Previsão do Preço do STETH em 2025: Análise das Tendências de Mercado e das Projeções de Especialistas para o Lido Staked Ethereum

Introdução: Posição de Mercado e Valor de Investimento do STETH

O Lido Staked Ether (STETH), reconhecido como a principal solução de staking líquido para Ethereum 2.0, tem registado um crescimento expressivo desde a sua criação. Em 2025, a capitalização bolsista do STETH atingiu 35 027 701 746 $, com uma oferta circulante de cerca de 8 493 211 tokens e um preço em torno dos 4 124,2 $. Este ativo, frequentemente designado "liquid staked ETH", assume um papel cada vez mais relevante na finança descentralizada (DeFi) e no staking de Ethereum.

Neste artigo, analisamos detalhadamente as tendências de preço do STETH entre 2025 e 2030, considerando padrões históricos, dinâmica de oferta e procura, desenvolvimento do ecossistema e fatores macroeconómicos, para apresentar previsões profissionais de preço e estratégias de investimento orientadas aos investidores.

I. Revisão Histórica do Preço do STETH e Situação Atual de Mercado

Evolução Histórica do Preço do STETH

- 2020: Lançamento da plataforma de staking Lido, preço inicial do STETH de 482,9 $

- 2022: Conclusão do merge da rede Ethereum, preço do STETH superou 1 500 $

- 2025: Máximo do ciclo de mercado, STETH atingiu recorde de 4 932,89 $ em 25 de agosto

Situação Atual de Mercado do STETH

A 15 de outubro de 2025, o STETH é negociado a 4 124,2 $, ocupando a 9.ª posição em capitalização de mercado. O token registou uma descida de 1,15% nas últimas 24 horas, com um volume transacionado de 69 804,38707 STETH. A capitalização bolsista atual é de 35 027 701 746 $, representando 0,85% do mercado global de criptoativos.

O desempenho do STETH tem sido heterogéneo consoante o horizonte temporal. Cresceu 0,84% na última hora, mas recuou 7,95% na última semana e 10,41% nos últimos 30 dias. No entanto, o token apresenta uma valorização robusta no longo prazo, com um aumento de 57,43% no último ano.

O token negoceia atualmente com um desconto de 16,39% face ao máximo histórico de 4 932,89 $ registado a 25 de agosto de 2025. Apesar de correções recentes no curto prazo, o STETH mantém-se muito acima do seu mínimo histórico de 482,9 $ registado em 22 de dezembro de 2020.

Clique para consultar o preço de mercado atual do STETH

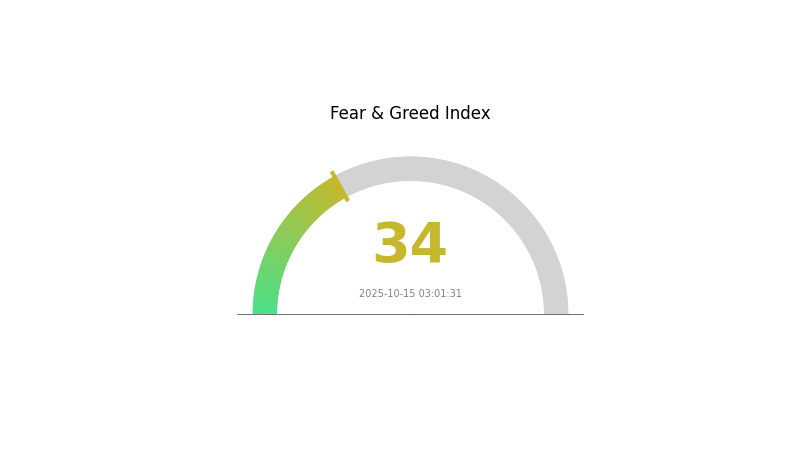

Indicador de Sentimento de Mercado do STETH

2025-10-15 Índice de Medo e Ganância: 34 (Medo)

Clique para consultar o Índice de Medo & Ganância do momento

O sentimento do mercado cripto inclina-se atualmente para o medo, com o Índice de Medo e Ganância nos 34. Isto revela que os investidores permanecem cautelosos e incertos face ao contexto de mercado. Fases de medo podem criar oportunidades de entrada para investidores de longo prazo, pois os ativos tendem a estar subavaliados. No entanto, é fundamental realizar uma análise aprofundada e ponderar o seu perfil de risco antes de investir. Acompanhe as tendências e mantenha-se informado para gerir eficazmente estes períodos de incerteza.

