[Large Settlement Analysis of the Liquidation Map]

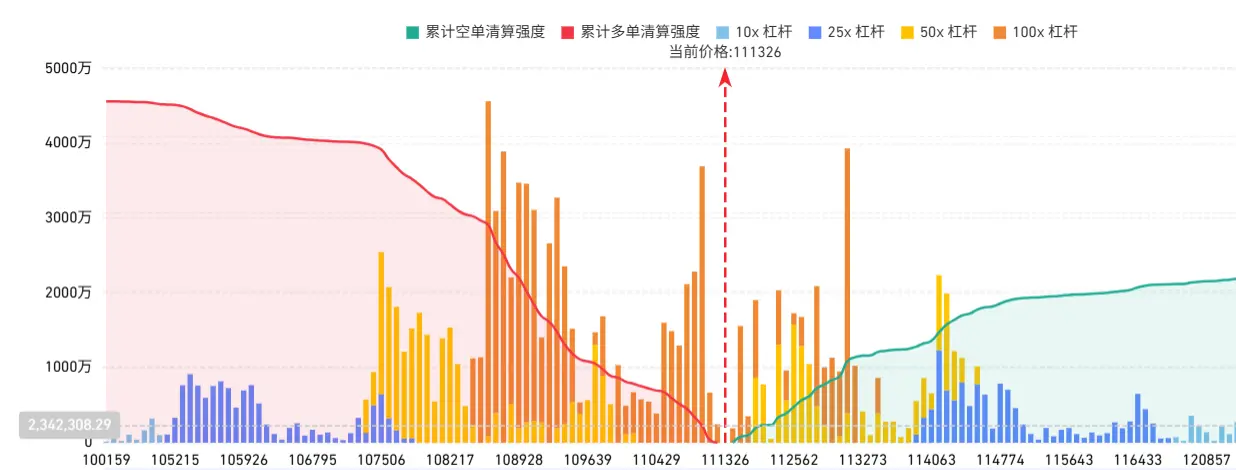

BTC:

Rising to 113,300 dollars, an estimated liquidation of about 730 million dollars;

Dropped to $109,300, expected liquidation of approximately $800 million.

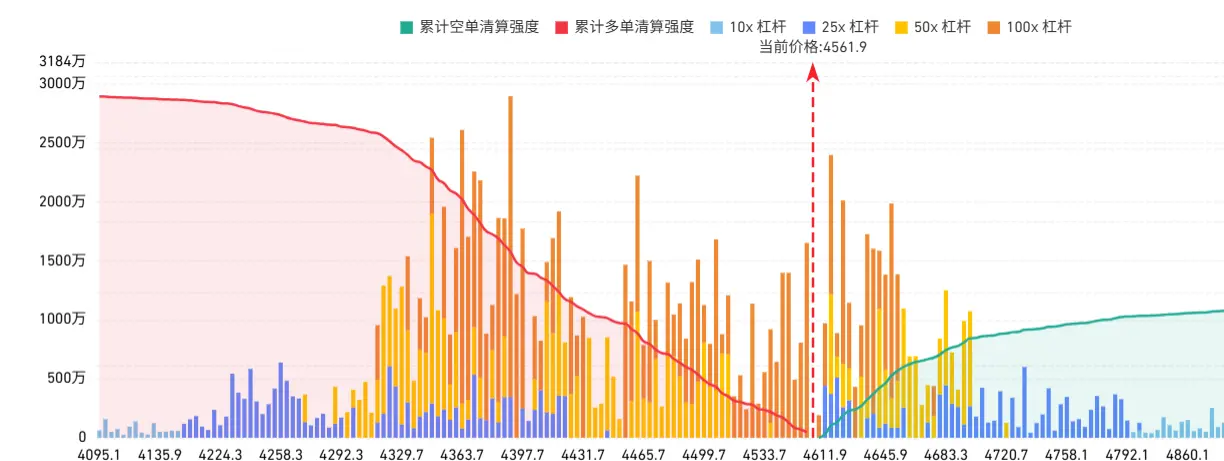

ETH:

Rising to 4660 USD, expected liquidation of approximately 680 million USD;

Dropped to 4460 USD, expected liquidation of around 1 billion dollars.

BTC:

Rising to 113,300 dollars, an estimated liquidation of about 730 million dollars;

Dropped to $109,300, expected liquidation of approximately $800 million.

ETH:

Rising to 4660 USD, expected liquidation of approximately 680 million USD;

Dropped to 4460 USD, expected liquidation of around 1 billion dollars.