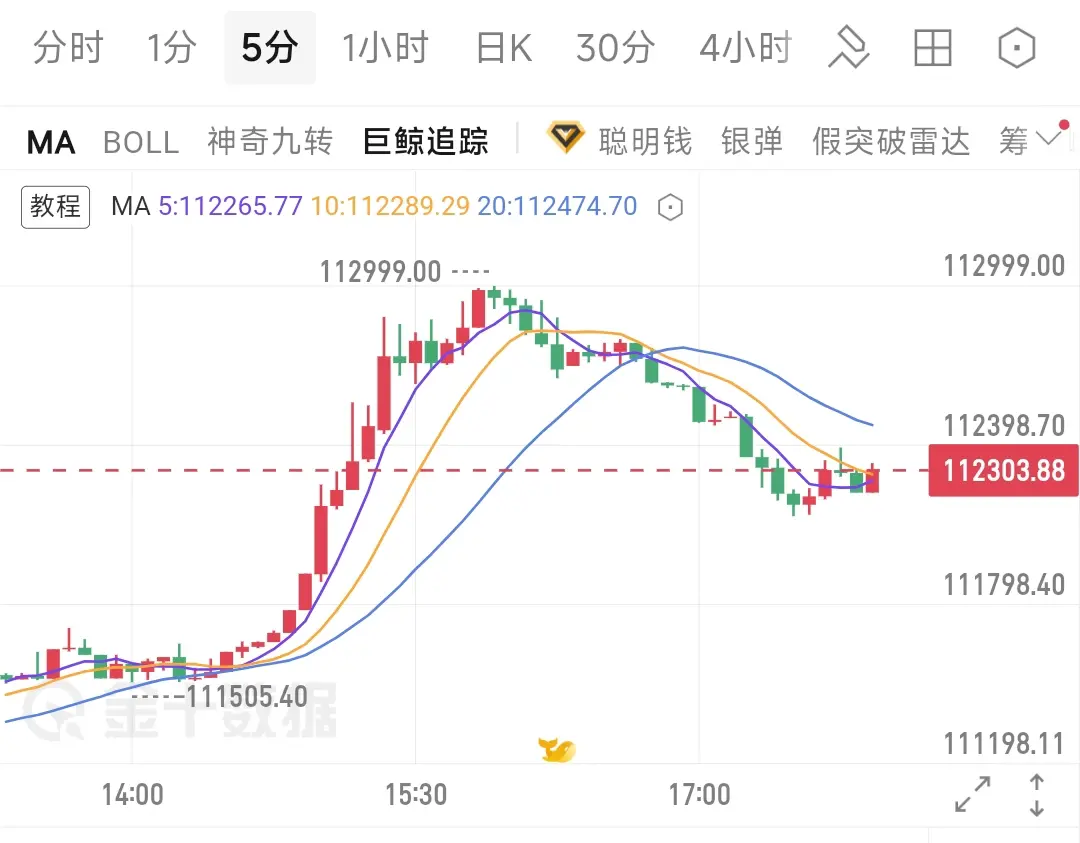

SOL has recently shown a regular oscillating trend: after the price rose to around 210, it faced pressure and fell back, currently consolidating around the 203 level. A top divergence signal has appeared on the four-hour chart, and caution is needed for the risk of a technical pullback. Although bulls are still trying to support the price, the upward momentum has clearly weakened in the short term, and the market may test the support area downwards.

Trading strategy:

· Entry area: around 205-206

· Target price: 200-195

· Stop-loss level: above 2

SOL has recently shown a regular oscillating trend: after the price rose to around 210, it faced pressure and fell back, currently consolidating around the 203 level. A top divergence signal has appeared on the four-hour chart, and caution is needed for the risk of a technical pullback. Although bulls are still trying to support the price, the upward momentum has clearly weakened in the short term, and the market may test the support area downwards.

Trading strategy:

· Entry area: around 205-206

· Target price: 200-195

· Stop-loss level: above 2

SOL0.26%