- Topic

23k Popularity

16k Popularity

100k Popularity

3k Popularity

8k Popularity

- Pin

- 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re - 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

[Foreign Exchange] The Key to the Yen's Weakness Turnaround: "Too Strong U.S. Economy" Ends | Yoshida Tsune's Foreign Exchange Daily | Moneyクリ Money's Media for Investment Information and Financial Guidance from Monex Securities

The Yen Depreciation After 2023 Cannot Be Explained by Structural Yen Depreciation Theory

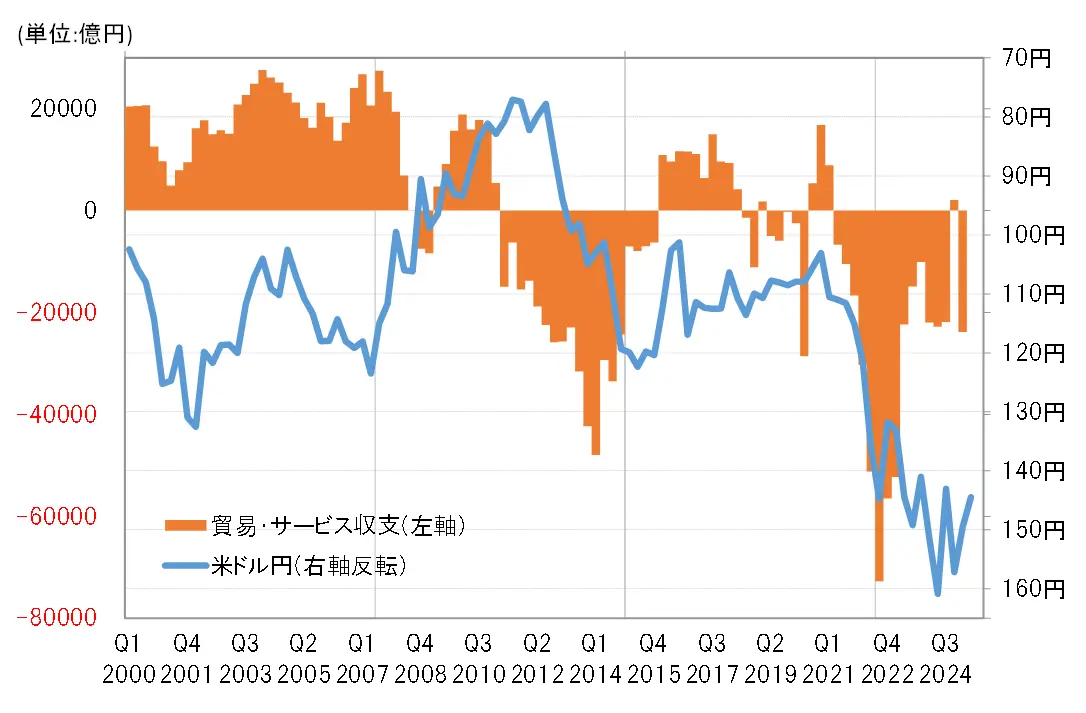

The USD/JPY rose significantly until it exceeded 150 yen in 2022. In this year, Japan's trade and services balance deficit expanded to the highest level on record (see Chart 1). This rapid depreciation of the yen has drawn attention to the theory of "structural yen depreciation," which suggests it is a result of the rapid expansion of the trade and services deficit, symbolizing the decline of the Japanese economy.

[Figure 1] Trade and Services Balance and USD/JPY (2000 onward) Source: Created by Monex Securities from Refinitiv data

However, the trade and services deficit has sharply narrowed since 2023. In contrast, the strong US dollar and weak yen have continued to exceed 150 yen since 2023, reaching a temporary high of 161 yen in 2024. From this perspective, it is likely that the significant depreciation of the yen, which exceeded 150 yen, due to the continued strength of the US dollar and the weak yen amidst the shrinking trade and services deficit, cannot be explained by the "structural depreciation of the yen" theory symbolized by the expansion of the trade and services deficit indicating the decline of the Japanese economy.

