Prediksi Harga AITECH 2025: Analisis Tren Pasar dan Faktor Utama yang Memengaruhi Nilai Masa Depan AITECH di Tengah Lanskap Teknologi yang Berkembang Cepat

Pendahuluan: Posisi Pasar dan Nilai Investasi AITECH

Solidus Ai Tech (AITECH), sebagai token utilitas infrastruktur AI deflasi pertama di dunia, telah mencetak berbagai pencapaian penting sejak diperkenalkan pada 2023. Per 2025, kapitalisasi pasar AITECH mencapai $48.289.636,94 dengan pasokan beredar sekitar 1.628.655.546 token dan harga di kisaran $0,02965. Aset yang dijuluki "AI Infrastructure Pioneer" ini memegang peran semakin vital dalam komputasi berkinerja tinggi serta proyek-proyek berfokus AI.

Artikel ini menyajikan analisis menyeluruh atas tren harga AITECH pada periode 2025 hingga 2030, menggabungkan data historis, dinamika suplai dan permintaan, perkembangan ekosistem, serta faktor makroekonomi untuk menyajikan prediksi harga profesional dan strategi investasi yang aplikatif bagi investor.

I. Tinjauan Sejarah Harga dan Kondisi Pasar Terkini AITECH

Perjalanan Evolusi Harga Historis AITECH

- 2023: Proyek diluncurkan, harga awal $0,00197

- 2024: Harga tertinggi sepanjang masa $0,5 pada 13 Maret

- 2025: Penurunan signifikan, harga turun ke $0,02965

Situasi Pasar Terkini AITECH

Per 30 September 2025, AITECH diperdagangkan di $0,02965, turun 74,27% dari harga satu tahun sebelumnya. Token ini mencatat penurunan 10,42% dalam 24 jam terakhir, dengan volume transaksi $763.737,48. Kapitalisasi pasar AITECH saat ini berada di $48.289.636,94, menempati peringkat ke-693 secara global. Jumlah beredar mencapai 1.628.655.546 AITECH atau 81,43% dari total suplai. Meski tren menurun, AITECH menunjukkan pemulihan kecil dalam satu jam terakhir dengan kenaikan 0,54%.

Klik untuk melihat harga pasar AITECH terkini

Indikator Sentimen Pasar AITECH

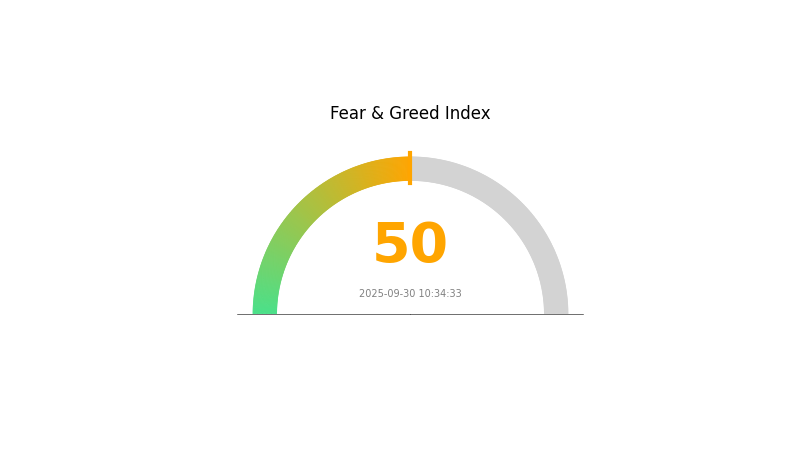

Indeks Fear and Greed 30 September 2025: 50 (Netral)

Klik untuk melihat Indeks Fear & Greed terkini

Sentimen pasar kripto saat ini berada di tingkat netral, menandakan keseimbangan antara optimisme dan kehati-hatian investor. Kondisi ini menunjukkan pelaku pasar mempertimbangkan faktor positif dan negatif secara berimbang. Walaupun tidak terlalu bullish, sentimen ini juga tidak menunjukkan ketakutan ekstrem, yang dapat mengindikasikan fase konsolidasi atau pengambilan keputusan yang lebih hati-hati di sektor kripto. Trader dan investor perlu memantau perkembangan pasar secara cermat untuk mengantisipasi perubahan arah.

