Dự báo giá ZEX năm 2025: Phân tích xu hướng thị trường và nhận định từ chuyên gia về triển vọng của token ZEX

Giới thiệu: Vị thế thị trường và giá trị đầu tư của ZEX

Zeta Markets (ZEX) đã khẳng định vai trò nổi bật trong ngành giao dịch phái sinh phi tập trung kể từ ngày ra mắt. Đến năm 2025, vốn hóa thị trường của ZEX đạt 24.339.911 USD, với nguồn cung lưu hành khoảng 181.438.032 token và giá quanh mức 0,13415 USD. Đây là tài sản thường được gọi là “nhà đổi mới DEX trên Solana”, ngày càng đóng vai trò trọng yếu trong lĩnh vực tài chính phi tập trung và giao dịch phái sinh.

Bài viết này mang đến phân tích chuyên sâu về xu hướng giá ZEX từ 2025 đến 2030, kết hợp dữ liệu lịch sử, cung cầu thị trường, tiến trình xây dựng hệ sinh thái và các yếu tố kinh tế vĩ mô để đưa ra dự báo giá chuyên nghiệp cùng chiến lược đầu tư thực tiễn dành cho nhà đầu tư.

I. Tổng quan lịch sử giá ZEX và trạng thái thị trường hiện tại

Diễn biến giá lịch sử của ZEX

- Năm 2024: ZEX xác lập mức cao nhất lịch sử 0,3184 USD vào ngày 27 tháng 6, đánh dấu cột mốc quan trọng

- Năm 2024: Token chạm đáy lịch sử 0,0218 USD vào ngày 5 tháng 8, thể hiện mức độ biến động mạnh

- Năm 2025: ZEX phục hồi ấn tượng, giá tăng 263,55% so với cùng kỳ năm trước

Tình hình thị trường ZEX hiện tại

Tính đến 04 tháng 10 năm 2025, ZEX được giao dịch ở mức 0,13415 USD. Token này ghi nhận hiệu suất nổi bật ở nhiều khung thời gian, tăng 2,12% trong 24 giờ gần nhất và tăng mạnh 121,22% trong 30 ngày qua. Vốn hóa thị trường hiện đạt 24.339.911,99 USD, xếp ZEX ở vị trí thứ 1.004 trên thị trường tiền mã hóa. Số lượng lưu hành là 181.438.032 ZEX, trên tổng cung 1.000.000.000 token, tương ứng tỷ lệ lưu hành 18,14%. Khối lượng giao dịch 24 giờ đạt 51.378,85 USD, phản ánh mức độ hoạt động vừa phải. Giá trị pha loãng hoàn toàn của ZEX ở mức 134.150.000 USD, thể hiện tiềm năng tăng trưởng.

Nhấn để xem giá thị trường ZEX cập nhật

Chỉ số tâm lý thị trường ZEX

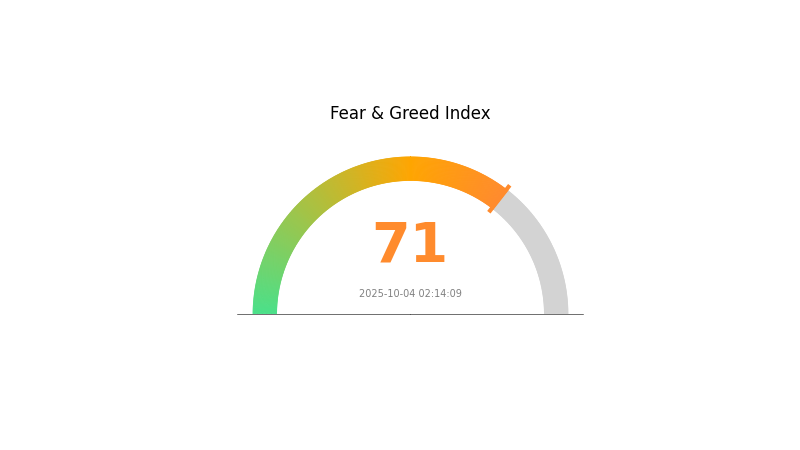

04 tháng 10 năm 2025, Chỉ số Sợ hãi và Tham lam: 71 (Tham lam)

Nhấn để xem Chỉ số Sợ hãi & Tham lam cập nhật

Thị trường tiền mã hóa hiện đang nghiêng về tâm lý tham lam, với Chỉ số Sợ hãi và Tham lam đạt 71. Điều này phản ánh sự lạc quan gia tăng của nhà đầu tư, đồng thời cho thấy xu hướng chấp nhận rủi ro lớn hơn. Tuy nhiên, mức tham lam cực điểm thường báo hiệu nguy cơ điều chỉnh thị trường. Nhà giao dịch nên thận trọng, chủ động quản trị rủi ro và giữ vững nguyên tắc đa dạng hóa, nghiên cứu kỹ khi ra quyết định đầu tư vào thị trường biến động cao.

