Từ khởi đầu khi chưa có gì đến lúc bùng nổ, liệu Động lực của Hệ sinh thái Sui sẽ tạo ra làn sóng thanh khoản mới trên thị trường?

Hãy tưởng tượng một buổi sáng năm 2028. Bạn cầm điện thoại, mở ví tiền điện tử và chỉ với một cú chạm, bạn đã bước vào dòng thanh khoản tài chính toàn cầu. Ngay lập tức, bạn có thể giao dịch hoặc đầu tư vào những tài sản tài chính hàng đầu trên thế giới, săn tìm các cơ hội kinh doanh chênh lệch giá—thực tế đó sẽ ra sao?

Viễn cảnh này đang đến gần hơn bạn nghĩ. Momentum hiện đang tạo lập một tuyến đường tới tương lai mà thanh khoản trở nên vô hạn, tài sản được mã hóa liền mạch, trao quyền cho mọi người dễ dàng tham gia vào làn sóng cơ hội tài chính mới.

Thị trường crypto tràn ngập dự án NFT, game blockchain, inscriptions, các nền tảng xã hội và vô số dự án khác—không ít dự án xuất hiện rầm rộ rồi nhanh chóng biến mất, chìm vào quên lãng. Trong sự xoay vần liên tục ấy, chỉ các đơn vị sáng tạo thực sự giải quyết được bài toán thực tế mới trụ vững. DeFi đã chứng kiến nhiều chu kỳ thăng trầm: Ethereum từ bị phê bình mạnh mẽ đã trở lại vị trí dẫn đầu, Solana tăng trưởng nhờ các meme, và những blockchain mới như Sui lặng lẽ xuất hiện. Airdrop cộng đồng cùng hiệu ứng tăng trưởng mạnh mẽ từ token SUI đã khơi nguồn cho hàng loạt lending, DEX và giao thức staking mới.

Giữa bối cảnh đó, Momentum nổi bật—không chỉ là một DEX trên Sui mà còn là lực lượng thúc đẩy Momentum X, lớp giao dịch dành cho các tổ chức với tài sản mã hóa.

Momentum X: Lớp giao dịch tiêu chuẩn tổ chức dành cho tài sản mã hóa

DeFi là trụ cột vững chắc của lĩnh vực crypto, và xu hướng mã hóa tài sản toàn cầu giờ đây là một trong những động lực phát triển chính.

Từ lần đầu tiên mã hóa đô la Mỹ (USDT, USDC) cho đến cổ phiếu Mỹ ngày nay, hàng chục đến hàng trăm nghìn tỷ tài sản đang dần được chuyển lên blockchain. Các sàn giao dịch lớn như Karen, Coinbase, Bybit đang hướng đến cơ hội khổng lồ này, còn những giao thức như Ondo Finance đang chạy đua để ra mắt tính năng giao dịch cổ phiếu mã hóa trong thời gian ngắn tới.

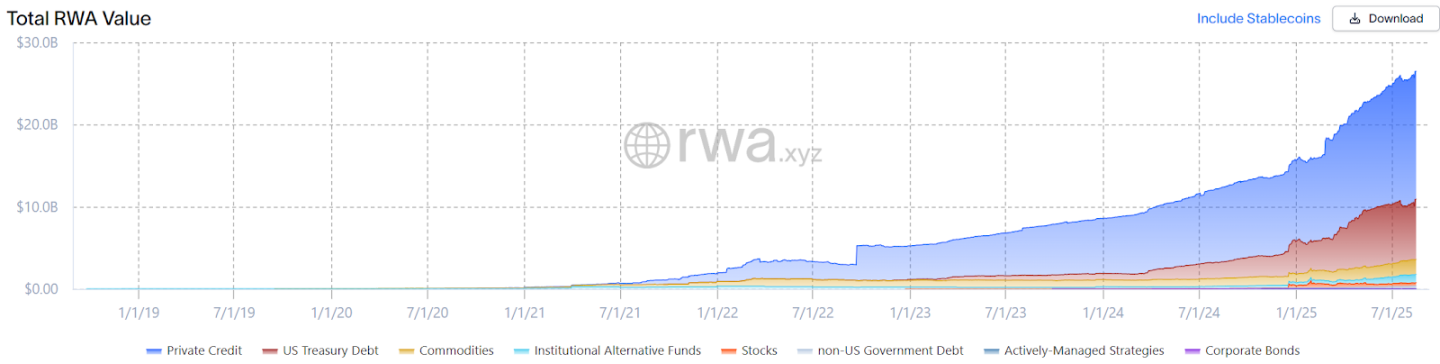

Theo dữ liệu mới nhất từ RWA.xyz, tổng giá trị tài sản mã hóa trên chuỗi đã tăng lên 26,48 tỷ USD—tốc độ tăng trưởng ngày càng mạnh mẽ.