Distribusi Kepemilikan AITECH

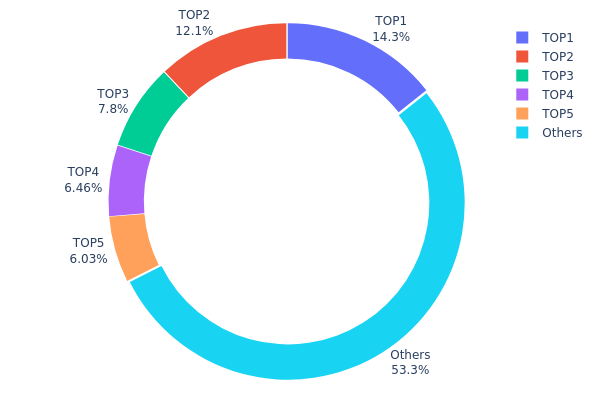

Distribusi kepemilikan AITECH menunjukkan konsentrasi cukup signifikan di kalangan pemegang utama. Lima alamat teratas menguasai 46,69% total suplai, dengan pemegang terbesar memiliki 14,34%. Tingkat konsentrasi ini mencerminkan distribusi token yang relatif terpusat.

Konsentrasi kepemilikan seperti ini dapat memengaruhi dinamika pasar. Pemegang besar memiliki kapasitas memengaruhi harga melalui transaksi besar. Selain itu, konsentrasi ini dapat berdampak pada tata kelola jika AITECH menerapkan sistem voting berbasis token. Namun, 53,31% suplai tersebar ke alamat lain, memberikan unsur desentralisasi.

Kondisi distribusi saat ini menuntut kewaspadaan terhadap risiko manipulasi pasar. Walaupun bukan hal langka di industri kripto, tingkat konsentrasi ini menekankan pentingnya memonitor aktivitas pemegang besar dan pengaruhnya terhadap stabilitas serta perkembangan jangka panjang AITECH.

Klik untuk melihat Distribusi Kepemilikan AITECH terkini

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 284.970,67K | 14,34% |

| 2 | 0xbb6d...22f720 | 240.000,00K | 12,07% |

| 3 | 0x3e93...2b995b | 155.010,40K | 7,80% |

| 4 | 0x2e8f...725e64 | 128.454,59K | 6,46% |

| 5 | 0x2c4d...c31184 | 119.735,29K | 6,02% |

| - | Lainnya | 1.059.040,48K | 53,31% |

II. Faktor Utama yang Memengaruhi Harga AITECH di Masa Depan

Mekanisme Pasokan

- Pembakaran Token: Sebagian token AITECH yang digunakan di platform akan dihancurkan secara teratur, berdampak pada kelangkaan dan harga token.

- Pola Historis: Sifat deflasi AITECH sangat berpengaruh terhadap pergerakan harga.

- Dampak Terkini: Pembakaran token secara berkelanjutan diperkirakan akan menjaga tekanan positif pada harga AITECH karena pasokan yang menurun.

Dinamika Institusi dan Whale

- Adopsi Perusahaan: Instansi pemerintah, korporasi besar, UMKM, dan profesional dapat memanfaatkan token AITECH untuk membeli layanan AI tanpa hambatan.

Lingkungan Makroekonomi

- Perlindungan terhadap Inflasi: Sebagai aset deflasi, AITECH berpotensi menjadi instrumen lindung nilai saat kondisi ekonomi tidak pasti.

Pengembangan Teknologi dan Ekosistem

- Integrasi AI dan Blockchain: AITECH merepresentasikan terobosan dalam integrasi blockchain dan kecerdasan buatan.

- Jaringan Komputasi Terdesentralisasi: Teknologi inti berupa jaringan antar-pengguna, memungkinkan akses sumber daya komputasi antar pengguna.

- Aplikasi Ekosistem: AITECH mendukung aplikasi nyata, terutama di bidang HPC dan AI. Pasar AI mengelompokkan perangkat menjadi model AI dasar, agen AI, dan solusi AI mandiri sehingga bisnis maupun individu dapat mengotomasi aktivitas harian dan meningkatkan produktivitas.

III. Prediksi Harga AITECH 2025-2030

Tinjauan 2025

- Prediksi konservatif: $0,02097 - $0,02500

- Prediksi netral: $0,02500 - $0,03000

- Prediksi optimis: $0,03000 - $0,03308 (memerlukan sentimen pasar dan perkembangan proyek yang positif)

Tinjauan 2027-2028

- Tahapan pasar: Potensi fase pertumbuhan dengan tingkat adopsi meningkat

- Proyeksi rentang harga:

- 2027: $0,02781 - $0,03484

- 2028: $0,03007 - $0,04374

- Pendorong utama: Inovasi teknologi, peningkatan utilitas, dan tren pasar luas

Tinjauan Jangka Panjang 2029-2030

- Skenario dasar: $0,03896 - $0,04753 (asumsi pertumbuhan pasar stabil)

- Skenario optimis: $0,04753 - $0,05610 (asumsi performa proyek kuat dan dukungan pasar)

- Skenario transformatif: $0,05610 - $0,05989 (terobosan proyek dan adopsi massal)

