Prediksi Harga CHEQ 2025: Analisis Tren Pasar serta Faktor-Faktor Pertumbuhan Potensial untuk Token Cheqd Network

Pendahuluan: Posisi Pasar dan Nilai Investasi CHEQ

CHEQD NETWORK (CHEQ), sebagai proyek yang membangun ekonomi data autentik, telah mencatat kemajuan substansial sejak awal berdiri. Pada 2025, kapitalisasi pasar CHEQ mencapai $23.336.264, dengan suplai beredar sekitar 962.717.168 token dan harga di kisaran $0,02424. Aset ini, kerap dijuluki pelopor autentikasi data, kini berperan semakin penting dalam mendorong kredensial terverifikasi serta paradigma identitas otonom yang fleksibel.

Artikel ini mengulas tren harga CHEQ dari 2025 hingga 2030 secara menyeluruh, menggabungkan pola historis, dinamika suplai dan permintaan pasar, perkembangan ekosistem, serta faktor makroekonomi untuk memberikan prediksi harga profesional dan strategi investasi yang relevan bagi investor.

I. Tinjauan Sejarah Harga CHEQ dan Status Pasar Terkini

Evolusi Harga CHEQ Secara Historis

- 2021: CHEQ mencatat rekor tertinggi di $0,71551 pada 26 November, menjadi tonggak penting bagi proyek ini.

- 2025: Token mencapai titik terendah di $0,0124221 pada 2 Juli, menandakan periode penuh tantangan bagi CHEQ.

Kondisi Pasar CHEQ Terkini

Per 4 Oktober 2025, CHEQ diperdagangkan pada $0,02424, naik 8,03% dalam 24 jam terakhir. Kapitalisasi pasar CHEQ sebesar $23.336.264, menempatkannya di peringkat 1026 secara global. Dalam satu bulan, token ini naik 21,57% selama 30 hari terakhir, namun masih turun 11,43% dibandingkan periode yang sama tahun lalu.

Volume perdagangan 24 jam CHEQ sebesar $53.012,77, menandakan aktivitas pasar yang cukup moderat. Suplai beredar mencapai 962.717.168 CHEQ, atau 96,27% dari total suplai 1.000.000.000 token. Walaupun masih jauh dari rekor harga tertinggi, CHEQ tetap menunjukkan daya tahan dengan harga yang jauh di atas titik terendahnya.

Klik untuk melihat harga pasar CHEQ saat ini

Indikator Sentimen Pasar CHEQ

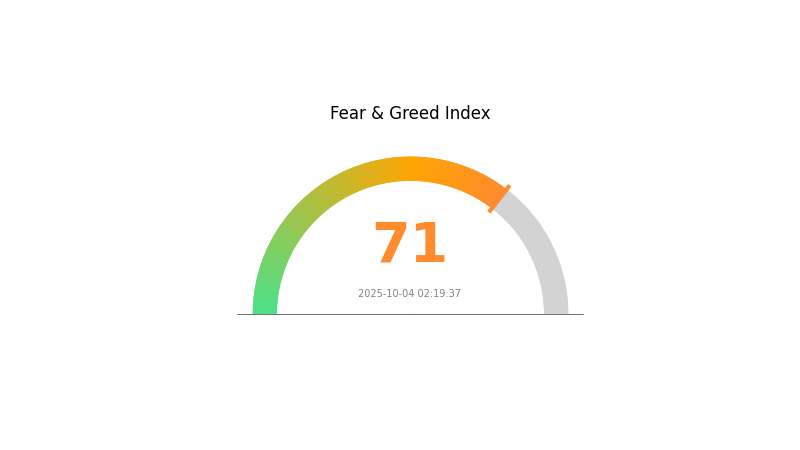

2025-10-04 Indeks Ketakutan dan Keserakahan: 71 (Keserakahan)

Klik untuk melihat Indeks Ketakutan & Keserakahan saat ini

Pasar kripto saat ini berada di fase keserakahan, dengan Indeks Ketakutan dan Keserakahan menyentuh level 71. Optimisme tinggi ini menggambarkan kepercayaan investor yang meningkat terhadap potensi pasar. Meski demikian, kehati-hatian tetap penting karena keserakahan ekstrem sering kali mendahului koreksi pasar. Trader perlu menyeimbangkan portofolio dan tidak membiarkan FOMO mendikte keputusan. Riset mendalam serta manajemen risiko tetap krusial dalam kondisi pasar seperti ini.

Distribusi Kepemilikan CHEQ

Data distribusi kepemilikan CHEQ menunjukkan pola konsentrasi token yang menarik. Analisis ini memberikan gambaran tentang penyebaran token di berbagai alamat, yang dapat menunjukkan pola kepemilikan serta potensi pengaruh pasar.

Berdasarkan data yang ada, tidak ditemukan konsentrasi signifikan CHEQ pada satu alamat, mengindikasikan distribusi yang cukup terdesentralisasi. Distribusi token yang merata umumnya dianggap positif, karena dapat mengurangi risiko manipulasi pasar dan mendukung pergerakan harga yang lebih stabil.

