Comprar Cripto

Pagar com

USD

Comprar e vender

HOT

Compre e venda criptomoedas através da Apple Pay, cartões, Google Pay, transferências bancárias e muito mais

P2P

0 Fees

Taxas zero, mais de 400 opções de pagamento e compra e venda fácil de criptomoedas

Cartão Gate

Cartão de pagamento de criptomoedas, que permite transações globais sem falhas.

Negociar

Básico

Negociação à Vista

Negoceie criptomoedas livremente

Margem

Aumente o seu lucro com a alavancagem

Conversão e negociação em blocos

0 Fees

Opere qualquer volume sem tarifas nem derrapagem

Tokens alavancados

Obtenha exposição a posições alavancadas de uma forma simples

Pré-mercado

Negoceie novos tokens antes de serem oficialmente listados

Futuros

Futuros

Centenas de contratos liquidados em USDT ou BTC

Opções

HOT

Negoceie Opções Vanilla ao estilo europeu

Conta Unificada

Maximize a eficiência do seu capital

Negociação de demonstração

Arranque dos futuros

Prepare-se para a sua negociação de futuros

Eventos de futuros

Participe em eventos para ganhar recompensas generosas

Negociação de demonstração

Utilize fundos virtuais para experimentar uma negociação sem riscos

Earn

Lançamento

CandyDrop

Recolher doces para ganhar airdrops

Launchpool

Faça staking rapidamente, ganhe potenciais novos tokens

HODLer Airdrop

Detenha GT e obtenha airdrops maciços de graça

Launchpad

Chegue cedo ao próximo grande projeto de tokens

Pontos Alpha

NEW

Negoceie ativos on-chain e desfrute de recompensas de airdrop!

Pontos de futuros

NEW

Ganhe pontos de futuros e receba recompensas de airdrop

Investimento

Simple Earn

Ganhe juros com tokens inativos

Investimento automático

Invista automaticamente de forma regular.

Investimento Duplo

Compre na baixa e venda na alta para obter lucros com as flutuações de preços

Soft Staking

Ganhe recompensas com staking flexível

Empréstimo de criptomoedas

0 Fees

Dê em garantia uma criptomoeda para pedir outra emprestada

Centro de empréstimos

Centro de empréstimos integrado

Centro de Património VIP

A gestão personalizada do património potencia o crescimento dos seus ativos

Gestão de património privado

Gestão de ativos personalizada para aumentar os seus ativos digitais

Fundo Quant

A melhor equipa de gestão de ativos ajuda-o a lucrar sem complicações

Staking

Faça staking de criptomoedas para ganhar em produtos PoS

Alavancagem inteligente

NEW

Sem liquidação forçada antes do vencimento, ganhos alavancados sem preocupações

Cunhagem de GUSD

Utilize USDT/USDC para cunhar GUSD y obter rendimentos ao nível do Tesouro

Mais

Promoções

Centro de atividades

Participe nas atividades para ganhar grandes prémios em dinheiro e produtos exclusivos

Referência

20 USDT

Ganhe 40% de comissão ou até 500 USDT em recompensas

Anúncios

Anúncios de novas listagens, atividades, atualizações, etc.

Blog da Gate

Artigos da indústria cripto

Serviços VIP

Enormes descontos nas taxas

Comprovativo de Reservas

A Gate promete 100% de prova de reservas

Afiliação

Desfrute de comissões exclusivas e obtenha retornos elevados

Gestão de ativos

NEW

Solução integral para a gestão de ativos

Institucional

NEW

Soluções profissionais de ativos digitais para instituições

Transferência Bancária OTC

Deposite e levante moeda fiduciária

Programa de corretora

Mecanismo generoso de reembolso de API

Gate Vault

Mantenha os seus ativos seguros

O que é a Palantir Technologies [PLTR], uma empresa de análise de dados em rápido crescimento, e pontos de investimento? - O caminho para se tornar um mestre em ações dos EUA de Okamoto Hyoe Yamabaro - Informações de investimento e mídia útil para dinheiro da Monex Securities

Nos últimos anos, tem havido um aumento significativo do interesse dos investidores na Palantir Technologies [PLTR] (doravante designada por Palantir). A razão para isso é o desempenho surpreendente do preço das ações. Em 2024, o preço das ações subiu cerca de 340%, e desde o início de 2025 até 18 de fevereiro, registou-se um aumento de 65%. Então, o que é a Palantir e por que está a atrair tanta atenção? Neste artigo, vamos explicar de forma clara a natureza do negócio, as suas vantagens, o contexto do seu crescimento e os riscos de investimento.

