Jokereth

Ainda sem conteúdo

Jokereth

pode ser um fim, ou pode ser o início de algo novo

não importa em que jogo estamos, a verdadeira questão é como garantir que permanecemos nele

Eu realmente não "me saí bem" em nenhuma plataforma InfoFi

mas tirei algo da experiência, e isso é suficiente

provavelmente é hora de voltar a focar em outras coisas..

Ver originalnão importa em que jogo estamos, a verdadeira questão é como garantir que permanecemos nele

Eu realmente não "me saí bem" em nenhuma plataforma InfoFi

mas tirei algo da experiência, e isso é suficiente

provavelmente é hora de voltar a focar em outras coisas..

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Feliz Ano Novo.

2026 vai ser o teu ano, todos vocês!

Mais clareza.

Melhor timing.

Movimentos mais inteligentes.

Seja o que for que estás a construir, aprender ou a preparar-se discretamente, este é o ano em que começa a dar frutos.

Vamos fazer dele um bom ano.

Ver original2026 vai ser o teu ano, todos vocês!

Mais clareza.

Melhor timing.

Movimentos mais inteligentes.

Seja o que for que estás a construir, aprender ou a preparar-se discretamente, este é o ano em que começa a dar frutos.

Vamos fazer dele um bom ano.

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

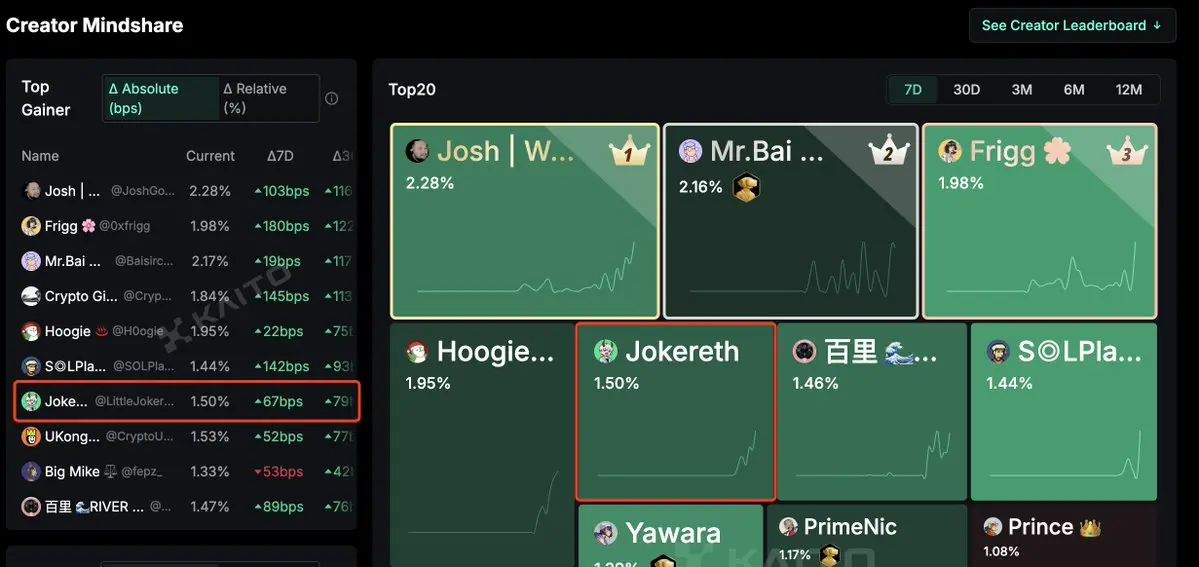

Muito bom ver isto na tabela de classificação do Warden x Kaito, atualmente em #7 (7D) and #16 (30D)

O que é engraçado é que na verdade tenho desacelerado bastante recentemente, apenas publicando sobre @wardenprotocol uma ou duas vezes a cada dois dias, mas de alguma forma a minha participação está a crescer mais rápido do que antes

Não tenho certeza se é o algoritmo a mudar, ou talvez seja só porque nem todos os criadores estão realmente a prestar atenção ao Warden ainda haha

De qualquer forma, tem funcionado

Também tenho que dizer, o meu grande irmão @H0ogie ainda é alguém que admiro quando

Ver originalO que é engraçado é que na verdade tenho desacelerado bastante recentemente, apenas publicando sobre @wardenprotocol uma ou duas vezes a cada dois dias, mas de alguma forma a minha participação está a crescer mais rápido do que antes

