Prévisions du prix CYBER pour 2025 : Analyse des tendances du marché et du potentiel de croissance du token CYBER dans le contexte de l’ère post-réglementation

Introduction : Positionnement de CYBER sur le marché et potentiel d’investissement

Cyber (CYBER), solution Layer 2 destinée aux interactions sociales dans l’environnement Web3, s’est imposé depuis son lancement par d’importants progrès. En 2025, la capitalisation boursière de Cyber atteint 74 439 898 $, avec environ 49 239 250 jetons en circulation et un prix avoisinant 1,5118 $. Surnommé « la couche sociale du Web3 », cet actif prend une place centrale dans la transformation des modes de connexion, de création, de monétisation et de partage de valeur au sein des applications décentralisées.

Ce dossier livre une analyse complète de l’évolution du prix de Cyber de 2025 à 2030, croisant tendances historiques, dynamique de marché, développement de l’écosystème et facteurs macroéconomiques, afin de formuler des prévisions chiffrées et des stratégies d’investissement concrètes pour les investisseurs.

I. Historique du prix de CYBER et situation du marché

Trajectoire historique du prix de CYBER

- 2023 : CYBER a inscrit son record historique à 16 $ le 1 septembre 2023

- 2025 : CYBER a touché son plancher record à 0,882 $ le 7 avril 2025

- 2025 : Dans le cycle actuel, le prix est redescendu de son sommet à 1,5118 $

Situation de marché actuelle de CYBER

Au 28 septembre 2025 à 00h00 (UTC), CYBER s’échange à 1,5118 $, pour une capitalisation de 74 439 898,76 $. Le prix du jeton a reculé de 2,72 % sur 24 heures, avec 370 387,57 $ échangés. L’offre en circulation s’élève à 49 239 250,40 jetons (soit 49,24 % de l’offre totale de 100 000 000). La capitalisation totalement diluée atteint 151 180 000,00 $. Sur un an, CYBER a reculé de 62,029 %. À court terme, sa performance reste contrastée : progression de 1,14 % sur 1 h, mais reculs de 18,86 % sur 7 jours et 22,82 % sur 30 jours.

Cliquez ici pour consulter le cours en temps réel de CYBER

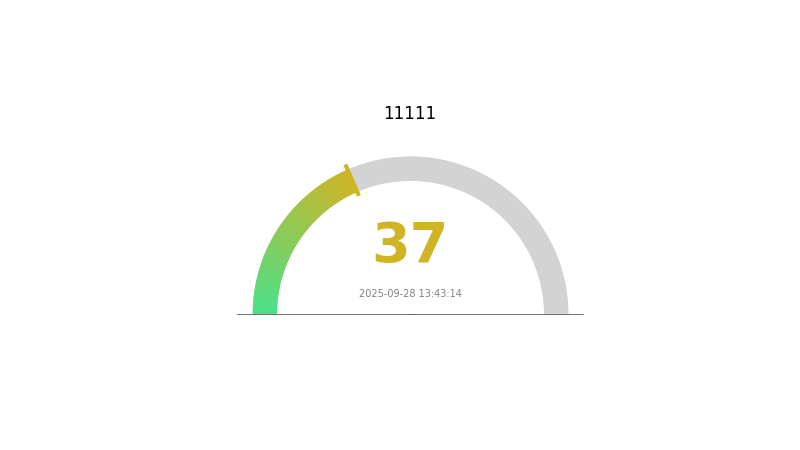

Indicateur de sentiment du marché CYBER

28 septembre 2025 : Indice de peur et de cupidité : 37 (Peur)

Cliquez ici pour consulter l’Indice de peur et de cupidité

Le climat du marché reste prudent : l’indice de peur et de cupidité à 37 traduit une phase d’inquiétude. Les investisseurs privilégient ainsi la prudence face à la volatilité. Ces contextes sont propices aux stratégies contrariennes s’appuyant sur le principe « achetez quand la peur domine, vendez quand la cupidité s’installe ». Il est essentiel d’effectuer vos propres recherches et de bien mesurer votre appétence au risque avant toute opération.