Đồng vốn ngoài hệ sinh thái nóng lòng tìm lối vào, còn người dùng trong hệ thì khao khát mở rộng khai thác các tài sản tài chính đa dạng hơn.

Các đặc điểm như minh bạch, bất biến, khả năng tiếp cận toàn cầu giúp các tài sản truyền thống—bất động sản, cổ phiếu, trái phiếu, hàng hóa—luân chuyển dưới dạng token trên blockchain, hỗ trợ giao dịch liên tục 24/7 và chia nhỏ quyền sở hữu.

Đầu tư trong tương lai sẽ trở nên dễ dàng hơn bao giờ hết. Với tư cách nhà đầu tư cá nhân, bạn có thể vừa nhâm nhi cà phê vừa dùng Momentum X để mua cổ phiếu Apple dưới dạng token chỉ bằng một cú click—không trung gian, không bị hạn chế bởi múi giờ. Giao dịch được hoàn thiện tức thì trên blockchain Sui, còn quyền sở hữu phân đoạn giúp bạn đầu tư vào các tài sản lớn chỉ với 100 USD. Cánh cửa tạo dựng tài sản đang mở rộng.

Dẫu vậy, thực tế vẫn còn nhiều rào cản cần vượt qua trước khi mã hóa tài sản phát huy hết tiềm năng.

Ba thách thức lớn cho nhà đầu tư cá nhân và tổ chức

Thời điểm hiện tại, mỗi bên phát hành đều xây dựng quy trình KYC, giao diện và bộ quy tắc tuân thủ riêng biệt. Dù đều dựa trên cùng loại tài sản thực, các token trên các blockchain khác nhau thường bị coi là công cụ hoàn toàn riêng lẻ, gây ra hiện tượng thị trường phân mảnh, giảm hiệu quả và thiếu thanh khoản sâu hợp nhất. Các tài sản mã hóa trên Base hay Solana, chẳng hạn, hầu như không liên thông.

Thực trạng này dẫn đến các biến động lạ trên thị trường—book lệnh mỏng khiến giá tăng bất thường. Ngày 03/07, một người dùng cố mua khoảng 500 USD token Amazon (AMZNX), đẩy giá lên tới 23.781,22 USD, cao gấp hơn 100 lần giá đóng cửa của Amazon trước đó.

Tuân thủ ngoài chuỗi vẫn phụ thuộc vào trung gian, chứ chưa tận dụng hợp đồng thông minh, tạo ra khoảng trống kiểm soát. Ngày 13/08, MyStonks—nền tảng RWA phi tập trung—đã đóng băng 6,2 triệu USDT của người dùng Caroline. Dù đã cung cấp đầy đủ hồ sơ, sự việc vẫn chưa được giải quyết, khiến chi phí duy trì niềm tin rất lớn.

Thiếu thanh khoản, giá phi lý và an toàn tài sản đã trở thành ba vấn đề lớn nhất với người dùng phổ thông.

Còn với các tổ chức lớn? Họ cũng đối mặt với vô số khó khăn riêng.

Fidelity—ông lớn Phố Wall kiểm soát hơn 10.000 tỷ USD—liên tục giao dịch cổ phiếu, trái phiếu, quỹ; nhưng thực hiện mua bán khối lượng lớn trái phiếu doanh nghiệp lại vô cùng khó nhọc.

Ví dụ, khi Fidelity mua hàng tỷ USD trái phiếu doanh nghiệp Mỹ cho quỹ hưu trí hoặc phòng hộ, quy trình truyền thống gồm:

Thanh khoản phân tán: Thị trường trái phiếu bị rải rác trên các sàn giao dịch và nền tảng OTC, làm khó kết nối thanh khoản, giá dao động mạnh và xử lý lệnh chậm.

Hiệu suất thanh toán kém: Giao dịch hoàn tất mất hai, ba ngày, qua nhiều trung gian, đội chi phí và tăng rủi ro (nguy cơ đối tác vỡ nợ).