Não tenho certeza se é o algoritmo a mudar, ou talvez seja só porque nem todos os criadores estão realmente a prestar atenção ao Warden ainda haha

De qualquer forma, tem funcionado

Também tenho que dizer, o meu grande irmão @H0ogie ainda é alguém que admiro quando

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

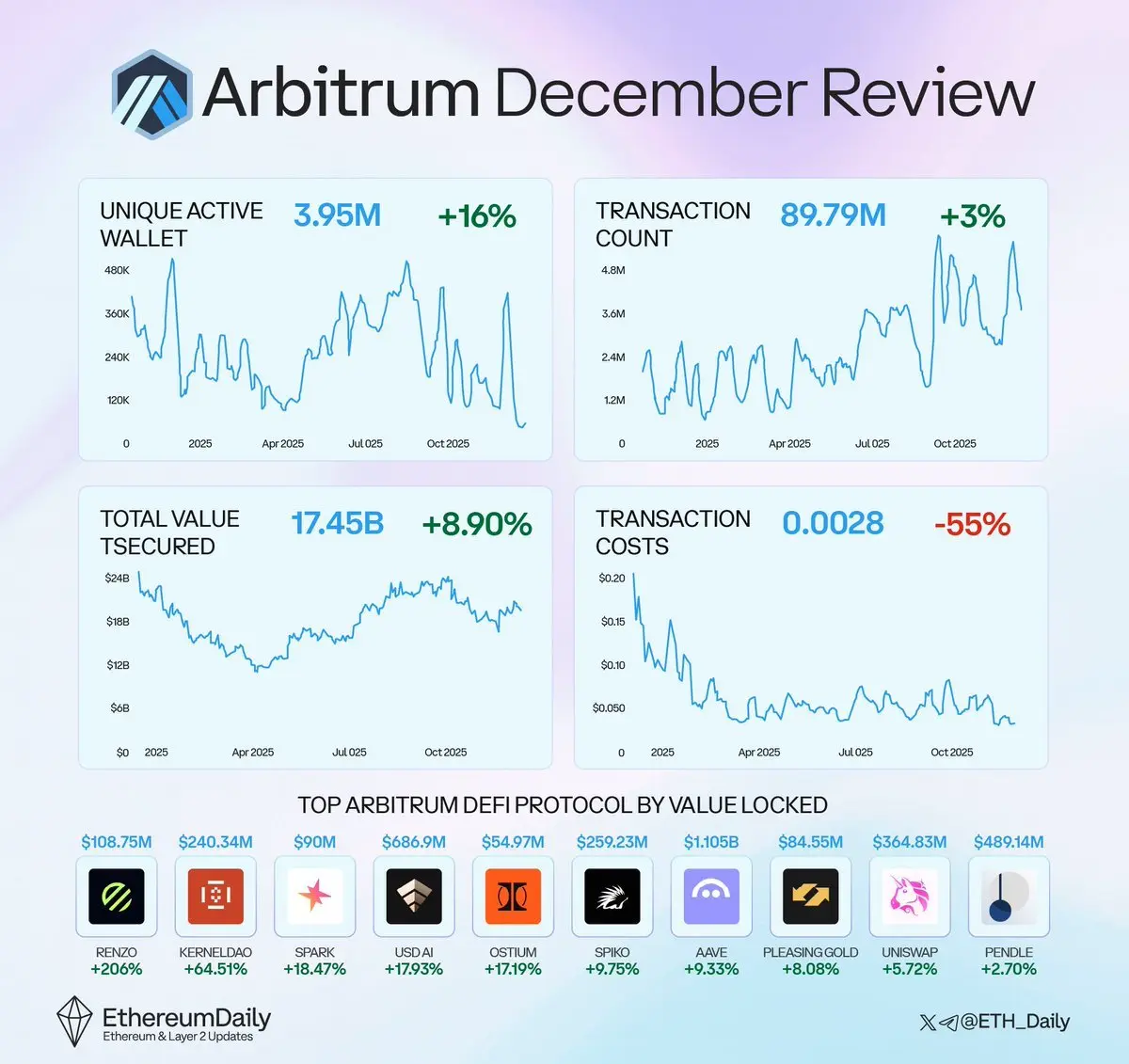

2025 está quase a chegar à estação, e um novo capítulo está prestes a começar

ignorando vibrações, narrativas e preços por um segundo, os dados tendem a ser o sinal mais honesto

