Qu'est-ce que Rhea Finance (RHEA) ?

Qu’est-ce que Rhea Finance ?

(Source : rhea_finance)

Rhea Finance n’est pas un protocole totalement inédit conçu ex nihilo. Il s’agit d’une plateforme nouvelle génération issue de la fusion de deux protocoles DeFi phares de l’écosystème NEAR : Ref Finance (DEX) et Burrow Finance (prêts). L’objectif affiché est de bâtir une infrastructure plus intégrée, efficiente et agile, pour redéfinir la DeFi sur NEAR.

Rhea ne se limite pas à un simple changement de nom—c’est un moteur d’innovation technologique. En intégrant profondément les technologies clés de NEAR, telles que l’abstraction de chaîne et les modules d’intelligence artificielle, Rhea occupe à la fois le rôle de couche d’agrégation de liquidité et de socle applicatif financier au sein de tout l’écosystème NEAR.

Positionnement central et vision technologique

La mission de Rhea Finance est de devenir l’infrastructure DeFi la plus robuste et évolutive de NEAR. En s’appuyant sur l’abstraction de chaîne, une architecture pilotée par intelligence artificielle et une conception modulaire, Rhea simplifie l’intégration des protocoles et le lancement de mécanismes d’incitation à la communauté. Elle aspire à servir de pôle de liquidité pour tous les projets de l’écosystème, en rehaussant considérablement l’efficacité du capital et en permettant au protocole de répondre aux exigences d’une large palette d’actifs, d’utilisateurs inter-chaînes et de modèles de gouvernance avancés.

Architecture produit à double pilier

À ce jour, Rhea propose deux produits structurants : un échange décentralisé (DEX) et un protocole de prêt décentralisé. Ces deux offres, basées sur une architecture et un modèle computationnel entièrement repensés, visent à maximiser l’efficacité du capital tout en améliorant l’expérience des utilisateurs.

Rhea DEX : Market Making automatisé flexible et ouvert

Le cœur de la fonctionnalité trading de Rhea, le DEX RHEA, repose sur un modèle AMM (automated market maker) de référence, tout en offrant une personnalisation poussée dont :

Création de pools de liquidité sans permission : chaque utilisateur peut lancer un nouveau pool de trading, sans contrainte liée à l’existence préalable d’une paire d’actifs.

Frais de pool sur mesure : les créateurs fixent librement leurs frais de transaction, permettant d’aligner les modèles de commission sur chaque classe d’actifs.

Protection contre le slippage : les utilisateurs définissent un montant minimum en sortie ou maximum en entrée à chaque transaction, réduisant l’impact des écarts de prix lors des volumes importants.

Swaps à montant de sortie défini : l’utilisateur saisit la quantité de jetons souhaitée, le système calcule automatiquement le montant à verser.

Routage multi-pools : même sans paire de trading directe, le protocole répartit automatiquement le swap sur différents pools.

Cette architecture accorde davantage de liberté aux fournisseurs de liquidité et permet aux utilisateurs d’optimiser la précision et le coût de leurs opérations.

Rhea Lending : marché des prêts à modèle de risque modulable

La composante prêts, RHEA Lending, introduit une évaluation multidimensionnelle du risque, offrant la possibilité d’adapter les paramètres de chaque actif aux réalités du marché :

Modèles de volatilité et de risque différenciés par actif : chaque classe d’actifs bénéficie d’une gestion des risques dédiée, s’écartant de l’approche unique.

Courbes de taux d’intérêt dynamiques : les taux d’emprunt s’ajustent en temps réel selon l’utilisation effective des actifs, optimisant la circulation du capital.

Mécanisme de liquidation transparent : la stabilité du protocole demeure assurée, tout en préservant la justice et l’ouverture.

Structures incitatives modulables : prêteurs et emprunteurs profitent d’incitations adaptées, générant une dynamique positive continue.

Grâce à ces mécanismes, Rhea s’adapte aux spécificités de chaque actif et réagit instantanément aux évolutions du marché, ce qui renforce sensiblement la liquidité globale.

Architecture technique de RHEA Finance

S’inspirant d’Uniswap v2, de Curve Finance et d’iZiSwap, le système de smart contracts de RHEA Finance intègre les modèles mathématiques suivants :

Courbe AMM traditionnelle : x * y = k, fondement pour les swaps de tokens stables.

Courbe StableSwap : conçue pour optimiser l’échange de stablecoins, garantissant des swaps efficaces entre actifs stables.

