2025 年 NCT 价格预测:深度解析 Nature Carbon Token 的市场趋势与发展前景

前言:NCT 的市场地位与投资价值

PolySwarm(NCT)作为去中心化威胁情报市场,自 2018 年成立以来持续发展壮大。截至 2025 年,PolySwarm 市值达到 37,879,710 美元,流通量约为 1,885,500,781 枚,当前价格维持在 0.02009 美元上下。该资产被誉为“网络威胁防御者”,在网络安全与威胁情报领域发挥着日益关键的作用。

本文将系统分析 NCT 2025 至 2030 年的价格趋势,结合历史走势、市场供需、生态系统演进和宏观经济环境,为投资者呈现专业的价格预测与实用的投资策略。

一、NCT 价格历史回顾与当前市场概况

NCT 历史价格演变

- 2020 年:历史最低价 0.00059593 美元(4 月 26 日)

- 2022 年:历史最高价 0.171845 美元(1 月 14 日)

- 2025 年:当前价 0.02009 美元,较历史低点大幅回升

NCT 当前市场状况

截至 2025 年 10 月 1 日,NCT 报价 0.02009 美元,24 小时成交量为 12,421.80827 美元。近 24 小时跌幅为 0.49%,市值达到 37,879,710.70 美元,排名全球加密货币第 805 位。

该代币在不同周期表现不一:过去一小时上涨 0.4%,过去一周下跌 2.90%;近 30 天上涨 1.16%,过去一年涨幅达 32.43%。

当前价格远高于历史最低,但距离历史最高仍有差距。NCT 流通量为 1,885,500,781.9581056 枚,占总量 1,885,913,076 枚的 99.97%。

点击查看当前 NCT 市场价格

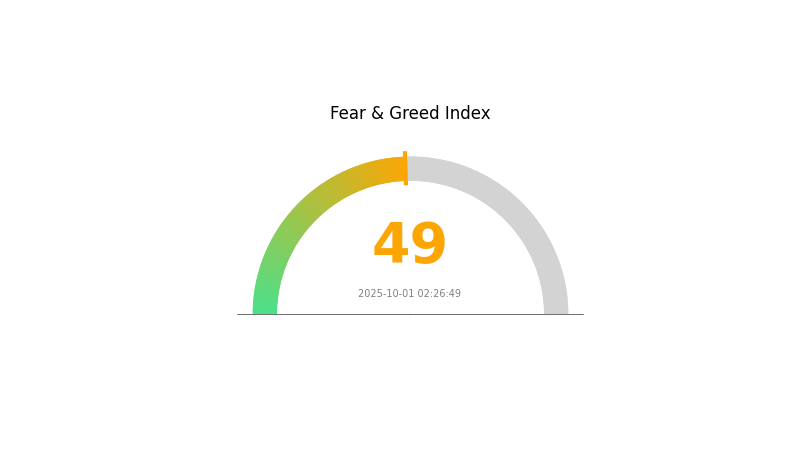

NCT 市场情绪指标

2025-10-01 恐惧与贪婪指数:49(中性)

点击查看当前 恐惧与贪婪指数

2025 年 10 月,加密市场情绪处于中性,恐惧与贪婪指数为 49。当前投资者心态既不偏向恐慌,也未过度贪婪,谨慎与乐观并存。中性情绪常是市场大幅波动前的信号,交易者需密切关注,Gate.com 提供全面工具助力用户应对复杂行情。

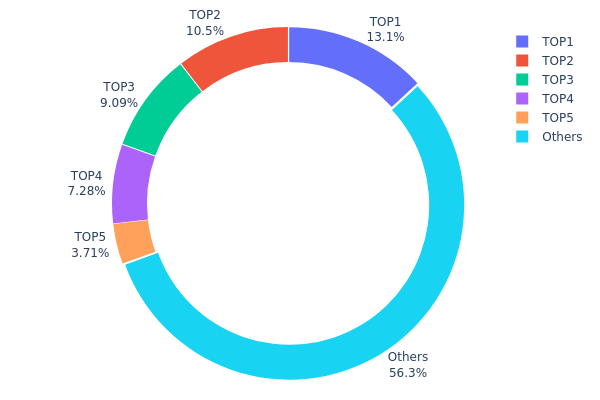

NCT 持仓分布

NCT 持币地址数据显示,整体持有较为集中。前五大地址合计持有 43.63% 总供应量,其中最大持者占 13.10%。这种集中度使主要持有者对市场影响显著。

虽然未极度中心化,但大户如若大额操作,价格易产生波动。其余地址合计持有 56.37%,为市场带来一定平衡,但仍需警惕大额地址异动。投资者应密切监控大户动向,理性制定交易策略。

点击查看当前 NCT 持仓分布

| 排名 | 地址 | 持币数量 | 持币比例 |

|---|---|---|---|

| 1 | 0xc034...f4ee91 | 247193.99K | 13.10% |

| 2 | 0x7510...17b882 | 197323.28K | 10.46% |

| 3 | 0x49d1...50f2bf | 171504.81K | 9.09% |

| 4 | 0xd4c2...45e169 | 137275.04K | 7.27% |

| 5 | 0xe4f4...358388 | 70013.46K | 3.71% |

| - | 其他 | 1062602.50K | 56.37% |

二、影响 NCT 未来价格的核心要素

供应机制

- 市场需求:NCT 价格随市场需求波动。

- 当前影响:供应变化预期直接影响价格。

宏观经济环境

- 抗通胀属性:通胀环境下表现会影响 NCT 价格。

- 地缘政治因素:国际局势亦会左右价格走向。

技术发展与生态建设

- 生态应用:DApp 及生态项目落地将推动 NCT 未来价格。

三、NCT 2025-2030 年价格预测

2025 年展望

- 保守预测:0.01889 - 0.0201 美元

- 中性预测:0.0201 - 0.02211 美元

- 乐观预测:0.02211 - 0.02412 美元(需市场环境配合)

