Predicción del precio de KMNO en 2025: Tendencias de mercado y factores que marcarán el futuro del permanganato de potasio

Introducción: Posición de mercado y valor de inversión de KMNO

Kamino (KMNO), el token nativo que impulsa la plataforma Kamino, se ha posicionado como uno de los actores principales en el ecosistema de Solana desde su lanzamiento. En 2025, KMNO cuenta con una capitalización de mercado de 193 330 610 $, una oferta en circulación de aproximadamente 3 038 356 280 tokens y un precio en torno a 0,06363 $. Este activo, conocido como “token de transferencia fluida entre redes”, desempeña un papel cada vez más fundamental en la facilitación de transacciones entre las redes conectadas a Kamino.

Este artículo analiza en profundidad la evolución del precio de KMNO entre 2025 y 2030, teniendo en cuenta patrones históricos, la dinámica de oferta y demanda, el desarrollo del ecosistema y factores macroeconómicos, para proporcionar predicciones de precio profesionales y estrategias de inversión prácticas para inversores.

I. Revisión histórica del precio de KMNO y situación actual del mercado

Evolución histórica del precio de KMNO

- 2024: KMNO marcó su máximo histórico en 112 $ el 30 de abril, un hito relevante para el token.

- 2024: El mercado sufrió una fuerte corrección, con KMNO cayendo a su mínimo histórico de 0,0191 $ el 5 de agosto.

- 2025: KMNO muestra signos de recuperación, situando el precio en 0,06363 $.

Situación actual del mercado de KMNO

El 19 de octubre de 2025, KMNO se intercambia a 0,06363 $, con una capitalización de mercado de 193 330 610 $. El token ha registrado una caída del 4,16 % en las últimas 24 horas, señalando un sentimiento bajista de corto plazo. No obstante, KMNO ha tenido un desempeño sólido la semana anterior, con una subida del 14 %. Las variaciones a 30 días y anual son negativas, con -30,50 % y -32,41 % respectivamente, lo que indica una volatilidad persistente.

El valor actual de KMNO está muy por debajo de su máximo histórico, lo que supone un descenso del 99,94 % desde su pico. El suministro en circulación de KMNO es de 3 038 356 279,75 tokens, equivalente al 30,38 % de la oferta total de 9 999 962 890,07488. La capitalización de mercado totalmente diluida asciende a 636 300 000 $.

El volumen de negociación en 24 horas de KMNO es de 865 971 $, reflejando una actividad moderada. Con 55 007 titulares, KMNO cuenta con una base de usuarios consolidada en la blockchain de Solana.

Haz clic para ver el precio de mercado actual de KMNO

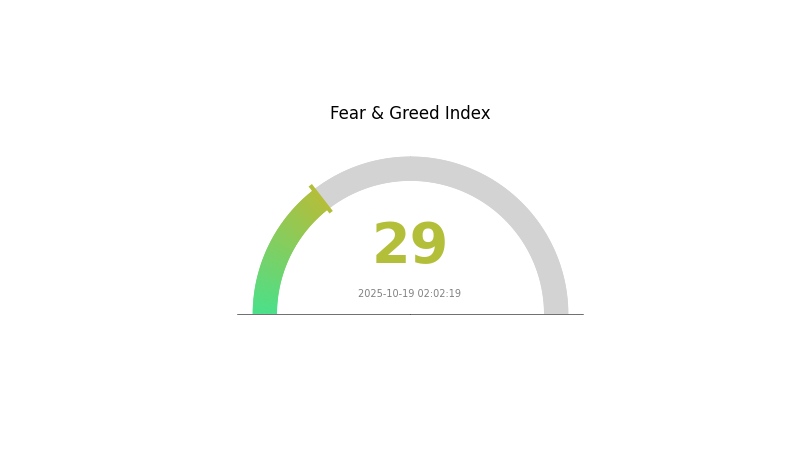

Indicador de sentimiento de mercado de KMNO

19-10-2025 Índice de Miedo y Avaricia: 29 (Miedo)

Haz clic para consultar el Índice de Miedo y Avaricia actual

El sentimiento en el mercado de criptomonedas sigue siendo cauteloso: el Índice de Miedo y Avaricia se sitúa en 29, en zona de miedo. Esto indica que los inversores se muestran reticentes y evitan asumir riesgos, lo que podría abrir oportunidades de compra para quienes operan en contra de la tendencia. Sin embargo, conviene recordar que el sentimiento puede variar rápidamente. Realiza siempre un análisis riguroso y emplea herramientas de gestión de riesgos como las que ofrece Gate.com antes de invertir en un entorno tan volátil.

