Predicción del precio de USDE en 2025: análisis de tendencias de mercado y factores potenciales de crecimiento

Introducción: Posición de mercado y valor de inversión de USDE

Ethena USDe (USDE), como solución sintética al dólar resistente a la censura y escalable, ha logrado avances significativos desde su creación. En 2025, la capitalización de mercado de USDE asciende a 12,5 mil millones de dólares, con una oferta circulante de aproximadamente 12,5 mil millones de tokens y un precio cercano a 0,9995 dólares. Este activo, considerado como la “solución estable nativa cripto”, está desempeñando un papel cada vez más relevante en las finanzas descentralizadas y en las operaciones cross-chain.

En este artículo encontrarás un análisis detallado de la evolución del precio de USDE desde 2025 hasta 2030, combinando patrones históricos, oferta y demanda, desarrollo del ecosistema y factores macroeconómicos para ofrecer previsiones profesionales y estrategias de inversión prácticas dirigidas a inversores.

I. Revisión histórica del precio de USDE y situación actual del mercado

Evolución histórica del precio de USDE

- 2023: USDE debutó y su precio se estabilizó en torno a 1 dólar

- 2024: Alcanzó máximo histórico de 1,5 dólares el 14 de noviembre, con fluctuaciones posteriores

- 2025: Ciclo de mercado, su precio descendió hasta un mínimo histórico de 0,9213 dólares el 10 de octubre

Situación actual del mercado de USDE

El 15 de octubre de 2025, USDE cotiza a 0,9995 dólares, manteniendo su paridad cercana al dólar. El volumen negociado en las últimas 24 horas es de 32 956,23 dólares, reflejando una actividad moderada. Su capitalización de mercado se sitúa en 12,50 mil millones de dólares, posicionando USDE como la decimosexta criptomoneda por capitalización. La valoración totalmente diluida es de 5,82 mil millones de dólares y la oferta circulante alcanza los 12,50 mil millones de USDE. El token ha experimentado ligeros movimientos positivos en el corto plazo, con subidas del 0,01 % en la última hora, 24 horas y 7 días. No obstante, ha sufrido un descenso del 0,1 % en los últimos 30 días y registra una subida del 0,21 % en el último año.

Haz clic para consultar el precio de mercado actual de USDE

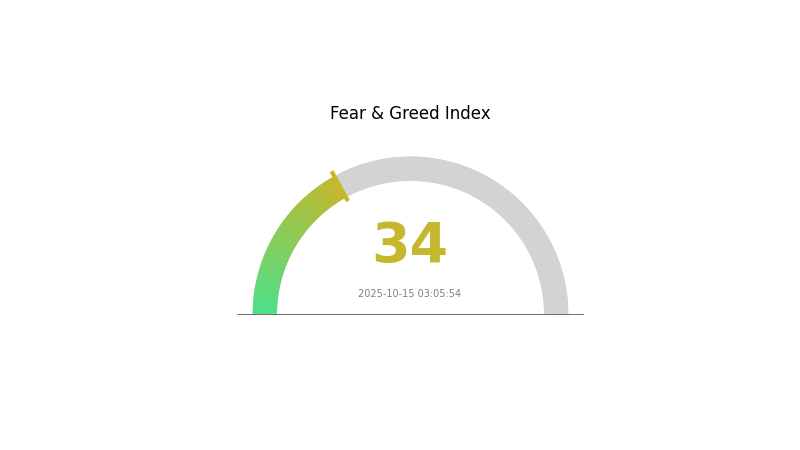

Indicador de sentimiento del mercado USDE

15-10-2025 Índice de Miedo y Codicia: 34 (Miedo)

Haz clic para consultar el Índice de Miedo y Codicia actual

El mercado de criptomonedas atraviesa una fase de miedo, con un Índice de Miedo y Codicia en 34. Esto refleja cautela entre los inversores, que dudan a la hora de tomar decisiones arriesgadas. En estos periodos, resulta fundamental mantenerse informado y actuar con racionalidad. Recuerda que las fluctuaciones de mercado son habituales, y el miedo puede suponer oportunidades para quienes investigan y analizan en profundidad. Presta atención a las tendencias y contempla diversificar tu cartera para reducir el riesgo.