2027-2028 年展望

- 市场阶段预期:进入增长周期

- 价格区间预测:

- 2027 年:0.01845 - 0.0337 美元

- 2028 年:0.0257 - 0.03756 美元

- 关键驱动力:用户规模扩大与技术进步

2029-2030 年长期展望

- 基础情景:0.0329 - 0.03619 美元(假设市场稳定增长)

- 乐观情景:0.03619 - 0.04234 美元(假设市场强劲表现)

- 变革性情景:0.04234 美元以上(技术突破与广泛应用)

- 2030-12-31:NCT 0.03619 美元(年末潜在价位)

| 年份 | 预测最高价 | 预测平均价 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02412 | 0.0201 | 0.01889 | 0 |

| 2026 | 0.02344 | 0.02211 | 0.01592 | 10 |

| 2027 | 0.0337 | 0.02277 | 0.01845 | 13 |

| 2028 | 0.03756 | 0.02824 | 0.0257 | 40 |

| 2029 | 0.03948 | 0.0329 | 0.02467 | 63 |

| 2030 | 0.04234 | 0.03619 | 0.03438 | 80 |

四、NCT 专业投资策略与风险管理

NCT 投资方法论

(1) 长线持有策略

- 适用对象:注重网络安全的长期投资者

- 操作建议:

- 市场回调时分批买入 NCT

- 关注 PolySwarm 在威胁情报领域的技术与应用进展

- 将代币存放在安全硬件 钱包

(2) 主动交易策略

- 技术分析工具:

- 均线:识别趋势及反转区间

- RSI(相对强弱指标):判定超买及超卖信号

- 波段操作要点:

- 严格设置止损位,控制风险

- 关键阻力位分批止盈

NCT 风险管理框架

(1) 资产配置原则

- 保守型:1-3%

- 激进型:5-10%

- 专业型:10-15%

(2) 风险对冲措施

- 资产分散:多币种与传统资产配置

- 止损机制:及时止损,防止亏损扩大

(3) 安全存储方案

- 硬件钱包推荐:Gate Web3 Wallet

- 冷存储:长期持有建议离线保管

- 安全防护:启用双重验证、强密码并定期升级软件

五、NCT 潜在风险与挑战

NCT 市场风险

- 价格波动剧烈:加密市场本身极易大幅波动

- 竞争加剧:其他威胁情报平台可能分流市场

- 流动性风险:成交量不足时易出现滑点

NCT 合规风险

- 监管不确定:政策变动或影响 NCT 实用性和价值

- 跨境限制:国际法规可能影响 PolySwarm 全球布局

- 合规挑战:需持续满足网络安全行业监管要求

NCT 技术风险

- 智能合约安全隐患:以太坊合约可能存在漏洞

- 扩展性瓶颈:以太坊网络拥堵可能影响 PolySwarm 性能

- 技术迭代风险:AI 与安全技术快速发展或冲击项目竞争力

六、结论与行动建议

NCT 投资价值评估

NCT 在网络安全市场具备长期成长空间,但短期波动和监管不确定性依然存在。其未来表现取决于 PolySwarm 能否巩固去中心化威胁情报平台的领先地位。

NCT 投资建议

✅ 新手:建议小额尝试,并深入学习网络安全行业 ✅ 有经验投资者:适度纳入多元化加密资产组合 ✅ 机构投资者:全面尽调 PolySwarm 技术与市场地位

NCT 参与方式

- 现货交易:在 Gate.com 现货市场买卖 NCT

- 质押参与:如开放质押项目,可获取被动收益

- DeFi 集成:可探索 NCT 相关去中心化金融机会

加密货币投资风险极高,本文不构成投资建议。投资者应结合自身风险承受能力谨慎决策,建议咨询专业财经顾问。切勿投入超过自身承受能力的资金。

常见问题

NCT 加密货币是什么?

NCT 是以太坊平台上的加密货币,流通量为 1,885,500,782 枚,应用于 PolySwarm 网络的威胁检测与网络安全场景。

QNT 到 2030 年会值多少?

综合当前趋势与预测,若跨链技术需求持续增长,QNT 到 2030 年底或将达到 540 美元左右。

Polkadot 能到 200 美元吗?

有可能。结合市场趋势、技术分析和链上数据,Polkadot 价格突破 200 美元具备一定条件,近期市场也显示上涨迹象。

hamster kombat coin 能涨到 1 美元吗?

$HMSTR 具备增长潜力,但涨至 1 美元仍不确定。分析师预计 2025 年有望达到 0.67 美元,冲击 1 美元需持续用户热度、平台扩展和有利市场环境。

加密货币崩盘还是仅仅是一次修正?

Pi to PHP: 当前汇率和转换指南 (2025)

2025 年 KSM 价格预测:深入剖析 Kusama Network 市场走势及未来增长潜力

2025 年 DCR 价格预测:深入剖析 Decred 在市场格局演变中的未来发展潜力

2025 MAG7SSI 价格预测:深入解析市场走势,展望 Magnificent Seven Semiconductor Index 未来估值潜力

2025 年 RVN 价格预测:深度剖析 Ravencoin 市场趋势与潜在增长动力

Griffin AI GAIN 代币漏洞危机剖析

Niza Global NIZA 代币迁移经济升级

降低以太坊Gas费用的有效策略

Banana Game 香蕉疗愈 Meme 游戏生态

ERC20代币与数字钱包使用全攻略