Прогноз ціни OBT на 2025 рік: майбутні тренди та перспективи розвитку токенів OBT у блокчейн-екосистемі

Вступ: ринкові позиції OBT та інвестиційна привабливість

Orbiter Finance (OBT), як інноваційний протокол інтероперабельності на базі ZK-технології, з моменту запуску формує новий досвід Web3 у мультичейнову епоху. Станом на 2025 рік ринкова капіталізація OBT становить $22 520 400, а в обігу перебуває близько 4 900 000 000 токенів; ціна коливається біля $0,004596. Актив, що отримав назву «міст між блокчейн-мережами», стає ключовим у посиленні безпеки взаємодії блокчейнів, забезпеченні безшовної інтероперабельності та мінімізації фрагментації ліквідності.

У цьому матеріалі здійснено ґрунтовний аналіз цінових тенденцій OBT у 2025–2030 роках із урахуванням історичних трендів, балансу ринкової пропозиції та попиту, розвитку екосистеми та макроекономічних факторів, щоб надати інвесторам експертні прогнози та дієві інвестиційні стратегії.

I. Огляд історії ціни OBT та поточного ринкового статусу

Динаміка ціни OBT: історичний огляд

- 2025: старт OBT — $0,02, абсолютний максимум $0,0335 14 березня

- 2025: ринкова корекція, мінімум $0,004249 30 вересня

- 2025: поточний цикл, ціна за 24 години в діапазоні $0,004541 – $0,00487

Поточний стан ринку OBT

Станом на 4 жовтня 2025 року OBT торгується за $0,004596, добовий обсяг — $23 871,39. За добу токен зріс на 1,42%, за тиждень — на 1,94%. За 30 днів спостерігається падіння на 4,25%, а за рік — суттєве зниження на 68,70%. Ринкова капіталізація OBT — $22 520 400, що відповідає 1038 місцю на глобальному крипторинку. В обігу — 4 900 000 000 OBT, тобто 49% від загальної емісії у 10 000 000 000 токенів. Повністю розведена капіталізація — $45 960 000.

Перегляньте поточну ринкову ціну OBT

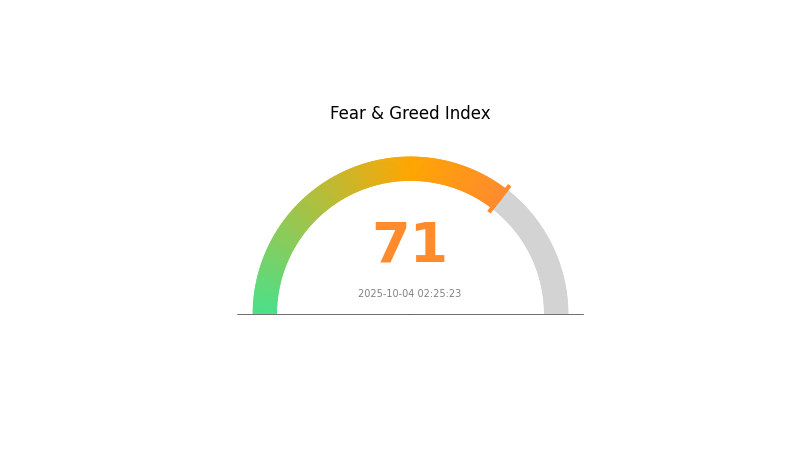

Індикатор ринкових настроїв OBT

04 жовтня 2025 року, Індекс страху та жадібності: 71 (Жадібність)

Перегляньте актуальний Індекс страху та жадібності

Крипторинок наразі перебуває у фазі жадібності — Індекс страху та жадібності досяг 71. Це говорить про надмірний оптимізм інвесторів і ризик перекупленості. Високий ентузіазм вимагає обачності: не слід приймати рішення лише на основі ринкових емоцій. Досвідчені трейдери трактують періоди пікової жадібності як сигнали до можливої корекції. Як завжди, фундаментальний аналіз і контроль ризиків є критично важливими для роботи на волатильному крипторинку.