Source: Created by Monex Securities from Refinitiv data

However, the trade and services deficit has sharply narrowed since 2023. In contrast, the strong US dollar and weak yen have continued to exceed 150 yen since 2023, reaching a temporary high of 161 yen in 2024. From this perspective, it is likely that the significant depreciation of the yen, which exceeded 150 yen, due to the continued strength of the US dollar and the weak yen amidst the shrinking trade and services deficit, cannot be explained by the "structural depreciation of the yen" theory symbolized by the expansion of the trade and services deficit indicating the decline of the Japanese economy.

The Absolute Significant Interest Rate Differential Supporting the Expansion of Speculative Yen Selling = 2024

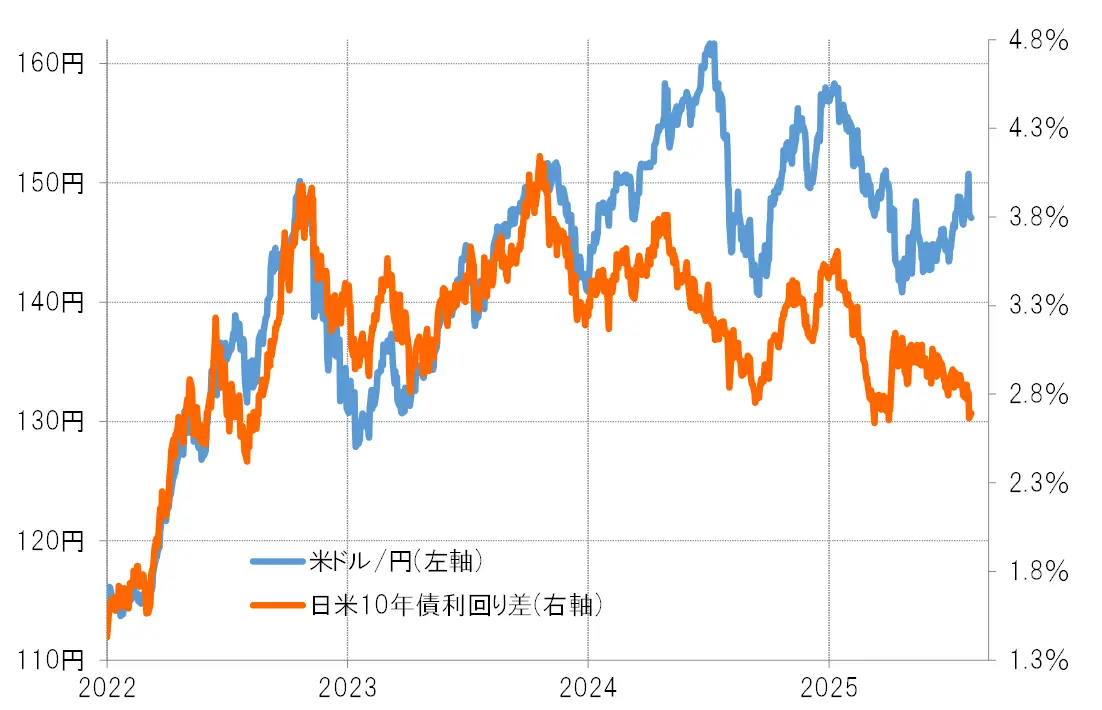

In 2023, the explanation for the rise of the US dollar and the depreciation of the yen amid a shrinking trade and services deficit was the widening of the interest rate differential between Japan and the US (US dollar superiority and yen inferiority). In the first place, the Japan-US interest rate differential became capable of explaining the historically low value of the yen exceeding 150 yen due to the arrival of historically high inflation since 2022 (see Chart 2).

[Figure 2] USD/JPY and the U.S.-Japan Interest Rate Differential (2022 onwards) Source: Created by Monex Securities from Refinitiv data.

As seen above, as of 2023, the main cause of the historically weak yen exceeding 150 yen since 1990 is likely the rapid expansion of the yen's disadvantage due to the arrival of historic inflation and the resulting interest rate differentials. However, in 2024, even as the interest rate differential between Japan and the U.S. begins to narrow, the strength of the U.S. dollar and the weakness of the yen have continued to grow, briefly recording 161 yen, the highest level since 1986.

