Polkadot (DOT) có phải là khoản đầu tư tiềm năng?: Phân tích cơ hội của mạng lưới đa chuỗi này trong bối cảnh thị trường crypto không ngừng thay đổi

Giới thiệu: Tình hình đầu tư Polkadot (DOT) và triển vọng thị trường

Polkadot (DOT) là một tài sản lớn trong lĩnh vực tiền mã hóa, ghi dấu ấn mạnh mẽ nhờ khả năng kết nối các mạng blockchain kể từ khi ra mắt. Tính đến năm 2025, vốn hóa thị trường của Polkadot đạt 4.915.400.336,74 USD, nguồn cung lưu hành khoảng 1.522.267.060 DOT, và giá hiện tại xoay quanh 3,229 USD. Với vị thế “Internet của Blockchain”, Polkadot thu hút sự quan tâm của nhà đầu tư với câu hỏi: “Polkadot (DOT) có phải là khoản đầu tư đáng giá không?” Bài viết này sẽ phân tích toàn diện giá trị đầu tư, xu hướng lịch sử, dự báo giá tương lai cùng các rủi ro, nhằm hỗ trợ quyết định đầu tư.

I. Đánh giá lịch sử giá và giá trị đầu tư hiện tại của Polkadot (DOT)

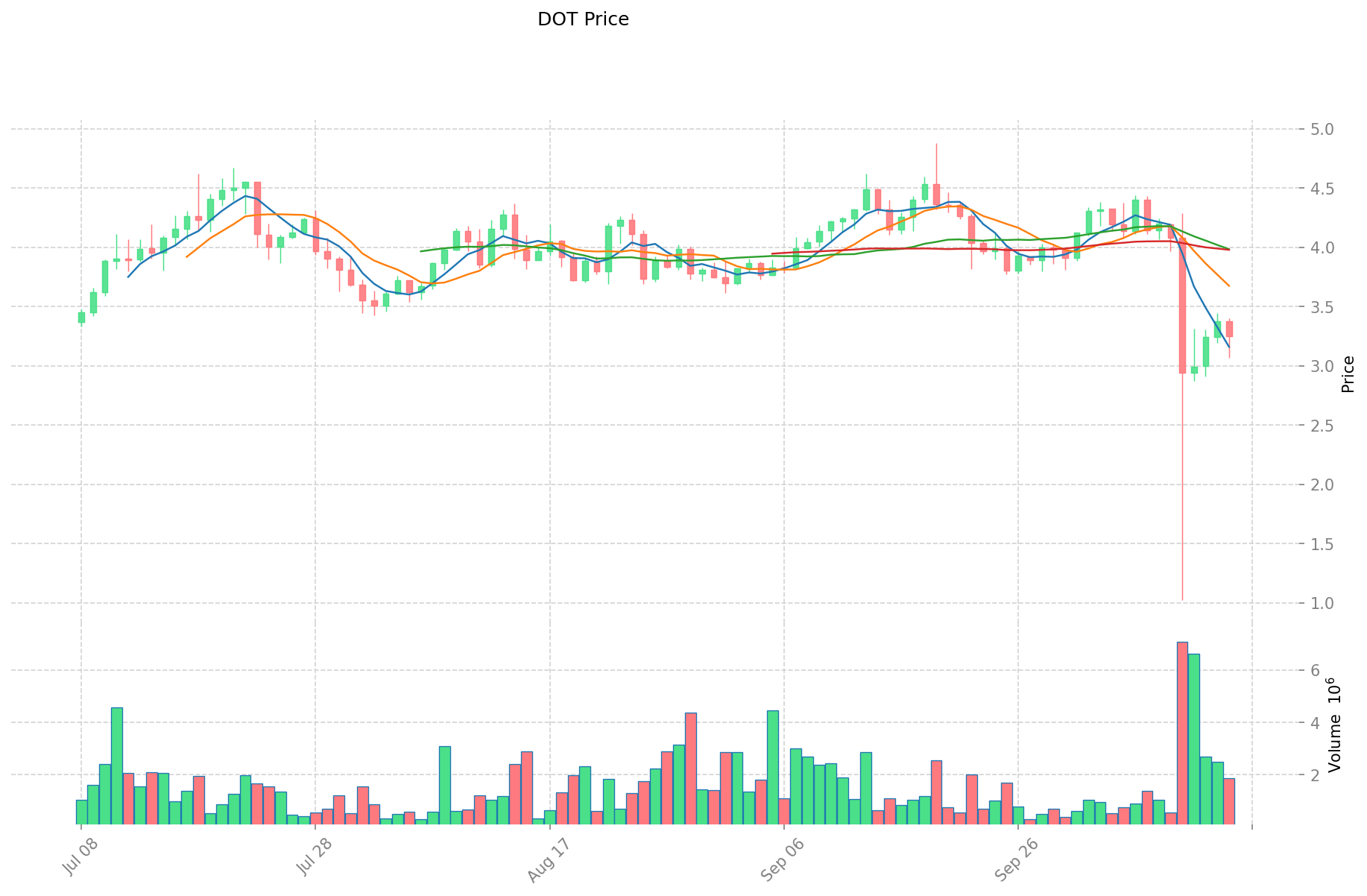

Xu hướng giá DOT và lợi suất đầu tư (Hiệu suất đầu tư Polkadot(DOT))

- Năm 2021: Giá cao nhất mọi thời đại 54,98 USD ngày 4 tháng 11 → Lợi nhuận lớn cho nhà đầu tư sớm

- Năm 2020: Giá thấp nhất 2,13 USD ngày 19 tháng 8 → Giá bắt đầu tăng trưởng

Tình hình thị trường đầu tư DOT hiện tại (Tháng 10 năm 2025)

- Giá DOT hiện tại: 3,229 USD

- Khối lượng giao dịch 24 giờ: 5.713.861,96 USD

- Vốn hóa thị trường: 4.915.400.336,74 USD