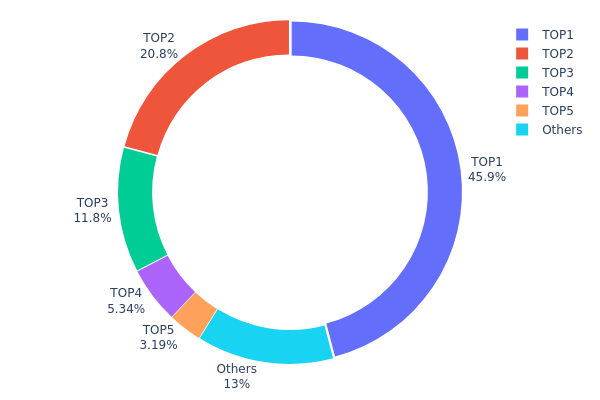

Distribución de tenencias de USDE

Los datos de distribución de direcciones muestran una propiedad muy concentrada en USDE. La dirección principal posee el 45,90 % del suministro total, y las cinco principales controlan en conjunto el 87,02 % de los tokens USDE. Este nivel de concentración genera inquietudes sobre posibles manipulaciones y volatilidad de precios.

Una distribución tan centralizada puede alterar de forma significativa la dinámica del mercado. Los principales tenedores tienen capacidad para influir en el precio y la liquidez de USDE. Cualquier transferencia masiva de tokens desde estas direcciones podría desencadenar fuertes movimientos de precio o crisis de liquidez.

Esta concentración revela además un bajo grado de descentralización en USDE, lo que puede afectar su estabilidad y resistencia a la manipulación. Si bien permite cierto control y supervisión, también introduce riesgos sistémicos y pone en cuestión los principios básicos de las finanzas descentralizadas.

Haz clic para consultar la distribución de tenencias de USDE actual

| Top | Dirección | Cantidad en tenencia | Tenencia (%) |

|---|---|---|---|

| 1 | 0x9d39...7a3497 | 5 739 349,39K | 45,90 % |

| 2 | 0xf977...41acec | 2 600 000,00K | 20,79 % |

| 3 | 0x5d3a...52ef34 | 1 477 278,06K | 11,81 % |

| 4 | 0x28c6...f21d60 | 667 963,01K | 5,34 % |

| 5 | 0x90d2...74cc8f | 398 405,91K | 3,18 % |

| - | Otros | 1 620 221,72K | 12,98 % |

II. Factores clave que influyen en el precio futuro de USDE

Mecanismo de suministro

- Requisito de reservas: Los emisores de USDE deben mantener reservas equivalentes, limitadas a efectivo en dólares, depósitos bancarios asegurados, bonos del Tesoro de corto plazo y acuerdos de recompra respaldados por valores del Tesoro.

- Patrón histórico: Los cambios en los requisitos de reserva han influido históricamente en el precio de las stablecoins y en la confianza del mercado.

- Impacto actual: Se espera que unos requisitos de reserva más estrictos refuercen la estabilidad y la credibilidad de USDE.

Dinámicas institucionales y de grandes tenedores

- Tenencias institucionales: Las principales instituciones están adoptando USDE para pagos internacionales y liquidaciones en mercados de capitales.

- Adopción corporativa: Empresas como Remote.com emplean USDE para la gestión global de nóminas, abarcando 69 países.

- Políticas gubernamentales: La Ley GENIUS de EE. UU. y la Ordenanza de Stablecoins de Hong Kong están definiendo el marco regulatorio para USDE.

Entorno macroeconómico

- Impacto de la política monetaria: Las decisiones de la Reserva Federal sobre los tipos de interés influyen de forma significativa en el valor de USDE.

