MetaMask 的内置币能改变稳定币的力量吗?

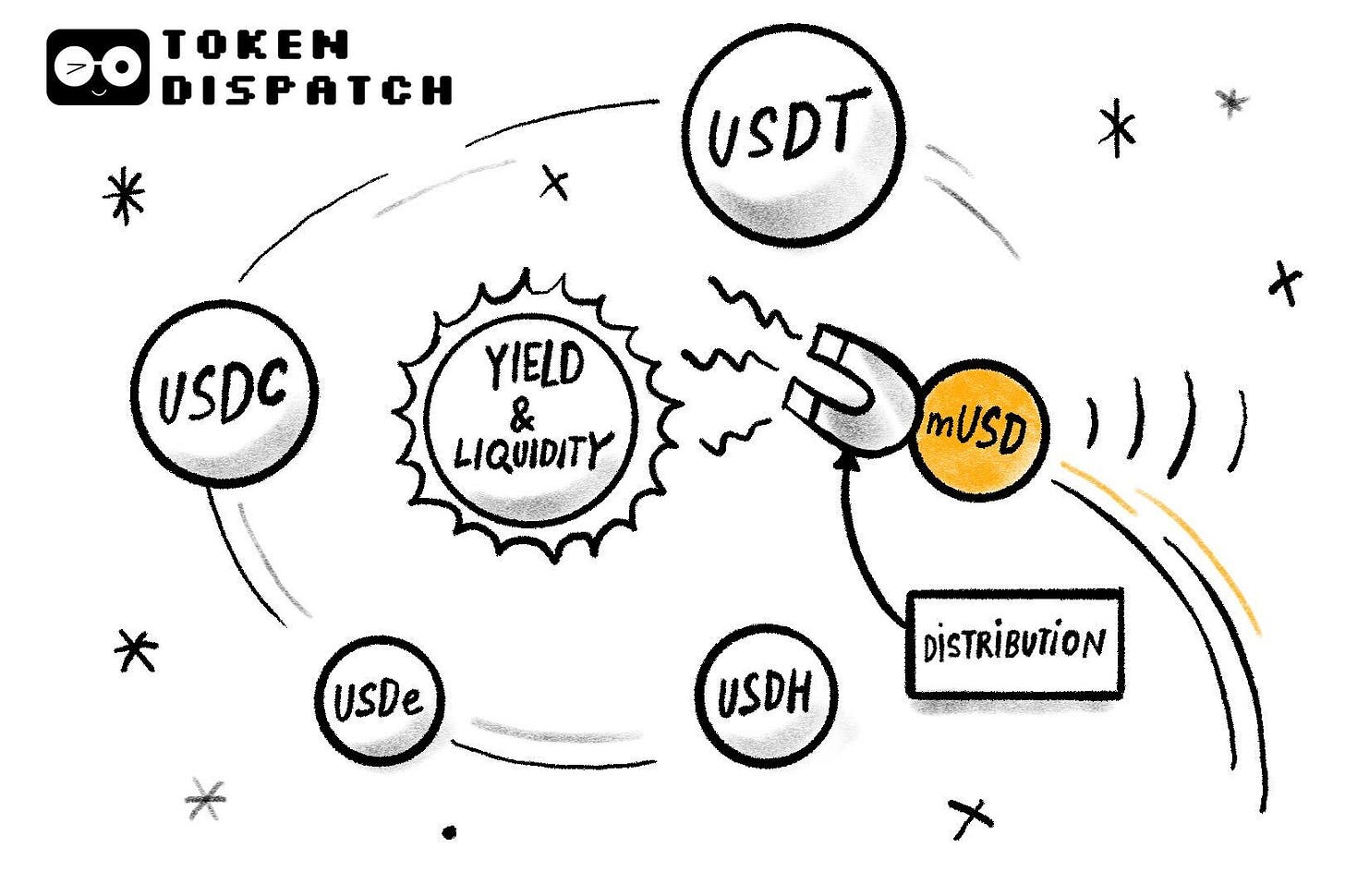

最近每周都让人感到“似曾相识”——稳定币不断上线,价值流向再度被重塑。最早我们见证了 Hyperliquid 的 USDH 发行争夺战,随后探讨了通过垂直整合来捕获美债收益的趋势。如今轮到 MetaMask 推出原生稳定币 mUSD。所有这些策略的核心都在于分发。