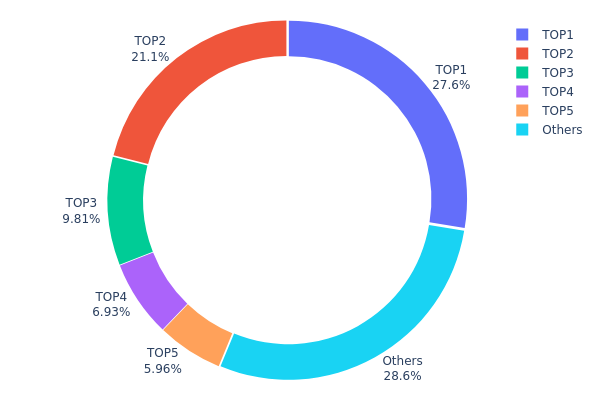

Розподіл володінь OBT

Розподіл токенів OBT демонструє високу концентрацію серед найбільших адрес: топ-5 володіють 71,39% всіх OBT, найбільший власник — 27,62%. Це свідчить про централізовану структуру, що може впливати на ринкову динаміку та стабільність ціни.

Такий розподіл підвищує ризики ринкових маніпуляцій і волатильності. Основні власники можуть суттєво вплинути на ціну токена при великих продажах або переказах. Концентрація також впливає на сприйняття ступеня децентралізації, оскільки вплив кількох учасників на мережу є значним.

Втім, 28,61% токенів розподілені між іншими адресами, що свідчить про участь широкого ринку. Поточна структура демонструє, що домінують великі гравці, але існує доступність для дрібних власників. З розвитком проєкту доцільно слідкувати за змінами розподілу для оцінки перспектив стабільності та децентралізації.

Перегляньте поточний розподіл володінь OBT

| Топ | Адреса | Кількість | Відсоток |

|---|---|---|---|

| 1 | 0x40b8...8bef9a | 645 680,25K | 27,62% |

| 2 | 0xd823...b01dfb | 492 900,91K | 21,08% |

| 3 | 0xc882...84f071 | 229 301,67K | 9,81% |

| 4 | 0x1443...96847c | 162 009,72K | 6,93% |

| 5 | 0x0d07...b492fe | 139 198,42K | 5,95% |

| - | Інші | 668 286,48K | 28,61% |

II. Основні чинники, що впливають на майбутню ціну OBT

Механізм пропозиції

- Волатильність ринку: Висока мінливість крипторинку суттєво впливає на ціну OBT. Різкі коливання курсу можуть змінити попит на кросчейн-операції та інвестиційну поведінку користувачів.

- Поточний вплив: У періоди нестабільності користувачі зменшують кросчейн-активність, що позначається на обсязі транзакцій та доходах Orbiter Finance.

Динаміка інституційних гравців та китів

- Національна політика: Регуляторні підходи до блокчейну та криптовалют різняться залежно від країни. Відсутність визначеності може створювати ризики для розвитку Orbiter Finance — наприклад, окремі юрисдикції впроваджують суворі обмеження на криптооперації, впливаючи на роботу платформи.

Макроекономічне середовище

- Геополітичні фактори: Світові події та конфлікти впливають на загальний стан крипторинку, зокрема й на ціну OBT.

Технологічний розвиток та екосистемний фундамент

- Rollup-технології: Orbiter Finance працює на Ethereum Layer 2, використовуючи технологію Rollup для ефективної кросчейн-комунікації та переказу активів — стиснення великих обсягів офчейн-транзакцій у пакети суттєво прискорює обробку й знижує витрати.

- Механізм Maker: Ключова інновація Orbiter Finance, що забезпечує користувачам ефективний і безпечний кросчейн-сервіс.

- Екосистемні застосування: Orbiter Finance демонструє стабільне зростання, а ринкові метрики підтверджують важливу роль проєкту у сфері кросчейн-інтеграції.

III. Прогноз ціни OBT на 2025–2030 роки

2025: Прогноз

- Консервативний: $0,00417 – $0,00459

- Нейтральний: $0,00459 – $0,00569

- Оптимістичний: $0,00569 – $0,00679 (за умови підтримки ринку)

2026–2027: Прогноз

- Очікується фаза зростання

- Діапазон:

- 2026: $0,00432 – $0,00802

- 2027: $0,00651 – $0,00959

- Ключові драйвери: розширення використання та сприятливі ринкові умови

2028–2030: Довгостроковий прогноз

- Базовий сценарій: $0,00822 – $0,01158 (за стабільного зростання)

- Оптимістичний: $0,01158 – $0,01371 (за сильного ринку)

- Трансформаційний: $0,01371+ (надзвичайно сприятливі умови)

