Прогноз ціни SHELL на 2025 рік: аналіз ринкових трендів і впливу екологічних факторів на фінансові перспективи Royal Dutch Shell

Вступ: ринкова позиція SHELL і інвестиційна цінність

MyShell (SHELL) — це платформа AI consumer layer, яка з 2023 року дозволяє користувачам створювати, поширювати та володіти агентами штучного інтелекту. Станом на 2025 рік ринкова капіталізація MyShell складає $32 192 100, а в обігу перебуває близько 270 000 000 токенів, ціна коливається біля $0,11923. Актив, відомий як «AI-Blockchain Bridge», відіграє дедалі важливішу роль у розвитку технологій штучного інтелекту та інтеграції блокчейну.

У цій статті здійснюється комплексний аналіз цінових трендів MyShell з 2025 по 2030 роки, з урахуванням історичних закономірностей, ринкової пропозиції і попиту, розвитку екосистеми та макроекономічних чинників, щоб надати професійні прогнози ціни та практичні інвестиційні стратегії для інвесторів.

I. Огляд історії ціни SHELL і поточної ринкової ситуації

Історична динаміка ціни SHELL

- 2025 (лютий): SHELL досяг історичного максимуму $0,7023

- 2025 (вересень): SHELL зафіксував історичний мінімум $0,10584

- 2025 (жовтень): ціна SHELL відновилася до $0,11923

Поточна ринкова ситуація SHELL

Станом на 2 жовтня 2025 року SHELL торгується по $0,11923, ринкова капіталізація — $32 192 100. За останні 24 години токен виріс на 4,68%, обсяг торгів — $348 675,83. Поточна ціна SHELL на 83,01% нижча від історичного максимуму і на 12,65% вища за історичний мінімум. В обігу — 270 000 000 SHELL (27% від загальної кількості — 1 000 000 000 SHELL). Ринкова частка SHELL становить 0,0027%, що свідчить про невелику позицію на крипторинку.

Перегляньте актуальну ринкову ціну SHELL

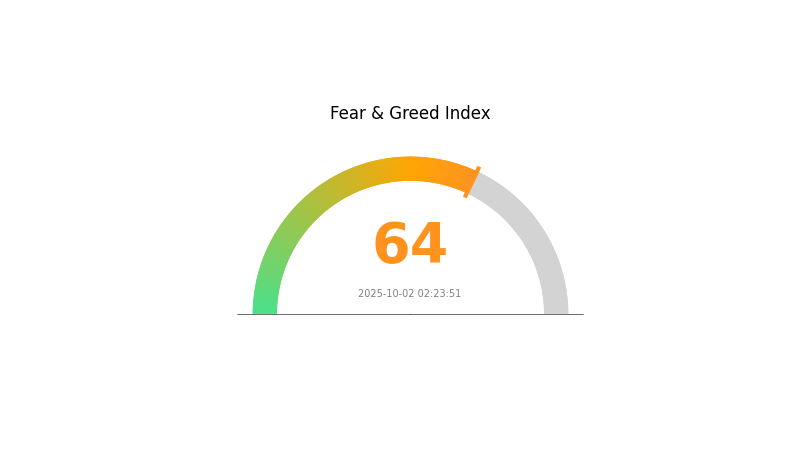

Індикатор ринкових настроїв SHELL

02 жовтня 2025 року: Індекс страху та жадібності — 64 (Жадібність)

Перегляньте поточний індекс страху та жадібності

Наразі криптовалютний ринок охоплений хвилею оптимізму: індекс страху та жадібності становить 64, що відповідає фазі жадібності. Це говорить про впевненість і оптимізм інвесторів щодо перспектив ринку. Однак надмірна жадібність може призвести до переоцінки та ринкової корекції. Трейдерам варто дотримуватися зваженого підходу до інвестицій. Як завжди, ретельний аналіз і ефективне управління ризиками є ключовими для успіху у волатильному криптосередовищі.

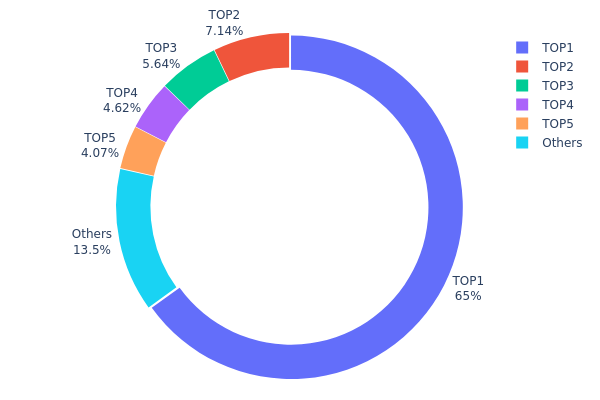

Розподіл володінь SHELL

Розподіл володінь SHELL свідчить про високу концентрацію власності. Найбільша адреса тримає 65,04% загальної кількості — це 320 000,00K SHELL. Такий рівень концентрації може суттєво впливати на ринкову динаміку.

