2025年SHELL価格予測:Royal Dutch Shell株式の主要市場要因分析と成長見通し

2025年から2030年にかけての市場動向や価格に影響を与える要因に関する詳細な分析を通じて、SHELLの成長可能性をご確認ください。SHELLの過去の実績、現在の市場状況、今後の予測、そして投資戦略についても解説します。はじめに:SHELLの市場ポジションと投資価値

MyShell(SHELL)は、2023年の登場以来、ユーザーがAIエージェントを作成・共有・所有できる革新的なAIコンシューマープラットフォームとして地位を確立しています。2025年現在、MyShellの時価総額は32,205,600ドル、流通供給量は約270,000,000トークン、価格は0.11928ドル前後で推移しています。「AI-Blockchain Bridge」と称される本資産は、AI開発とブロックチェーン統合領域で重要性を増しています。

本記事では、2025年から2030年までのMyShell価格動向を、過去の動き、市場需給、エコシステムの発展、マクロ経済要因を踏まえて詳細に分析し、プロフェッショナルな価格予測および実践的な投資戦略を提示します。

I. SHELLの価格推移と市場現況

SHELLの過去価格推移

- 2025年:プロジェクト始動、価格は0.022ドルでスタート

- 2025年2月:史上最高値0.7023ドルを記録

- 2025年9月:史上最安値0.10584ドルに到達

SHELLの市場現況

2025年10月3日現在、SHELLは0.11928ドルで取引されています。過去24時間で0.32%上昇し、取引高は613,854.33ドルです。SHELLの時価総額は32,205,600ドルで、暗号資産市場全体で884位にランクされています。

トークンのパフォーマンスは期間により異なります。過去1週間では1.23%、直近1カ月で6.05%の上昇が見られますが、過去1年では83.52%の大幅下落となっています。これは長期的な弱気相場からの回復基調を示唆しています。

現在価格は史上最高値から83.02%下落しており、市場環境が好転すれば成長余地が大きいことを示します。流通供給量は270,000,000 SHELLで、総供給量の27%に相当します。

最新のSHELL市場価格を見る

SHELL市場センチメント指標

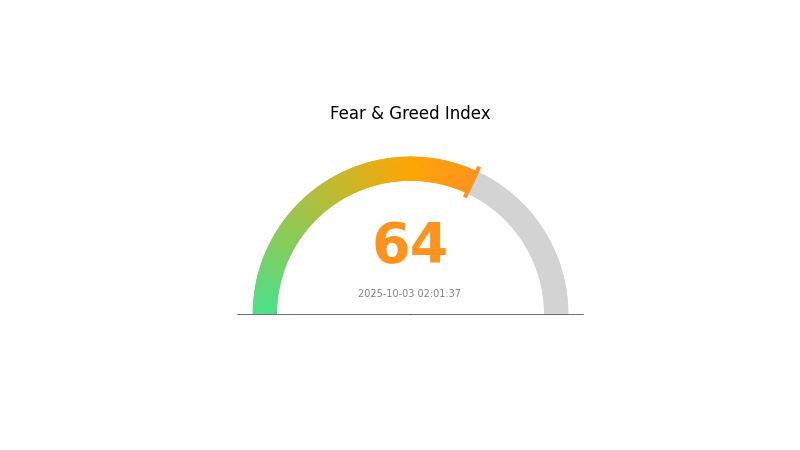

2025年10月3日 恐怖・強欲指数:64(強欲)

最新の恐怖・強欲指数を見る

現在の暗号資産市場は強欲状態にあり、恐怖・強欲指数は64です。投資家の楽観姿勢が強まっており、買われ過ぎの兆候が見られます。トレーダーは利益確定やヘッジを検討しつつ、リスク管理を徹底することが重要です。極端な強欲心理は調整相場の前兆となる場合があるため、冷静な対応が求められます。