Rào cản tuân thủ: Giao dịch xuyên biên giới chịu yêu cầu từ SEC, FINRA cùng quy trình KYC/AML chặt chẽ, đều hạn chế thanh khoản toàn cầu.

Làm sao để tổ chức tháo gỡ các trở ngại—xử lý tài sản mã hóa tức thì trên blockchain, mở thanh khoản toàn cầu mà vẫn đảm bảo tuân thủ và an toàn?

Những ông lớn truyền thống như Fidelity cần một cầu nối tiêu chuẩn tổ chức để thực sự đưa tài sản lên chuỗi trong kỷ nguyên crypto.

Ví + Danh tính: Khai phá thị trường nghìn tỷ USD

Đó chính là giá trị cốt lõi của Momentum X: Là lớp giao dịch và thanh toán chuẩn tổ chức cho tài sản mã hóa, Momentum X vừa hỗ trợ giao dịch, vừa giải quyết “bài toán cuối cùng” của RWA.

Momentum X tổ chức hệ sinh thái RWA thành một khung kết nối thống nhất, kiểm toán, tuân thủ và logic được tích hợp trực tiếp ở tầng token—tận dụng cơ sở hạ tầng chuyên biệt của Sui.

- Lớp danh tính hợp nhất: Walrus (dựa trên ZK) và quyền Seal mã hóa tạo KYC/AML một lần duy nhất;

- Khả năng liên thông của bên phát hành: RWA từ nhiều tổ chức phát hành có thể giao dịch, chuyển đổi liền mạch;

- Tuân thủ lập trình: Quyền lợi nhà đầu tư, thẩm quyền pháp lý, giới hạn giao dịch được nhúng ngay tầng tài sản;

Đối với tổ chức, việc tích hợp DeFi gốc của Momentum X giúp họ giao dịch hoặc staking trái phiếu mã hóa ngay trên blockchain. Thanh khoản xuyên chuỗi kết nối thị trường phân mảnh; tài sản EVM triển khai sang Sui chỉ trong vài giờ, thông lượng cao, không nghẽn. Các quỹ hưu trí áp dụng chiến lược vault tự động để quản lý rủi ro chủ động, còn công cụ tuân thủ thời gian thực thu hút dòng vốn lớn của TradFi—đẩy thị trường RWA từ hàng chục lên nghìn tỷ USD.

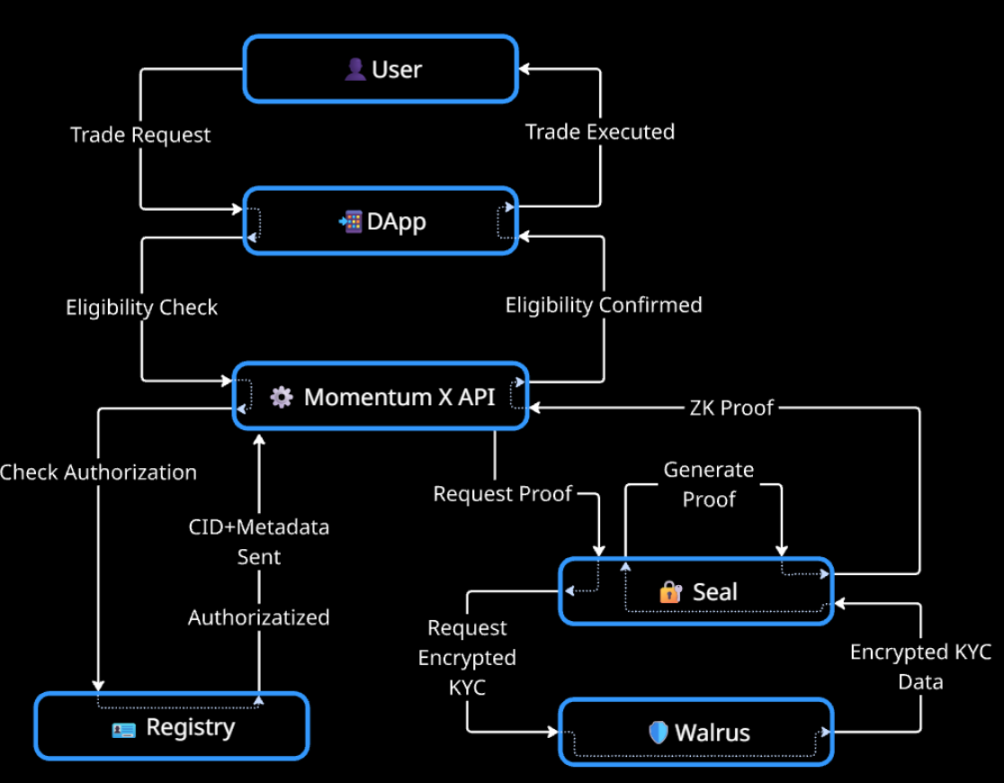

Quy trình tiêu chuẩn như sau:

