Previsão do Preço do XRP em 2025: Bull Run ou Bear Market - Análise de Cenários Potenciais para a Criptomoeda da Ripple

Introdução: Posição de Mercado e Valor de Investimento da XRP

A XRP (XRP), enquanto ativo digital de referência no setor dos pagamentos transfronteiriços, alcançou marcos assinaláveis desde o seu lançamento em 2012. Em 2025, a sua capitalização bolsista já atinge 150,63 mil milhões $, com uma oferta em circulação de cerca de 59,92 mil milhões de tokens e o preço próximo dos 2,514 $. Este ativo, frequentemente designado por "moeda ponte", assume um papel cada vez mais determinante na facilitação de transações internacionais rápidas e eficientes em termos de custos.

Este artigo apresenta uma análise detalhada das tendências de preço da XRP entre 2025 e 2030, integrando padrões históricos, equilíbrio de oferta e procura, evolução do ecossistema e fatores macroeconómicos, para fornecer previsões profissionais e estratégias de investimento práticas a investidores.

I. Evolução Histórica do Preço da XRP e Estado Atual do Mercado

Evolução Histórica do Preço da XRP

- 2014: A XRP atingiu o seu mínimo histórico de 0,00268621 $ em 22 de maio, nos primórdios da sua existência

- 2018: A XRP atingiu o seu máximo histórico de 3,65 $ em 4 de janeiro, durante o bull market das criptomoedas

- 2023-2025: Forte valorização, com a XRP a passar de menos de 0,50 $ para mais de 2,50 $

Situação Atual da XRP no Mercado

Em 15 de outubro de 2025, a XRP transaciona a 2,514 $, ocupando o 5.º lugar no ranking das criptomoedas, com uma capitalização de mercado de 150,63 mil milhões $. O volume transacionado nas últimas 24 horas atinge 355,12 milhões $, sinalizando elevada atividade de mercado. Nas últimas 24 horas, a XRP caiu 1,98%, mas regista um impressionante crescimento de 358,62% no último ano.

O preço atual está 31,12% abaixo do máximo histórico de 3,65 $, revelando potencial de valorização. Contudo, encontra-se significativamente acima do mínimo histórico, evidenciando uma notável valorização de longo prazo. A oferta em circulação de 59 916 045 245 XRP representa 59,92% da oferta máxima de 100 mil milhões de tokens.

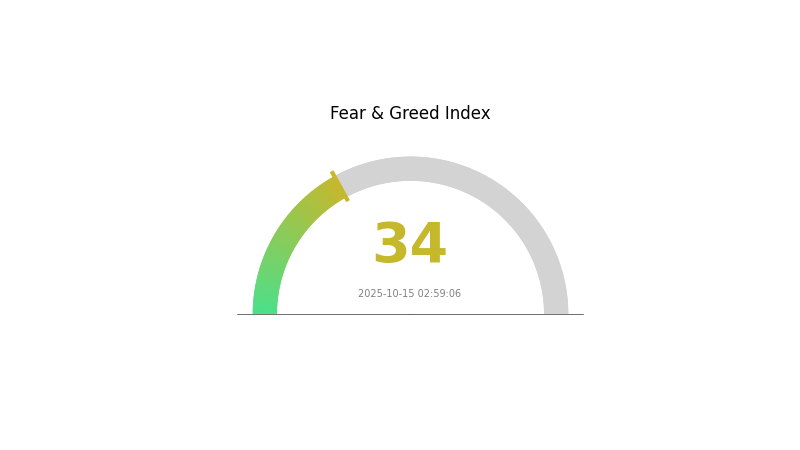

A dominância da XRP é de 6,16%, ilustrando o seu peso no ecossistema cripto. O Índice Fear and Greed está em 34, sinalizando um sentimento de "Medo" no mercado cripto global, com potencial impacto nos movimentos de curto prazo do preço da XRP.

