- Topic1/3

95k Popularity

67k Popularity

83k Popularity

11k Popularity

25k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

[Forex] What deterioration in the unemployment rate is necessary for the resumption of US interest rate cuts? | Yoshida Tsune's Forex Daily | Moneyクリ Monex Securities' investment information and media useful for money.

July unemployment rate 4.2% = conditions for resuming rate cuts not met

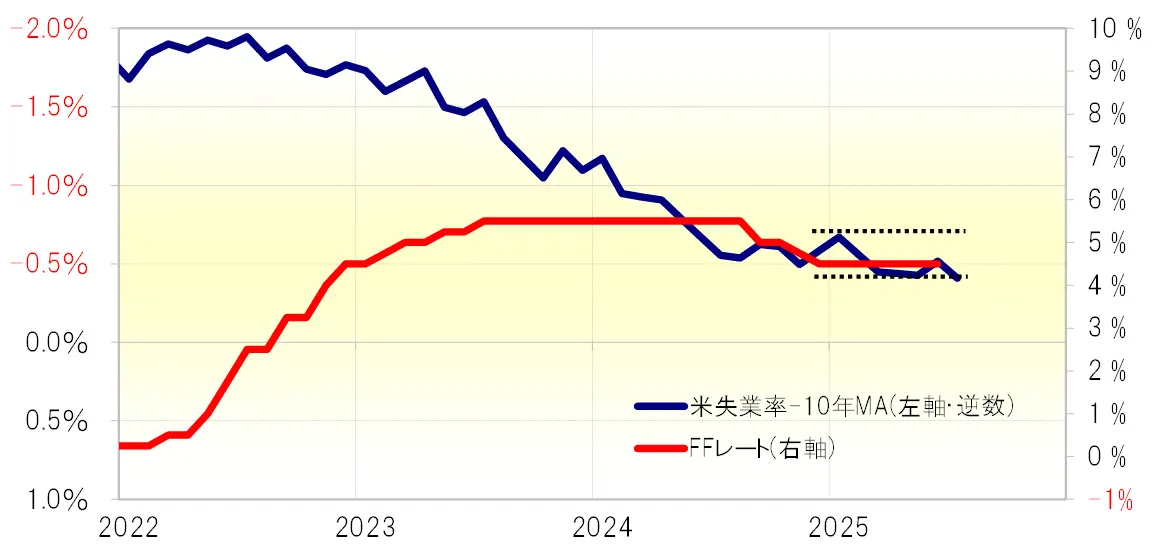

There is a correlation between the FF rate and the U.S. unemployment rate, where an increase in the unemployment rate tends to lower the FF rate, or vice versa. In particular, when we calculate the "adjusted unemployment rate" by subtracting the average unemployment rate over the past 10 years (10-year MA = moving average) from the unemployment rate, the correlation between the two becomes stronger. Using this "adjusted unemployment rate," let’s consider what the conditions for a resumption of U.S. rate cuts would be.

The unemployment rate in the U.S. improved unexpectedly to 4.1% in the previously announced June figures. The preliminary forecast for the July figures, scheduled to be announced on August 1, is a slight increase to 4.2%. If the July unemployment rate indeed reaches 4.2% as expected, the "adjusted unemployment rate" is projected to remain within the range of the "adjusted unemployment rate" that has been maintained since the policy interest rate was kept unchanged in 2025, with a slight increase (see Chart 1). Based on this, if the July unemployment rate is 4.2%, it is unlikely that the conditions for resuming interest rate cuts will be met based on previous experience.

[Figure 1] FF Rate and "Adjusted Unemployment Rate" Part 1 = Unemployment Rate of 4.2% in July (from January 2022) Source: Created by Monex Securities based on data from Refinitiv.

Source: Created by Monex Securities based on data from Refinitiv.