分发已经成为加密行业乃至其他领域构建商业模式的“加速器”。如果你拥有数百万规模的社区,为何不直接通过空投代币释放社区潜力?但现实并非总是如此。Telegram 曾以 TON 项目尝试,尽管拥有 5 亿消息用户,但这些用户始终未能迁移上链。Facebook 的 Libra 项目也曾信心满满,认为数十亿社交账户足以成为新货币的基础。两者理论上前景光明,却都在实践中折戟。

这也是为何 MetaMask 的 mUSD——狐狸耳朵和“$”符号的组合——引发我的关注。初看其与其他稳定币无异——以受监管托管的短期美债为担保,通过 Bridge.xyz 和 M0 protocol 的框架发行。

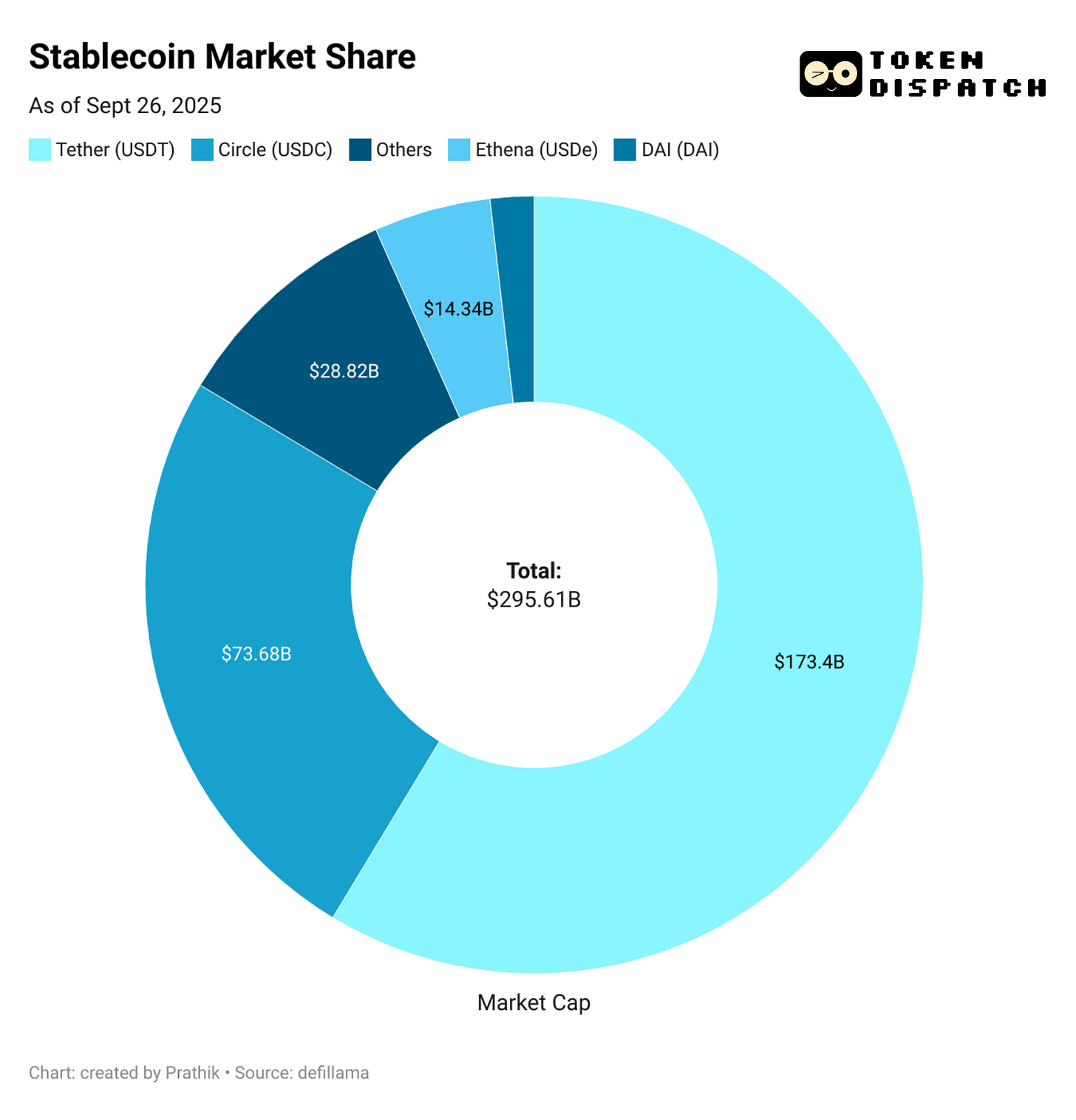

那么,在目前由头部双寡头主导的 3000 亿美元稳定币市场,MetaMask 的 mUSD 会凭什么脱颖而出?