Clique para consultar o preço de mercado atual da XRP

Índice de Sentimento de Mercado da XRP

15 de outubro de 2025 — Fear and Greed Index: 34 (Medo)

Clique para consultar o Fear & Greed Index atual

O mercado da XRP atravessa atualmente uma fase de medo, refletida no Fear and Greed Index de 34. Isto indica que os investidores se mostram cautelosos e pouco propensos a assumir riscos elevados. Este tipo de sentimento pode abrir oportunidades para investidores contrarianistas, que acreditam no potencial da XRP a longo prazo. Contudo, recomenda-se uma análise rigorosa e a ponderação da tolerância ao risco antes de investir num mercado tão volátil.

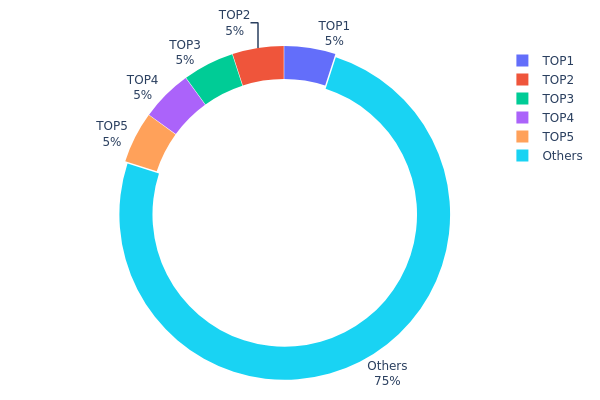

Distribuição das Detenções de XRP

Os dados de distribuição por endereço revelam uma concentração significativa de tokens XRP entre os maiores detentores. Os cinco principais endereços detêm, cada um, cerca de 5% da oferta total, agregando 25% de todos os tokens XRP. Este nível de concentração aponta para uma distribuição relativamente centralizada, com impacto potencial na dinâmica do mercado.

Apesar de a maioria dos tokens (75%) se encontrar dispersa por "Outros", o peso dos maiores detentores confere-lhes capacidade de influência. Esta concentração pode acentuar a volatilidade e afetar a liquidez, já que grandes ordens de compra ou venda têm impacto relevante. Além disso, este padrão de distribuição pode levantar preocupações quanto ao risco de manipulação, já que ações coordenadas dos principais detentores podem alterar o sentimento e o preço do mercado.

Numa perspetiva global, esta distribuição reflete uma descentralização moderada da XRP. Apesar da presença de grandes stakeholders, o facto de três quartos da oferta estar dispersa denota resiliência da rede. Ainda assim, os participantes devem estar atentos ao impacto potencial dos grandes detentores na estabilidade do ecossistema e na evolução do preço do token, tanto a curto como a longo prazo.

Clique para consultar a Distribuição de Detenções de XRP

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | rB3WNZ...oqscPn | 5 000 000,23K | 5,00% |

| 2 | r9UUEX...M6HiYp | 5 000 000,22K | 5,00% |

| 3 | rDdXiA...CFWeCK | 5 000 000,22K | 5,00% |

| 4 | rMhkqz...6bDyb1 | 5 000 000,21K | 5,00% |

| 5 | r9NpyV...BdsEN3 | 5 000 000,20K | 5,00% |

| - | Others | 74 999 998,92K | 75% |

II. Fatores Determinantes para o Futuro da Cotação da XRP

Mecanismo de Oferta

- Lançamento controlado: A Ripple Labs detém uma larga fatia da XRP e liberta-a de forma programada no mercado.

- Padrão histórico: Lançamentos controlados anteriores contribuíram para a estabilidade dos preços, embora por vezes provoquem pressão descendente.

- Impacto atual: A estratégia de lançamentos controlados mantém impacto direto na dinâmica do mercado da XRP.

Atividade Institucional e dos Grandes Detentores

- Participação institucional: Grandes instituições financeiras reconhecem cada vez mais a XRP para transferências de grandes montantes.

- Adoção empresarial: As parcerias estratégicas com bancos e instituições financeiras globais multiplicam-se, aumentando o valor de utilidade da XRP.

- Políticas governamentais: A clareza regulatória, sobretudo nos EUA, é decisiva para o futuro da XRP.

Ambiente Macroeconómico

- Impacto da política monetária: As políticas dos bancos centrais e o contexto económico global condicionam o apetite dos investidores por ativos como a XRP.