Bấm để xem giá DOT thời gian thực giá thị trường

II. Các yếu tố quyết định Polkadot (DOT) có phải là khoản đầu tư tốt không

Cơ chế cung ứng và tính khan hiếm (Khan hiếm trong đầu tư DOT)

- Cơ chế lạm phát nguồn cung → Ảnh hưởng giá và giá trị đầu tư

- Lịch sử: Các thay đổi nguồn cung thúc đẩy biến động giá DOT

- Ý nghĩa đầu tư: Tính khan hiếm là yếu tố quan trọng cho đầu tư dài hạn

Đầu tư tổ chức và sự chấp nhận phổ biến (Đầu tư tổ chức vào Polkadot)

- Xu hướng nắm giữ tổ chức: Dữ liệu hạn chế

- Các doanh nghiệp lớn áp dụng Polkadot → Tăng giá trị đầu tư

- Tác động của chính sách quốc gia tới triển vọng đầu tư Polkadot

Ảnh hưởng của môi trường vĩ mô đối với đầu tư Polkadot

- Chính sách tiền tệ, biến động lãi suất → Thay đổi sức hút đầu tư

- Vai trò phòng ngừa lạm phát → Định vị “vàng kỹ thuật số”

- Bất ổn địa chính trị → Tăng nhu cầu đầu tư Polkadot

Phát triển công nghệ và hệ sinh thái (Công nghệ & hệ sinh thái cho đầu tư Polkadot)

- Nâng cấp Polkadot 2.0: Nâng cao hiệu suất mạng → Tăng sức hấp dẫn đầu tư

- Mở rộng hệ sinh thái parachain: Đa dạng hóa ứng dụng → Hỗ trợ giá trị dài hạn

- Ứng dụng DeFi, NFT, thanh toán thúc đẩy giá trị đầu tư

III. Dự báo đầu tư DOT và triển vọng giá trong tương lai (Polkadot(DOT) có đáng đầu tư giai đoạn 2025-2030)

Triển vọng đầu tư DOT ngắn hạn (2025)