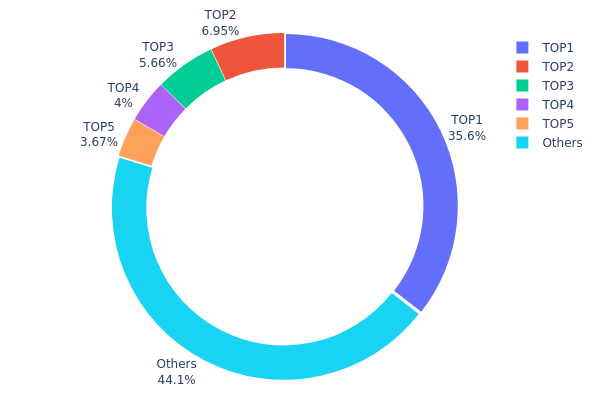

Distribución de tenencias de KMNO

El análisis de la distribución de direcciones con tenencias de KMNO revela una concentración elevada entre los principales titulares. La dirección principal ostenta el 35,59 % de la oferta total, mientras que las cinco primeras concentran el 55,86 % de los tokens KMNO. Este reparto apunta a una estructura de propiedad centralizada, con potenciales efectos sobre la dinámica de mercado y la estabilidad de precios.

Esta concentración suscita preocupaciones sobre posibles riesgos de manipulación y problemas de liquidez. La posición dominante de la dirección principal, que acumula más de un tercio de la oferta, podría acentuar la volatilidad si realiza grandes operaciones. Además, la distribución limitada entre pocos actores puede dificultar una adopción más amplia y reducir la participación en el mercado.

Este patrón centralizado sugiere que la estructura on-chain de KMNO es menos descentralizada de lo aconsejable para un proyecto cripto, y que la gobernanza y la toma de decisiones pueden quedar influidas por un puñado de grandes participantes, impactando en el desarrollo a largo plazo y la implicación de la comunidad.

Haz clic para consultar la distribución actual de tenencias de KMNO

| Top | Dirección | Cantidad en tenencia | Tenencia (%) |

|---|---|---|---|

| 1 | GvXkGJ...AEiRVU | 3 559 505,88K | 35,59 % |

| 2 | Ec6MuW...F16G57 | 695 310,78K | 6,95 % |

| 3 | 8civ8u...txZ8ew | 565 681,47K | 5,65 % |

| 4 | 4x3uU2...Hbhe1B | 400 000,00K | 4,00 % |

| 5 | 4uD7K6...oAhD8N | 367 000,00K | 3,67 % |

| - | Resto | 4 412 464,76K | 44,14 % |

II. Factores clave para el precio futuro de KMNO

Entorno macroeconómico

- Cobertura frente a la inflación: Como criptoactivo, KMNO puede actuar como cobertura frente a la inflación en períodos de incertidumbre económica.

Desarrollo tecnológico y construcción del ecosistema

- Aplicaciones en el ecosistema: El ecosistema de KMNO puede integrar aplicaciones descentralizadas (DApps) y proyectos que aumentan su valor y utilidad global.

III. Predicción del precio de KMNO para 2025-2030

Perspectiva para 2025

- Previsión conservadora: 0,05353 $ – 0,06373 $

- Previsión neutral: 0,06373 $ – 0,06819 $

- Previsión optimista: 0,06819 $ – 0,07000 $ (si las condiciones del mercado son favorables)

Perspectiva para 2027

- Fase de mercado prevista: Potencial fase de crecimiento

- Intervalo de precios estimado:

- 2026: 0,05541 $ – 0,08311 $

- 2027: 0,07155 $ – 0,08348 $

- Catalizadores: Mayor adopción y avances tecnológicos

Perspectiva a largo plazo para 2030

- Escenario base: 0,09774 $ – 0,11000 $ (si el mercado mantiene un crecimiento estable)

- Escenario optimista: 0,11000 $ – 0,13391 $ (si el mercado rinde de forma sobresaliente)

- Escenario transformador: 0,13391 $ – 0,15000 $ (si se producen innovaciones disruptivas y adopción masiva)

- 31-12-2030: KMNO 0,13391 $ (posible máximo)

| Año | Precio máximo previsto | Precio medio previsto | Precio mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,06819 | 0,06373 | 0,05353 | 0 |

| 2026 | 0,08311 | 0,06596 | 0,05541 | 3 |

| 2027 | 0,08348 | 0,07454 | 0,07155 | 17 |

| 2028 | 0,09323 | 0,07901 | 0,05373 | 24 |

| 2029 | 0,10937 | 0,08612 | 0,07492 | 35 |

| 2030 | 0,13391 | 0,09774 | 0,06842 | 53 |

IV. Estrategias profesionales de inversión en KMNO y gestión de riesgos

Metodología de inversión en KMNO

(1) Estrategia de tenencia a largo plazo

- Perfil adecuado: Inversores a largo plazo con elevada tolerancia al riesgo

- Recomendaciones:

- Acumula KMNO en correcciones de mercado

- Define objetivos de precio y revisa tu cartera de forma periódica

- Emplea la wallet web3 de Gate para almacenar de forma segura

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: Seguimiento de tendencias a corto y largo plazo

- Índice de Fuerza Relativa (RSI): Señalización de zonas de sobrecompra o sobreventa

- Puntos clave para swing trading:

- Establece órdenes stop-loss para limitar pérdidas

- Recoge beneficios en niveles prefijados

Marco de gestión de riesgos para KMNO

(1) Principios de asignación de activos

- Inversores conservadores: 1–3 % de la cartera

- Inversores agresivos: 5–10 % de la cartera

- Inversores profesionales: 10–20 % de la cartera

(2) Soluciones para cobertura del riesgo

- Diversificación: Distribuye entre varias criptomonedas

- Stablecoins: Convierte temporalmente a stablecoins en periodos de alta volatilidad

(3) Soluciones de custodia segura

- Hot wallet recomendada: Wallet Web3 de Gate

- Almacenamiento en frío: Hardware wallet para conservación a largo plazo

- Medidas de seguridad: Habilita la autenticación en dos pasos y utiliza contraseñas robustas

V. Riesgos y desafíos potenciales de KMNO

Riesgos de mercado de KMNO

- Alta volatilidad: Fluctuaciones de precio significativas, habituales en criptomonedas

- Liquidez limitada: Dificultad para ejecutar grandes operaciones sin afectar al precio

- Sentimiento de mercado: Vulnerabilidad ante cambios rápidos en la percepción inversora

Riesgos regulatorios de KMNO

- Incertidumbre normativa: Posibles nuevas regulaciones que afecten a KMNO

- Cumplimiento internacional: Dificultad de adaptación a normativas globales

- Cambios fiscales: Posible tratamiento fiscal adverso para operaciones con criptoactivos

Riesgos técnicos de KMNO

- Vulnerabilidades en smart contracts: Riesgo de exploits en el código fuente

- Congestión de red: Retrasos en transacciones en picos de actividad

- Obsolescencia tecnológica: Posibilidad de quedar superado por soluciones blockchain más avanzadas

VI. Conclusión y recomendaciones

Valoración del potencial de inversión de KMNO

KMNO es una opción de inversión con alto nivel de riesgo y potencial, dentro del ecosistema Solana. Aunque incorpora características innovadoras y posibilidades de crecimiento, los inversores deben tener presentes la volatilidad elevada y la incertidumbre regulatoria del mercado cripto.

Recomendaciones de inversión en KMNO

✅ Principiantes: Empieza con importes pequeños y asumibles para familiarizarte con el mercado ✅ Inversores experimentados: Aplica una estrategia equilibrada y asigna una parte de tu cartera en función de tu perfil de riesgo ✅ Inversores institucionales: Realiza una evaluación rigurosa y contempla KMNO como parte de una cartera cripto diversificada

Formas de invertir y operar con KMNO

- Trading al contado: Compra y venta directa de KMNO en Gate.com

- Staking: Participa en programas de staking de KMNO si están disponibles

- Integración DeFi: Explora opciones de yield farming o provisión de liquidez en el ecosistema Kamino

Las inversiones en criptomonedas implican riesgos muy elevados y este artículo no constituye asesoramiento de inversión. Toma tus decisiones con cautela según tu tolerancia al riesgo y consulta siempre a asesores financieros profesionales. No inviertas nunca más de lo que te puedas permitir perder.

FAQ

¿Para qué sirve el KMnO coin?

El KMnO coin es un utility token que se utiliza en un ecosistema descentralizado para aplicaciones en la industria química, facilitando tanto transacciones como la gobernanza en la red KMnO.

¿Cuál es el futuro de Coin98?

Coin98 tiene potencial de crecimiento en el universo DeFi. Sus funciones de wallet multichain y agregador DEX lo posicionan para una mayor adopción y un mayor valor a medida que evoluciona el ecosistema cripto.

¿Qué previsión de precio hay para Kusama en 2040?

De acuerdo con las tendencias actuales y su potencial de crecimiento, Kusama podría situarse entre los 5 000 $ y los 7 500 $ en 2040, en línea con su papel en el ecosistema Polkadot y la expansión de la adopción cripto.

¿Cuál es el valor del token KMNO?

En octubre de 2025, el token KMNO tiene un valor aproximado de 0,75 $. Su precio ha crecido de forma sostenida el último año, con una subida del 25 % solo en el último trimestre.

Predicción del precio de RAY para 2025: análisis de los factores que impulsan el crecimiento y el potencial de mercado del token RAY en los próximos años

Predicción del precio de RAY en 2025: ¿Conseguirá este protocolo Layer-1 superar sus límites en el dinámico entorno DeFi?

Predicción del precio de KMNO para 2025: tendencias de mercado, factores clave y perspectivas de inversión

Predicción del precio de JUP en 2025: análisis del potencial de Jupiter en el mercado de criptomonedas en evolución

Predicción del precio de JTO en 2025: ¿Llegará el token de Jito Network a nuevos máximos en el ecosistema DeFi?

Predicción del precio de RAY para 2025: análisis de las tendencias del mercado y posibles factores de crecimiento

Criptomonedas en bancarrota retoman protagonismo: Estrategias de recuperación de LUNA, LUNC, FTT y USTC para 2025

Bonos perpetuos: claves para entenderlos en el mundo cripto

HumidiFi $WET Token en Solana: Guía completa de yield farming y liquidity mining en DeFi

Guía completa para entender el modelo Stock-to-Flow de Bitcoin

Por qué Solana está superando a Bitcoin y Ethereum en 2024: análisis del repunte de SOL y la expansión de su ecosistema