- Propriedades de cobertura contra inflação: O desempenho da XRP como proteção em cenários inflacionistas é alvo de acompanhamento por parte dos investidores.

- Fatores geopolíticos: Relações internacionais e necessidades de pagamentos transfronteiriços influenciam a adoção e o valor da XRP.

Desenvolvimento Técnico e Consolidação do Ecossistema

- Atualizações ao XRP Ledger (XRPL): Melhorias contínuas no XRPL aumentam a velocidade e a eficiência das transações.

- Ripple Protocol Consensus Algorithm (RPCA): Este mecanismo de consenso exclusivo distingue a XRP das restantes criptomoedas.

- Aplicações e ecossistema: O desenvolvimento de projetos DeFi, tokenização de ativos e DeFi institucional na rede XRP amplia os seus casos de uso.

III. Previsão de Preço da XRP para 2025-2030

Perspetiva para 2025

- Projeção conservadora: 2,20 $ – 2,40 $

- Projeção neutra: 2,40 $ – 2,60 $

- Projeção otimista: 2,60 $ – 2,59 $ (dependente de progressos regulatórios favoráveis)

Perspetiva para 2027-2028

- Expectativa de fase de mercado: Possível consolidação seguida de nova fase de crescimento

- Intervalo de preços previsto:

- 2027: 1,42 $ – 3,52 $

- 2028: 2,54 $ – 4,04 $

- Principais catalisadores: Adoção institucional reforçada, avanços tecnológicos na rede Ripple

Perspetiva de Longo Prazo para 2030

- Cenário base: 3,92 $ – 4,50 $ (com crescimento sustentado do mercado)

- Cenário otimista: 4,50 $ – 5,23 $ (com adoção generalizada em pagamentos transfronteiriços)

- Cenário transformador: mais de 5,23 $ (num contexto regulatório extremamente favorável e adoção massiva)

- 31 de dezembro de 2030: XRP a 4,09 $ (preço potencial médio de fim de ano)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2,5853 | 2,51 | 2,2088 | 0 |

| 2026 | 2,82789 | 2,54765 | 2,29289 | 1 |

| 2027 | 3,52098 | 2,68777 | 1,42452 | 6 |

| 2028 | 4,03569 | 3,10438 | 2,54559 | 23 |

| 2029 | 4,60534 | 3,57003 | 2,46332 | 42 |

| 2030 | 5,23224 | 4,08769 | 3,92418 | 62 |

IV. Estratégias Profissionais de Investimento em XRP e Gestão de Risco

Metodologia de Investimento em XRP

(1) Estratégia de Detenção a Longo Prazo

- Indicada para: Investidores conservadores em busca de crescimento estável

- Sugestões de operação:

- Investimento periódico: Aplicar montantes fixos em intervalos regulares

- Manter o investimento durante pelo menos 3 a 5 anos para ultrapassar períodos de volatilidade

- Armazenar a XRP numa hardware wallet segura ou em serviço de custódia credível

(2) Estratégia de Negociação Ativa

- Ferramentas de análise técnica:

- Médias móveis: Identificar tendências e potenciais reversões

- Índice de Força Relativa (RSI): Avaliar situações de sobrecompra ou sobrevenda

- Pontos chave para swing trading:

- Definir pontos claros de entrada e saída com base em indicadores técnicos

- Utilizar ordens stop-loss para limitar perdas

Estrutura de Gestão de Risco para XRP

(1) Princípios de Alocação de Ativos

- Investidores conservadores: 1–3% da carteira

- Investidores moderados: 3–7% da carteira

- Investidores agressivos: 7–15% da carteira

(2) Soluções de Cobertura

- Diversificação: Distribuir o investimento entre várias criptomoedas e ativos tradicionais

- Utilização de opções: Considerar contratos de opções sobre XRP para proteção contra quedas

(3) Soluções de Armazenamento Seguro

- Recomendação de hardware wallet: Gate Web3 Wallet

- Armazenamento a frio: Wallet em papel para detenção prolongada

- Medidas de segurança: Ativar autenticação de dois fatores, utilizar palavras-passe robustas e manter o software atualizado