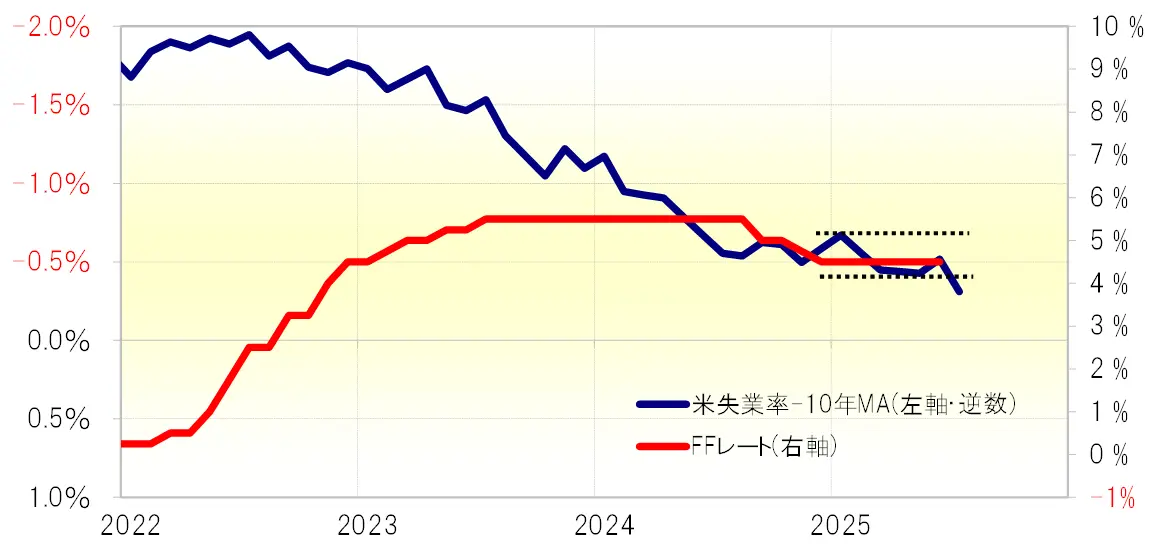

July unemployment rate 4.3% = condition for resuming rate cuts met

What if the unemployment rate in July rises to 4.3%, exceeding previous expectations? In that case, the "adjusted unemployment rate" is expected to break through the upper limit of the range starting from 2025 (see Chart 2). Referring to the relationship between the two so far, it seems likely to meet the conditions for a reduction in the FF rate, in other words, a resumption of interest rate cuts.

[Figure 2] FF Rate and "Adjusted Unemployment Rate" Part 2 = July Unemployment Rate 4.3% (From January 2022) Source: Created by Monex Securities from data provided by Refinitiv.

So, what about the opposite case? If the unemployment rate continues to unexpectedly decrease, as was the case with the June unemployment rate, could this suggest the need for a rate hike rather than a rate cut, based on the previous relationships?

Source: Created by Monex Securities from data provided by Refinitiv.

So, what about the opposite case? If the unemployment rate continues to unexpectedly decrease, as was the case with the June unemployment rate, could this suggest the need for a rate hike rather than a rate cut, based on the previous relationships?

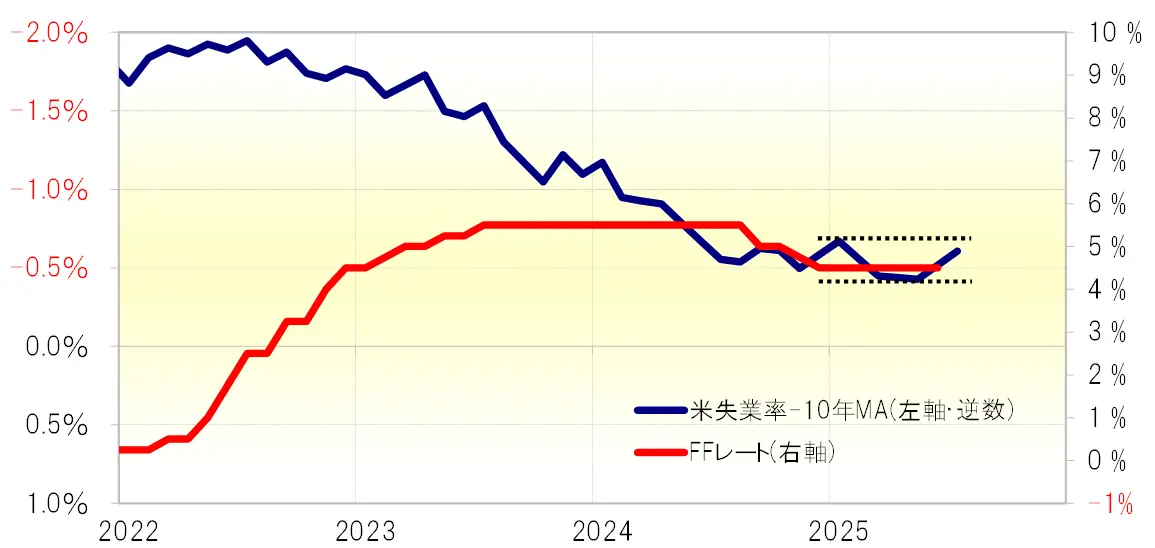

July unemployment rate 4% = does not indicate a shift towards interest rate hikes

The unemployment rate in July improved further from the previous figure, dropping to 4%, but the decline in the "adjusted unemployment rate" is expected to remain within the range starting in 2025 (see Chart 3). Even if the unemployment rate drops to 3.9%, it is unlikely to change significantly, and even if there is an unexpected improvement in the unemployment rate, the possibility of a shift towards rate hikes still does not seem realistic.

[Figure 3] FF Rate and "Adjusted Unemployment Rate" No. 3 = When the July Unemployment Rate is 4% (from January 2022) Source: Created by Monex Securities from data provided by Refinitiv.

The immediate focus is likely on when the rate cuts will resume. If the unemployment rate rises above 4.3%, there is a high possibility that the conditions set by the FOMC for resuming rate cuts will be met as before. On the other hand, if rate cuts are resumed while the unemployment rate remains below 4.2%, it could be perceived by the financial markets as the FOMC succumbing to political pressure from President Trump and making unnecessary rate cuts.

Source: Created by Monex Securities from data provided by Refinitiv.

The immediate focus is likely on when the rate cuts will resume. If the unemployment rate rises above 4.3%, there is a high possibility that the conditions set by the FOMC for resuming rate cuts will be met as before. On the other hand, if rate cuts are resumed while the unemployment rate remains below 4.2%, it could be perceived by the financial markets as the FOMC succumbing to political pressure from President Trump and making unnecessary rate cuts.