Source: Created by Monex Securities from Refinitiv data.

As seen above, as of 2023, the main cause of the historically weak yen exceeding 150 yen since 1990 is likely the rapid expansion of the yen's disadvantage due to the arrival of historic inflation and the resulting interest rate differentials. However, in 2024, even as the interest rate differential between Japan and the U.S. begins to narrow, the strength of the U.S. dollar and the weakness of the yen have continued to grow, briefly recording 161 yen, the highest level since 1986.

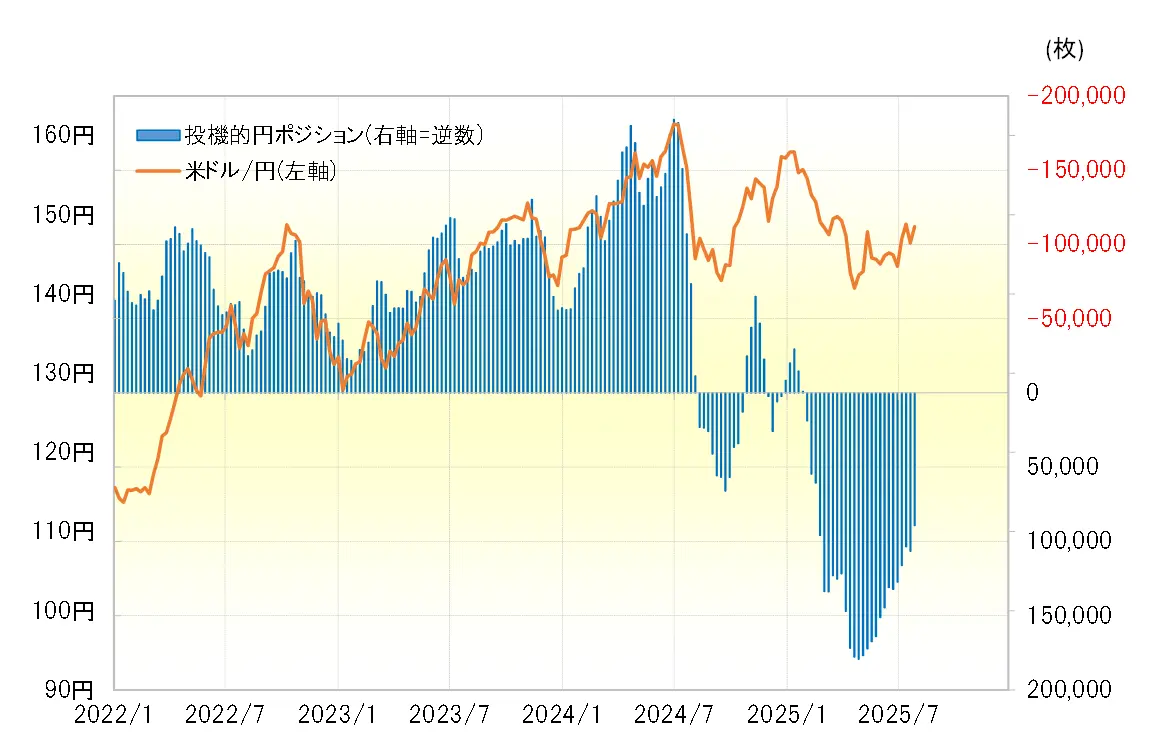

What justified the further expansion of the strong US dollar and weak yen in 2024 was the increased buying of US dollars and selling of yen by speculators engaged in short-term trading (see Chart 3). The issue is why speculators moved to increase US dollar buying and yen selling even as the interest rate differential between Japan and the US narrowed. It may be because, despite the narrowing of the interest rate differential, the absolute advantage of the US dollar over the yen remained significant, and the situation still favored US dollar buying and yen selling.

