Прогноз ціни SIDUS на 2025 рік: аналіз ринкових тенденцій і потенційних чинників зростання

Вступ: Ринкова позиція та інвестиційна цінність SIDUS

SIDUS (SIDUS) — ігровий токен для WebGL, AAA, P2E, NFT та MMORPG гри SIDUS HEROES, який з моменту запуску активно використовується як внутрішньоігровий актив і винагорода на маркетплейсі SIDUS. Станом на 2025 рік ринкова капіталізація SIDUS становить $4 955 630, обсяг токенів в обігу — близько 11 069 086 922, а вартість тримається біля $0,0004477. Цей актив, — «валюта космічного метавсесвіту», — відіграє дедалі важливішу роль у внутрішньоігрових платежах для всіх класів і персонажів.

У статті представлений комплексний аналіз цінових трендів SIDUS у період з 2025 до 2030 року: враховано історичні закономірності, баланс попиту і пропозиції, розвиток екосистеми та макроекономічні чинники для надання професійних прогнозів і практичних інвестиційних стратегій.

I. Огляд цінової історії SIDUS та поточного ринку

Історична динаміка ціни SIDUS

- 2022: Абсолютний максимум $0,193233 зафіксовано 1 січня — це вершина цінового руху SIDUS.

- 2025: Значне падіння, історичний мінімум — $0,00040412 4 вересня.

Поточний стан ринку SIDUS

SIDUS торгується по $0,0004477, що означає скорочення на 21,07% за останні 24 години. Токен перебуває під значним тиском: мінус 20,94% за тиждень і мінус 21,29% за 30 днів. За рік SIDUS втратив 87,08% вартості. Нинішня ціна на 99,77% нижча за історичний максимум — це ознака глибокого ведмежого ринку. Ринкова капіталізація — $4 955 630, повністю розведена оцінка — $13 431 000; SIDUS займає 1 734 місце серед криптовалют. Обсяг торгів за 24 години — $58 371, що свідчить про низьку ліквідність.

Перегляньте актуальну ринкову ціну SIDUS

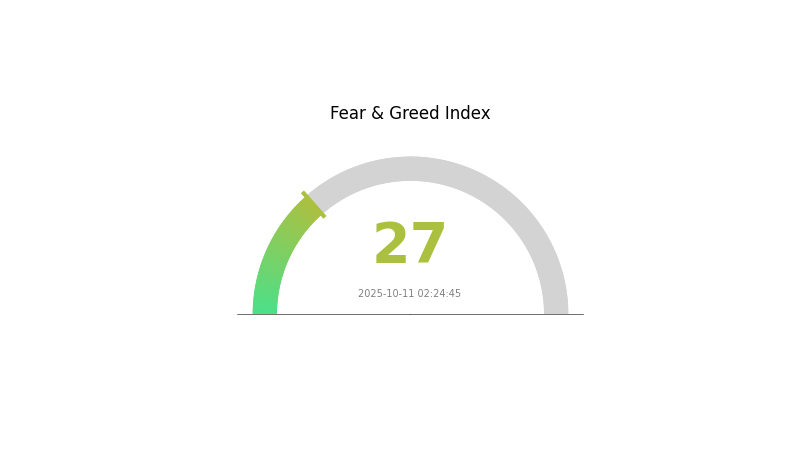

Індикатор ринкових настроїв SIDUS

11 жовтня 2025 року Індекс страху і жадібності: 27 (Страх)

Перегляньте Індекс страху і жадібності SIDUS

Криптовалютний ринок перебуває у стані страху: індекс страху і жадібності — 27. Це сигналізує про обережність інвесторів і небажання ухвалювати ризикові рішення. Частина трейдерів розглядає таку фазу як період для накопичення, керуючись принципом: «купуй, коли інші бояться». Водночас варто ретельно досліджувати ринок і оцінювати власну схильність до ризику перед інвестиціями. Слідкуйте за тенденціями та новинами, що можуть змінити настрій у найближчі дні.

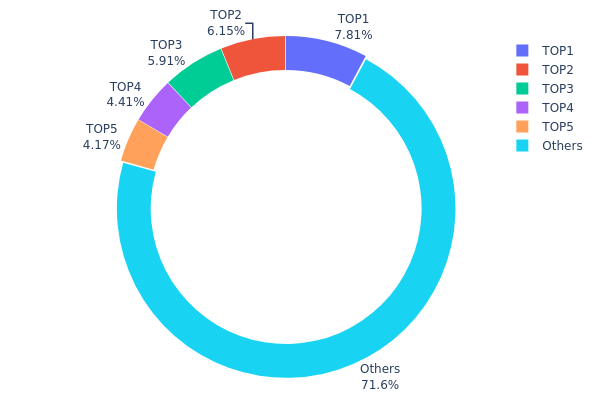

Розподіл володіння SIDUS

Дані щодо розподілу володінь по адресах дозволяють оцінити концентрацію SIDUS серед різних гаманців. Аналіз показує помірно концентрований характер: топ-5 адрес контролюють 28,42% усіх SIDUS, найбільша — 7,81%. Це суттєво, але не свідчить про надмірну централізацію.