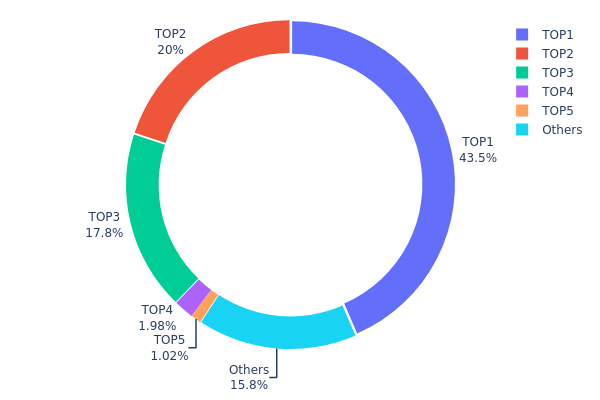

Phân bổ sở hữu ZEX

Số liệu phân bổ địa chỉ cho thấy cấu trúc sở hữu ZEX cực kỳ tập trung. Địa chỉ lớn nhất giữ 43,45% tổng cung, ba địa chỉ hàng đầu kiểm soát 81,22% tổng số token ZEX. Mức tập trung này đặt ra thách thức về phi tập trung hóa và ổn định thị trường.

Phân bổ sở hữu tập trung làm gia tăng nguy cơ biến động giá và thao túng thị trường. Các cá nhân hoặc nhóm sở hữu lớn có thể chi phối biến động giá, tạo điều kiện cho các đợt bán tháo hoặc tích trữ lớn tác động mạnh đến thị trường. Đồng thời, rủi ro cho quản trị dự án cũng hiện diện nếu quyền biểu quyết gắn với số lượng token nắm giữ.

Dù nhóm nhỏ lẻ (“Nhóm khác” chiếm 15,8%) góp phần vào phân bổ, tổng thể vẫn cần thúc đẩy phân tán token để tăng sức chống chịu và thúc đẩy phi tập trung hóa. Tình trạng sở hữu hiện tại có thể làm một số nhà đầu tư e ngại về rủi ro tập trung và biến động giá.

Nhấn để xem Phân bổ sở hữu ZEX cập nhật

| Top | Địa chỉ | Số lượng nắm giữ | Tỷ lệ (%) |

|---|---|---|---|

| 1 | Bs5XaF...T2DBXt | 434.524,48K | 43,45% |

| 2 | 3zmHxC...NfrbAN | 200.000,00K | 20,00% |

| 3 | EibcRb...HqyrAT | 177.703,40K | 17,77% |

| 4 | AC5RDf...CWjtW2 | 19.763,94K | 1,97% |

| 5 | 9zrxxf...e1zqwC | 10.186,28K | 1,01% |

| - | Nhóm khác | 157.819,30K | 15,8% |

II. Các yếu tố chủ chốt tác động đến giá ZEX trong tương lai

Cơ chế cung ứng

- Mô hình khan hiếm thử nghiệm: ZEX vận hành theo mô hình khan hiếm thử nghiệm, có thể ảnh hưởng mạnh đến động thái giá.

- Ảnh hưởng tức thì: Cơ chế cung ứng độc đáo này góp phần thúc đẩy tâm lý đầu cơ và tiềm ẩn biến động giá lớn.

Yếu tố tổ chức và cá mập

- Doanh nghiệp chấp nhận: Việc các tổ chức lớn sử dụng ZEX sẽ ảnh hưởng lớn đến xu hướng giá trong tương lai.

Yếu tố kinh tế vĩ mô

- Khả năng phòng ngừa lạm phát: Mức độ hiệu quả của ZEX trong môi trường lạm phát sẽ ảnh hưởng trực tiếp đến giá trị và mức độ phổ biến của token.

Tiến trình công nghệ và xây dựng hệ sinh thái

- Tương tác cộng đồng: Mức độ tham gia của cộng đồng và tiến trình phát triển hệ sinh thái là yếu tố quyết định định giá ZEX trong tương lai.