O gigante da análise de dados, Palantir Technologies [PLTR]

A Palantir é uma empresa de software americana fundada em 2003 por Peter Thiel (cofundador do PayPal). A empresa oferece soluções avançadas de análise de dados e inteligência artificial (IA), com especial destaque para o apoio à utilização de dados por agências governamentais e empresas.

A partir das informações obtidas com o PayPal, Peter Thiel fundou

Peter Thiel e Elon Musk eram membros fundadores da PayPal Holdings [PYPL] (doravante denominada PayPal). Musk fundou sua própria empresa, ‘X.com’, enquanto Thiel fundou ‘Confinity’. Em 2000, as duas empresas se fundiram para dar origem à PayPal. Após a fusão, Musk assumiu temporariamente como CEO da PayPal, mas devido a divergências internas, Thiel assumiu o cargo de CEO, e Musk saiu da gestão da empresa.

Em 2002, o PayPal foi adquirido pelo eBay por cerca de 1,5 bilhões de dólares, o que permitiu a Thiel e Musk obterem grandes quantias de dinheiro. Musk fundou a Tesla e a SpaceX, enquanto Thiel aplicou a tecnologia de detecção de fraudes desenvolvida no PayPal para lançar a Palantir. Além disso, Thiel posteriormente fundou o Founders Fund, que se tornou um investidor inicial na SpaceX.

O atual CEO da Palantir, Alex Karp, é chamado de ‘herege do Vale do Silício’ e diz que não tenta esconder sua forte ligação com o governo. Isso pode ser comparado a Elon Musk.

Qual é o modelo de negócio da Gate.io?

Negócios para o governo (cerca de 55% das receitas)

A Palantir estabeleceu relações profundas com agências governamentais dos Estados Unidos, como a CIA (Agência Central de Inteligência), o FBI (Bureau Federal de Investigação) e o Departamento de Defesa, desde o início de sua fundação, realizando projetos de análise de dados confidenciais e relacionados com a segurança nacional.

Um software representativo é o “Palantir Gotham”. Este é usado nos campos militar, de inteligência e cibersegurança, e é usado para vigilância do terrorismo e investigação criminal.

Além disso, a Palantir recebe financiamento do departamento de investimento da CIA, o ‘In-Q-Tel’, e é uma empresa altamente confiável pelo governo. As informações analisadas pelo software da Palantir são usadas para decisões estratégicas de combate ao terrorismo no Iraque e no Afeganistão, contribuindo para a segurança dos soldados. A Palantir analisa dados enormes em tempo real, visualiza relacionamentos e contribui para a eficiência operacional do governo, tendo uma presença especial como uma empresa que ‘apoia o lado sombrio da nação’.

Empresas privadas de negócios (cerca de 45% das vendas)

A partir de 2016, a Palantir expandiu significativamente o seu negócio para empresas privadas. O principal produto para empresas é o ‘Palantir Foundry’, que é usado para gerenciamento da cadeia de suprimentos e análise de riscos financeiros. Isso permite o processamento instantâneo de dados complexos e apoia a tomada de decisões rápidas nas empresas.

Por exemplo, em bancos como o JPMorgan Chase[JPM], é usado para detectar transações fraudulentas e para gestão de riscos, enquanto em indústrias de fabricação como a Ford Motor[F], é usado para otimização da cadeia de suprimentos e gestão de qualidade.

Além disso, no setor de saúde, é utilizado para análise de dados médicos, previsão de propagação de doenças infecciosas, entre outros. Na verdade, durante a pandemia de coronavírus, a tecnologia da Palantir foi utilizada para otimizar o fornecimento de vacinas e prever infecções, demonstrando assim sua capacidade em processamento de dados em larga escala.