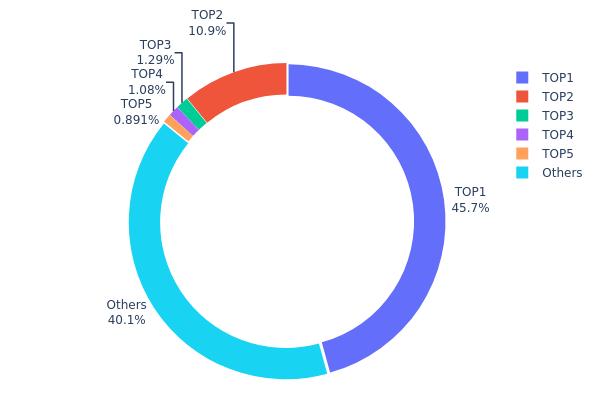

Distribuição das Detenções de STETH

Os dados sobre distribuição de endereços mostram uma forte concentração na titularidade do STETH. O principal endereço detém 45,73% do total, enquanto o segundo maior controla 10,88%. Esta concentração nos dois primeiros endereços, que juntos representam mais de 56% do total de STETH, sinaliza uma estrutura potencialmente centralizada.

Tal concentração suscita preocupações quanto à estabilidade do mercado e à possibilidade de manipulação de preços. Com poucos endereços a concentrarem a maior parte dos tokens, aumenta o risco de grandes vendas ou ações coordenadas com impacto significativo no preço e liquidez do STETH. Os cinco maiores endereços concentram, no total, quase 60% da oferta, restando apenas cerca de 40% dispersos entre outros titulares.

Este padrão de distribuição revela um grau de descentralização relativamente baixo no STETH, o que pode afetar a sua resiliência a choques de mercado e a estabilidade estrutural on-chain. Embora alguma concentração seja frequente em diversos criptoativos, a assimetria extrema no caso do STETH exige monitorização rigorosa pelos participantes e analistas de mercado.

Clique para consultar a Distribuição de Detenções de STETH atual

| Top | Endereço | Qtd Detida | % Detida |

|---|---|---|---|

| 1 | 0x7f39...5e2ca0 | 3 884,48K | 45,73% |

| 2 | 0x93c4...51564d | 924,53K | 10,88% |

| 3 | 0x176f...d0a132 | 109,63K | 1,29% |

| 4 | 0xa92c...0e1f66 | 91,66K | 1,07% |

| 5 | 0x2be0...46d43c | 75,66K | 0,89% |

| - | Outros | 3 407,17K | 40,14% |

II. Fatores-Chave que Influenciam o Preço Futuro do STETH

Mecanismo de Oferta

- Staking e Unstaking: A oferta de STETH está intimamente ligada ao volume de ETH em staking via Lido. Maior volume em staking corresponde a mais STETH emitido e vice-versa.

- Padrão Histórico: No passado, o aumento do staking de ETH traduziu-se, regra geral, em estabilidade ou valorização do STETH.

- Impacto Atual: A tendência de reforço do staking de ETH continuará a sustentar o valor do STETH.

Dinâmicas Institucionais e de Grandes Detentores

- Posições Institucionais: Grandes instituições, como o fundo ETHA da BlackRock, detêm volumes relevantes de ETH, podendo influenciar indiretamente o STETH.

- Adoção Corporativa: Empresas como a JPMorgan exploram projetos baseados em Ethereum, validando o valor do ecossistema.

- Políticas Nacionais: A eventual inclusão de criptoativos em planos de reforma 401(k) pode impulsionar fortemente a procura de ETH e STETH.

Ambiente Macroeconómico

- Impacto da Política Monetária: As políticas dos bancos centrais, especialmente da Reserva Federal, influenciam o apetite ao risco em ativos como o STETH.