Pools générant du rendement (Rated Pools) : adaptés spécifiquement aux actifs productifs de rendement, comme stETH, grâce à une logique sur mesure.

Modèle de liquidité concentrée discrétisé (Discretized CLAMM) : reprenant le modèle Uniswap v3/iZiSwap pour une efficience du capital accrue.

L’ensemble des modèles fonctionne nativement sur la blockchain NEAR, en open source, sans restriction et en pleine décentralisation. Tout utilisateur peut intervenir comme trader ou fournisseur de liquidité en déposant une valeur équivalente d’actifs afin d’obtenir des tokens LP, échangeables à tout moment. À la différence de la structure éclatée d’Uniswap, la conception contractuelle unique de Rhea regroupe tous pools et paires au sein d’un seul contrat principal (v2.ref-finance.near), ce qui simplifie considérablement la maintenance et le passage à l’échelle du système.

Gouvernance communautaire et participation

La gouvernance de Rhea repose sur une structure DAO Sputnik basée sur NEAR, s’articulant autour d’une double instance :

Conseil : initie les propositions et prend les décisions finales.

Communauté : vote sur tous les sujets, le Conseil suivant en général l’avis majoritaire.

Outre le vote, Rhea stimule activement la participation communautaire à tous les niveaux : gestion de projet, planification, tests produits, élaboration de stratégies, analyse de marché, support utilisateurs, gestion de communauté, relations publiques et communication de l’écosystème. Cette organisation ouverte permet à chacun de contribuer à l’évolution du protocole, instaurant une gouvernance décentralisée concrète et opérationnelle.