Vamos olhar para dezembro, @arbitrum teve um mês silenciosamente forte:

- Carteiras Ativas Únicas - 3.95M (+16%)

- Transações - 89.79M (+3%)

- Valor Total Garantido - $17.45B (+8.9%)

- Custos Médios de Transação - $0.0028 (-55%)

Baixas taxas + Forte segurança + Infraestrutura madura = um volante em funcionamento

> txs mais baratos tornam as pessoas mais dispostas a realmente usar a rede, impulsionando a atividade e o v

Ver originalignorando vibrações, narrativas e preços por um segundo, os dados tendem a ser o sinal mais honesto

Vamos olhar para dezembro, @arbitrum teve um mês silenciosamente forte:

- Carteiras Ativas Únicas - 3.95M (+16%)

- Transações - 89.79M (+3%)

- Valor Total Garantido - $17.45B (+8.9%)

- Custos Médios de Transação - $0.0028 (-55%)

Baixas taxas + Forte segurança + Infraestrutura madura = um volante em funcionamento

> txs mais baratos tornam as pessoas mais dispostas a realmente usar a rede, impulsionando a atividade e o v

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

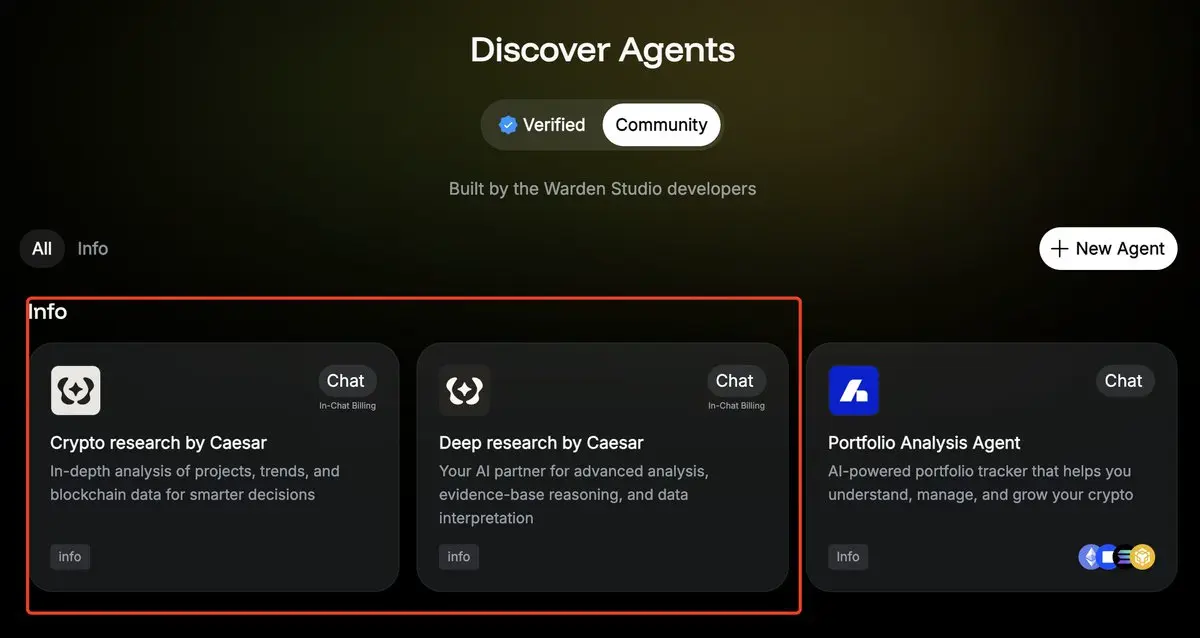

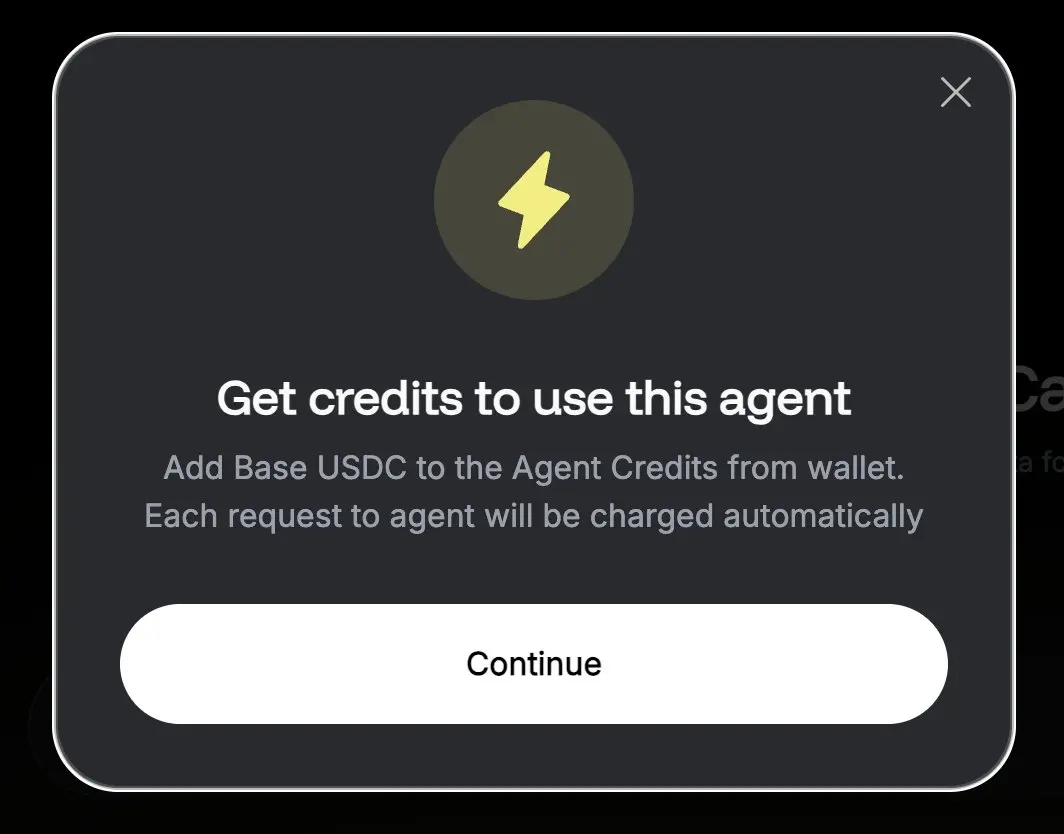