你的加密资产还在闲置?不该如此!

使用 EarnPark,让你的 BTC、ETH 及稳定币通过成熟策略和链上真实收益充分运作。

无需交易,无需压力,智能自动赚收益。

- 通过 DeFi 和机构策略赚取收益

- 链上透明,完全非托管

- 随时提现,无锁定期

就像有一个收益团队全天候为你服务。

MetaMask 虽然身处竞争激烈的赛道,但它拥有别人无法复制的核心优势:分发。凭借全球 1 亿年活跃用户,MetaMask 拥有无可比拟的用户基础。mUSD 也是首个在自托管钱包内原生发行的稳定币,支持法币入金、币币兑换,甚至通过 MetaMask Card 实体卡线下消费。用户无需四处寻找交易所、跨链桥接或手动添加自定义代币,实现一站式体验。

Telegram 未能实现产品与用户行为的高度契合,而 MetaMask 却成功做到了。Telegram 希望将消息用户迁移到区块链,推动去中心化金融应用;MetaMask 则通过在钱包内集成原生稳定币,直接提升用户体验。

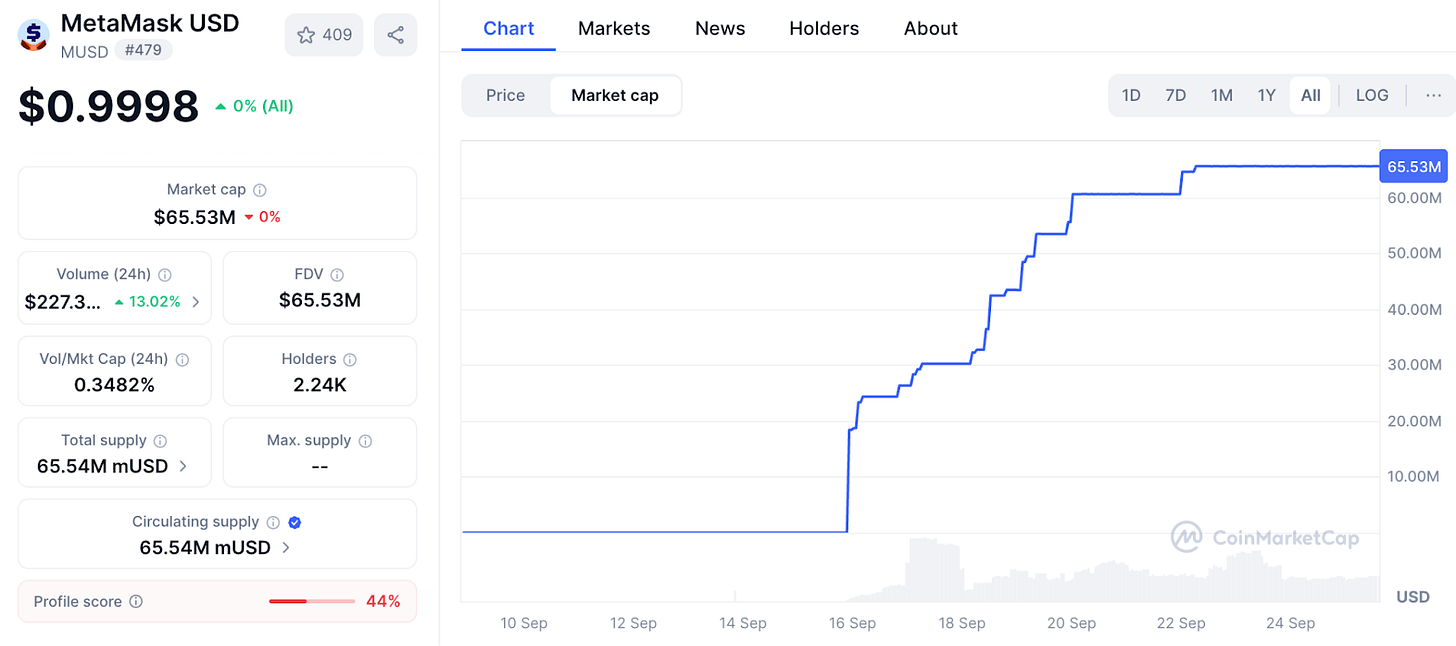

数据证明采用速度极快。

MetaMask 的 mUSD 市值在一周内迅速从 2500 万美元增长至 6500 万美元。近九成流通于 ConsenSys 旗下 Layer 2 网络 Linea,彰显 MetaMask 界面对流动性的强大引导力。这种平台效应类似交易所曾用的策略:2022 年 Binance 自动将用户充值转为 BUSD,流通量瞬间暴增。界面掌控者即为代币的掌控者。MetaMask 拥有超过 3000 万月活用户,是 Web3 领域屏幕数量最多的平台。