Структура розподілу свідчить про збалансований ринок: 71,58% токенів належать адресам поза топ-5. Такий розподіл сприяє стабільності ціни, адже жоден власник не має вирішального впливу на емісію. Водночас, узгоджені дії найбільших холдерів можуть впливати на ринкову динаміку.

Загалом, SIDUS демонструє помірну децентралізацію: хоча частина токенів зосереджена у великих власників, більшість належить дрібним учасникам — це позитивний сигнал для стійкості ринку і захисту від маніпуляцій.

Перегляньте актуальний розподіл володінь SIDUS

| Топ | Адреса | Кількість | Частка (%) |

|---|---|---|---|

| 1 | 0x5d1e...ccab17 | 1 475 240,10K | 7,81% |

| 2 | 0xf89d...5eaa40 | 1 162 285,74K | 6,15% |

| 3 | 0x0d07...b492fe | 1 115 851,42K | 5,90% |

| 4 | 0xd621...d19a2c | 832 206,60K | 4,40% |

| 5 | 0xdc40...a5fbc4 | 787 371,09K | 4,16% |

| - | Інші | 13 515 923,83K | 71,58% |

II. Ключові чинники, що впливають на майбутню ціну SIDUS

Макроекономічне середовище

-

Вплив монетарної політики: Очікується, що Федеральна резервна система США продовжить знижувати ставки. Прогнози вказують на рівень 3–3,5% з жовтня до 2026 року, що може стимулювати зростання фондових ринків.

-

Геополітичні чинники: Аргентина планує запровадити механізм плаваючого валютного курсу після скасування обмежень у 2025 році, що може вплинути на міжнародні ринки та валютну динаміку.

Технологічний розвиток та розвиток екосистеми

- Екосистемні застосування: SIDUS може використовуватись у геймінгу, цифрових сервісах, віртуальних трансляціях і культурно-туристичних експозиціях. Розвиток таких напрямків впливає на майбутню ціну токена.

III. Прогноз ціни SIDUS на 2025–2030 роки

Прогноз на 2025 рік

- Консервативний прогноз: $0,00028 – $0,00035

- Нейтральний прогноз: $0,00035 – $0,00055

- Оптимістичний прогноз: $0,00055 – $0,00065 (за умови відновлення ринку та розвитку проєкту)

Прогноз на 2026–2027 роки

- Очікуваний етап ринку: консолідація і зростання

- Прогноз цінових діапазонів:

- 2026: $0,00043 – $0,00059

- 2027: $0,00053 – $0,00083

- Ключові драйвери: активніше використання екосистеми SIDUS, поліпшення настроїв ринку

Довгостроковий прогноз на 2028–2030 роки

- Базовий сценарій: $0,00060 – $0,00079 (за умови стабільного зростання і стабільності ринку)

- Оптимістичний сценарій: $0,00079 – $0,00084 (при суттєвому розширенні екосистеми та масовому впровадженні)

- Трансформаційний сценарій: $0,00084+ (у разі великих партнерств чи технологічних проривів)

- 31 грудня 2030 року: SIDUS $0,00084 (потенційний максимум згідно прогнозів)

| Рік | Максимальна ціна | Середня ціна | Мінімальна ціна | Зміна (%) |

|---|---|---|---|---|

| 2025 | 0,00065 | 0,00045 | 0,00028 | 1 |

| 2026 | 0,00059 | 0,00055 | 0,00043 | 22 |

| 2027 | 0,00083 | 0,00057 | 0,00053 | 27 |

| 2028 | 0,00081 | 0,0007 | 0,0006 | 56 |

| 2029 | 0,00083 | 0,00076 | 0,00039 | 68 |

| 2030 | 0,00084 | 0,00079 | 0,00058 | 77 |

IV. Професійні інвестиційні стратегії та управління ризиками для SIDUS

Методика інвестування в SIDUS

(1) Довгострокова стратегія утримання

- Для інвесторів із високою толерантністю до ризику та довгостроковим баченням

- Операційні поради:

- Накопичуйте SIDUS під час ринкових спадів

- Встановіть цільові ціни для часткового фіксування прибутку

- Зберігайте токени в захищених гаманцях з регулярними оновленнями безпеки

(2) Активна стратегія торгівлі

- Технічні інструменти:

- Ковзні середні (Moving Averages): для визначення трендів і точок розвороту

- RSI (Relative Strength Index): моніторинг стану перекупленості/перепроданості

- Ключові аспекти для свінг-трейдингу:

- Слідкуйте за новинами ігрової індустрії та оновленнями SIDUS HEROES

- Встановлюйте чіткі стоп-лоси для контролю ризиків падіння

Система управління ризиками SIDUS

(1) Принципи алокації активів

- Консервативні інвестори: 1–3% крипто-портфеля

- Агресивні інвестори: 5–10% крипто-портфеля

- Професійні інвестори: до 15% крипто-портфеля

(2) Стратегії хеджування ризиків

- Диверсифікація: розподіляйте інвестиції між різними ігровими токенами

- Стоп-лоси: використовуйте для обмеження втрат

(3) Безпечні рішення для зберігання

- Рекомендація гарячого гаманця: Gate Web3 Wallet

- Холодне зберігання: апаратний гаманець для довгострокових інвестицій

- Безпека: двофакторна автентифікація, унікальні паролі

V. Можливі ризики та виклики для SIDUS

Ринкові ризики SIDUS

- Висока волатильність: значні цінові коливання властиві ігровим токенам

- Конкуренція: ринок насичується новими блокчейн-іграми

- Прийняття користувачами: залежить від успіху та популярності SIDUS HEROES

Регуляторні ризики SIDUS

- Невизначеність законодавства: можливість посилення контролю над ігровими токенами

- Транскордонні обмеження: різний правовий статус у різних країнах

- Податкові наслідки: змінюється підхід до оподаткування ігрових токенів та внутрішньоігрових доходів

Технічні ризики SIDUS

- Уразливості смарт-контрактів: можливість експлойтів чи помилок

- Проблеми масштабованості: можливе перевантаження мережі у пікові періоди

- Взаємодія: інтеграція з іншими блокчейн-мережами або іграми

VI. Висновки та практичні рекомендації

Оцінка інвестиційної цінності SIDUS

SIDUS — це високоризиковий, потенційно високоприбутковий актив у блокчейн-геймінгу. Довгострокова цінність залежить від успіху SIDUS HEROES, а короткострокова волатильність залишається суттєвим ризиком.

Рекомендації для інвесторів SIDUS

✅ Початківцям: розпочинайте з малих інвестицій, вивчайте ігрову екосистему ✅ Досвідченим інвесторам: застосовуйте усереднення вартості, слідкуйте за розвитком проєкту ✅ Інституційним інвесторам: включайте до диверсифікованого портфеля ігрових токенів, проводьте ретельну перевірку

Варіанти участі у торгівлі SIDUS

- Спотова торгівля: купуйте SIDUS на Gate.com

- Стейкінг: беріть участь у стейкінгових програмах платформи SIDUS (за наявності)

- Внутрішньоігрові покупки: використовуйте SIDUS у SIDUS HEROES

Інвестиції у криптовалюти супроводжуються надзвичайно високими ризиками; ця стаття не є інвестиційною порадою. Приймайте рішення, враховуючи власну толерантність до ризику, і консультуйтеся з професійними фінансовими радниками. Не інвестуйте більше, ніж готові втратити.

FAQ

Якою є цільова ціна Sidus?

Аналітики прогнозують цільову ціну Sidus на рівні $10,00 — це максимальна та мінімальна оцінка на 2026 рік.

Чи варто інвестувати у Sidus space?

Так, інвестиції у Sidus space можуть бути прибутковими. Проєкт має потенціал у зростаючих секторах Web3 та космічних технологій.

Якою буде ціна Blum coin у 2025 році?

За поточними тенденціями, у 2025 році ціна Blum coin очікується на рівні $0,005, що свідчить про зростання порівняно з квітнем 2025 року ($0,003124).

Яка мем-коін найбільше зросте у 2025 році: прогноз ціни

Мем-коіни з потужними біржовими лістингами та великою капіталізацією мають найвищі шанси на зростання у 2025 році. Орієнтуйтеся на ті, що пробивають нові максимуми і демонструють суттєве зростання цінності.

Чи варто інвестувати в Major (MAJOR)?: Оцінка можливих прибутків і ризиків на сучасному ринку

Чи варто інвестувати в Counter Fire (CEC)?: Аналіз потенційної прибутковості та ризиків цієї перспективної криптовалюти

Прогноз вартості WAM на 2025 рік: огляд ринкових трендів і ключових чинників потенційного зростання

WZRD проти CRO: Битва магічного масштабу на крипторинку

Чи варто інвестувати в Engines of Fury Token (FURY)?: Огляд потенціалу та ризиків цієї геймінгової криптовалюти

Чи варто інвестувати в BADMAD ROBOTS (METALDR)?: Оцінка потенціалу та ризиків цієї перспективної криптовалюти

В'язниця До Квона знаменує нову главу для Terra та спадщини LUNA

Відповідь на щоденну вікторину Xenea 14 грудня 2025 року

Посібник для початківців з розуміння термінів у сфері криптовалют

Аналіз Soulbound Tokens: новий напрям у технології NFT

Огляд механізму консенсусу Tendermint у технології блокчейн