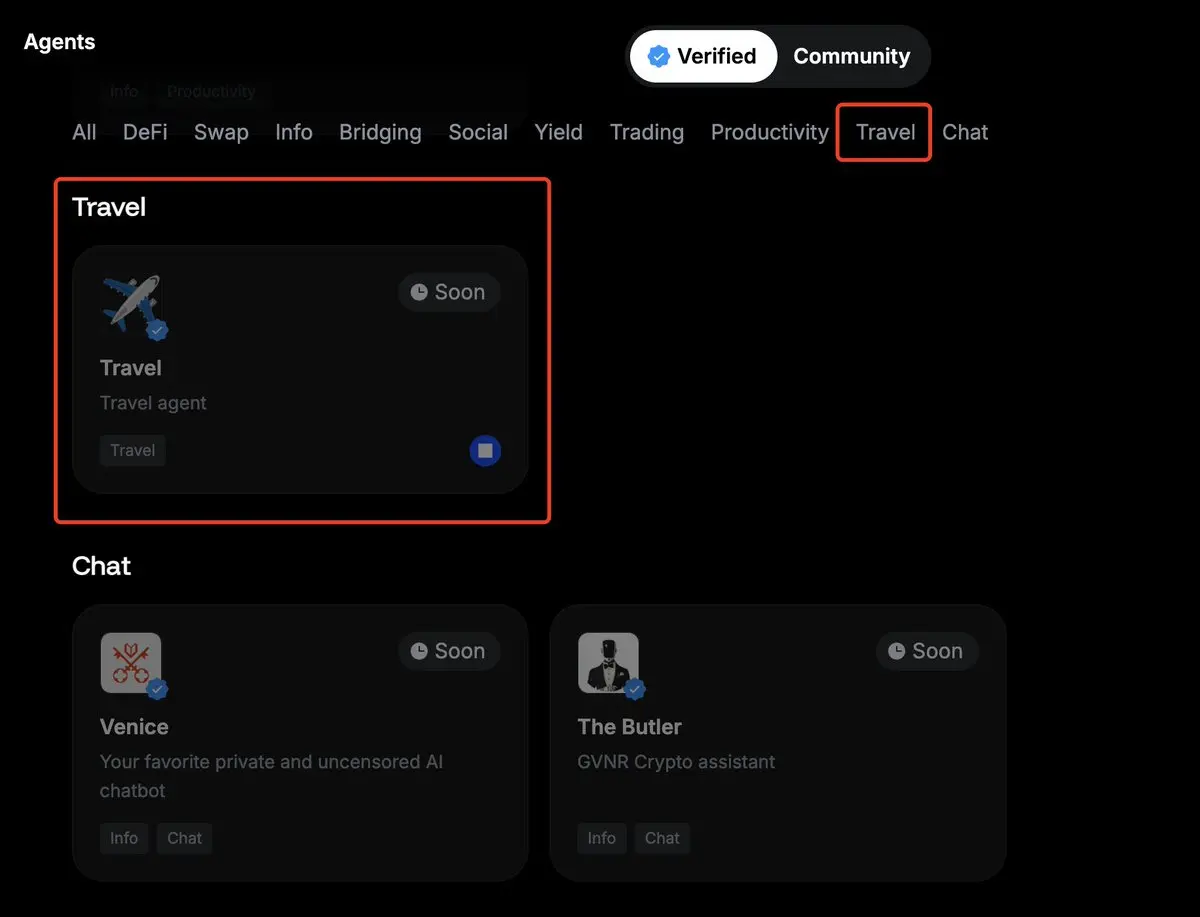

novos agentes de IA criados e implantados por desenvolvedores da comunidade usando Warden Studio já estão ao vivo e utilizáveis?

ainda não tenho ideia de quão profundas são as funcionalidades ou análises(é pago, então sim, não os experimentei pessoalmente lol

mas, para ser honesto, é exatamente por isso que os construtores de agentes deveriam estar de olho no @wardenprotocol

> uma ferramenta poderosa que torna muito mais fácil transformar ideias em produtos reais

> criação e implantação limpas e suaves

> execução, automação e infraestrutura integradas são geridas para você, o que significa que

Ver originalainda não tenho ideia de quão profundas são as funcionalidades ou análises(é pago, então sim, não os experimentei pessoalmente lol

mas, para ser honesto, é exatamente por isso que os construtores de agentes deveriam estar de olho no @wardenprotocol

> uma ferramenta poderosa que torna muito mais fácil transformar ideias em produtos reais

> criação e implantação limpas e suaves

> execução, automação e infraestrutura integradas são geridas para você, o que significa que

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

“Quero começar uma viagem em janeiro de 2026 - orçamento de 10 mil dólares, de 5 a 7 dias - podes planear um roteiro por Paris e reservar os meus voos e hotel?”

é basicamente isso que me passou pela cabeça quando vi este próximo “Agente de Viagens” no @wardenprotocol lol

ainda não tenho ideia de como vai funcionar ou como realmente vai ser a experiência

mas uma coisa está bastante clara, pode realmente facilitar muito as decisões de viagem

sem stress, sem múltiplas abas confusas, sem taxas escondidas, apenas um agente a gerir tudo numa interface/fluxo limpo e organizado

ainda nem foi lançado,

Ver originalé basicamente isso que me passou pela cabeça quando vi este próximo “Agente de Viagens” no @wardenprotocol lol

ainda não tenho ideia de como vai funcionar ou como realmente vai ser a experiência

mas uma coisa está bastante clara, pode realmente facilitar muito as decisões de viagem

sem stress, sem múltiplas abas confusas, sem taxas escondidas, apenas um agente a gerir tudo numa interface/fluxo limpo e organizado