V. Riscos e Desafios Potenciais para a XRP

Riscos de Mercado da XRP

- Volatilidade: A XRP está sujeita a oscilações de preço acentuadas

- Risco de liquidez: Ordens de grande volume podem afetar o preço de mercado

- Risco de correlação: Elevada correlação com a tendência do mercado cripto

Riscos Regulatórios da XRP

- Enquadramento regulatório incerto: Litígios em curso e escrutínio das autoridades

- Regulação transfronteiriça: Tratamento legal variável consoante a jurisdição

- Custos de compliance: Adaptação a requisitos regulatórios em constante evolução

Riscos Técnicos da XRP

- Segurança da rede: Possíveis vulnerabilidades no XRP Ledger

- Escalabilidade: Manter a performance com o aumento da utilização da rede

- Concorrência de outras soluções blockchain: Novas tecnologias podem superar a XRP

VI. Conclusão e Recomendações de Ação

Avaliação do Valor de Investimento da XRP

A XRP oferece potencial de valorização de longo prazo como solução de pagamento eficiente, mas enfrenta riscos regulatórios e de mercado no curto prazo. A sua adoção por instituições financeiras poderá impulsionar o crescimento, embora as disputas legais em curso introduzam incertezas relevantes.

Recomendações de Investimento em XRP

✅ Iniciantes: Comece com pequenos investimentos regulares para ganhar exposição progressivamente ✅ Investidores experientes: Adote uma estratégia equilibrada, combinando detenção a longo prazo com negociação tática ✅ Investidores institucionais: Realize due diligence exaustiva e avalie a XRP como componente de uma carteira cripto diversificada

Formas de Participação em XRP

- Negociação à vista: Comprar e vender XRP em bolsas de referência como a Gate.com

- Derivados: Negociar futuros ou opções para estratégias avançadas

- Staking: Explorar opções de staking de XRP, quando disponíveis em plataformas suportadas

Os investimentos em criptomoedas apresentam riscos muito elevados; este artigo não constitui aconselhamento financeiro. Os investidores devem decidir de acordo com o seu perfil de risco e recorrer a consultores financeiros profissionais. Nunca invista mais do que aquilo que está disposto a perder.

FAQ

Qual é a previsão para a XRP em 2025?

Prevê-se que a XRP alcance 13 $ em 2025, sustentada pela força do Bitcoin acima dos 115 000 $. Os analistas estimam uma subida de 364% face aos atuais 2,8 $, caso as tendências de mercado se mantenham.

A XRP pode atingir 100 dólares?

Apesar de teoricamente possível, é improvável. A projeção aponta para 10 $–25 $ em 2025, podendo chegar a 50 $ em cenários extremos de adoção.

Quanto poderá valer a XRP em 2030?

Com base nas tendências atuais e previsões de especialistas, a XRP poderá atingir entre 100 $ e 1 000 $ até 2030, impulsionada pela adoção crescente e pela inovação tecnológica no universo cripto.

A XRP pode chegar a 500 $ no final de 2025?

Não. É altamente improvável que a XRP atinja 500 $ até ao final de 2025. As tendências e projeções atuais do mercado não suportam esse cenário num horizonte próximo.

Cripto Crash ou Apenas uma Correção?

Previsão do preço do XRP para 2025: análise dos efeitos da regulamentação e da adoção pelo mercado na valorização futura

Previsão do preço do XRP para 2025: potencial valorização até 5 $ devido ao aumento da adoção institucional

De que forma os dados on-chain evidenciam a posição de mercado do XRP em 2025?

De que forma a análise dos concorrentes no setor cripto afeta a quota de mercado em 2025?

A Grande Reformulação: Como a Binance, OKX e Gate Estão Redefinindo a Paisagem CEX em 2025

Compreender o Ataque dos 51%: Riscos e Implicações para a Segurança da Blockchain

Essenciais do Trading de Criptomoedas Spot: Guia para Iniciantes

Hamster Kombat Daily Combo & Cipher Answer 14 de dezembro de 2025

Carteiras ERC20 de Referência para Utilizadores Iniciantes

Maximize os lucros com os pools de liquidez descentralizados da Curve