Прогноз ціни TREE на 2025 рік: аналіз ринку та потенціал зростання для екологічних криптовалютних активів

Вступ: ринкова позиція TREE та інвестиційна цінність

Treehouse (TREE) — піонер децентралізованої інфраструктури фіксованого доходу для криптовалют — з моменту запуску досягла відчутних результатів. Станом на 2025 рік ринкова капіталізація TREE становить $40 076 632, обігова пропозиція — близько 156 122 449 токенів, ціна — приблизно $0,2567. Актив, що здобув репутацію «інноватора еталонної ставки DeFi», набуває дедалі більшої ваги у формуванні ринків фіксованого доходу в криптоіндустрії.

У статті подано комплексний аналіз цінових тенденцій TREE у 2025–2030 роках із залученням історичних патернів, балансу попиту й пропозиції, розвитку екосистеми та макроекономічних чинників для формування професійних прогнозів і практичних інвестиційних стратегій для інвесторів.

I. Огляд історії ціни TREE та поточний ринковий статус

Історична динаміка ціни TREE

- 2025 липень: TREE досягла абсолютного максимуму $1,3524 29 липня, що стало ключовою подією для проекту

- 2025 вересень: Відбулося різке падіння ціни до історичного мінімуму $0,2454 30 вересня

- 2025 жовтень: TREE знаходиться у фазі відновлення, ціна стабілізувалась біля $0,2567

Поточний ринковий стан TREE

На 1 жовтня 2025 року TREE торгується на рівні $0,2567, демонструючи невелике відновлення після останнього мінімуму. Добовий обсяг торгів становить $356 251,24 — це свідчить про помірну активність ринку. За добу токен втратив 1,34%, що вказує на короткострокову волатильність. Наразі ринкова капіталізація TREE дорівнює $40 076 632,66, що відповідає 786-й позиції у загальному рейтингу крипторинку.

Обігова пропозиція TREE — 156 122 449 токенів, або 15,61% від загальної емісії 1 000 000 000. Низький рівень циркуляції може впливати на ринкову динаміку зі збільшенням обігу токенів. Повністю розбавлена капіталізація — $256 700 000, що демонструє потенціал для подальшого зростання у разі зростання популярності проекту.

У довгостроковій перспективі TREE показує негативний тренд: за тиждень та місяць фіксується падіння на 14,39% і 24,75% відповідно. Тиск на ціну може бути зумовлений як загальним станом ринку, так і специфікою проекту.

Перейдіть, щоб переглянути актуальну ринкову ціну TREE

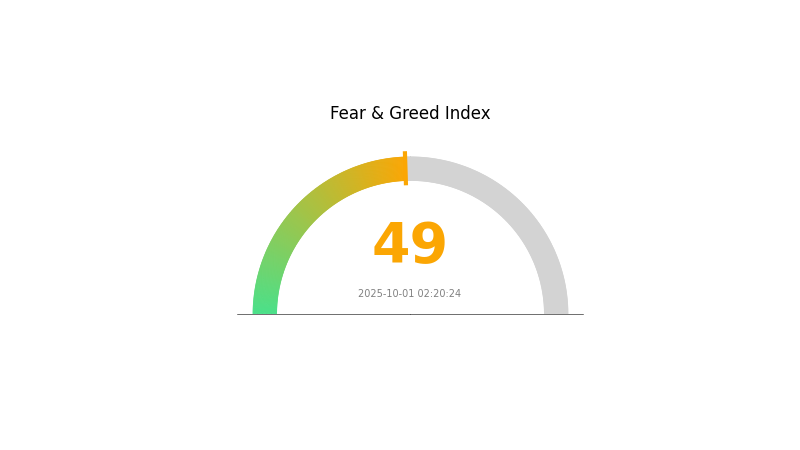

Індикатор ринкових настроїв TREE

01 жовтня 2025 року Індекс страху та жадібності: 49 (нейтрально)

Перейдіть, щоб переглянути індекс страху та жадібності

Ринкові настрої залишаються нейтральними, інвестори зберігають рівновагу між ризиками та можливостями. Індекс 49 вказує на відсутність крайніх емоцій — на ринку немає переважної паніки чи ажіотажу. Такий баланс дає підстави для обережного оптимізму і підготовки стратегії з урахуванням швидких змін настроїв. Для прийняття ефективних рішень слід постійно стежити за ринком за допомогою Gate.com.