ainda nem foi lançado,

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

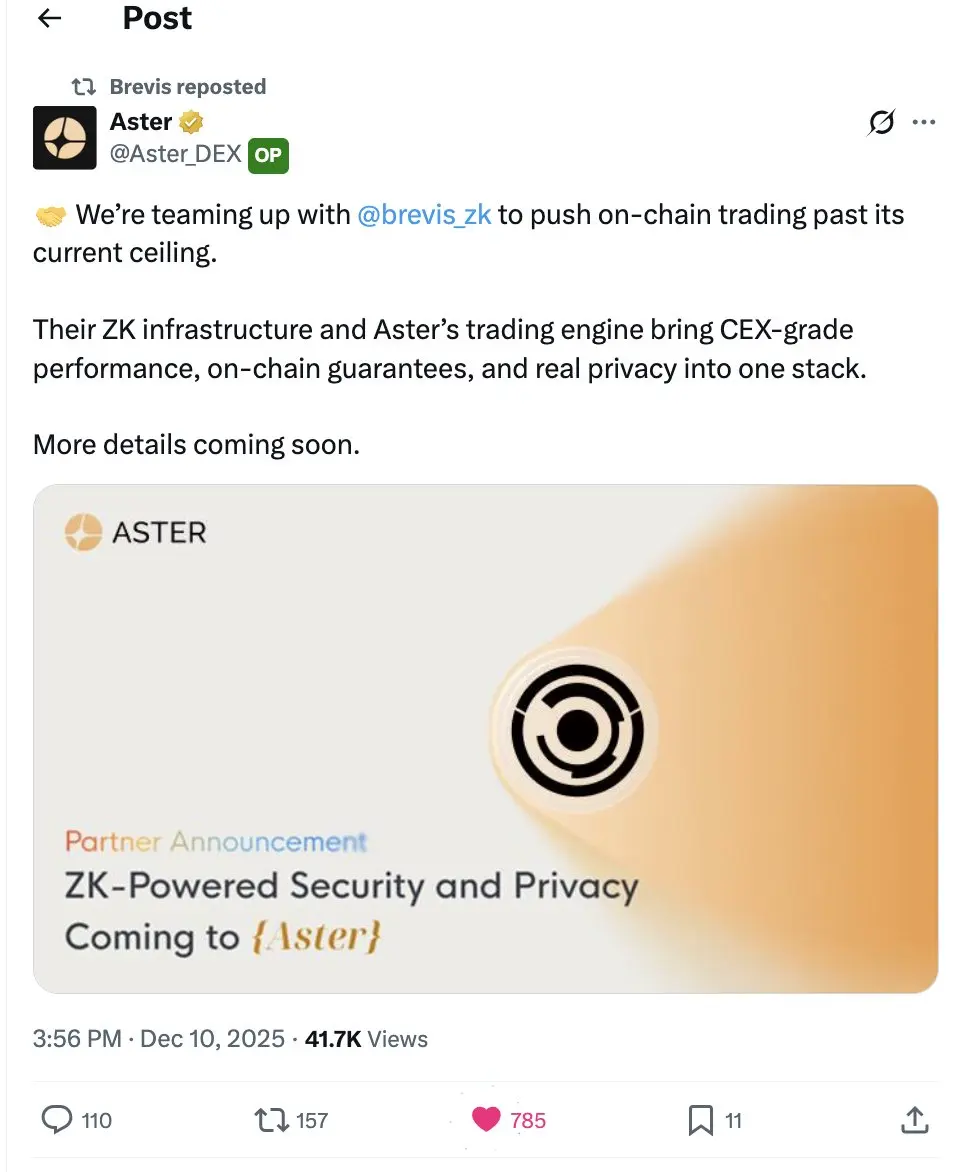

a parceria aqui simplesmente faz sentido, a segurança alimentada por zk tem tantos casos de uso reais, até para negociação na cadeia

resolve um problema muito real: como escalamos a negociação na cadeia sem transformar a UX numa situação de trade-off?

Aster já era sólida como uma DEX, mas com a infra de computação verificável do @brevis_zk?

é meio que como o Trump de repente receber o apoio do Elon lol, tudo simplesmente sobe de nível instantaneamente

velocidade, confiança, desempenho, privacidade - todas as coisas que devíamos ter estão finalmente num só lugar, e não precisamos sacrificar a d

resolve um problema muito real: como escalamos a negociação na cadeia sem transformar a UX numa situação de trade-off?

Aster já era sólida como uma DEX, mas com a infra de computação verificável do @brevis_zk?

é meio que como o Trump de repente receber o apoio do Elon lol, tudo simplesmente sobe de nível instantaneamente

velocidade, confiança, desempenho, privacidade - todas as coisas que devíamos ter estão finalmente num só lugar, e não precisamos sacrificar a d