Ketiadaan kepemilikan besar pada alamat individu juga menandakan struktur pasar CHEQ yang lebih sehat, mengurangi risiko aksi jual besar-besaran oleh pemegang utama. Pola ini menunjukkan pasar CHEQ yang lebih dewasa dan cenderung kurang volatil, sehingga menarik minat investor dan pengguna yang lebih beragam.

Klik untuk melihat distribusi kepemilikan CHEQ saat ini

| Top | Alamat | Jumlah Kepemilikan | Kepemilikan (%) |

|---|

II. Faktor Utama yang Mempengaruhi Harga CHEQ di Masa Depan

Mekanisme Suplai

- Dinamika Pasar: Faktor utama yang memengaruhi harga CHEQ adalah interaksi suplai dan permintaan.

- Pola Historis: Perubahan suplai di masa lalu telah berdampak signifikan pada pergerakan harga.

- Dampak Terkini: Perubahan suplai saat ini diyakini masih akan memengaruhi harga CHEQ dalam waktu dekat.

Lingkungan Makroekonomi

- Dampak Kebijakan Moneter: Keputusan suku bunga dan arah kebijakan moneter Federal Reserve berpengaruh pada harga CHEQ.

- Lindung Nilai Inflasi: CHEQ dapat dianggap sebagai aset lindung nilai terhadap inflasi, khususnya di situasi inflasi tinggi.

- Faktor Geopolitik: Ketegangan dan konflik internasional dapat meningkatkan daya tarik CHEQ sebagai aset safe haven.

Pengembangan Teknologi dan Ekosistem

- Sentimen Pasar: Sentimen pasar kripto dan kepercayaan investor sangat memengaruhi pergerakan harga CHEQ.

- Aplikasi Ekosistem: Pengembangan DApps dan proyek ekosistem di jaringan CHEQ dapat mendorong adopsi dan nilai tambah.

III. Prediksi Harga CHEQ 2025-2030

Outlook 2025

- Prediksi konservatif: $0,0146 - $0,02433

- Prediksi netral: $0,02433 - $0,03

- Prediksi optimis: $0,03 - $0,03601 (dengan sentimen pasar positif dan peningkatan adopsi)

Outlook 2027-2028

- Ekspektasi fase pasar: Fase pertumbuhan dengan peningkatan adopsi

- Rentang harga prediksi:

- 2027: $0,02196 - $0,03433

- 2028: $0,02414 - $0,03458

- Katalis utama: Kemajuan proyek, tren pasar, dan adopsi kripto yang lebih luas

Outlook Jangka Panjang 2029-2030

- Skenario dasar: $0,0289 - $0,03915 (dengan pertumbuhan pasar stabil)

- Skenario optimis: $0,03915 - $0,04469 (dengan kondisi pasar positif dan meningkatnya utilitas)

- Skenario transformatif: $0,04469 - $0,04893 (dengan inovasi besar dan adopsi massal)

- 2030-12-31: CHEQ $0,03915 (potensi kenaikan 60% dari 2025)

| Tahun | Prediksi Harga Tertinggi | Prediksi Harga Rata-rata | Prediksi Harga Terendah | Perubahan (%) |

|---|---|---|---|---|

| 2025 | 0,03601 | 0,02433 | 0,0146 | 0 |

| 2026 | 0,03168 | 0,03017 | 0,01991 | 23 |

| 2027 | 0,03433 | 0,03092 | 0,02196 | 26 |

| 2028 | 0,03458 | 0,03262 | 0,02414 | 33 |

| 2029 | 0,04469 | 0,0336 | 0,0289 | 37 |

| 2030 | 0,04893 | 0,03915 | 0,02271 | 60 |

IV. Strategi Investasi Profesional dan Manajemen Risiko CHEQ

Metodologi Investasi CHEQ

(1) Strategi Kepemilikan Jangka Panjang

- Cocok untuk: Investor jangka panjang yang fokus pada ekonomi data autentik

- Saran operasional:

- Akumulasi token CHEQ saat harga turun

- Pantau perkembangan proyek dan tingkat adopsi jaringan

- Simpan token secara aman di dompet non-penitipan

(2) Strategi Perdagangan Ayunan

- Alat analisis teknikal:

- Moving Averages: Memonitor tren jangka panjang

- RSI (Relative Strength Index): Mengidentifikasi kondisi overbought/oversold

- Poin penting perdagangan ayunan:

- Tentukan titik masuk dan keluar secara jelas

- Gunakan batasan kerugian (stop-loss) untuk manajemen risiko

Kerangka Manajemen Risiko CHEQ

(1) Prinsip Alokasi Aset

- Investor konservatif: 1-3% dari portofolio kripto

- Investor agresif: 5-10% dari portofolio kripto

- Investor profesional: 10-15% dari portofolio kripto

(2) Strategi Mitigasi Risiko

- Diversifikasi: Sebar investasi pada berbagai aset kripto

- Batasan kerugian (stop-loss): Batasi potensi kerugian dalam transaksi di exchange