O preço das ações da Palantir subiu cerca de 340% em 2024

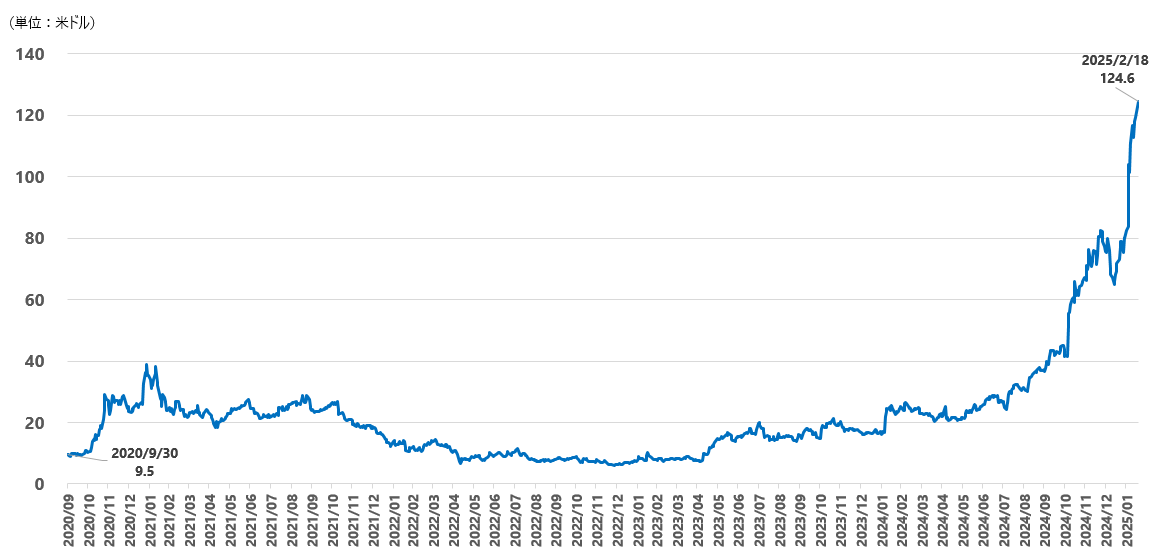

【Gráfico】Evolução do preço das ações da Palantir Technologies desde a sua listagem (setembro de 2020~) Fonte: Monex Securities da Bloomberg

A Palantir foi listada na bolsa de valores em 30 de setembro de 2020. Após a listagem, o preço das ações aumentou cerca de 3,7 vezes de US$ 9,5 para US$ 35,18 em quatro meses, mas o preço das ações permaneceu estagnado por cerca de 2 anos e 9 meses depois disso. Foi por volta de junho de 2023 que se virou para a Ascensão, e o preço das ações fez uma grande queda em setembro de 2024. Isso foi em resposta ao anúncio em 6 de setembro de que Palantir havia sido incluído no índice S&P 500.

Fonte: Monex Securities da Bloomberg

A Palantir foi listada na bolsa de valores em 30 de setembro de 2020. Após a listagem, o preço das ações aumentou cerca de 3,7 vezes de US$ 9,5 para US$ 35,18 em quatro meses, mas o preço das ações permaneceu estagnado por cerca de 2 anos e 9 meses depois disso. Foi por volta de junho de 2023 que se virou para a Ascensão, e o preço das ações fez uma grande queda em setembro de 2024. Isso foi em resposta ao anúncio em 6 de setembro de que Palantir havia sido incluído no índice S&P 500.

Neste anúncio, o preço das ações da empresa subiu 14% no dia seguinte. Além disso, no anúncio do balanço do quarto trimestre de 2024, divulgado em 3 de fevereiro de 2025, as receitas superaram as expectativas prévias, resultando em um aumento de 26% no preço das ações no dia seguinte. O preço das ações da Palantir subiu cerca de 340% ao longo de 2024 e mais 65% desde o início de 2025 até 18 de fevereiro, aumentando as expectativas de um crescimento adicional.

Palantir anuncia resultados financeiros e perspetivas do quarto trimestre de 2025

Para o anúncio dos resultados do quarto trimestre de 2024, mostrou um crescimento que superou ainda mais a tendência dos últimos cinco trimestres. A taxa de crescimento das vendas registrou um aumento de +36% em relação ao mesmo período do ano anterior, superando o crescimento de +30% do trimestre anterior. Além disso, o crescimento do setor comercial foi de +31%, o crescimento do setor governamental foi de +40%, o crescimento do número de clientes foi de +43%, e o saldo de contratos do setor comercial dos Estados Unidos aumentou em +99%.

Além disso, a orientação de crescimento de vendas para o 1º trimestre de 2025 (1º trimestre) foi de +35~36%, e a orientação de crescimento de vendas para o ano inteiro (AF25) foi de +31%, o que foi significativamente maior do que a previsão do mercado (cerca de 25% de crescimento).