- Proteção Contra a Inflação: O STETH, indexado ao ETH, é cada vez mais visto como possível cobertura face à inflação.

- Fatores Geopolíticos: Incertezas económicas globais podem direcionar investidores para ou contra criptoativos, afetando a procura por STETH.

Desenvolvimento Técnico e Crescimento do Ecossistema

- Layer 2 Scaling: O desenvolvimento acelerado de soluções Layer 2 como Arbitrum e Optimism expande a utilidade e capacidade transacional do Ethereum.

- Atualizações EIP: As Ethereum Improvement Proposals (EIP) continuam a reforçar a eficiência e as capacidades da rede.

- Aplicações do Ecossistema: O crescimento do DeFi, dos NFTs e de outras dApps em Ethereum impulsiona a procura global por ETH e STETH.

III. Previsão de Preço do STETH para 2025-2030

Perspetiva para 2025

- Previsão conservadora: 2 965,10 $ – 3 541,65 $

- Previsão neutra: 3 541,65 $ – 4 118,20 $

- Previsão otimista: 4 118,20 $ – 4 488,84 $ (dependente de evolução positiva do ecossistema Ethereum)

Perspetiva para 2027-2028

- Fase de mercado prevista: Potencial ciclo de crescimento impulsionado por adoção crescente

- Intervalos de preço previstos:

- 2027: 4 066,83 $ – 5 783,93 $

- 2028: 4 378,62 $ – 7 572,43 $

- Catalisadores principais: Upgrades na rede Ethereum, aumento do staking

Perspetiva de Longo Prazo para 2030

- Cenário base: 6 390,50 $ – 7 793,29 $ (com crescimento estável do Ethereum)

- Cenário otimista: 7 793,29 $ – 8 494,69 $ (em caso de adoção institucional generalizada)

- Cenário transformador: 8 494,69 $+ (com avanços disruptivos na escalabilidade do Ethereum)

- 2030-12-31: STETH 7 793,29 $ (preço médio potencial)

| Ano | Preço máximo previsto | Preço médio previsto | Preço mínimo previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 4 488,84 | 4 118,20 | 2 965,10 | 0 |

| 2026 | 4 733,87 | 4 303,52 | 4 131,38 | 4 |

| 2027 | 5 783,93 | 4 518,69 | 4 066,83 | 9 |

| 2028 | 7 572,43 | 5 151,31 | 4 378,62 | 24 |

| 2029 | 9 224,71 | 6 361,87 | 4 580,55 | 54 |

| 2030 | 8 494,69 | 7 793,29 | 6 390,50 | 88 |

IV. Estratégias Profissionais de Investimento e Gestão de Risco para STETH

Metodologia de Investimento em STETH

(1) Estratégia de Detenção de Longo Prazo

- Perfil-alvo: Investidores conservadores que procuram retorno estável

- Recomendações práticas:

- Acumular STETH de forma gradual em correções de mercado

- Manter pelo menos durante 1-2 anos para capturar o potencial de crescimento da rede Ethereum

- Armazenar em carteira não custodial segura

(2) Estratégia de Negociação Ativa

- Ferramentas de análise técnica:

- Médias móveis: Utilize médias móveis de 50 e 200 dias para identificar tendências

- RSI: Monitorize situações de sobrecompra e sobrevenda

- Pontos-chave para swing trading:

- Definir stop-loss para limitar eventuais perdas

- Realizar parciais de lucro em subidas expressivas de preço

Estrutura de Gestão de Risco do STETH

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1-3%

- Investidores agressivos: 5-10%

- Investidores profissionais: 10-15%

(2) Soluções de Cobertura de Risco

- Diversificação: Distribuir o investimento por vários criptoativos

- Stop-loss: Implementar para limitar potenciais perdas

(3) Soluções de Armazenamento Seguro

- Hot wallet recomendada: Gate Web3 Wallet

- Armazenamento frio: Carteira hardware para reservas de longo prazo

- Precauções de segurança: Ativar 2FA, utilizar passwords robustas e assegurar atualizações regulares do software