- Cualidades para cubrir la inflación: USDE se utiliza cada vez más como cobertura frente a la inflación en países como Nigeria, Indonesia, Turquía, Brasil e India.

- Factores geopolíticos: Las relaciones comerciales entre EE. UU. y China y los conflictos internacionales pueden afectar la confianza en USDE.

Desarrollo tecnológico y ecosistema

- Tecnología cross-chain: Las mejoras en la interoperabilidad permiten transferir USDE entre diferentes blockchains, ampliando sus aplicaciones.

- Integración de smart contracts: La mayor funcionalidad de los contratos inteligentes posibilita aplicaciones financieras más avanzadas con USDE.

- Aplicaciones en el ecosistema: USDE se integra en diversos DApps, incluidos exchanges descentralizados y plataformas de préstamos en varias redes blockchain.

III. Predicción del precio de USDE para 2025-2030

Perspectiva para 2025

- Pronóstico conservador: 0,56972 - 0,9995 dólares

- Pronóstico neutral: 0,9995 - 1,14943 dólares

- Pronóstico optimista: 1,14943 - 1,30 dólares (requiere sentimiento positivo de mercado)

Perspectiva para 2027-2028

- Fase de mercado esperada: posible fase de crecimiento

- Rangos de precio previstos:

- 2027: 0,83599 - 1,52601 dólares

- 2028: 1,06986 - 2,03987 dólares

- Catalizadores clave: mayor adopción, expansión del mercado y avances tecnológicos

Perspectiva a largo plazo 2029-2030

- Escenario base: 1,73318 - 2,12314 dólares (con crecimiento estable)

- Escenario optimista: 2,12314 - 2,84501 dólares (si el mercado muestra buen rendimiento)

- Escenario transformador: 2,84501 - 3,00 dólares (en condiciones excepcionales y adopción masiva)

- 31 de diciembre de 2030: USDE 2,12314 dólares (precio medio previsto)

| Año | Precio máximo previsto | Precio medio previsto | Precio mínimo previsto | Variación porcentual |

|---|---|---|---|---|

| 2025 | 1,14943 | 0,9995 | 0,56972 | 0 |

| 2026 | 1,57946 | 1,07446 | 0,6017 | 7 |

| 2027 | 1,52601 | 1,32696 | 0,83599 | 32 |

| 2028 | 2,03987 | 1,42648 | 1,06986 | 42 |

| 2029 | 2,51311 | 1,73318 | 1,31721 | 73 |

| 2030 | 2,84501 | 2,12314 | 1,46497 | 112 |

IV. Estrategias profesionales de inversión y gestión de riesgos en USDE

Metodología de inversión en USDE

(1) Estrategia de tenencia a largo plazo

- Indicada para: inversores conservadores que buscan rentabilidad estable

- Recomendaciones operativas:

- Destina una pequeña parte de tu cartera a USDE como cobertura frente a la inflación

- Promedia el coste de entrada en USDE para reducir la volatilidad a corto plazo

- Almacena USDE en wallets seguras y realiza copias de seguridad

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: observa las tendencias a corto y largo plazo

- Índice de Fuerza Relativa (RSI): detecta situaciones de sobrecompra o sobreventa

- Puntos clave para el trading de rango:

- Monitoriza el sentimiento de mercado y factores macroeconómicos que afectan a las stablecoins

- Establece niveles estrictos de stop-loss y toma de beneficios

Marco de gestión de riesgos para USDE

(1) Principios de asignación de activos

- Inversores conservadores: 1-3 %

- Inversores moderados: 3-5 %

- Inversores agresivos: 5-10 %

(2) Soluciones para cobertura de riesgos

- Diversificación: reparte tu inversión entre varias stablecoins y activos tradicionales

- Uso de derivados: valora opciones o futuros para protegerte ante posibles eventos de desvinculación