- Dự báo thận trọng: 3,00 – 3,50 USD

- Dự báo trung lập: 3,50 – 4,00 USD

- Dự báo lạc quan: 4,00 – 4,53 USD

Dự báo đầu tư Polkadot(DOT) trung hạn (2026-2027)

- Kỳ vọng thị trường: Có thể tăng trưởng khi mức độ áp dụng gia tăng

- Dự báo lợi nhuận đầu tư:

- 2026: 3,42 – 5,75 USD

- 2027: 2,89 – 5,54 USD

- Động lực chính: Tăng đầu tư tổ chức, mở rộng hệ sinh thái, cải thiện khả năng mở rộng

Triển vọng đầu tư dài hạn (Polkadot có phải là khoản đầu tư dài hạn tốt?)

- Kịch bản cơ bản: 4,80 – 5,65 USD (Hệ sinh thái phát triển ổn định, mức độ áp dụng tăng dần)

- Kịch bản lạc quan: 5,65 – 8,25 USD (Áp dụng rộng rãi, thị trường thuận lợi)

- Kịch bản rủi ro: 1,70 – 3,00 USD (Thách thức pháp lý hoặc sự cố kỹ thuật)

Bấm để xem đầu tư dài hạn DOT và dự báo giá: Dự báo giá

Triển vọng dài hạn 2025-10-15 – 2030

- Kịch bản cơ bản: 4,80 – 5,65 USD (Tương ứng tiến triển ổn định và cải thiện ứng dụng phổ biến)

- Kịch bản lạc quan: 5,65 – 8,25 USD (Áp dụng quy mô lớn, thị trường thuận lợi)

- Kịch bản đột phá: Trên 8,25 USD (Nếu hệ sinh thái và mức độ áp dụng phổ biến đạt tiến bộ vượt trội)

- Dự báo giá cao năm 2030-12-31: 8,25 USD (Dựa theo giả định phát triển lạc quan)

Miễn trừ trách nhiệm: Thông tin chỉ nhằm mục đích giáo dục, không phải tư vấn tài chính. Đầu tư tiền mã hóa rủi ro, biến động mạnh. Luôn tự nghiên cứu và tham khảo chuyên gia tài chính trước khi quyết định đầu tư.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4,5346 | 3,239 | 1,71667 | 0 |

| 2026 | 5,752464 | 3,8868 | 3,420384 | 20 |

| 2027 | 5,5425768 | 4,819632 | 2,8917792 | 49 |

| 2028 | 5,95827006 | 5,1811044 | 3,62677308 | 60 |

| 2029 | 5,7367778469 | 5,56968723 | 4,9570216347 | 72 |

| 2030 | 8,253719506137 | 5,65323253845 | 4,8052476576825 | 75 |

IV. Cách đầu tư Polkadot (DOT)

Chiến lược đầu tư Polkadot

- HODL DOT: Phù hợp nhà đầu tư bảo thủ

- Giao dịch chủ động: Dựa vào phân tích kỹ thuật, giao dịch xoay vòng

Quản trị rủi ro khi đầu tư Polkadot

- Tỷ lệ phân bổ tài sản:

- Bảo thủ: 1 – 5% danh mục

- Mạo hiểm: 5 – 10% danh mục

- Chuyên nghiệp: 10 – 20% danh mục

- Chiến lược phòng ngừa: Danh mục đa tài sản + công cụ hedging

- Lưu trữ an toàn: Ví lạnh, ví nóng wallet + khuyến nghị ví phần cứng

V. Rủi ro khi đầu tư Polkadot (DOT)

- Rủi ro thị trường: Biến động mạnh, nguy cơ thao túng giá

- Rủi ro pháp lý: Chính sách không ổn định giữa các quốc gia

- Rủi ro kỹ thuật: Lỗ hổng bảo mật mạng, thất bại khi nâng cấp

VI. Kết luận: Polkadot (DOT) có phải là khoản đầu tư tốt?

- Tóm tắt giá trị đầu tư: Polkadot có tiềm năng đầu tư dài hạn lớn, nhưng biến động giá ngắn hạn mạnh.