V. Riscos e Desafios Potenciais para o STETH

Riscos de Mercado do STETH

- Volatilidade: O mercado de criptoativos é altamente volátil

- Correlação com ETH: O preço do STETH acompanha de perto o desempenho do Ethereum

- Risco de liquidez: Vendas massivas podem comprometer a estabilidade do preço

Riscos Regulatórios do STETH

- Incerteza regulatória: Mudanças no quadro legal podem afetar o estatuto do STETH

- Regulação do staking: Eventuais restrições a serviços de staking

- Implicações fiscais: Alterações legislativas podem impactar detentores de STETH

Riscos Técnicos do STETH

- Vulnerabilidades de smart contract: Potencial para exploits no protocolo Lido

- Riscos na transição para Ethereum 2.0: Atrasos ou problemas na migração podem afetar o STETH

- Desempenho dos validadores: Eventos de slashing podem prejudicar os retornos do STETH

VI. Conclusão e Recomendações Práticas

Avaliação do Valor de Investimento do STETH

O STETH permite acesso às recompensas de staking do Ethereum com liquidez adicional. O seu potencial de longo prazo está dependente do sucesso da rede Ethereum, embora a volatilidade no curto prazo e os riscos técnicos permaneçam elementos fundamentais a considerar.

Recomendações de Investimento em STETH

✅ Iniciantes: Iniciar com uma exposição reduzida, dar prioridade à aprendizagem e à detenção de longo prazo

✅ Investidores experientes: Optar por uma abordagem equilibrada entre detenção e negociação ativa

✅ Investidores institucionais: Integrar STETH num portefólio cripto diversificado e implementar uma gestão de risco rigorosa

Formas de Participação em STETH

- Negociação spot: Comprar STETH no mercado spot da Gate.com

- Integração DeFi: Utilizar STETH em protocolos DeFi compatíveis para rendimento adicional

- Staking: Converter ETH em STETH através do serviço de staking da Lido

O investimento em criptoativos implica riscos elevados. Este artigo não constitui aconselhamento financeiro. Os investidores devem tomar decisões informadas em função do seu perfil de risco e consultar profissionais qualificados. Nunca invista mais do que aquilo que pode perder.

FAQ

Qual a previsão de preço para criptoativos em 2025?

Prevê-se que o Bitcoin atinja 60 000 $, o Ethereum 4 000 $ e o Solana 100 $ em 2025. Estas projeções apontam para um crescimento expressivo nas principais criptomoedas.

O que é o stETH?

O stETH é um token que representa ETH em staking, permitindo aos utilizadores receber recompensas de staking enquanto o utilizam em DeFi. É emitido pela Lido e pode ser transferido e usado como ETH.

Qual a previsão de preço para XRP em 2030?

Em 2030, estima-se que o XRP possa atingir valores entre 90 $ e 120 $. Esta projeção representa um marco importante para o seu futuro, com base nas tendências atuais do mercado.

Que criptoativo tem a previsão de preço mais elevada?

O Bitcoin (BTC) apresenta a previsão de preço mais alta para 2025, seguido do Ethereum (ETH) e da Solana (SOL).

Previsão do preço da WEETH em 2025: análise das tendências de mercado e do potencial de crescimento no cenário dinâmico da DeFi em constante transformação

Swell Network (SWELL) constitui uma opção de investimento sólida? Avaliação do potencial de retorno e da posição competitiva no ecossistema de staking líquido

Previsão do Preço EIGEN em 2025: Análise das Tendências de Mercado e dos Potenciais Fatores de Crescimento para esta Criptomoeda Emergente

Estaca ETH em 2025: Opções On-Chain e Melhores Plataformas

Análise de Preços Uniswap 2025: Posição no Mercado DeFi e Perspetivas de Investimento a Longo Prazo

Maximize o seu ETH: a Estaca na cadeia da Gate oferece um rendimento anual de 5,82% em 2025.

Dropee Daily Combo 12 de dezembro de 2025

Tomarket Daily Combo 12 de dezembro de 2025

Guia para Participação e Recolha de Recompensas do SEI Airdrop

Estratégias Eficazes para Trading Algorítmico em Criptomoedas

Compreender a Avaliação do Bitcoin através do Modelo Stock-to-Flow