- Ứng dụng hệ sinh thái: Sự phát triển các DApp và dự án hệ sinh thái sẽ nâng cao tính hữu dụng ZEX, đồng thời thúc đẩy giá trị token.

III. Dự báo giá ZEX giai đoạn 2025-2030

Triển vọng năm 2025

- Dự báo thận trọng: 0,12074 - 0,13415 USD

- Dự báo trung lập: 0,13415 - 0,16098 USD

- Dự báo lạc quan: 0,16098 - 0,18781 USD (cần tâm lý thị trường tích cực)

Triển vọng 2026-2027

- Kỳ vọng giai đoạn: Khả năng bước vào chu kỳ tăng trưởng

- Dự báo biên độ giá:

- Năm 2026: 0,1143 - 0,18835 USD

- Năm 2027: 0,16768 - 0,2358 USD

- Động lực chính: Mức độ phổ cập, cải tiến công nghệ

Triển vọng dài hạn 2028-2030

- Kịch bản cơ bản: 0,20523 - 0,269 USD (giả định tăng trưởng ổn định)

- Kịch bản lạc quan: 0,269 - 0,32012 USD (giả định thị trường tăng mạnh)

- Kịch bản đột phá: Trên 0,32012 USD (giả định điều kiện thị trường đặc biệt và mức độ phổ cập cao)

- 31 tháng 12 năm 2030: ZEX đạt 0,32012 USD (đỉnh tiềm năng theo dự báo lạc quan)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,18781 | 0,13415 | 0,12074 | 0 |

| 2026 | 0,18835 | 0,16098 | 0,1143 | 20 |

| 2027 | 0,2358 | 0,17466 | 0,16768 | 30 |

| 2028 | 0,29758 | 0,20523 | 0,19907 | 52 |

| 2029 | 0,2866 | 0,25141 | 0,14833 | 87 |

| 2030 | 0,32012 | 0,269 | 0,14257 | 100 |

IV. Chiến lược đầu tư chuyên nghiệp và quản trị rủi ro cho ZEX

Phương pháp đầu tư ZEX

(1) Chiến lược nắm giữ dài hạn

- Phù hợp với: Nhà đầu tư chấp nhận rủi ro, có tầm nhìn dài hạn

- Khuyến nghị vận hành:

- Tích lũy ZEX khi thị trường điều chỉnh giảm

- Đặt mục tiêu giá, định kỳ đánh giá lại các yếu tố nền tảng của dự án

- Lưu trữ token an toàn trong ví cá nhân phi tập trung

(2) Chiến lược giao dịch chủ động

- Công cụ phân tích kỹ thuật:

- Đường trung bình động: Nhận diện xu hướng và khả năng đảo chiều

- RSI: Theo dõi trạng thái quá mua/quá bán

- Lưu ý khi giao dịch lướt sóng:

- Quan sát các diễn biến hệ sinh thái Solana có thể ảnh hưởng đến ZEX

- Đặt lệnh cắt lỗ để kiểm soát rủi ro giảm giá

Khung quản trị rủi ro ZEX

(1) Nguyên tắc phân bổ tài sản

- Nhà đầu tư thận trọng: 1-3%

- Nhà đầu tư mạo hiểm: 5-10%

- Nhà đầu tư chuyên nghiệp: Tối đa 15%

(2) Giải pháp phòng ngừa rủi ro

- Đa dạng hóa: Đầu tư vào nhiều loại tài sản tiền mã hóa khác

- Lệnh cắt lỗ: Áp dụng để hạn chế thua lỗ tiềm năng

(3) Giải pháp lưu trữ an toàn

- Khuyến nghị ví phần cứng: Gate web3 wallet

- Lựa chọn ví phần mềm: Ví Solana chính thức

- Biện pháp bảo mật: Sử dụng xác thực hai lớp, sao lưu seed phrase an toàn

V. Rủi ro và thách thức tiềm ẩn đối với ZEX

Rủi ro thị trường ZEX

- Biến động: Giá tiền mã hóa thường biến động mạnh

- Thanh khoản: Có thể gặp khó khăn khi thực hiện lệnh lớn

- Cạnh tranh: Các dự án DEX khác trên Solana tác động đến thị phần

Rủi ro pháp lý ZEX

- Quy định chưa rõ ràng: Nguy cơ bị siết chặt quản lý với các nền tảng DeFi

- Yêu cầu tuân thủ: Có thể cần áp dụng quy trình KYC/AML

- Hạn chế xuyên biên giới: Tình trạng pháp lý khác nhau ở từng quốc gia/vùng lãnh thổ