Khi bạn giao dịch qua DApp, hệ thống gửi yêu cầu xác thực năng lực tới API Momentum X, kiểm tra quyền của ứng dụng đối với xác minh danh tính. Nhờ công nghệ Seal, hệ thống truy xuất dữ liệu danh tính mã hóa từ Walrus, chỉ giải mã những thông tin phù hợp quy tắc tài sản—vùng pháp lý, chứng nhận, hạn mức chuyển nhượng...

Bằng chứng được gửi lại cho ứng dụng. Nếu hợp lệ, giao dịch của bạn được chấp nhận tức thì. Cách làm này vừa tuân thủ quy định, vừa bảo vệ quyền riêng tư, tạo trải nghiệm liền mạch cho tổ chức cũng như cá nhân.

Tóm lại, mục tiêu của Momentum X là đưa người dùng đến thị trường mã hóa nghìn tỷ USD với một địa chỉ, một danh tính. Sui cung cấp nền tảng kỹ thuật mạnh mẽ, Walrus và ZK bảo vệ quyền riêng tư—giúp bạn di chuyển linh hoạt trên thị trường tài chính toàn cầu với Momentum X.

Chỉ trong thời gian ngắn tới, sau khi xác thực danh tính trên Momentum X, bạn có thể ngay lập tức mua tài sản tài chính mong muốn trên Fidelity, Robinhood hoặc nền tảng blockchain khác—không cần phải nộp hồ sơ mỗi lần đăng nhập.

Cuộc sống sẽ hoàn toàn đổi thay: Bạn staking cổ phiếu mã hóa trên Momentum X, vừa nhận token vừa duy trì thanh khoản, rồi cho vay để hưởng thu nhập thụ động—tất cả chỉ từ một giao diện. Sắp tới hệ thống sẽ bổ sung các loại tài sản mới như cổ phần tư nhân, kết hợp chiến lược staking chuẩn tổ chức để các quỹ lớn tham gia dễ dàng.

DeFi và TradFi đang hội tụ với tốc độ chưa từng có—việc chọn mua RWA sẽ đơn giản như mua thực phẩm, dòng vốn toàn cầu luân chuyển không biên giới, không bị giới hạn thời gian.