ASTER-6,7%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

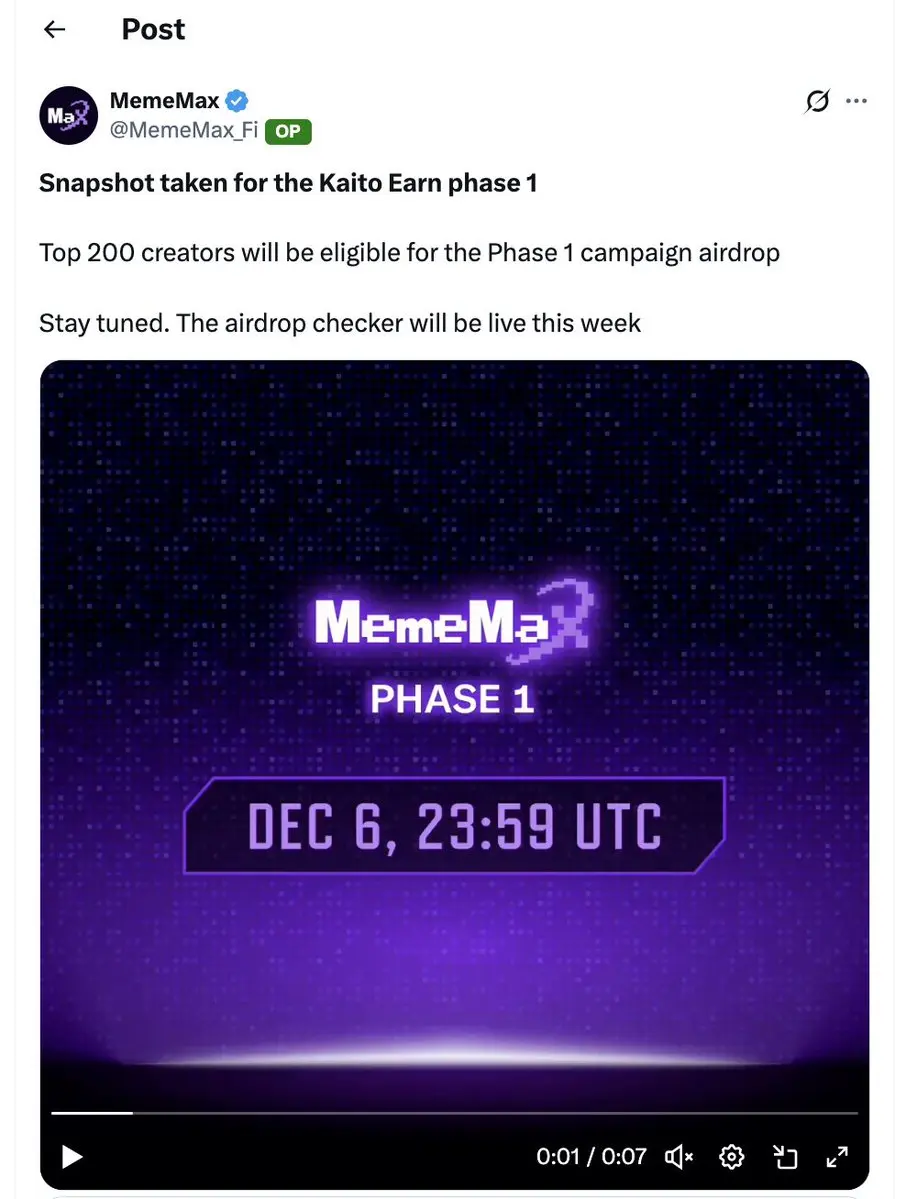

parabéns a todos os que conseguiram

@MemeMax_Fi acabou de tirar o primeiro snapshot para a Fase 1 e o nosso dia da pizza está quase a chegar

ainda não sabemos quando começa a Fase 2 ou se o leaderboard vai ser reiniciado, mas a energia por aqui não se desvanece assim tão facilmente, mantenham-se atentos

aliás, feliz domingo, lendas!!