Tokenomics de RHEA Finance

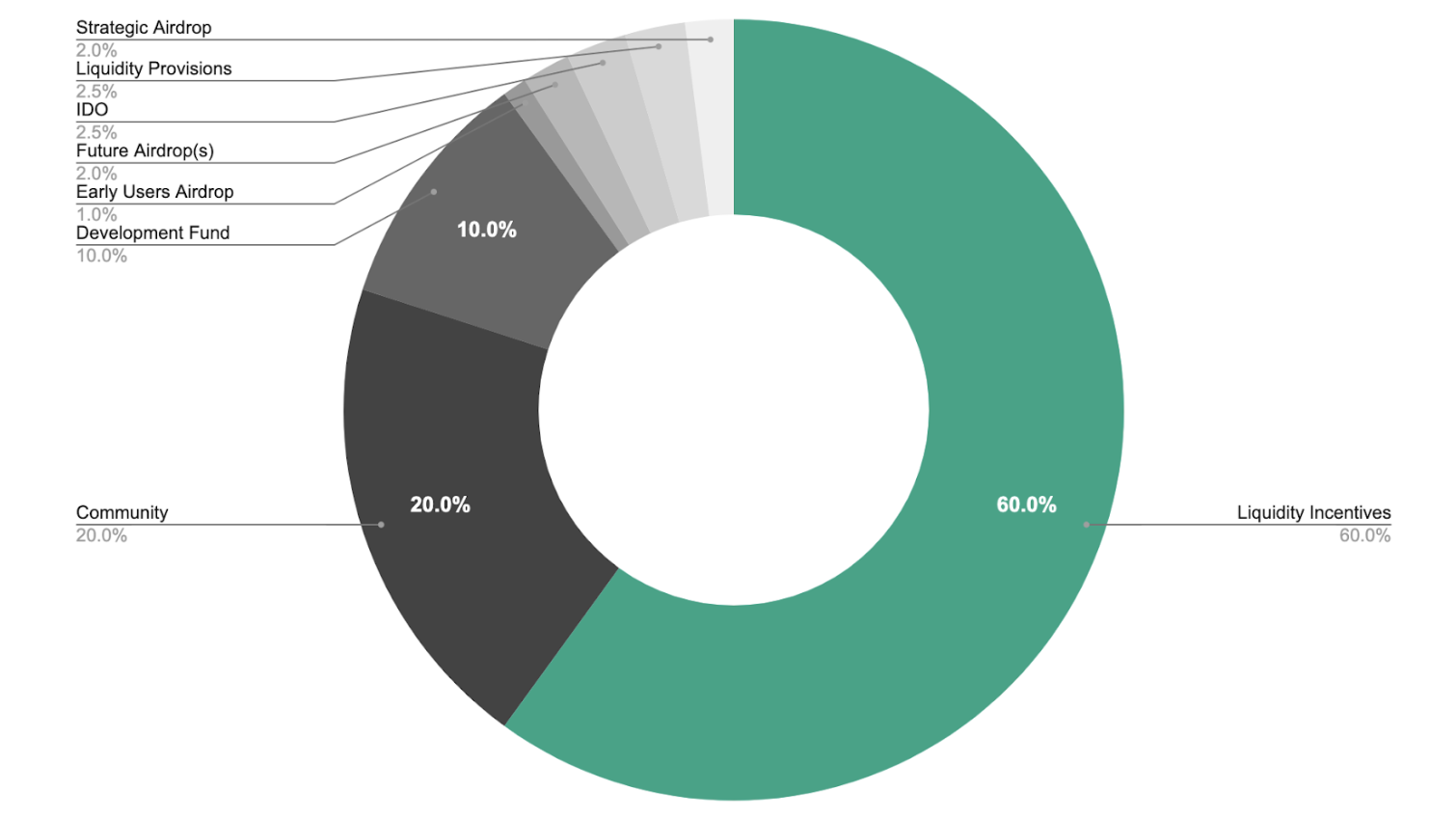

Le token de gouvernance du protocole RHEA est le REF, associé au partage des revenus. L’offre totale est plafonnée à 100 millions de tokens REF, répartis comme suit :

Incitations à la liquidité (60 %)

La majorité des tokens sont attribués aux utilisateurs actifs—traders ou fournisseurs de liquidité. La distribution s’étale sur quatre ans, avec un maximum la première année puis une baisse progressive, pour récompenser l’engagement précoce et la participation continue.Trésorerie du protocole (20 %)

Réservée au développement futur du protocole et au financement de l’écosystème. Aucun calendrier d’acquisition rigide—la DAO gère ces ressources de façon souple, pour les partenariats stratégiques, le développement technique ou l’expansion du marché.Fonds de développement (10 %)

Destiné au développement continu du protocole, aux évolutions techniques et à l’open source. Acquisition linéaire sur quatre ans, garantissant un soutien stable à long terme des équipes.Airdrop utilisateurs précoces (1 %)

Récompense les premiers utilisateurs et contributeurs. Les tokens sont débloqués au terme d’une période de trois mois, puis distribués linéairement sur les trois mois suivants.Airdrops futurs (2 %)

Réservés à d’éventuelles opérations communautaires ou de marketing. Les détails et le calendrier sont définis et publiés par la DAO.Initial DEX Offering (IDO) (2,5 %)

Organisé aux enchères via Skyward Finance en juillet 2021, pour lever des fonds et assurer une large distribution du token.Réserve de liquidité (2,5 %)

Servant à alimenter les pools de liquidité détenus par le protocole, stabiliser les échanges et soutenir les premiers swaps d’actifs.Airdrop stratégique (2 %)

Incite les partenaires, contributeurs clés et projets de l’écosystème afin d’accélérer la croissance collaborative.

(Source : guide.rhea)

Ce cadre de distribution a été pensé pour équilibrer la dynamique initiale du protocole, l’engagement communautaire et la pérennité du développement. Il traduit l’engagement de Rhea Finance pour une gouvernance avant tout communautaire et porteuse de valeur durable.

Pour explorer d’autres analyses Web3, cliquez pour vous inscrire : https://www.gate.com/

Résumé

Rhea Finance fusionne les fonctionnalités essentielles et l’infrastructure de protocole pour offrir une plateforme financière flexible, modulaire et hautement composable. Que vous soyez développeur, trader, fournisseur de liquidité ou acteur de la gouvernance, Rhea Finance s’impose comme un pôle Web3 incontournable pour un engagement profond. À mesure que l’abstraction de chaîne NEAR et les modules IA se mettent en place, Rhea se positionne comme le pont central de la nouvelle vague DeFi—concrétisant pleinement le potentiel de NEAR.

Articles Connexes

Pi Network (PI) au taux de change du franc CFA d'Afrique de l'Ouest (XOF) : Valeur actuelle et guide de conversion

Comment vendre la pièce PI : Guide du débutant

Valeur de Pi Crypto : Lancement sur Mainnet le 20 février 2025 & Prédictions de prix futures

Qu'est-ce que FAFO : jeton MEME dérivé de la plateforme sociale de Trump

Est-ce que XRP est un bon investissement? Un guide complet sur son potentiel