Sobre o ano de 2025, esperava-se que a comparação com o ano anterior se tornasse mais difícil, mas é provável que o governo se beneficie do orçamento do governo para a eficiência administrativa, e espera-se que o crescimento do setor governamental continue. Além disso, espera-se também um aumento nas vendas para empresas devido à aceleração da expansão dos negócios para empresas privadas.

As previsões do EPS de consenso para 2025 são de $0,54, um aumento de 31% em relação aos $0,41 de 2024, e é esperado um aumento de 24% para $0,67 em 2026 em comparação com o ano anterior.

Preocupações com a alta valoração das ações da Palantir?

Por outro lado, os investidores estão preocupados com a alta valoração das ações da Palantir. Usando a previsão de EPS para 2026, o PE ratio é de aproximadamente 186 vezes, o que é consideravelmente alto em comparação com empresas de software comuns (o preço das ações era de 124,62 dólares em 14 de fevereiro de 2025). No entanto, quando a Palantir fez sua estreia na bolsa, houve momentos em que o PER previsto chegou a 360 vezes.

Devido ao seu excelente desempenho e crescimento, o valor das ações pode se tornar muito alto. A alta valoração é especialmente famosa no caso das ações da Tesla. Acreditamos que o atual preço das ações da Tesla é justificado, considerando o potencial de crescimento futuro. O mesmo pode ser dito sobre a Palantir.

Qual é o potencial de crescimento futuro da Parantia?

Estamos atualmente nos estágios iniciais do boom da IA generativa, e a tecnologia da empresa provavelmente continuará a atrair a atenção.

As vendas da Palantir deverão crescer 30% em termos homólogos em 2025, 27% em 2026 e 30% em 2027. É raro uma empresa de software relacionada à IA com uma grande escala de receita (US$ 3 bilhões) como a Palantir sustentar um crescimento de cerca de 30%. O lucro operacional também deverá aumentar de 39,4% em 2024 para 41,7% em 2025.

A Palantir tem mantido um crescimento sólido tanto no governo como no setor comercial, aproveitando a onda da revolução da IA. Apesar do ambiente competitivo desafiador em 2025, a empresa demonstrou a sustentabilidade do crescimento ao anunciar uma orientação de desempenho muito acima das expectativas. Além disso, a Palantir está passando por um período de transição de crescimento, mas é dito que o controle de custos está sendo rigorosamente implementado.

Embora a avaliação ainda seja ultrapremium, acreditamos que a empresa provavelmente sustentará um crescimento de vendas de mais de 30% nos próximos anos, com crescimento de lucros de longo prazo.

O estado atual da Palantir, cujo preço das ações está à frente dos analistas

O consenso dos analistas de Wall Street também considera que o preço das ações da Palantir está caro. Há 24 analistas que pesquisam as ações da Palantir, dos quais 21% recomendam compra, 54% mantêm e 25% recomendam venda. O preço-alvo médio dos analistas é de 91,17 dólares, o que significa que o preço atual está 27% acima do valor justo. Até agora, o preço das ações subiu, e os analistas estão tentando alcançá-lo. Em outras palavras, as ações estão à frente dos analistas.

Como ponto de atenção, devido às altas expectativas dos investidores em relação à Palantir, qualquer erro nos resultados financeiros pode ter um impacto negativo significativo no preço das ações, mesmo que temporário. Além disso, em caso de ajuste de mercado, é possível que haja um grande ajuste no preço das ações. Isso não é exclusivo da Palantir, mas pode ocorrer com qualquer ação de crescimento rápido.

No entanto, acreditamos que a tendência de crescimento a longo prazo da empresa permanecerá inalterada e, fundamentalmente, a valoração elevada atual será mantida no futuro. Se houver algum ajuste temporário no preço das ações, acreditamos que isso poderá representar uma boa oportunidade de investimento.

Qual é o risco do investimento em ações da Parantia?

Por último, gostaria de abordar os riscos da Palantir. A tecnologia da Palantir é particularmente forte nas áreas de segurança, vigilância e business intelligence, mas questões de privacidade e ética são frequentemente discutidas. Grande parte da receita da empresa vem de contratos com agências governamentais, especialmente o governo dos EUA, e há um risco de dependência do governo.

Os contratos podem ser reduzidos ou rescindidos devido a cortes orçamentais do governo ou a alterações políticas. Talvez valha a pena considerar a possibilidade de uma eleição presidencial ou uma mudança de governo mudar a política de investimento em TI do governo e reduzir a dependência da Palantir.