USDC face à APT : l’affrontement pour la suprématie des stablecoins sur le marché des cryptomonnaies

Introduction : Comparaison d’investissement USDC vs APT

La confrontation entre USDC et APT s’impose comme un enjeu majeur pour tout investisseur sur le marché des cryptomonnaies. Ces deux actifs se distinguent non seulement par leur rang en capitalisation, leurs usages et leur évolution de prix, mais incarnent également des positionnements très différents au sein du secteur crypto.

USDC (USDC) : Depuis 2018, USDC s’est affirmé comme le stablecoin indexé au dollar américain le plus reconnu, grâce à sa garantie complète.

APT (APT) : Apparue en 2022, APT est saluée pour sa blockchain Layer 1 performante, résolument centrée sur la sécurité et la scalabilité.

Cet article propose une analyse complète de la valeur d’investissement de USDC et APT, en abordant les tendances historiques, les mécanismes d’émission, l’adoption institutionnelle, les écosystèmes technologiques et les perspectives à venir, pour éclairer la question essentielle :

"Quel est le meilleur choix à ce jour ?" Voici l’analyse issue du modèle et des données disponibles :

I. Historique des prix et situation de marché actuelle

Tendances historiques de USDC et APT

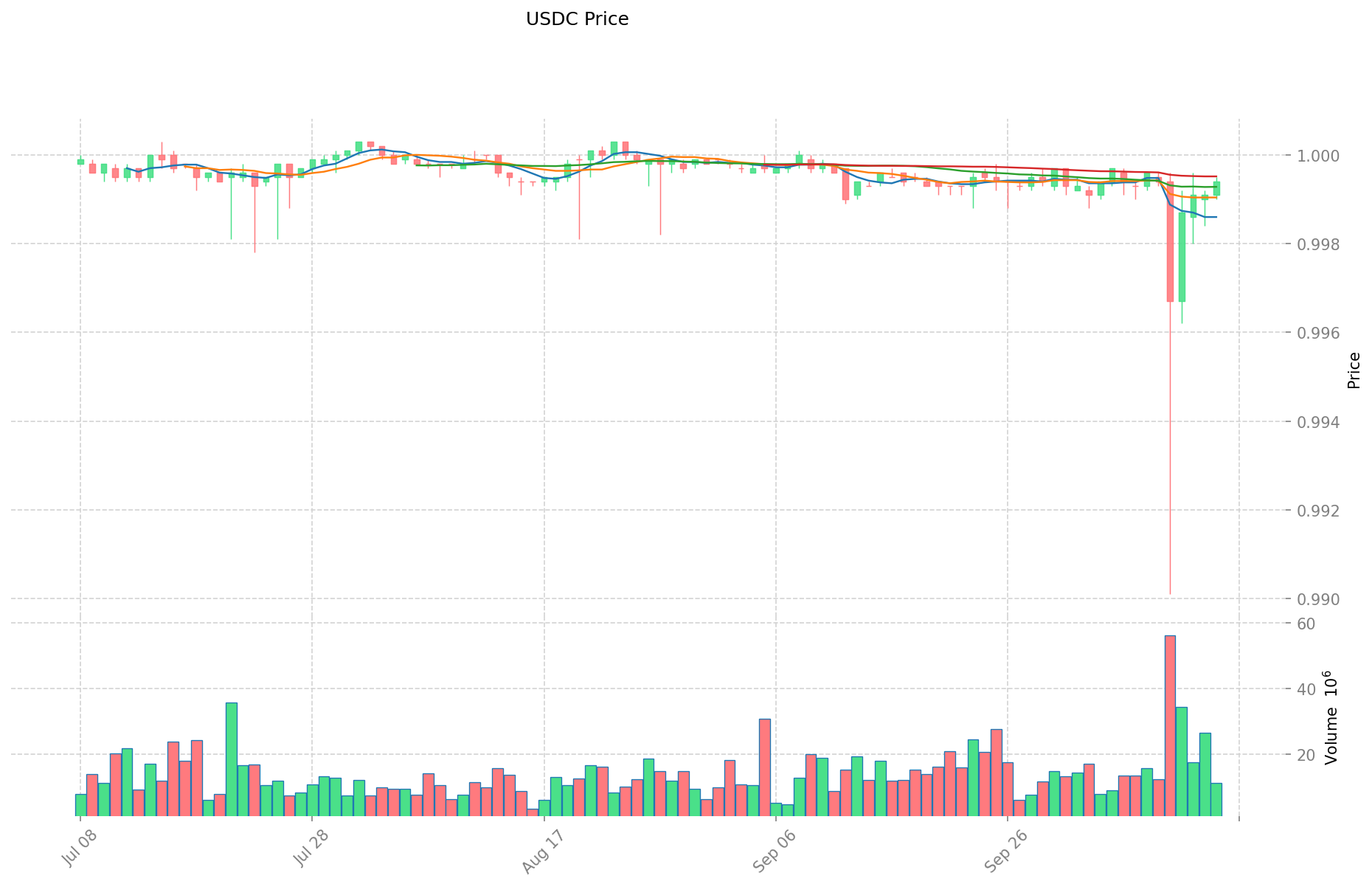

- 2023 : USDC a connu une forte volatilité lors de la crise bancaire, passant sous la barre des 0,90 $ avant de retrouver sa valeur.