[Figure 3] US Dollar/Yen and CFTC Statistics of Speculative Yen Positions (January 2022 - ) Source: Created by Monex Securities from data provided by Refinitiv

Source: Created by Monex Securities from data provided by Refinitiv

The "Too Strong U.S. Economy" That Extended the Significant Interest Rate Differential and Deteriorated the Yen Is Coming to an End

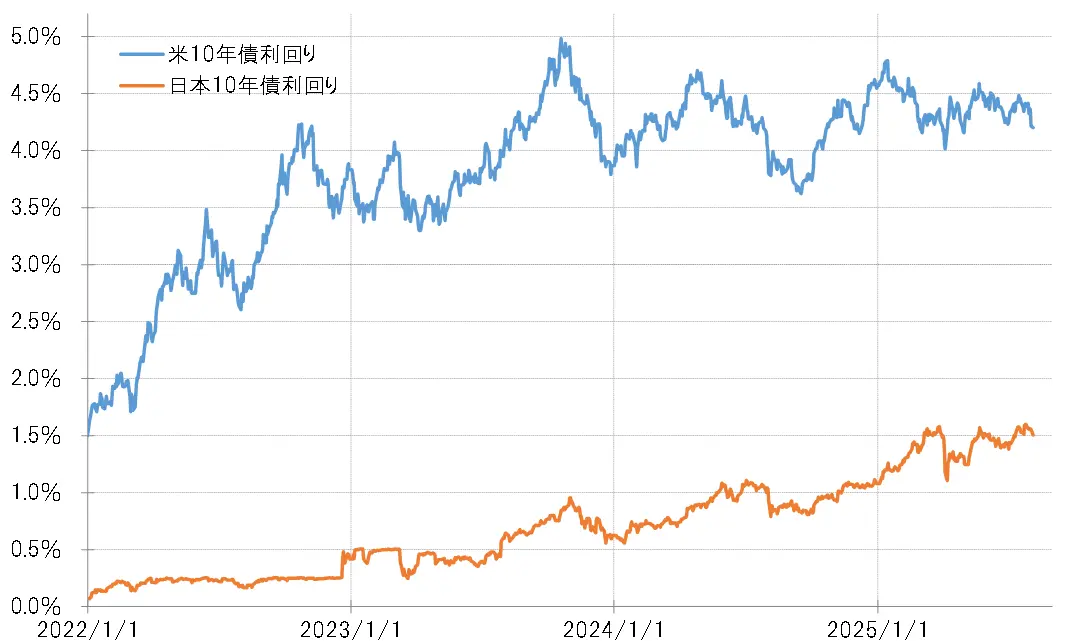

Looking at it this way, the main cause of the prolonged depreciation of the yen is likely the absolute and significant interest rate differential that continues to disadvantage the yen. So, what was the main cause of this? It is likely that while Japan's interest rate rise was gradual, the continued recovery of the US economy after 2023 has meant that the decline in US interest rates has had the most significant limited impact (see Chart 4).

[Figure 4] 10-Year Bond Yields of Japan and the United States (January 2022 - ) Source: Created by Monex Securities from data provided by Refinitiv.

Will the recovery of the U.S. economy continue or change further under the Trump administration? This has been one of the most important themes in considering the future of the USD/JPY. There was a concern that President Trump's policy of "America First," which is anti-international cooperation, might actually worsen the U.S. economy. However, until now, contrary results have been observed, with unexpected increases in employment and rising stock prices.

Source: Created by Monex Securities from data provided by Refinitiv.

Will the recovery of the U.S. economy continue or change further under the Trump administration? This has been one of the most important themes in considering the future of the USD/JPY. There was a concern that President Trump's policy of "America First," which is anti-international cooperation, might actually worsen the U.S. economy. However, until now, contrary results have been observed, with unexpected increases in employment and rising stock prices.

However, following the U.S. employment statistics announced on August 1, the possibility has emerged that the job growth was a "mistake." Are these really "mistakes," and will this finally mark the end of the "stronger-than-expected U.S. economy"? As a result, if U.S. interest rates drop further, will this change the overwhelmingly favorable situation for selling yen due to the significantly lower interest rate differential? This will likely become the most important theme when considering the future of the USD/JPY.