Prediksi Harga TOSHI 2025: Analisis Potensi Pertumbuhan dan Faktor Pasar pada Sektor Aset Digital yang Tengah Berkembang

Pendahuluan: Posisi Pasar TOSHI dan Nilai Investasi

Toshi (TOSHI), sebagai proyek berbasis komunitas terbesar dalam sejarah kripto, telah menunjukkan perkembangan signifikan sejak awal tahun 2024. Hingga tahun 2025, kapitalisasi pasar TOSHI mencapai $312.740.946, dengan jumlah token yang beredar sekitar 420.690.000.000, serta harga bergerak di sekitar $0,0007434. TOSHI sering disebut sebagai meme token paling berorientasi komunitas, aset ini semakin berperan penting dalam tata kelola dan partisipasi komunitas yang terdesentralisasi.

Artikel ini menyajikan analisis komprehensif tren harga TOSHI dari 2025 hingga 2030. Analisis ini menggabungkan data historis, dinamika penawaran dan permintaan pasar, pengembangan ekosistem, serta faktor makroekonomi untuk memberikan prediksi harga profesional dan strategi investasi praktis bagi para investor.

I. Tinjauan Sejarah Harga TOSHI dan Status Pasar Terkini

Evolusi Harga TOSHI

- 2024: Proyek diluncurkan, harga awal $0,0001403

- 2024: Harga rekor terendah di $0,0000738 pada 6 September

- 2025: Harga rekor tertinggi di $0,002325 pada 26 Januari

Situasi Pasar Terkini TOSHI

Pada 23 September 2025, TOSHI diperdagangkan seharga $0,0007434. Token ini turun tipis sebesar 0,8% dalam 24 jam terakhir, dengan volume perdagangan $4.290.992,58. Kapitalisasi pasar TOSHI senilai $312.740.946, menempatkannya di posisi ke-232 dalam daftar pasar kripto.

Selama sepekan terakhir, TOSHI mencatat pertumbuhan 25,06%. Dalam 30 hari terakhir, kinerjanya juga positif dengan kenaikan sebesar 5,92%. Dalam satu tahun, TOSHI mengalami lonjakan luar biasa sebesar 679,98%.

Harga saat ini masih jauh di bawah rekor tertinggi di $0,002325 yang dicapai 26 Januari tahun ini, tetapi tetap jauh di atas rekor terendah $0,0000738 pada 6 September 2024.

Klik untuk melihat harga pasar TOSHI saat ini

Indikator Sentimen Pasar TOSHI

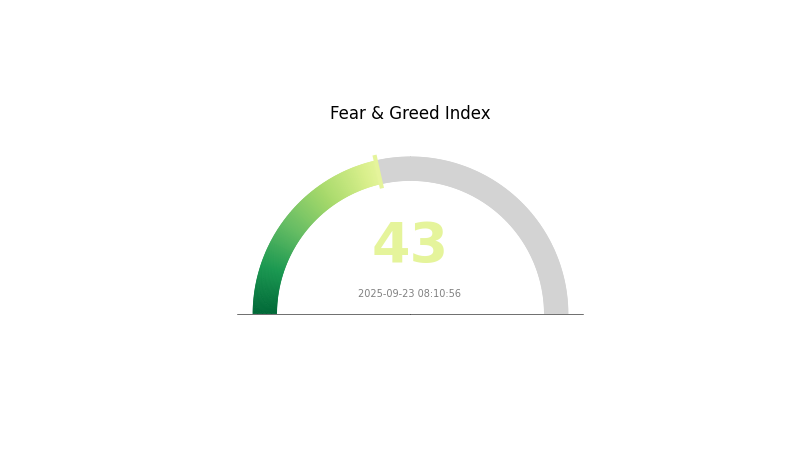

Indeks Fear and Greed 23 September 2025: 43 (Fear)

Klik untuk melihat Indeks Fear & Greed TOSHI

Sentimen pasar kripto masih berada di zona “Fear” dengan skor 43. Artinya, investor bersikap hati-hati—kondisi ini dapat menandakan bahwa pasar sedang undervalued. Walau situasi ini dapat menjadi peluang beli bagi investor kontras, tetap penting untuk riset mendalam dan manajemen risiko ketat. Sentimen dapat berubah dengan cepat. Diversifikasi portofolio dan pemantauan tren pasar secara menyeluruh sangat disarankan sebelum mengambil keputusan investasi.

Distribusi Kepemilikan TOSHI

Data distribusi alamat TOSHI menunjukkan pola distribusi kepemilikan token yang menarik. Metrik ini mengindikasikan tingkat konsentrasi token di berbagai alamat, menjadi penanda desentralisasi dan dinamika potensial pasar.