Чотири наступні найбільші адреси разом володіють ще 21,45% загального обсягу. Тобто п’ять топових адрес контролюють 86,49% усіх токенів SHELL, а решта 13,51% розподілені між іншими власниками. Така концентрація викликає питання щодо децентралізації токена та ризиків ринкової маніпуляції.

Концентрація SHELL у кількох адресах посилює волатильність і підвищує чутливість до великих ринкових рухів з боку основних власників, впливає на ліквідність й може стримувати дрібних інвесторів через ризики централізації. Важливо моніторити зміни у портфелях топових адрес для розуміння майбутньої ринкової динаміки й потенційних цінових коливань SHELL.

Перегляньте поточний розподіл володінь SHELL

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb760...f96b0c | 320 000,00K | 65,04% |

| 2 | 0xc336...e6cf58 | 35 146,10K | 7,14% |

| 3 | 0xf977...41acec | 27 755,37K | 5,64% |

| 4 | 0xc3b9...c7da6f | 22 712,75K | 4,61% |

| 5 | 0x5a52...70efcb | 20 000,00K | 4,06% |

| - | Others | 66 354,43K | 13,51% |

II. Ключові чинники, що впливають на майбутню вартість SHELL

Механізм пропозиції

- Коливання цін на нафту та газ: Подальша діяльність SHELL визначається волатильністю цін на нафту і природний газ.

- Поточний вплив: У першій половині 2025 року затяжне зниження цін на нафту негативно позначилося на прибутковості SHELL.

Динаміка інституційних та ключових гравців

- Корпоративне впровадження: На бізнес SHELL у сфері переробки впливає зростання конкуренції на світовому ринку. Нові заводи в Азії та Африці наростили пропозицію, а спад економіки в Європі зменшив попит, що призвело до падіння цін і прибутків на перероблену продукцію.

Макроекономічне середовище

- Геополітичні чинники: Світова конкуренція та регіональні економічні умови суттєво впливають на результати SHELL.

Технологічний розвиток і екосистемне будівництво

- Енергетичний перехід: Глобальна тенденція до чистої й стійкої енергетики зумовлює попит на Shell core transformers, які сприяють інтеграції відновлюваної енергії у мережу.

- Екосистемні застосування: SHELL адаптується до світового енергетичного переходу, що може суттєво вплинути на її довгострокову бізнес-модель і рентабельність.

III. Прогноз ціни SHELL на 2025–2030 роки

Перспективи 2025 року

- Консервативний прогноз: $0,09618 – $0,11000

- Нейтральний прогноз: $0,11000 – $0,12000

- Оптимістичний прогноз: $0,12000 – $0,12349 (за умов позитивного ринкового настрою)

Перспективи 2027–2028 років

- Очікувана ринкова фаза: потенційний етап зростання

- Прогнозований діапазон цін:

- 2027: $0,08127 – $0,19061

- 2028: $0,11843 – $0,24532

- Ключові драйвери: розширення використання, технологічний прогрес

Довгострокові перспективи 2029–2030 років

- Базовий сценарій: $0,20725 – $0,24145 (за умови стабільного ринкового зростання)

- Оптимістичний сценарій: $0,24145 – $0,2994 (за умови сильного ринкового результату)

- Трансформаційний сценарій: понад $0,2994 (при надзвичайно сприятливих умовах)

- 31 грудня 2030 року: SHELL $0,2994 (потенційний пік)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,12349 | 0,11874 | 0,09618 | 0 |

| 2026 | 0,17441 | 0,12111 | 0,11264 | 1 |

| 2027 | 0,19061 | 0,14776 | 0,08127 | 23 |

| 2028 | 0,24532 | 0,16919 | 0,11843 | 41 |

| 2029 | 0,27565 | 0,20725 | 0,12642 | 73 |

| 2030 | 0,2994 | 0,24145 | 0,15211 | 102 |

IV. Професійні інвестиційні стратегії та управління ризиками щодо SHELL

Інвестиційна методологія SHELL

(1) Довгострокова стратегія утримання

- Підходить для: довгострокових інвесторів і ентузіастів AI

- Рекомендації до дій:

- Накопичуйте токени SHELL під час ринкових спадів

- Слідкуйте за технологічними оновленнями MyShell

- Зберігайте токени в апаратному гаманці

(2) Стратегія активної торгівлі

- Інструменти технічного аналізу:

- Ковзні середні: для визначення тренду та точок входу/виходу

- Relative Strength Index (RSI): для моніторингу перекупленості/перепроданості

- Ключові моменти для свінг-трейдингу:

- Встановлюйте стоп-лоси для обмеження ризику

- Фіксуйте прибуток на визначених рівнях опору

Рамки управління ризиками SHELL

(1) Принципи алокації активів

- Консервативним інвесторам: 1–3% криптопортфеля

- Агресивним інвесторам: 5–10% криптопортфеля

- Професійним інвесторам: до 15% криптопортфеля

(2) Рішення для хеджування ризиків

- Диверсифікація: розподіл інвестицій між кількома AI-проєктами

- Стоп-лоси: для обмеження потенційних втрат

(3) Безпечні рішення для зберігання

- Рекомендовано апаратний гаманець: Gate web3 wallet

- Варіант програмного гаманця: офіційний MyShell wallet (за наявності)

- Заходи безпеки: двофакторна автентифікація, складні паролі

V. Потенційні ризики та виклики SHELL

Ринкові ризики SHELL

- Висока волатильність: для криптовалют характерні швидкі цінові коливання

- Конкуренція: нові AI-блокчейн проєкти можуть стати сильними конкурентами

- Ринкові настрої: загальні тенденції крипторинку мають значний вплив на ціну SHELL

Регуляторні ризики SHELL

- Невизначеність регулювання: зміни у криптовалютному законодавстві можуть вплинути на впровадження SHELL

- Міжнародні обмеження: різниця у регулюванні може обмежити глобальне використання

- AI-регулювання: можливі обмеження щодо технологій AI можуть впливати на діяльність MyShell

Технічні ризики SHELL

- Уразливість смарт-контрактів: можливі проблеми безпеки у коді токена

- Проблеми масштабованості: платформа MyShell може зіткнутися з продуктивністю у процесі зростання

- Технологічне старіння: швидкий розвиток AI може випередити MyShell

VI. Висновки та практичні рекомендації

Оцінка інвестиційної цінності SHELL

SHELL пропонує унікальні перспективи на стику технологій AI та блокчейну. Токен має довгостроковий потенціал на стрімко зростаючому ринку штучного інтелекту, але короткострокові ризики волатильності та регуляторної невизначеності залишаються значними.

Рекомендації щодо інвестування в SHELL

✅ Початківцям: розглядайте невеликі довгострокові інвестиції після ретельного аналізу ✅ Досвідченим інвесторам: використовуйте стратегію середньої вартості із суворим контролем ризиків ✅ Інституційним інвесторам: проводьте комплексну перевірку та розглядайте SHELL як частину диверсифікованого AI-блокчейн портфеля

Способи участі в торгівлі SHELL

- Спотова торгівля: купуйте SHELL на Gate.com

- Стейкінг: беріть участь у програмах стейкінгу, якщо їх пропонує MyShell

- Створення AI-агентів: взаємодійте з екосистемою через платформу MyShell

Інвестування в криптовалюту несе надзвичайно високі ризики, і ця стаття не є інвестиційною порадою. Інвестор приймає рішення, враховуючи власну толерантність до ризику, і повинен консультуватися з професійними фінансовими радниками. Ніколи не інвестуйте більше, ніж готові втратити.

FAQ

Чи зростуть акції Shell?

Так, очікується зростання акцій Shell. Аналітики прогнозують підвищення на 5,87% протягом наступних 12 місяців, базуючись на поточних ринкових тенденціях і позитивних перспективах.

Чи вигідно інвестувати в Shell?

Так, інвестування в Shell є вигідною стратегією. Компанія має сильну ринкову позицію, стабільні дивіденди й потенціал зростання в енергетичному секторі.

Чому падає ціна Shell?

Ціна Shell знижується внаслідок низьких цін на нафту, скорочення прибутків від торгівлі газом та збитків у хімічній галузі. Водночас прибутки залишаються вищими за прогнози аналітиків.

Чи переоцінені акції Shell?

Станом на 02 жовтня 2025 року акції Shell недооцінені на 59% відносно ринкової ціни, що свідчить про потенційну інвестиційну привабливість.

Поділіться

Контент