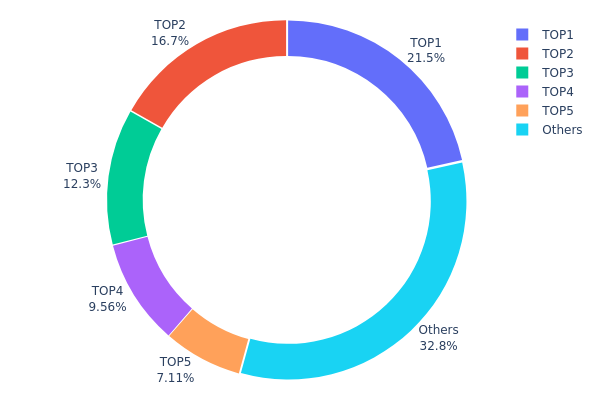

Répartition des avoirs CYBER

L’analyse de la distribution des jetons par adresse fait ressortir une concentration significative de l’offre entre les principaux portefeuilles. Les 5 premières adresses concentrent au total 67,22 % de l’offre, la première détenant 21,51 % à elle seule.

Ce degré de concentration peut soulever des risques de manipulation de marché ou d’une volatilité exacerbée. D’importants transferts ou ventes par ces adresses pourraient générer des variations prononcées. Ce schéma réduit le niveau de décentralisation de l’écosystème, quelques acteurs possédant un fort pouvoir de marché.

Cependant, 32,78 % des jetons restent répartis entre d’autres portefeuilles, signe d’une certaine ouverture. La tendance dominante incite toutefois à davantage de diversification. Cela permettrait de renforcer la stabilité du marché et limiter la concentration du pouvoir.

Cliquez ici pour visualiser la répartition actuelle des avoirs CYBER

| Top | Adresse | Quantité détenue | Part détenue (%) |

|---|---|---|---|

| 1 | 0xe1d9...5b46b1 | 21 514,08K | 21,51 % |

| 2 | 0xc0af...5922c9 | 16 746,67K | 16,74 % |

| 3 | 0x3d2f...708210 | 12 300,00K | 12,30 % |

| 4 | 0xb360...fb55f6 | 9 560,93K | 9,56 % |

| 5 | 0xf977...41acec | 7 113,54K | 7,11 % |

| - | Autres | 32 764,78K | 32,78 % |

II. Facteurs déterminants pour l’évolution future du prix de CYBER

Mécanismes d’offre

- Déblocage de jetons : Le prochain déblocage de jetons CYBER augmentera l’offre, pouvant provoquer une correction du prix.

- Comportement historique : Ces phases s’accompagnent généralement d’une pression vendeuse accrue et d’une dépréciation temporaire.

- Impact à court terme : L’arrivée de 1,26 million de jetons sur le marché pourrait générer une volatilité marquée.

Dynamique institutionnelle et grands porteurs

- Adoption entreprise : CyberConnect, à l’origine de CYBER, confirme sa stature sur le segment des graphes sociaux décentralisés.

Contexte macroéconomique

- Pression réglementaire : Tout changement du cadre légal par la SEC, la CFTC, etc., peut accroître la volatilité sectorielle.

Développement technique & expansion de l’écosystème

- Fonction de gouvernance : Les détenteurs de CYBER participent aux votes sur l’avenir du protocole CyberConnect.

- Utilités écosystémiques : Paiement des frais, développement et animation communautaire au sein du réseau CyberConnect.

III. Projections de cours CYBER : 2025-2030

Prévision 2025

- Scénario prudent : 1,04 $ – 1,51 $

- Scénario central : 1,51 $ – 1,75 $

- Scénario optimiste : 1,75 $ – 1,98 $ (sous réserve d’un contexte porteur)

Prévisions 2027-2028

- Phase anticipée : possible expansion du marché

- Fourchettes attendues :

- 2027 : 1,69 $ – 2,48 $

- 2028 : 1,98 $ – 3,09 $

- Moteurs : Adoptions croissantes et innovations techniques

Horizon 2030

- Scénario de base : 1,91 $ – 3,04 $ (si croissance régulière)

- Scénario optimiste : 3,04 $ – 4,53 $ (en cas d’accélération écosystémique)

- Scénario transformationnel : au-delà de 4,53 $ (en situation d’adoption généralisée)