Rủi ro kỹ thuật ZEX

- Lỗ hổng hợp đồng thông minh: Nguy cơ bị khai thác hoặc lỗi phần mềm

- Thách thức mở rộng: Phụ thuộc vào khả năng mạng Solana

- Vấn đề tương thích: Hạn chế đối với chức năng liên chuỗi

VI. Kết luận và khuyến nghị hành động

Đánh giá giá trị đầu tư ZEX

ZEX có tiềm năng trở thành DEX nhanh, bảo mật trên Solana nhưng phải đối mặt với cạnh tranh cao và rủi ro pháp lý chưa rõ ràng. Triển vọng dài hạn khả quan, song biến động và rủi ro ngắn hạn ở mức cao.

Khuyến nghị đầu tư ZEX

✅ Người mới: Bắt đầu với số vốn nhỏ, tập trung học hỏi

✅ Nhà đầu tư giàu kinh nghiệm: Cân nhắc phân bổ vào danh mục DeFi đa dạng

✅ Nhà đầu tư tổ chức: Theo dõi sát tiến trình dự án và diễn biến pháp lý

Phương thức tham gia giao dịch ZEX

- Giao dịch giao ngay: Có trên Gate.com và các sàn khác

- Tương tác DeFi: Tham gia trực tiếp với giao thức Zeta Markets

- Staking: Tham gia quản trị giao thức, nhận phần thưởng

Đầu tư tiền mã hóa tiềm ẩn rủi ro rất cao. Bài viết này không phải là lời khuyên đầu tư. Nhà đầu tư cần tự cân nhắc mức độ chấp nhận rủi ro cá nhân. Nên tham khảo ý kiến chuyên gia tài chính. Không đầu tư vượt quá khả năng tài chính của bạn.

FAQ

Dự báo giá ZEC năm 2030 là bao nhiêu?

Dựa trên phân tích thị trường hiện tại, dự báo giá ZEC năm 2030 là 196,11 USD, dự kiến sẽ tăng so với mức giá hiện nay.

Giá ZEX hiện tại là bao nhiêu?

Hiện tại, giá ZEX là 0,1346 USD, giảm 0,94% trong 24 giờ qua. Khối lượng giao dịch hiện tại đạt 742.724 USD.

ZEX crypto là gì?

ZEX là đồng tiền mã hóa gốc của Zeta Markets, sàn giao dịch phi tập trung trên Solana. ZEX dùng cho quản trị, staking, khuyến khích giao dịch và làm token gas cho Zeta X – giải pháp DeFi Layer 2.

Dự báo giá Zoo Token năm 2025 là bao nhiêu?

Zoo Token dự kiến đạt 0,0₁₁3277 USD vào ngày 01 tháng 10 năm 2025, giảm 10,15%. Giá dự báo dao động từ 0,0₁₁2046 đến 0,0₁₁3650 USD trong năm 2025.

Zeta Markets (ZEX) có phải là lựa chọn đầu tư phù hợp?: Đánh giá tiềm năng phát triển và rủi ro trong thị trường quyền chọn DeFi

Drift Protocol (DRIFT) có phải là lựa chọn đầu tư phù hợp?: Đánh giá tiềm năng và rủi ro của nền tảng giao dịch phi tập trung này

Drift Protocol (DRIFT) có phải là khoản đầu tư tiềm năng?: Đánh giá cơ hội và rủi ro của nền tảng phái sinh phi tập trung này

Dự báo giá ORCA năm 2025: Token DeFi này sẽ bứt phá hay tụt dốc trong đại dương crypto?

TURBOS đối đầu SOL: Cuộc cạnh tranh động cơ hiệu suất cao trong lĩnh vực kỹ thuật ô tô hiện đại

Cách chuyển đổi SOL sang USD: Máy tính giá Solana thời gian thực

Các Nghệ Sĩ NFT Nổi Bật

Tìm hiểu công nghệ Blockchain Fantom: Phân tích các đặc điểm nổi bật

Tìm Hiểu Độ Hiếm NFT: Hướng Dẫn Đánh Giá Theo Hệ Thống Chấm Điểm

Tìm hiểu về cơ chế đồng thuận Proof-of-Work trong blockchain

Hướng dẫn đơn giản về cách chuyển đổi Satoshi sang Bitcoin