- 2023 : APT a atteint 19,92 $ en janvier, porté par l’adoption croissante et l’expansion de son écosystème.

- Analyse comparative : Sur le marché baissier de 2022-2023, USDC a maintenu son ancrage à 1 $ avec de faibles écarts, tandis qu’APT est passé de son sommet à la zone des 3-4 $.

Situation de marché actuelle (15 octobre 2025)

- Prix USDC actuel : 1,00 $

- Prix APT actuel : 3,643 $

- Volume d’échange sur 24h : USDC 10 369 955 $ vs APT 2 610 481 $

- Indice de sentiment (Fear & Greed Index) : 34 (Peur)

Cliquez pour accéder aux prix en temps réel :

- Voir le prix USDC actuel Prix du marché

- Voir le prix APT actuel Prix du marché

II. Facteurs déterminants pour la valeur d’investissement USDC vs APT

Comparaison des mécanismes d’émission (Tokenomics)

- USDC : Stablecoin garanti à 100 % avec des réserves en USD (liquidités et bons du Trésor) à parité 1:1, assurant la stabilité à 1 $

- APT : Offre initiale de 1 milliard de tokens sans plafond, alimentée par des récompenses de staking proches du modèle Ethereum

- 📌 Observation historique : L’émission stable de USDC garantit la constance des prix, tandis que le modèle inflationniste d’APT requiert une croissance soutenue de l’écosystème pour préserver sa valeur.

Adoption institutionnelle et applications marché

- Détention institutionnelle : USDC bénéficie d’une confiance accrue et d’une adoption par Coinbase, Visa et Stripe ; APT a séduit le capital-risque avec 350 millions $ investis

- Adoption entreprise : USDC domine les paiements transfrontaliers et les règlements sur 23 blockchains ; APT vise l’infrastructure des futures applications décentralisées

- Position réglementaire : USDC est conforme aux normes MiCA et GENIUS, tandis qu’APT rencontre une réglementation variable selon les territoires

Développement technologique et structuration des écosystèmes

- Technologie USDC : Le protocole CCTP de Circle facilite la liquidité inter-chaînes, avec une forte présence sur Solana et Base

- Technologie APT : Basée sur le langage Move innovant, avec un TPS théorique de plusieurs millions, axée sur la performance et la réduction des coûts

- Comparaison des écosystèmes : USDC reste le collatéral de choix sur DeFi et CEX ; L’écosystème APT affiche une croissance rapide avec une hausse du Total Value Locked (TVL)

Facteurs macroéconomiques et cycles de marché

- Performance en période d’inflation : USDC procure de la stabilité sans offrir de couverture contre l’inflation ; APT peut profiter des phases d’expansion du marché

- Effet des politiques monétaires : Les taux d’intérêt influent sur le rendement des réserves USDC ; Le prix d’APT dépend surtout du climat général du marché crypto

- Facteurs géopolitiques : USDC bénéficie d’une demande accrue pour les règlements internationaux ; L’adoption d’APT dépend de l’acceptation globale de la technologie blockchain

III. Prévisions de prix 2025-2030 : USDC vs APT

Prévision court terme (2025)

- USDC : Fourchette conservatrice 1,00 $ - 1,00 $ | Fourchette optimiste 1,00 $ - 1,00 $

- APT : Fourchette conservatrice 2,48 $ - 3,65 $ | Fourchette optimiste 3,65 $ - 4,89 $

Prévision moyen terme (2027)

- USDC devrait rester stable, prix attendu 1,00 $

- APT pourrait entrer en phase de croissance, prix attendu 3,99 $ - 6,79 $

- Principaux moteurs : Apports institutionnels, ETF, développement de l’écosystème

Prévision long terme (2030)

- USDC : Scénario de base 1,00 $ - 1,00 $ | Scénario optimiste 1,00 $ - 1,00 $

- APT : Scénario de base 6,31 $ - 7,99 $ | Scénario optimiste 7,99 $ - 11,03 $

Avertissement

USDC :

| Année | Prix max prévisionnel | Prix moyen prévisionnel | Prix min prévisionnel | Variation |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