- 2030-12-31: AITECH $0,05989 (proyeksi harga puncak pada skenario optimis)

| Tahun | Harga Tertinggi (Prediksi) | Harga Rata-rata (Prediksi) | Harga Terendah (Prediksi) | Perubahan (%) |

|---|---|---|---|---|

| 2025 | 0,03308 | 0,02954 | 0,02097 | 0 |

| 2026 | 0,0357 | 0,03131 | 0,0238 | 6 |

| 2027 | 0,03484 | 0,0335 | 0,02781 | 13 |

| 2028 | 0,04374 | 0,03417 | 0,03007 | 15 |

| 2029 | 0,0561 | 0,03896 | 0,02727 | 32 |

| 2030 | 0,05989 | 0,04753 | 0,04135 | 61 |

IV. Strategi Investasi Profesional dan Manajemen Risiko AITECH

Metodologi Investasi AITECH

(1) Strategi Pegangan Jangka Panjang

- Cocok untuk: Investor jangka panjang dan penggemar AI

- Rekomendasi:

- Kumpulkan token AITECH saat harga turun

- Berpartisipasi dalam ekosistem Solidus AI Tech untuk memaksimalkan utilitas

- Simpan token secara aman di dompet perangkat keras atau dompet perangkat lunak terpercaya

(2) Strategi Trading Aktif

- Alat analisis teknikal:

- Moving Averages: Untuk identifikasi tren dan potensi pembalikan

- Relative Strength Index (RSI): Untuk mengukur kondisi jenuh beli/jenuh jual

- Poin penting untuk perdagangan ayunan:

- Pantau berita dan perkembangan AI

- Tentukan titik masuk dan keluar berdasarkan indikator teknikal

Kerangka Manajemen Risiko AITECH

(1) Prinsip Alokasi Aset

- Investor konservatif: 1-3% portofolio kripto

- Investor moderat: 3-7% portofolio kripto

- Investor agresif: 7-15% portofolio kripto

(2) Solusi Lindung Nilai Risiko

- Diversifikasi: Kombinasikan AITECH dengan aset kripto lain dan investasi tradisional

- Batas kerugian otomatis: Terapkan untuk membatasi kerugian potensial

(3) Solusi Penyimpanan Aman

- Rekomendasi dompet perangkat lunak wallet: Gate Web3 Wallet

- Dompet perangkat keras: Untuk penyimpanan jangka panjang dan jumlah besar

- Keamanan: Aktifkan autentikasi dua faktor, gunakan password kuat, dan simpan private key secara offline

V. Risiko dan Tantangan Potensial bagi AITECH

Risiko Pasar AITECH

- Volatilitas: Fluktuasi harga tinggi umum di pasar kripto

- Kompetisi: Proyek AI pendatang baru dapat mengurangi pangsa pasar AITECH

- Adopsi: Adopsi layanan Solidus AI Tech yang lambat dari ekspektasi

Risiko Regulasi AITECH

- Regulasi kripto: Perubahan kebijakan global dapat memengaruhi operasional AITECH

- Regulasi industri AI: Potensi pembatasan pengembangan dan penggunaan AI

- Pajak: Regulasi pajak yang terus berubah untuk aset kripto dan pendapatan AI

Risiko Teknis AITECH

- Kerentanan smart contract: Potensi eksploitasi atau bug pada kontrak token

- Skalabilitas: Keterbatasan pada infrastruktur Solidus AI Tech

- Ketertinggalan teknologi: Perkembangan AI yang pesat dapat melampaui fitur Solidus

VI. Kesimpulan dan Rekomendasi Tindakan

Penilaian Nilai Investasi AITECH

AITECH menghadirkan nilai unik di bidang infrastruktur AI melalui model token deflasi. Potensi jangka panjang ada di industri AI yang bertumbuh, namun risiko volatilitas dan adopsi jangka pendek perlu diperhatikan.

Rekomendasi Investasi AITECH

✅ Pemula: Mulai dengan investasi kecil dan rutin untuk memahami proyek dan dinamika pasar ✅ Investor berpengalaman: Pilih strategi seimbang, alokasikan sesuai profil risiko dan outlook sektor AI ✅ Investor institusi: Sertakan AITECH sebagai bagian dari portofolio terdiversifikasi di AI dan blockchain

Metode Partisipasi AITECH

- Pembelian token: Dapatkan AITECH di exchange ternama seperti Gate.com

- Keterlibatan ekosistem: Gunakan layanan Solidus AI Tech untuk pengalaman praktis dengan token

- Partisipasi komunitas: Ikut dalam tata kelola dan pantau perkembangan proyek

Investasi kripto sangat berisiko tinggi. Artikel ini bukan saran investasi. Setiap investor harus mengambil keputusan secara cermat sesuai toleransi risiko masing-masing dan dianjurkan berkonsultasi dengan penasihat keuangan profesional. Jangan pernah berinvestasi melebihi kemampuan Anda.

Bagikan

Konten