- 31 décembre 2030 : CYBER 3,04 $ (prix moyen envisagé)

| Année | Prix max. prévision | Prix moyen prévision | Prix min. prévision | Variation (%) |

|---|---|---|---|---|

| 2025 | 1,98111 | 1,5123 | 1,04349 | 0 |

| 2026 | 1,81657 | 1,74671 | 1,46723 | 15 |

| 2027 | 2,47648 | 1,78164 | 1,69256 | 17 |

| 2028 | 3,08714 | 2,12906 | 1,98003 | 40 |

| 2029 | 3,46877 | 2,6081 | 1,5127 | 72 |

| 2030 | 4,52727 | 3,03844 | 1,91421 | 100 |

IV. Stratégies professionnelles et gestion du risque pour CYBER

Méthodologie d’investissement CYBER

(1) Stratégie de conservation longue durée

- Profil : investisseurs long terme, à forte tolérance au risque

- Conseils :

- Accumuler lors des phases de repli

- Fixer des objectifs de prix et procéder à des rééquilibrages réguliers

- Sécuriser via un portefeuille matériel

(2) Stratégie de trading actif

- Outils d’analyse technique :

- Moyennes mobiles : repérer les tendances et les signaux d’entrée/sortie

- RSI : identifier les zones de surachat/survente

- Recommandations pour le trading dynamique :

- Surveiller sentiment réseaux sociaux et actualités du projet

- Paramétrer des ordres stop-loss pour limiter l’exposition baissière

Gestion des risques pour CYBER

(1) Règles d’allocation d’actifs

- Investisseurs prudents : 1-3 % du portefeuille cryptomonnaies

- Investisseurs dynamiques : 5-10 %

- Professionnels : jusqu’à 15 %

(2) Options de couverture

- Diversification sur d’autres jetons L2 et jetons de réseaux sociaux

- Options de vente pour se prémunir des baisses

(3) Solutions de stockage sécurisé

- Portefeuille chaud : Gate Web3 Wallet

- Portefeuille froid : portefeuilles matériels pour les réserves

- Sécurité : authentification à deux facteurs, mots de passe forts

V. Risques et défis pour CYBER

Risques de marché

- Volatilité élevée : fluctuations majeures des prix

- Concurrence d’autres jetons L2 et jetons de réseaux sociaux

- Risque de liquidité : volume d’échange limité

Risques réglementaires

- Environnement réglementaire incertain : contrôle accru possible sur les solutions L2

- Réglementations transfrontalières divergentes

- Risques de classification du jeton comme valeur mobilière

Risques techniques

- Failles potentielles des smart contracts

- Problèmes de scalabilité : congestion possible

- Enjeux d’interopérabilité avec d’autres blockchains

VI. Conclusion et recommandations

Évaluation du potentiel d’investissement CYBER

CYBER se démarque sur le segment L2 social par ses perspectives de croissance long terme, malgré une forte volatilité à court terme et un contexte réglementaire incertain.

Recommandations d’investissement CYBER

- Débutants : privilégier de faibles investissements et s’informer sur la technologie L2

- Investisseurs avertis : envisager l’investissement progressif (« DCA ») et définir clairement ses sorties

- Institutionnels : mener une « due diligence » complète et envisager les solutions OTC

Modes de participation au marché CYBER

- Spot trading : achat/conservation sur plateformes d’échange de référence

- Staking : participation aux programmes de staking (si disponibles)

- DeFi : explorer le yield farming avec le jeton CYBER

L’investissement en cryptomonnaies comporte des risques élevés : cet article n’est pas un conseil financier. Les décisions doivent être prises en fonction de sa propre tolérance au risque, et il est recommandé de consulter un professionnel. N’investissez jamais plus que ce que vous pouvez perdre.

FAQ

Quelle est la prévision de prix pour CYBER ?

CYBER devrait s’échanger entre 1,05 $ et 4,17 $ à l’horizon 2030, soit un potentiel de hausse de 172,71 % si la borne supérieure est atteinte.

Quelle est la prévision pour le boom des cryptomonnaies en 2025 ?

Des hausses notables sont attendues pour les grandes cryptomonnaies comme Bitcoin et Ethereum. L’ensemble du marché affiche une dynamique haussière robuste selon les tendances récentes.

Quelle cryptomonnaie présente le potentiel de hausse le plus élevé ?

Bitcoin (BTC) conserve les plus fortes perspectives pour 2025-2030, suivi d’Ethereum (ETH), selon les prévisions actuelles du marché.

Quel est le prix actuel de CYBER ?

Au 28 septembre 2025, le prix de CYBER est de 1,52 $, soit une légère baisse de 0,65 % sur 24 heures.

Partager

Contenu