- Khuyến nghị cho nhà đầu tư: ✅ Người mới: Trung bình hóa chi phí + lưu trữ ví an toàn ✅ Nhà đầu tư kinh nghiệm: Giao dịch xoay vòng + đa dạng hóa danh mục ✅ Tổ chức: Phân bổ dài hạn chiến lược

⚠️ Lưu ý: Đầu tư tiền mã hóa tiềm ẩn rủi ro cao. Bài viết chỉ tham khảo, không phải tư vấn đầu tư.

VII. FAQ

Q1: Polkadot (DOT) là gì và hoạt động ra sao? A: Polkadot là mạng đa chuỗi cho phép các blockchain khác nhau tương tác, kết nối nhiều mạng blockchain để trao đổi dữ liệu và tài sản liền mạch.

Q2: Polkadot (DOT) có phải là khoản đầu tư tốt năm 2025? A: Polkadot có tiềm năng đầu tư năm 2025, dự báo giá từ 3,00 – 4,53 USD. Tuy nhiên, đầu tư tiền mã hóa rất biến động và rủi ro cao, cần nghiên cứu kỹ và cân nhắc trước khi đầu tư.

Q3: Làm sao để đầu tư Polkadot (DOT)? A: Có thể đầu tư bằng cách mua DOT trên sàn giao dịch, nắm giữ lâu dài (HODL) hoặc giao dịch chủ động. Cần sử dụng ví bảo mật và thực hiện quản lý rủi ro đúng quy trình.

Q4: Các rủi ro chính khi đầu tư Polkadot là gì? A: Rủi ro gồm biến động thị trường, nguy cơ thao túng giá, bất ổn pháp lý và rủi ro kỹ thuật như lỗ hổng hoặc thất bại nâng cấp mạng.

Q5: Triển vọng dài hạn của Polkadot (DOT) ra sao? A: Triển vọng dài hạn dao động theo kịch bản cơ bản từ 4,80 – 5,65 USD năm 2030; kịch bản lạc quan có thể đạt tới 8,25 USD. Đây chỉ là dự báo, có thể thay đổi theo nhiều yếu tố.

Q6: Polkadot so với các đồng tiền mã hóa khác trong đầu tư như thế nào? A: Polkadot nổi bật là “Internet của Blockchain”, đem lại ứng dụng đa dạng hơn một số đồng tiền khác. Tuy nhiên, hiệu suất còn tùy thuộc vào thị trường và tiến bộ công nghệ.

FST và VET: Phân tích so sánh giữa công nghệ dịch vụ tài chính và hệ thống đào tạo giáo dục thú y

Swarms (SWARMS) có phải là lựa chọn đầu tư phù hợp?: Đánh giá cơ hội và rủi ro của tài sản crypto mới nổi này trong năm 2023

FIO Protocol (FIO) có phải là lựa chọn đầu tư hiệu quả?: Đánh giá tiềm năng cùng rủi ro của giải pháp blockchain này trong năm 2023

ALKIMI vs VET: Đối chiếu các nền tảng Blockchain tiên tiến dành cho quảng cáo kỹ thuật số

Bedrock (BR) có phải là lựa chọn đầu tư hiệu quả?: Đánh giá khả năng sinh lời và các rủi ro liên quan đến token dịch vụ AI của Amazon

PlatON (LAT) có phải là lựa chọn đầu tư phù hợp?: Đánh giá tiềm năng phát triển và các yếu tố rủi ro trong lĩnh vực blockchain hạ tầng

Tìm hiểu về node: Những thành phần và chức năng trọng yếu trong blockchain

Những nền tảng nổi bật nhất cho giao dịch tiền mã hóa phi tập trung

Những Giải Pháp Phần Cứng Bảo Mật Đỉnh Cao Cho Việc Bảo Quản NFT An Toàn

Khám phá các giải pháp Cross-Chain: Cẩm nang về tính tương tác giữa các blockchain

Dễ dàng tìm kiếm và đặt trước tên miền ENS phù hợp nhất với bạn