正是这种分发能力,让 MetaMask 与那些早期失败的稳定币项目拉开距离。

Telegram 的宏伟计划部分败于合规障碍。MetaMask 则通过与 Bridge(Stripe 旗下发行方)合作,以美债为每枚代币背书,合规环节一一落实。美国最新 GENIUS 法案也为其从一开始就提供了法律基础。流动性同样关键。MetaMask 正在为 Linea DeFi 注入 mUSD 交易对,押注自有网络可带动采用。

但分发并不保证成功。MetaMask 最大挑战来自现有巨头,尤其是在市场已被少数龙头垄断的前提下。

Tether 的 USDT 与 Circle 的 USDC 占据近 85% 的市场份额。第三位是 Ethena 的 USDe,供应量已达 140 亿美元,因收益吸引资金。Hyperliquid 的 USDH 刚上线,主打将交易所存款回流自家生态。

这也让我再次思考,MetaMask 希望 mUSD 扮演什么样的角色?

直接挑战 USDT 和 USDC 并不现实。流动性、上币和用户习惯都偏向头部平台。也许 mUSD 无需正面碰撞。正如我曾预期 Hyperliquid 的 USDH 会通过价值回流惠及社区,mUSD 更可能通过现有用户捕捉更多价值。

延伸阅读:Minting Control 🏦

每当新用户通过 Transak 入金、每有人在 MetaMask 内用 ETH 兑换稳定币,或在门店刷卡消费,mUSD 都将成为首选。这让稳定币成为生态内默认方案。

让我想起过去在 Ethereum、Solana、Arbitrum 和 Polygon 间桥接 USDC 的繁琐经历,只为满足不同场景。

mUSD 彻底终结了繁琐的跨链和兑换。

还有一个关键启示:收益。

有了 mUSD,MetaMask 能捕获美债支持所带来的收益。每 10 亿美元流通量,意味着每年数千万美元利息流回 ConsenSys。钱包从成本中心转为利润引擎。

仅 10 亿美元 mUSD 由等值美债支持,年利息收入可达 4000 万美元。对比来看,MetaMask 去年仅靠手续费就赚取了 6700 万美元。

这为 MetaMask 开辟了另一条被动且可观的收入渠道。

但这也引发了我的担忧。一直以来,钱包在我心中都是中立的签名工具。如今 mUSD 的出现,模糊了这一角色,让我曾信赖的基础设施变成依赖我的存款获利的业务单元。

分发既是优势,同时也带来了风险。它可能让 mUSD 默认“黏性”,也可能引发关于偏见和锁定的质疑。如果 MetaMask 调整兑换流程,使自家币种路线更优或优先展示,开放金融的边界或将收窄。

还有碎片化风险。

如果每个去中心化钱包都发行自己的美元,最终可能形成多个封闭生态式货币,而非当下 USDT/USDC 的双寡头格局。

未来的走向仍不明朗。MetaMask 通过与卡片集成,打通了买入、投资、消费 mUSD 的完整闭环。首周的增长证明其具备突破上线初期障碍的能力。但头部平台的强势也说明,用户规模从百万跃升至数十亿绝非易事。

MetaMask 的 mUSD 命运可能取决于上述因素之间的平衡。

本周的深度解析到此结束。

我们下周再见。

在这期间,保持好奇心。

Prathik

Token Dispatch 是每日加密通讯,由人类团队精心筛选与撰写。如欲触达 Token Dispatch 超 20 万订阅社区,可了解合作机会 🙌

📩 填写此表单,即可提交信息并预约会议。

免责声明:本通讯所含分析及观点仅代表作者,内容仅供参考,不构成投资建议。加密货币交易风险极高——投资资金存在风险。请务必充分调研。

免责声明:

- 本文转载自 [TOKEN DISPATCH],所有版权归原作者 [Prathik Desai] 所有。如对转载有异议,请联系 Gate Learn 团队,我们将及时处理。

- 责任声明:本文观点仅代表作者,不构成任何投资建议。

- 本文其他语种翻译由 Gate Learn 团队完成,除特殊说明外,禁止复制、分发或抄袭译文。

相关文章

什么是 USDe?解密 USDe 的多种收益方式

稳定币收益策略一览

Circle 公司 与 USDC 稳定币专题分析

Gate 研究院:稳定币赛道拆解深度报告 - 全景分析现状、应用、竞争与展望