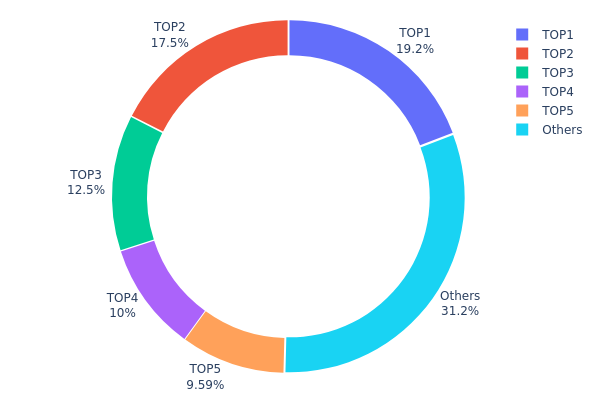

Розподіл володіння TREE

Дані про розподіл токенів TREE серед адрес дають змогу оцінити концентрацію володінь. Аналіз свідчить про високу централізацію: п’ять найбільших гаманців контролюють 68,77% загальної емісії, найбільший володіє 19,18% токенів TREE.

Суттєва концентрація у невеликого числа власників підвищує ризики маніпуляцій і волатильності. Володар майже п’ятої частини емісії здатний впливати на ринок; ще три адреси мають понад 10% кожна, що посилює проблему централізації.

Для багатьох криптовалют часткова концентрація типова, однак поточна структура TREE свідчить про обмежену децентралізацію. Це може вплинути на стабільність екосистеми й стійкість до великих продажів або узгоджених дій основних гравців. Інвесторам варто враховувати ці аспекти, оцінюючи ринкову поведінку TREE та її перспективи.

Перейдіть, щоб переглянути розподіл володіння TREE

| Топ | Адреса | Кількість токенів | Частка, % |

|---|---|---|---|

| 1 | 0x43f8...de3d77 | 191 868,37K | 19,18% |

| 2 | 0x5fd1...6373e2 | 175 000,00K | 17,50% |

| 3 | 0xb897...05a7b7 | 125 000,00K | 12,50% |

| 4 | 0x4c21...5c42fb | 100 000,00K | 10,00% |

| 5 | 0x6315...259d14 | 95 918,37K | 9,59% |

| - | Інші | 312 213,27K | 31,23% |

II. Ключові фактори, що визначають майбутню ціну TREE

Механізм пропозиції

- Історичні патерни: минулі зміни пропозиції суттєво впливали на ціну TREE.

- Поточний вплив: актуальні зміни пропозиції формують коротко- й середньострокову динаміку ціни.

Динаміка інституцій та «китів»

- Інституційні володіння: великі інституції проявляють зростаючий інтерес до TREE, що може позначитися на стабільності й потенціалі зростання ціни.

Макроекономічне середовище

- Вплив монетарної політики: рішення центральних банків щодо ставок та інфляції можуть суттєво змінити ціну TREE.

- Захист від інфляції: TREE у періоди інфляції може виступати хеджем, що підвищує її привабливість.

- Геополітичні чинники: міжнародна економічна й політична нестабільність стимулюватиме попит на альтернативні активи, зокрема TREE.

Технологічний розвиток і розбудова екосистеми

- Застосування: розширення DApps та проєктів на базі TREE може підштовхнути попит і посилити ринкову вартість токена.

III. Прогноз ціни TREE на 2025–2030 роки

Прогноз на 2025 рік

- Консервативний діапазон: $0,16223–$0,2575

- Нейтральний діапазон: $0,2575–$0,2884

- Оптимістичний діапазон: $0,2884–$0,32 (за умови позитивних настроїв і підвищення використання)

Прогноз на 2027–2028 роки

- Очікувана ринкова фаза: можливе зростання з підвищеною волатильністю

- Прогнозовані діапазони:

- 2027: $0,16213–$0,40833

- 2028: $0,30823–$0,39326

- Ключові драйвери: технологічні інновації, широка інтеграція екосистеми, сприятливе регуляторне середовище

Довгостроковий прогноз (2029–2030)

- Базовий сценарій: $0,37378–$0,45227 (за умови стійкого ринкового росту та впровадження)

- Оптимістичний сценарій: $0,45227–$0,54272 (при прискореному впровадженні й сприятливих ринкових умовах)

- Трансформаційний сценарій: $0,54272–$0,60 (за умови проривних застосувань і масової інтеграції)

- 31 грудня 2030 року: TREE $0,54272 (можливий максимум за оптимістичними прогнозами)

| Рік | Максимальна ціна | Середня ціна | Мінімальна ціна | Зміна, % |

|---|---|---|---|---|

| 2025 | 0,2884 | 0,2575 | 0,16223 | 0 |

| 2026 | 0,32754 | 0,27295 | 0,23201 | 6 |

| 2027 | 0,40833 | 0,30025 | 0,16213 | 16 |

| 2028 | 0,39326 | 0,35429 | 0,30823 | 38 |

| 2029 | 0,53076 | 0,37378 | 0,29154 | 45 |

| 2030 | 0,54272 | 0,45227 | 0,28945 | 76 |

IV. Професійні інвестиційні стратегії та управління ризиками для TREE

Інвестиційна методологія TREE

(1) Довгострокова стратегія володіння

- Підходить: для інвесторів, які орієнтуються на довгострокову вартість

- Рекомендації:

- Накопичуйте токени TREE під час спадів на ринку

- Оформіть регулярний план інвестування

- Зберігайте токени у безпечних некостодіальних гаманцях

(2) Активна торгова стратегія

- Інструменти технічного аналізу:

- Ковзаючі середні: моніторинг коротко- та довгострокових тенденцій

- RSI: виявлення зон перекупленості та перепроданості

- Ключові аспекти для свінг-трейдингу:

- Відстежуйте тенденції DeFi та показники ліквідності

- Встановіть стоп-лосс для контролю ризиків

Фреймворк управління ризиками TREE

(1) Принципи алокації активів

- Консервативні інвестори: 1–3%

- Агресивні інвестори: 5–10%

- Професійні інвестори: 10–15%

(2) Інструменти хеджування ризиків

- Диверсифікуйте портфель серед кількох DeFi-проєктів

- Скористайтеся staking/фармінгом для компенсації можливих втрат

(3) Безпечні рішення для зберігання

- Гарячий гаманець: Gate web3 wallet

- Холодне зберігання: апаратний гаманець для довгострокових інвестицій

- Додаткові заходи: двофакторна автентифікація, унікальні паролі

V. Потенційні ризики та виклики TREE

Ринкові ризики TREE

- Волатильність: DeFi-токени часто мають сильні цінові коливання

- Ліквідність: складнощі із продажем великих обсягів без впливу на ціну

- Конкуренція: нові DeFi-проєкти можуть зменшити частку TREE на ринку

Регуляторні ризики TREE

- Невизначеність норм: змінювані світові правила впливають на DeFi

- Комплаєнс: можливі труднощі із дотриманням вимог у майбутньому

- Транскордонні обмеження: міжнародні норми можуть стримувати розширення

Технічні ризики TREE

- Вразливість смарт-контрактів: ризик експлойтів у коді протоколу

- Масштабування: труднощі із збільшенням транзакційної активності

- Інтероперабельність: складнощі інтеграції з іншими блокчейн-мережами

VI. Висновки та рекомендації до дій

Оцінка інвестиційної цінності TREE

TREE пропонує перспективу довгострокової вартості на ринку DeFi завдяки інноваціям у сфері фіксованого доходу, водночас короткострокова волатильність і регуляторна невизначеність залишаються ключовими ризиками.

Інвестиційні рекомендації TREE

✅ Початківцям: інвестуйте невеликі суми на регулярній основі, щоб краще розуміти ринок ✅ Досвідченим: виділіть частину DeFi-портфеля для TREE, зберігаючи диверсифікацію ✅ Інституційним: проведіть ретельний due diligence, розглядайте TREE як елемент ширшої DeFi-стратегії

Методи участі у торгівлі TREE

- Спотова торгівля: купуйте та продавайте TREE на Gate.com

- Staking: беріть участь у програмах фармінгу доходу, якщо вони доступні

- DeFi-інтеграція: використовуйте TREE в екосистемі Treehouse для додаткової утиліти

Інвестиції у криптовалюти супроводжуються надзвичайно високим ризиком, і ця стаття не є інвестиційною порадою. Інвестор приймає рішення самостійно відповідно до власної толерантності до ризику та повинен консультуватися з професійними фінансовими радниками. Не інвестуйте більше, ніж готові втратити.

FAQ

Чи варто купувати акції TREE?

Так, TREE вважається привабливим активом для купівлі. 88% аналітиків дають рейтинг «Купувати» або «Сильна купівля». Перш ніж інвестувати, обов’язково врахуйте поточні ринкові тенденції.

Яка криптовалюта має потенціал зростання у 1000 разів?

Bitcoin Hyper та Snorter Token демонструють потужний потенціал 1000x. Це топові альткоїни 2025 року з очікуваними пресейлами та високим потенціалом зростання.

LendingTree: купувати, продавати чи тримати?

За результатами поточного аналізу ринку LendingTree (TREE) рекомендовано купувати. Аналітики одностайно радять купувати акції, і станом на жовтень 2025 року немає жодного рейтингу «тримати» чи «продавати».

Який довгостроковий прогноз для акцій TREE?

Акції TREE мають позитивний довгостроковий прогноз — очікувана ціна $70,96 у 2025 році, що становить приріст на 4,85% від поточних рівнів.

Поділіться

Контент