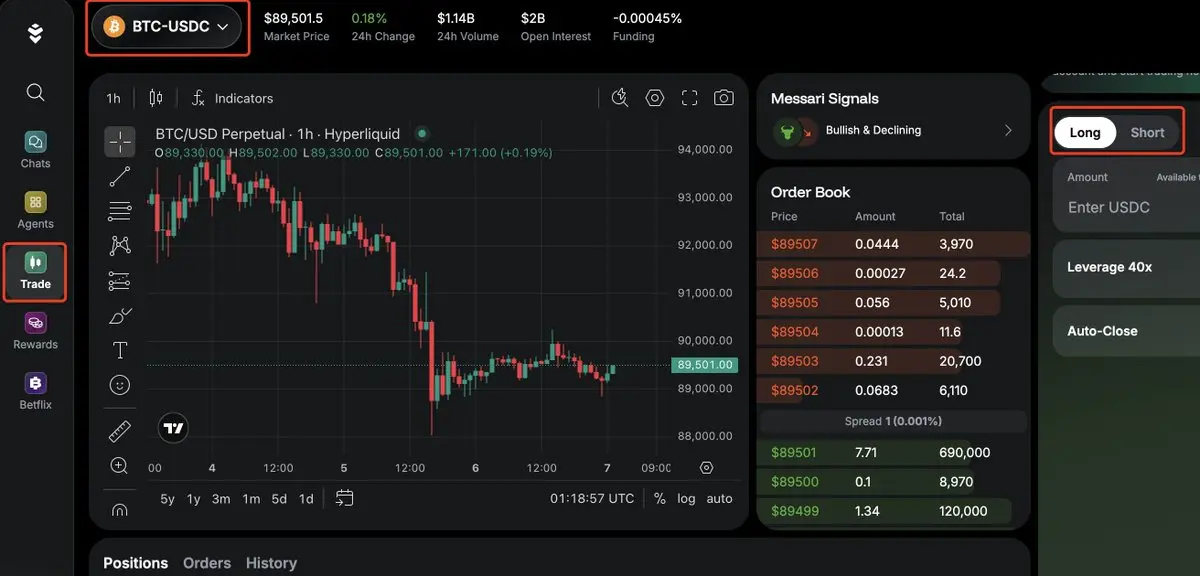

Por aqui não se passa grande coisa, por isso decidi experimentar o novo Terminal de Trading por IA da @wardenprotocol

tenho de dizer, está bastante sólido, interface limpa, processo fluido, e podemos usar insights de IA e alguns sinais inteligentes para nos ajudar

@MemeMax_Fi acabou de tirar o primeiro snapshot para a Fase 1 e o nosso dia da pizza está quase a chegar

ainda não sabemos quando começa a Fase 2 ou se o leaderboard vai ser reiniciado, mas a energia por aqui não se desvanece assim tão facilmente, mantenham-se atentos

aliás, feliz domingo, lendas!!

Por aqui não se passa grande coisa, por isso decidi experimentar o novo Terminal de Trading por IA da @wardenprotocol

tenho de dizer, está bastante sólido, interface limpa, processo fluido, e podemos usar insights de IA e alguns sinais inteligentes para nos ajudar

USDC0,05%

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Faltam 3 dias e 20 horas, isso marca o fim do pré-lançamento? O que vem a seguir, finalmente vamos ter a Gota do PrepDEX?

Eu honestamente mal posso esperar para ver como @MemeMax_Fi constrói um novo tipo de PrepDEX, estou curioso sobre o que vai torná-lo realmente diferente.

Quero dizer, as funcionalidades, a vibe, a experiência, os incentivos.. tudo isso

Produto orientado > Token orientado, certo?

não queremos realmente outro protocolo que atraia liquidez de curto prazo com altos incentivos, apenas para enfrentar uma pressão de venda pesada logo em seguida

então sim, espero que o Mememax vá p

Ver originalEu honestamente mal posso esperar para ver como @MemeMax_Fi constrói um novo tipo de PrepDEX, estou curioso sobre o que vai torná-lo realmente diferente.

Quero dizer, as funcionalidades, a vibe, a experiência, os incentivos.. tudo isso

Produto orientado > Token orientado, certo?

não queremos realmente outro protocolo que atraia liquidez de curto prazo com altos incentivos, apenas para enfrentar uma pressão de venda pesada logo em seguida

então sim, espero que o Mememax vá p

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar

Você pode precisar de um agente DeFi para gerenciar suas negociações, estratégias de rendimento e portfólio

Você também pode precisar de um agente social para analisar seu desempenho, análises e estratégia de crescimento.

Ou talvez você apenas queira uma máquina de chat de IA privada e sem censura & um assistente inteligente para lidar com suas tarefas diárias

de fato, os gigantes da IA centralizada ainda dominam em termos de capital e escala, mas a IA Web3 tem ganhado um verdadeiro impulso de forma silenciosa

>>> Os agentes autônomos on-chain já estão começando a reformular como o Web3 funcio

Ver originalVocê também pode precisar de um agente social para analisar seu desempenho, análises e estratégia de crescimento.

Ou talvez você apenas queira uma máquina de chat de IA privada e sem censura & um assistente inteligente para lidar com suas tarefas diárias

de fato, os gigantes da IA centralizada ainda dominam em termos de capital e escala, mas a IA Web3 tem ganhado um verdadeiro impulso de forma silenciosa

>>> Os agentes autônomos on-chain já estão começando a reformular como o Web3 funcio

- Recompensa

- gostar

- Comentar

- Republicar

- Partilhar