(3) Strategi Penyimpanan Aman

- Rekomendasi dompet perangkat keras: Gate Web3 Wallet

- Opsi dompet perangkat lunak: Dompet resmi CHEQD (jika tersedia)

- Langkah keamanan: Aktifkan autentikasi dua faktor, gunakan kata sandi kuat

V. Risiko dan Tantangan Potensial CHEQ

Risiko Pasar CHEQ

- Volatilitas harga: CHEQ rentan terhadap fluktuasi harga besar

- Likuiditas terbatas: Volume perdagangan rendah memengaruhi kemudahan transaksi

- Sentimen pasar: Performa CHEQ sangat dipengaruhi tren pasar kripto global

Risiko Regulasi CHEQ

- Ketidakpastian regulasi: Peraturan kripto yang terus berkembang bisa berdampak pada CHEQ

- Kepatuhan lintas negara: Setiap negara memiliki aturan berbeda

- Isu privasi data: Regulasi pengelolaan data dapat memengaruhi adopsi

Risiko Teknis CHEQ

- Keamanan jaringan: Potensi kerentanan pada infrastruktur blockchain

- Tantangan skalabilitas: Kemampuan menangani volume transaksi besar

- Risiko smart contract: Bug atau exploitasi bisa menyebabkan kerugian

VI. Kesimpulan dan Rekomendasi Tindakan

Penilaian Nilai Investasi CHEQ

CHEQ memiliki potensi jangka panjang di ekonomi data autentik, namun menghadapi risiko jangka pendek akibat volatilitas pasar dan ketidakpastian regulasi.

Rekomendasi Investasi CHEQ

✅ Pemula: Mulai dengan alokasi kecil dan fokus pada pemahaman proyek ✅ Investor berpengalaman: Pertimbangkan alokasi sedang sesuai profil risiko ✅ Investor institusional: Lakukan uji tuntas mendalam dan pantau pertumbuhan jaringan

Metode Partisipasi Perdagangan CHEQ

- Perdagangan spot: Beli dan jual CHEQ di Gate.com

- Staking: Ikut serta validasi jaringan jika tersedia

- Integrasi keuangan terdesentralisasi (DeFi): Jelajahi opsi keuangan terdesentralisasi saat tersedia

Investasi cryptocurrency berisiko sangat tinggi, dan artikel ini bukan saran investasi. Investor harus membuat keputusan secara bijak sesuai toleransi risiko masing-masing dan disarankan berkonsultasi dengan penasihat keuangan profesional. Jangan berinvestasi lebih dari kemampuan menanggung kerugian.

FAQ

Prediksi meme coin yang akan meledak di 2025?

BONK diperkirakan akan melonjak harga pada 2025, didorong oleh budaya internet dan hype komunitas. Potensi pertumbuhan ini mengikuti tren meme coin populer sebelumnya.

Berapa harga Cheq coin?

Per 2025-10-04, harga Cheq coin adalah $0,02255 dengan volume perdagangan 24 jam sebesar $460.418. Ini menunjukkan kenaikan harga 3,57%.

Apakah hamster kombat coin bisa mencapai $1?

Walau Hamster Kombat berpotensi, harga $1 masih belum pasti. Tren dan prediksi pasar beragam, sehingga tidak ada proyeksi pasti untuk pencapaian tersebut.

AI terbaik untuk prediksi harga saham apa?

Model hybrid GARCH-LSTM adalah pilihan utama untuk prediksi harga saham, menggabungkan metode statistik dan AI untuk akurasi dan reliabilitas tinggi dalam peramalan.

Prediksi Harga FTT 2025: Analisis Tren Pasar dan Faktor Potensi Pertumbuhan di Ekosistem Aset Digital

Prediksi Harga HT Tahun 2025: Analisis Tren Pasar dan Faktor-Faktor Potensi Pertumbuhan Huobi Token

Prediksi Harga MTL 2025: Analisis Tren Pertumbuhan di Masa Mendatang dan Potensi Pasar Metal Token

Prediksi Harga VICE 2025: Analisis Tren Pasar dan Faktor Pertumbuhan Potensial bagi Raksasa Media Digital

Prediksi Harga TOMI 2025: Analisis Pasar dan Outlook Masa Depan untuk Aset Digital yang Tumbuh Pesat

Prediksi Harga CRTS 2025: Analisis Tren Pasar dan Proyeksi Nilai Token CRTS di Tengah Perkembangan Lanskap Cryptocurrency

Jawaban Kuis Harian Spur Protocol Hari Ini 9 Desember 2025

Jawaban Kuis Harian Xenea 9 Desember 2025

Menjelajahi Blockchain Ethereum: Panduan Lengkap

Memahami Standar Token BEP-2: Panduan Lengkap

Gate Ventures Mingguan Recap Kripto (8 Desember 2025)