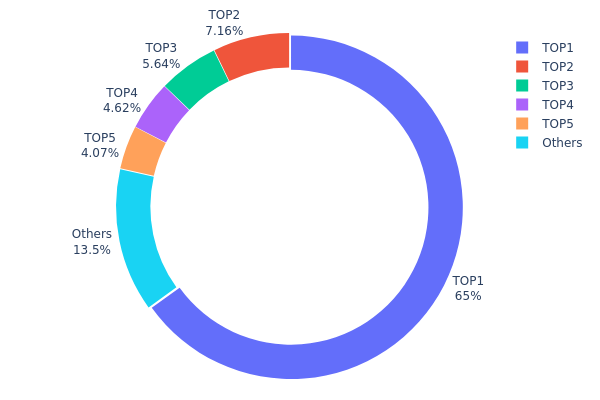

SHELL保有分布

アドレスごとの保有分布データによると、SHELLトークンの所有は極めて集中しています。トップアドレスは全供給量の65.04%(320,000,000 SHELL)を保有。次いで4つの大口が4.06%~7.15%ずつ保有し、上位5アドレス合計で全体の86.5%を掌握しています。残る13.5%のみがその他アドレスに分散されています。

この過度な集中は、市場操作や価格変動リスクを高めます。1アドレスが供給の大半を握るため、大規模売却時の価格急変が懸念されます。また、こうした中央集権的分布は分散型の理念と対立し、投資家心理や長期安定性にも影響を及ぼします。

現状の保有分布はSHELL市場構造が理想的とは言えず、流動性不足から価格変動の激化や市場操作リスクが高まるため、投資家・トレーダーは十分な注意が必要です。

最新のSHELL保有分布を見る

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb760...f96b0c | 320000.00K | 65.04% |

| 2 | 0xc336...e6cf58 | 35214.63K | 7.15% |

| 3 | 0xf977...41acec | 27755.37K | 5.64% |

| 4 | 0xc3b9...c7da6f | 22712.75K | 4.61% |

| 5 | 0x5a52...70efcb | 20000.00K | 4.06% |

| - | その他 | 66285.90K | 13.5% |

II. SHELLの将来価格に影響する主な要因

供給メカニズム

- 石油・ガス価格の変動:原油や天然ガス価格の変動がSHELLの収益性や株価に直結します。

- 過去の動向:SHELL株価は歴史的に世界の石油・ガス価格と高い相関性を示しています。

- 現状の影響:エネルギー市場での供給制約や需要変動が、今後のSHELL価格に影響を与える見通しです。

機関・大口投資家動向

- 企業導入:主要エネルギー消費企業・産業によるSHELL製品・サービス採用は、需要・価格への影響が大きいです。

- 国家政策:エネルギー転換や環境規制を含む政府方針が、SHELLの市場地位や将来見通しを左右します。

マクロ経済環境

- 金融政策の影響:中央銀行の金利やインフレ政策がSHELLの資金調達コストや投資家心理に影響します。

- 地政学的要因:国際情勢や貿易摩擦、世界経済動向が石油・ガス市場に影響し、SHELL株価にも波及します。

技術開発とエコシステム構築

- エネルギー転換技術:再生可能エネルギーや低炭素技術へのSHELL投資が、長期競争力と株価評価に直結します。

- エコシステム展開:電動車充電網や水素インフラなど新エネエコシステムへの参画・統合力が、将来成長余地を左右します。

III. 2025年~2030年のSHELL価格予測

2025年見通し

- 保守的予想:0.10613~0.11925ドル

- 中立的予想:0.11925~0.13416ドル

- 楽観的予想:0.13416~0.14906ドル(市場心理が好転した場合)

2027~2028年見通し

- 市場局面予想:成長期突入の可能性

- 価格帯予想:

- 2027年:0.14167~0.1579ドル

- 2028年:0.0779~0.20925ドル

- 主なカタリスト:利用拡大・技術進展

2030年長期見通し

- ベースシナリオ:0.18099~0.21176ドル(市場が安定成長した場合)

- 楽観シナリオ:0.21176~0.24253ドル(市場好調時)

- 変革シナリオ:0.24253~0.27317ドル(イノベーション・普及拡大時)