APT :

| Année | Prix max prévisionnel | Prix moyen prévisionnel | Prix min prévisionnel | Variation |

|---|---|---|---|---|

| 2025 | 4,891 | 3,65 | 2,482 | 0 |

| 2026 | 4,911075 | 4,2705 | 3,373695 | 17 |

| 2027 | 6,7943655 | 4,5907875 | 3,993985125 | 25 |

| 2028 | 7,798829805 | 5,6925765 | 4,89561579 | 56 |

| 2029 | 9,241613318925 | 6,7457031525 | 5,80130471115 | 85 |

| 2030 | 11,03124836528325 | 7,9936582357125 | 6,314990006212875 | 119 |

IV. Comparaison des stratégies d’investissement : USDC vs APT

Stratégies d’investissement long terme vs court terme

- USDC : Convient aux investisseurs recherchant stabilité et maîtrise des risques

- APT : Convient aux investisseurs misant sur le potentiel de l’écosystème et la croissance durable

Gestion des risques et allocation d’actifs

- Investisseurs prudents : USDC 80 % vs APT 20 %

- Investisseurs dynamiques : USDC 40 % vs APT 60 %

- Outils de couverture : Allocation stablecoins, options, portefeuilles multi-devises

V. Comparaison des risques potentiels

Risque de marché

- USDC : Risque de désancrage lors de chocs extrêmes sur le marché

- APT : Forte volatilité et dépendance à la tendance du marché crypto

Risque technique

- USDC : Préoccupations liées à la centralisation, dépendance au secteur bancaire traditionnel

- APT : Défis de scalabilité, vulnérabilités potentielles des smart contracts

Risque réglementaire

- Les politiques mondiales peuvent impacter différemment les deux actifs, USDC étant plus exposé à la surveillance des stablecoins

VI. Conclusion : Quel est le meilleur choix ?

📌 Synthèse sur la valeur d’investissement :

- USDC : Stabilité, adoption étendue, conformité réglementaire

- APT : Potentiel de croissance, technologie innovante, écosystème en expansion

✅ Conseils d’investissement :

- Nouveaux investisseurs : Privilégier USDC pour sa stabilité

- Investisseurs expérimentés : Opter pour un portefeuille équilibré USDC / APT

- Institutionnels : Allocation adaptée au profil de risque et aux objectifs

⚠️ Avertissement : Le marché des cryptomonnaies est extrêmement volatil. Ce contenu ne constitue pas un conseil en investissement. None

VII. FAQ

Q1 : Quelles différences principales entre USDC et APT ? R : USDC est un stablecoin indexé au dollar (stabilité et adoption internationale), APT est un token Layer 1 axé sur la performance et la scalabilité, avec potentiel de développement dans la DeFi.

Q2 : Lequel est le plus stable, USDC ou APT ? R : USDC est conçu pour la stabilité via son ancrage 1:1 sur le dollar. APT, comme les autres tokens, reste exposé à la volatilité du marché.

Q3 : Comment diffèrent les mécanismes d’émission de USDC et APT ? R : USDC dispose d’une réserve garantie en USD sur le modèle 1:1. APT présente une offre initiale de 1 milliard sans plafond maximum, alimentée par le staking.

Q4 : Quel token bénéficie de la meilleure adoption institutionnelle ? R : USDC jouit d’une adoption élargie par des acteurs majeurs comme Coinbase, Visa, Stripe. APT attire les fonds de capital-risque mais doit encore affirmer sa présence institutionnelle.

Q5 : Quels sont les risques potentiels pour chaque actif ? R : USDC : désancrage possible en situation extrême et pression réglementaire. APT : forte volatilité, vulnérabilités techniques et réglementation en évolution.

Q6 : Quelle performance en période d’inflation ? R : USDC reste stable mais ne protège pas contre l’inflation. APT peut croître lors des phases d’expansion mais reste volatil en période inflationniste.

Q7 : Quel choix pour un investissement long terme ? R : Cela dépend des objectifs. USDC privilégie la stabilité et la gestion du risque, APT offre un potentiel de croissance lié à son écosystème. Une allocation équilibrée est recommandée.

Prévision du prix de l'USDC pour 2025 : Analyse de la stabilité des stablecoins dans un environnement réglementaire des cryptomonnaies en pleine mutation

Prévision du prix RSR en 2025 : Analyse du potentiel de marché à venir et des facteurs de croissance du token Reserve Rights

Prévisions pour le prix XPL en 2025 : analyse des tendances du marché et des facteurs de croissance potentiels

PayPal USD (PYUSD) est-il un investissement pertinent ? Analyse du potentiel et des risques liés au stablecoin de PayPal

Plasma (XPL) constitue-t-il un investissement pertinent ? Analyse du potentiel et des risques associés à cette cryptomonnaie en émergence

Worldwide USD (WUSD) : un investissement judicieux ? Analyse du potentiel et des risques de ce stablecoin émergent

Combo quotidien de Dropee 12 décembre 2025

Tomarket Daily Combo 12 décembre 2025

Guide pour participer et réclamer les récompenses de l'airdrop SEI

Stratégies efficaces pour le trading algorithmique de cryptomonnaies

Comprendre l’évaluation du Bitcoin à l’aide du modèle Stock-to-Flow