- 31 грудня 2030 року — OBT $0,01228 (можливий максимум)

| Рік | Максимум | Середня ціна | Мінімум | Зміна (%) |

|---|---|---|---|---|

| 2025 | 0,00679 | 0,00459 | 0,00417 | 0 |

| 2026 | 0,00802 | 0,00569 | 0,00432 | 23 |

| 2027 | 0,00959 | 0,00685 | 0,00651 | 49 |

| 2028 | 0,01069 | 0,00822 | 0,00534 | 78 |

| 2029 | 0,01371 | 0,00946 | 0,0069 | 105 |

| 2030 | 0,01228 | 0,01158 | 0,00591 | 152 |

IV. Професійні інвестиційні стратегії та ризик-менеджмент OBT

Методики інвестування в OBT

(1) Довгострокова стратегія утримання

- Підходить для: інвесторів із високою толерантністю до ризику та довгостроковим підходом

- Операційні поради:

- Акумулюйте OBT під час ринкових спадів

- Визначте інвестиційний горизонт не менше ніж 2–3 роки

- Зберігайте токени в апаратному гаманці

(2) Активна торгова стратегія

- Технічні інструменти:

- Ковзні середні: для визначення трендів та точок розвороту

- RSI: моніторинг перекупленості/перепроданості

- Торгівля у межах циклів:

- Встановлюйте чіткі точки входу та виходу за індикаторами

- Використовуйте жорсткі стоп-лосс для контролю ризику

Система управління ризиками для OBT

(1) Принципи алокації активів

- Консервативний інвестор: 1–3% портфеля

- Агресивний: 5–10% портфеля

- Професіонал: до 15% портфеля

(2) Методи хеджування ризиків

- Диверсифікація: розподіляйте вкладення між різними криптоактивами

- Стоп-лосс: обмежуйте потенційні втрати

(3) Захищені рішення для зберігання

- Гарячий гаманець: Gate Web3 гаманець

- Холодне зберігання: апаратний гаманець для довгостроку

- Безпека: двофакторна автентифікація, надійні паролі

V. Потенційні ризики та виклики для OBT

Ринкові ризики OBT

- Висока волатильність: значні цінові коливання

- Обмежена ліквідність: складність великих угод

- Ринкові настрої: чутливість до швидких змін

Регуляторні ризики OBT

- Невизначеність регуляцій: ризик несприятливих змін на ключових ринках

- Виклики комплаєнсу: зміни регуляторного середовища можуть впливати на діяльність

- Обмеження транскордонних операцій: можливі бар’єри для міжнародних транзакцій

Технічні ризики OBT

- Вразливість смарт-контрактів: ризик експлойтів чи багів

- Перевантаження мережі: масштабованість і швидкість транзакцій

- Інтероперабельність: ризики кросчейн-операцій

VI. Висновки та рекомендації

Оцінка інвестиційної привабливості OBT

OBT — це високоризиковий актив із значним потенціалом у секторі кросчейн-інтероперабельності. Попри інноваційність, інвесторам слід враховувати суттєві ринкові, регуляторні та технічні ризики.

Рекомендації щодо інвестування в OBT

✅ Початківцям: інвестуйте невеликі суми та фокусуйтеся на навчанні ✅ Досвідченим: застосовуйте збалансований підхід і ефективний ризик-менеджмент ✅ Інституційним: проводьте ретельний аналіз і шукайте стратегічні партнерства

Способи участі у торгівлі OBT

- Спот-торги: доступно на Gate.com та інших біржах

- DeFi-платформи: використовуйте децентралізовані біржі

- OTC-ринок: для великих обсягів — мінімізація проскальзування

Інвестиції у криптовалюти супроводжуються надзвичайно високими ризиками; цей матеріал не є інвестиційною порадою. Приймайте рішення відповідно до власної толерантності до ризику та консультуйтеся з професійними фінансовими радниками. Ніколи не інвестуйте більше, ніж готові втратити.

FAQ

Який прогноз ціни GRT на 2025 рік?

Згідно з актуальними прогнозами, максимальна ціна The Graph (GRT) у 2025 році становитиме $1,77, мінімальна — $1,06.

Який прогноз для Toncoin у 2030 році?

До 2030 року очікується, що Toncoin досягне $10 — цьому сприятимуть інтеграція з Telegram і розвиток децентралізованої екосистеми.

Яка криптовалюта має найвищий ціновий прогноз?

Найвищий прогноз має Bitcoin — очікувана ціна $140 652. За ним — Chainlink із прогнозом $62,60.

Який прогноз ціни XRP на 2030 рік?

У 2030 році XRP прогнозується у діапазоні $90 – $120, що стане знаковим етапом його розвитку.

Поділіться

Контент