- 2030年12月31日:SHELL 0.27317ドル(想定ピーク価格)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14906 | 0.11925 | 0.10613 | 0 |

| 2026 | 0.16099 | 0.13416 | 0.1033 | 12 |

| 2027 | 0.1579 | 0.14757 | 0.14167 | 23 |

| 2028 | 0.20925 | 0.15274 | 0.0779 | 27 |

| 2029 | 0.24253 | 0.18099 | 0.13574 | 51 |

| 2030 | 0.27317 | 0.21176 | 0.17364 | 77 |

IV. SHELL向けプロ投資戦略とリスク管理

SHELL投資手法

(1) 長期保有戦略

- 対象:リスク許容度の高い長期投資家

- 運用アドバイス:

- 下落局面でSHELLを積み立て

- 1~2年以上の長期保有で変動リスクを吸収

- ハードウェアウォレットで安全に保管

(2) アクティブトレード戦略

- テクニカル分析:

- 移動平均:トレンドや反転ポイントの判断

- RSI:買われ過ぎ・売られ過ぎを監視

- スイングトレード要点:

- テクニカル指標に基づく明確なエントリー・イグジット設定

- 損切り注文で下落リスクを限定

SHELLリスク管理体制

(1) 資産配分方針

- 保守型:暗号資産全体の1~3%

- 積極型:5~10%

- プロ投資家:最大15%

(2) リスクヘッジ手段

- 分散投資:複数の暗号資産に投資を分散

- 損切り注文:自動売却で損失を最小化

(3) 安全な保管策

- ハードウェアウォレット推奨:Gate Web3 Wallet

- ソフトウェアウォレット:公式MyShellウォレット(利用可能時)

- セキュリティ対策:二段階認証、リカバリーフレーズの厳重管理

V. SHELLが直面するリスクと課題

SHELL市場リスク

- 高い価格変動性:SHELL価格は大幅な変動リスクあり

- 流動性不足:大口取引に十分なボリュームが確保できない可能性

- 競合:AI系ブロックチェーンプロジェクトの台頭によるシェア侵食

SHELL規制リスク

- 規制不透明性:暗号資産規制がSHELL運営に影響を及ぼすリスク

- 国際的な法令対応:各国で異なる要件が発生

- AIガバナンス:将来のAI規制がMyShell開発に影響を及ぼす可能性

SHELL技術リスク

- スマートコントラクト脆弱性:トークン契約のバグ・悪用リスク

- AIモデル限界:MyShell AI性能が期待を下回る場合

- スケーラビリティ課題:プラットフォーム成長に伴う負荷対応

VI. 結論とアクション推奨

SHELL投資価値評価

SHELLはAIとブロックチェーン融合領域における独自性を持ちますが、市場変動や規制リスクも大きいです。MyShellがAIエージェントプラットフォームを実現できれば、長期成長の可能性があります。

SHELL投資推奨

✅ 初心者:プロジェクト理解目的で少額投資を検討

✅ 経験者:ハイリスク資産の一部として配分し、継続監視

✅ 機関投資家:徹底した調査と戦略的提携の検討を推奨

SHELL取引参加方法

- 現物取引:Gate.comのスポット市場で売買

- ステーキング:MyShellや提携先が提供するステーキングへの参加

- AIエージェント作成:MyShellプラットフォームでAIエージェントを構築・収益化

暗号資産投資は極めて高リスクです。本記事は投資助言ではありません。投資判断はご自身のリスク許容度に基づき慎重に行い、専門家の助言を受けてください。余剰資金以上の投資は厳禁です。

FAQ

SHELLへの投資は今が好機か?

SHELLは強弱混在のシグナルを示しています。将来性はあるものの、現状では新規購入よりも保有を推奨。より良いエントリーポイントを見極めてください。

SHELL株は今買い時か?

はい、SHELL株は現時点で買い時と考えられます。堅調なバリュエーション指標およびValue Scoreから割安感があり、現市場環境では魅力的な選択肢となります。

SHELL投資は賢明か?

はい、SHELL投資は賢明です。統合型ビジネスモデルや低炭素ソリューションへの取り組み、安定配当実績を有し、競争力のある分野で成長を続けています。

SHELL株の将来価格は?

SHELL株は2025年に72~92ドル、2030年に119~164ドルへ到達が予想され、翌日には1.68%の上昇見込みです。

共有

内容