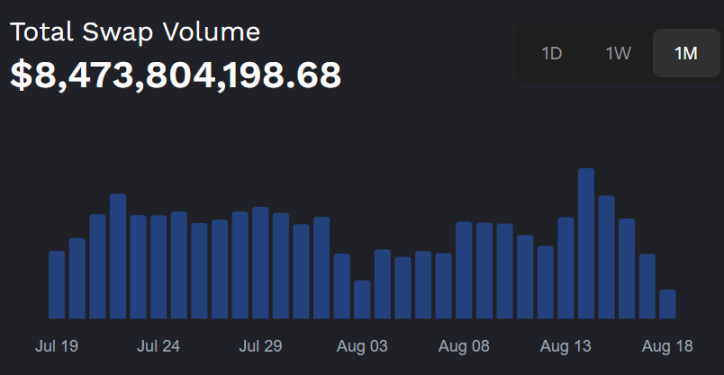

Khối lượng DEX vượt 8 tỷ USD, TVL đạt 180 triệu USD

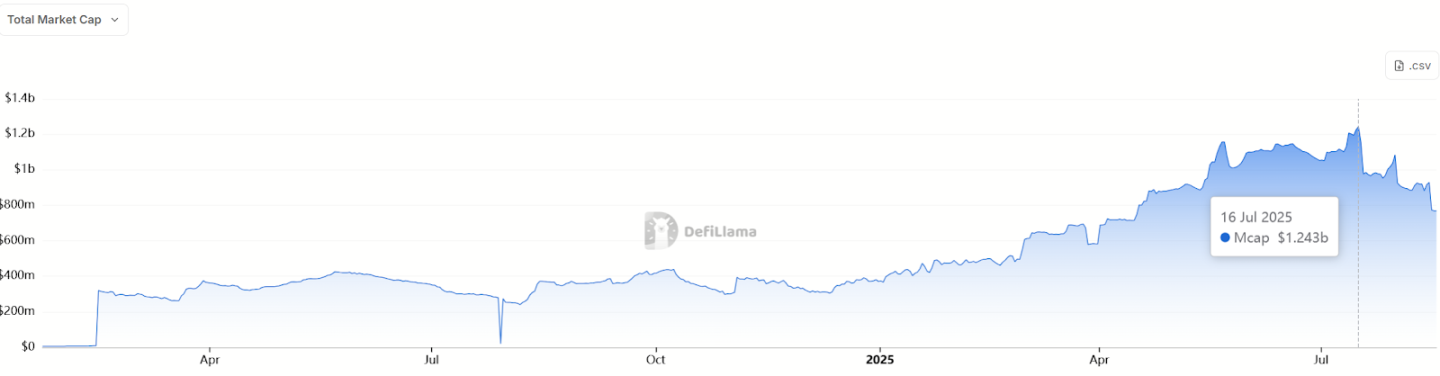

Năm 2023, chuỗi công khai Sui do Mysten Labs phát triển đã thu hút giới lập trình nhờ ngôn ngữ Move, thông lượng tối ưu và độ trễ thấp. Từ 2024 đến 2025, tổng nguồn cung stablecoin trên Sui đã vọt từ 5,4 triệu USD lên 1.243 tỷ USD tính đến ngày 16/07 năm nay.

Ở mảng hệ sinh thái, TVL DeFi đạt kỷ lục khoảng 2,25 tỷ USD, trong khi khối lượng giao dịch hàng ngày của DEX vượt 300 triệu USD, đỉnh điểm là 746,69 triệu USD vào ngày 15/08. Các giao thức lending cũng tăng trưởng mạnh, khối lượng DEX hàng tháng tiếp cận 15 tỷ USD—cho thấy sức hút lớn từ phía người dùng và dòng vốn.

Tuy nhiên, trở ngại lớn nhất với Sui ban đầu là thanh khoản thấp: Người dùng muốn giao dịch nhưng thanh khoản cạn nên slippage cao. Slippage quá lớn khiến cả những ví lớn cũng e ngại giao dịch.

Momentum giải quyết vấn đề này khi LP được phép thiết lập vùng giá riêng khi cung cấp thanh khoản, tạo chiều sâu đúng điểm cần thiết, cải thiện hiệu quả giao dịch lẫn lợi suất LP.

Bản Beta của Momentum ra mắt cuối tháng 3, tốc độ tăng trưởng vượt bậc. Chỉ sau 4 tháng, TVL đạt 180 triệu USD, một kỷ lục mới.

Đến ngày 07/08, dữ liệu Momentum cho thấy ví cá nhân vượt 1 triệu, tăng gấp đôi sau 2 tuần. TVL chỉ là một góc nhìn; khối lượng giao dịch mới thể hiện sự trung thành của người dùng. Ngày 18/08, Momentum công bố trên Twitter tổng khối lượng giao dịch DEX vượt 8,4 tỷ USD.

Thành tích này đạt được chỉ hai tháng sau vụ hack giao thức Cetus trong hệ sinh thái Sui. Sui không sụp đổ mà còn thể hiện sức bật mạnh mẽ. Một số dự án khác thất bại do hack hoặc đứt thanh khoản; các DEX truyền thống như Cetus chứng kiến TVL sụt giảm mạnh. Momentum đã phản ứng nhanh, chủ động khôi phục quỹ và thanh khoản.

Nguồn gốc của Momentum bắt đầu từ MSafe, ra mắt trên Aptos cuối năm 2022 và Sui năm 2023. MSafe là giải pháp multisig treasury và token vesting đầu tiên của hệ Move. Cơ chế đa chữ ký (mmmt) giúp tài sản treasury tránh rủi ro điểm lỗi duy nhất.

Cách này gia tăng mạnh độ an toàn, khuyến khích các LP lớn tham gia—tăng sức mạnh hệ sinh thái, tạo vòng lặp tăng trưởng tích cực.