Menurut data yang tersedia, distribusi token TOSHI cukup seimbang. Tidak ada satu alamat pun yang mendominasi persentase besar dari total pasokan. Tingkat desentralisasi yang baik ini umumnya dipandang positif di industri kripto. Tidak adanya pemegang besar (whale) mengurangi risiko manipulasi dan fluktuasi harga oleh pihak tertentu.

Struktur distribusi saat ini menjadi pondasi pasar TOSHI yang stabil. Dengan sebaran token di banyak alamat, potensi terjadinya tekanan jual atau beli secara terkoordinasi yang dapat memicu pergerakan harga drastis menjadi lebih kecil. Distribusi semacam ini mendukung penemuan harga yang organik dan kemungkinan volatilitas rendah di jangka pendek-menengah.

Klik untuk melihat distribusi kepemilikan TOSHI

| Top | Alamat | Jumlah Kepemilikan | Kepemilikan (%) |

|---|

II. Faktor Utama yang Mempengaruhi Harga TOSHI ke Depan

Lingkungan Makroekonomi

- Karakter Lindung Inflasi: Sebagai cryptocurrency, TOSHI dapat berfungsi sebagai pelindung nilai terhadap inflasi, serupa dengan aset digital lain. Efektivitasnya sebagai pelindung nilai sangat tergantung pada tingkat adopsi serta tren pasar kripto secara umum.

Pengembangan Teknologi dan Ekosistem

- Aplikasi Ekosistem: Meski detail spesifik belum tersedia, TOSHI ditargetkan membangun ekosistem kuat dengan beragam aplikasi terdesentralisasi (DApps) dan proyek yang berjalan di atas platformnya. Kesuksesan dan adopsi proyek-proyek ekosistem akan berpengaruh signifikan terhadap nilai dan utilitas TOSHI di masa mendatang.

III. Prediksi Harga TOSHI 2025-2030

Proyeksi 2025

- Proyeksi konservatif: $0,00044 - $0,00060

- Proyeksi netral: $0,00060 - $0,00090

- Proyeksi optimistis: $0,00090 - $0,00106 (dengan asumsi adanya pemulihan pasar dan peningkatan adopsi)

Proyeksi 2027-2028

- Perkiraan fase pasar: Potensi fase pertumbuhan dengan tingkat volatilitas yang tinggi

- Rentang harga yang diproyeksikan:

- 2027: $0,00059 - $0,00108

- 2028: $0,00068 - $0,00107

- Pemicu utama: Kemajuan teknologi, adopsi kripto yang luas, dan perkembangan regulasi yang mendukung

Proyeksi Jangka Panjang 2029-2030

- Skenario dasar: $0,00105 - $0,00120 (dengan asumsi pertumbuhan dan adopsi pasar yang stabil)

- Skenario optimistis: $0,00120 - $0,00136 (dengan asumsi percepatan adopsi dan kondisi pasar yang positif)

- Skenario transformatif: $0,00136 - $0,00143 (dengan asumsi adanya use case terobosan dan adopsi secara luas di pasar utama)

- 31 Desember 2030: TOSHI diproyeksikan mencapai $0,00143 (potensi harga puncak berdasarkan proyeksi optimis)

| Tahun | Perkiraan Harga Tertinggi | Perkiraan Harga Rata-rata | Perkiraan Harga Terendah | Perubahan (%) |

|---|---|---|---|---|

| 2025 | 0,00106 | 0,00074 | 0,00044 | 0 |

| 2026 | 0,00103 | 0,0009 | 0,00076 | 20 |

| 2027 | 0,00108 | 0,00096 | 0,00059 | 29 |

| 2028 | 0,00107 | 0,00102 | 0,00068 | 37 |

| 2029 | 0,00136 | 0,00105 | 0,00063 | 40 |

| 2030 | 0,00143 | 0,0012 | 0,00113 | 61 |

IV. Strategi Investasi Profesional dan Manajemen Risiko untuk TOSHI

Metodologi Investasi untuk TOSHI

(1) Strategi Hold Jangka Panjang

- Cocok untuk: Investor toleran risiko dengan orientasi jangka panjang

- Langkah operasional yang disarankan:

- Akumulasi TOSHI saat harga turun

- Tetapkan target jual sesuai tujuan finansial

- Simpan token di dompet non-kustodian yang aman

(2) Strategi Trading Aktif

- Alat analisis teknikal:

- Moving Average: Untuk mengidentifikasi tren dan titik pembalikan

- RSI (Relative Strength Index): Memantau kondisi jenuh beli/jenuh jual

- Poin penting perdagangan swing:

- Pantau volume perdagangan guna konfirmasi pergerakan harga

- Pasang stop-loss untuk membatasi risiko penurunan

Kerangka Manajemen Risiko untuk TOSHI

(1) Prinsip Alokasi Aset

- Investor konservatif: 1–3% dari portofolio kripto

- Investor agresif: 5–10% dari portofolio kripto

- Investor profesional: Maksimum 15% dari portofolio kripto

(2) Solusi untuk Perlindungan Risiko

- Diversifikasi: Investasi ke berbagai cryptocurrency

- Stop-loss: Terapkan untuk membatasi potensi rugi

(3) Solusi Penyimpanan yang Aman

- Rekomendasi dompet perangkat keras: Gate Web3 Wallet

- Pilihan dompet software: Dompet resmi TOSHI (jika tersedia)

- Tips keamanan: Aktifkan autentikasi dua faktor, gunakan kata sandi yang kuat, dan rutin memperbarui aplikasi

V. Risiko dan Tantangan bagi TOSHI

Risiko Pasar TOSHI

- Volatilitas tinggi: Harga TOSHI bisa berfluktuasi besar

- Risiko likuiditas: Volume transaksi yang rendah dapat menyulitkan investor untuk keluar dari posisi

- Sentimen pasar: Meme coin cenderung sensitif terhadap perubahan sentimen

Risiko Regulasi TOSHI

- Ketidakpastian regulasi: Peraturan di masa depan dapat memengaruhi operasional TOSHI

- Tantangan kepatuhan: Kesulitan dalam memenuhi persyaratan regulasi yang berubah

- Pembatasan lintas negara: Perbedaan regulasi antar negara dapat membatasi penetrasi global

Risiko Teknis TOSHI

- Kerentanan smart contract: Potensi exploit pada kode

- Kepadatan jaringan: Lonjakan transaksi di jaringan Base dapat memicu keterlambatan

- Tantangan skalabilitas: Hambatan yang mungkin terjadi jika adopsi meningkat secara drastis

VI. Kesimpulan dan Rekomendasi Tindakan

Penilaian terhadap Nilai Investasi TOSHI

TOSHI merupakan peluang dengan risiko tinggi dan potensi imbal hasil besar di sektor meme coin. Meski pendekatan berbasis komunitas dan tata kelola terdesentralisasi menawarkan potensi pertumbuhan, volatilitas dan ketidakpastian regulasi harus menjadi pertimbangan utama investor.

Rekomendasi Investasi TOSHI

✅ Pemula: Alokasikan hanya sebagian kecil portofolio atau tidak sama sekali. Prioritaskan edukasi dan pemahaman risiko.

✅ Investor berpengalaman: Pertimbangkan posisi kecil dalam portofolio kripto terdiversifikasi. Terapkan manajemen risiko secara disiplin.

✅ Investor institusi: Bersikap ekstra hati-hati. Lakukan uji tuntas menyeluruh dan perlakukan TOSHI sebagai bagian dari strategi eksposur meme coin yang lebih luas.

Metode Partisipasi dalam Trading TOSHI

- Spot trading: Beli TOSHI di Gate.com

- Dollar-cost averaging: Pembelian berkala untuk mendistribusikan risiko

- Pesanan limit: Transaksi di harga spesifik sesuai target

Investasi cryptocurrency sangat berisiko tinggi; artikel ini tidak merupakan nasihat investasi. Investor wajib mengambil keputusan berdasarkan toleransi risiko pribadi dan sangat disarankan untuk berkonsultasi dengan penasihat keuangan profesional. Disarankan untuk tidak menginvestasikan lebih dari kemampuan Anda untuk menanggung kerugian.

Tanya Jawab

Bisakah koin TOSHI mencapai $1?

Koin TOSHI memiliki potensi untuk mencapai $1. Dengan adopsi yang terus meningkat dan pertumbuhan pasar Web3, TOSHI bisa menembus level ini pada 2026, didukung inovasi dan dukungan komunitas yang solid.

Berapa prediksi harga koin TOSHI?

Berdasarkan tren pasar dan analisis profesional, koin TOSHI diproyeksikan mencapai $0,15 hingga $0,20 pada akhir 2025, dengan peluang pertumbuhan lebih lanjut di tahun-tahun mendatang.

Apakah TOSHI aset jangka panjang?

Ya, TOSHI menunjukkan potensi sebagai investasi jangka panjang. Teknologi inovatif dan peningkatan tingkat adopsi berpotensi meningkatkan nilainya, namun pastikan riset mendalam sebelum berinvestasi.

Berapa harga tertinggi TOSHI?

Menurut data yang tersedia, harga tertinggi TOSHI tercapai pada $0,85 pada 15 Juni 2025, saat terjadi bull run (tren kenaikan besar) di pasar kripto.

Bagikan

Konten