Thanh khoản và đổi mới

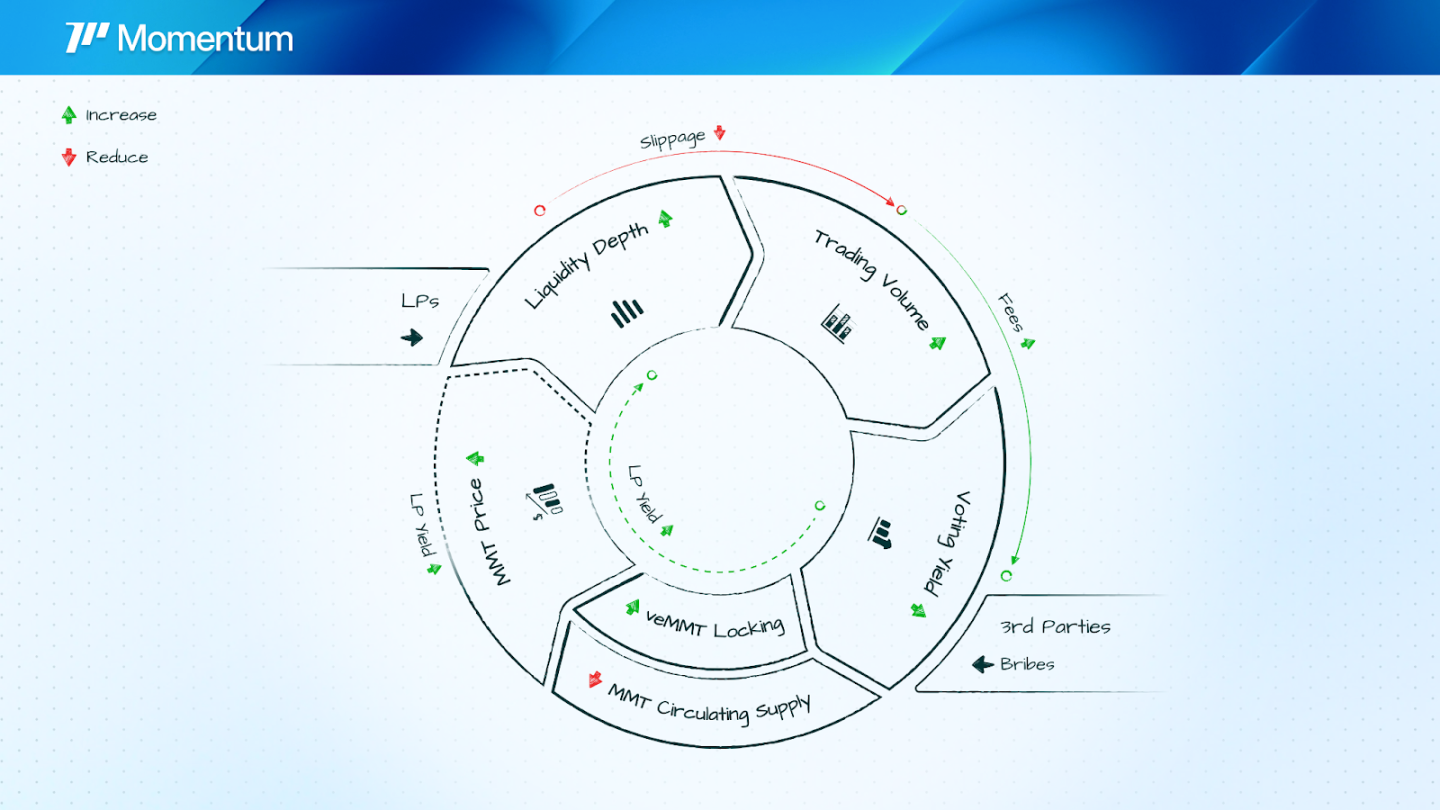

Khám phá sản phẩm Momentum, bạn sẽ thấy nền tảng này vượt xa ranh giới một DEX truyền thống. Cốt lõi là cơ chế ve(3,3): Người dùng khóa MMT để nhận quyền biểu quyết veMMT, quyết định cách phân bổ phần thưởng. Khác với Curve (veCRV), Momentum (3,3) hướng tới “ba bên cùng thắng”—trader hưởng slippage thấp, LP nhận APR cao, holder chia sẻ phí giao thức.

Đơn giản, cơ chế ve(3,3) cho phép holder lẫn LP đều tham gia mà không lo biến động giá hoặc tổn thất tạm thời. Cơ chế này chưa chính thức ra mắt nhưng theo thông tin sẽ giảm 80% phí giao dịch và tăng 400% lợi nhuận LP. Khi Momentum triển khai, ve(3,3) dự kiến giúp doanh thu giao thức đạt 60 triệu USD/năm.

Momentum vừa ra mắt AI Vaults. Nếu bạn chưa quen với impermanent loss hay các thông số chuyên sâu, những công cụ này sẽ biến DeFi từ sân chơi chuyên gia thành nguồn thu nhập thụ động cho mọi người—giúp người mới tiếp cận dễ dàng.

Nền tảng cũng ra mắt Token Generation Lab (TGL), chuyển mình từ nền tảng giao dịch sang vai trò vườn ươm tài sản Sui, thúc đẩy tạo dựng giá trị. xSUI—token staking lỏng của Momentum—tối ưu hóa khả năng phối hợp, lợi nhuận và hiệu quả vốn.

Với những người dùng SUI lớn hoặc chuyên nghiệp, có vô vàn cách để tối đa hóa lợi nhuận—staking, quản lý chiến lược AI, khởi tạo token mới...

Đội ngũ sáng lập giàu kinh nghiệm và hậu thuẫn từ các quỹ đầu tư mạo hiểm hàng đầu là bảo chứng cho tiềm năng của Momentum.

Năm 2023, Momentum gọi vốn thành công 5 triệu USD vòng seed do Jump dẫn dắt. Tháng 3/2025, nền tảng tiếp tục gọi vốn 10 triệu USD do Varys Capital dẫn đầu, có Sui Foundation tham gia. Dù thị trường đầu tư đang thận trọng, Momentum vẫn huy động chiến lược với định giá 100 triệu USD vào tháng 6, do OKX Ventures chủ trì, còn có Coinbase Ventures cùng đối tác lớn.

Nhóm nòng cốt đa phần là chuyên gia ngôn ngữ Move. Đồng sáng lập kiêm CEO ChefWEN là tiến sĩ khoa học máy tính UC Berkeley, có 7 năm làm việc tại Meta (Facebook) trong đội Libra/Diem, trực tiếp phát triển ngôn ngữ Move.

Kết luận

Momentum X sẽ mở rộng danh mục RWA đến các loại tài sản như cổ phần tư nhân mã hóa, đồng thời triển khai chiến lược staking và vault chuẩn tổ chức mới. Nền tảng cũng sẽ đưa vào các công cụ vốn tuân thủ cho tổ chức, như cổng KYC tự động, dashboard quản lý rủi ro thực tế, API thanh toán xuyên chuỗi—thúc đẩy thị trường RWA từ hàng chục tỷ lên nghìn tỷ USD.

Nhà đầu tư cá nhân có thể xây dựng tài sản bằng thu nhập thụ động. Tổ chức hưởng lợi nhờ thanh toán tối ưu.

Hãy tưởng tượng một sân chơi tài chính toàn cầu nơi ai cũng được tham gia, DeFi không còn riêng cho giới tinh hoa—tương lai này sẽ mở rộng cho tất cả. Khi TVL của Sui không ngừng tăng và các tổ chức tích cực tham gia, Momentum X sẽ trở thành hạ tầng cốt lõi của thị trường crypto, thúc đẩy làn sóng đổi mới thanh khoản tiếp theo.

Lưu ý:

- Bài viết này được đăng lại từ [Foresight News]. Bản quyền thuộc về tác giả gốc [1912212.eth, Foresight News]. Nếu cần tái xuất bản, vui lòng liên hệ đội ngũ Gate Learn. Chúng tôi sẽ xử lý theo quy trình chuẩn.

- Lưu ý: Quan điểm, nhận định trong bài viết hoàn toàn thuộc về tác giả, không phải khuyến nghị đầu tư.

- Bản dịch do đội ngũ Gate Learn thực hiện. Vui lòng không sao chép, phát hành hoặc đạo văn nếu chưa ghi rõ nguồn Gate.

Bài viết liên quan

Tronscan là gì và Bạn có thể sử dụng nó như thế nào vào năm 2025?

Coti là gì? Tất cả những gì bạn cần biết về COTI

Stablecoin là gì?

Mọi thứ bạn cần biết về Blockchain

HODL là gì