(3) Soluciones de almacenamiento seguro

- Wallet caliente recomendada: Gate Web3 Wallet

- Almacenamiento en frío: wallets de hardware para tenencias a largo plazo

- Medidas de seguridad: activa la autenticación en dos pasos, usa contraseñas robustas y mantén el software actualizado

V. Riesgos y desafíos potenciales de USDE

Riesgos de mercado de USDE

- Riesgo de liquidez: posibles problemas en periodos de alta actividad de trading

- Riesgo de volatilidad: fluctuaciones de precio a corto plazo a pesar de ser una stablecoin

- Riesgo competitivo: aparición de nuevas stablecoins con características superiores

Riesgos regulatorios de USDE

- Incertidumbre regulatoria: evolución de la normativa internacional sobre stablecoins

- Desafíos de cumplimiento: dificultades potenciales para adaptarse a futuros requisitos regulatorios

- Riesgos geopolíticos: impacto de políticas internacionales en el uso y adopción de stablecoins

Riesgos técnicos de USDE

- Vulnerabilidades en los smart contracts: riesgos de explotación del código subyacente

- Problemas de escalabilidad: retos para gestionar un mayor volumen de transacciones

- Riesgos de colateral: incidencias potenciales con el mecanismo de cobertura delta sobre Ethereum staked

VI. Conclusión y recomendaciones de acción

Valoración del potencial de inversión de USDE

USDE plantea una propuesta única como stablecoin resistente a la censura y escalable, respaldada por Ethereum staked con cobertura delta. Si bien ofrece potencial a largo plazo en el ecosistema DeFi, los riesgos a corto plazo incluyen incertidumbre regulatoria y desafíos técnicos.

Recomendaciones para invertir en USDE

✅ Principiantes: Empieza con asignaciones pequeñas y prioriza la formación sobre stablecoins y DeFi

✅ Inversores experimentados: Incluye USDE en una cartera diversificada y monitoriza de cerca la evolución del mercado

✅ Inversores institucionales: Evalúa el potencial de USDE para gestión de tesorería y aplicaciones DeFi, realizando una due diligence exhaustiva

Formas de participación en USDE

- Compra directa: Adquiere USDE en Gate.com

- Integración DeFi: Usa USDE en diversos protocolos DeFi para obtener rentabilidad

- Inversión automatizada: Programa compras recurrentes para construir tu posición progresivamente

Invertir en criptomonedas implica riesgos muy elevados, y este artículo no constituye asesoramiento financiero. Toma tus decisiones con cautela según tu tolerancia al riesgo y consulta siempre con profesionales. No inviertas nunca más de lo que puedas permitirte perder.

FAQ

¿Qué es USDe crypto?

USDe es un dólar sintético emitido por Ethena, respaldado íntegramente por stablecoins y criptoactivos. Está colateralizado con futuros perpetuos cortos y puede stakearse para obtener recompensas.

¿Se espera que USDT suba?

No, USDT no está previsto que suba de manera significativa. Como stablecoin, está diseñada para mantener un valor próximo a 1,00 dólar.

¿Cuánto valdrá USDC en 2025?

Se espera que USDC mantenga su paridad de 1 dólar en 2025, con fluctuaciones mínimas en torno a 1,007 dólares según las tendencias actuales.

¿Hamster Kombat Coin llegará a 1 dólar?

Actualmente, Hamster Kombat cotiza a 0,011 dólares; alcanzar 1 dólar sería un hito relevante. Es posible, aunque depende de las condiciones del mercado y la evolución del proyecto.

¿Es Dai (DAI) una buena inversión?: Análisis sobre la estabilidad y el potencial de la stablecoin líder

Predicción del precio de DAI para 2025: ¿Conseguirá la stablecoin mantener su paridad en medio de la volatilidad del mercado?

¿Es Ethena USDe (USDE) una buena inversión?: Análisis del potencial y los riesgos de esta nueva stablecoin

Predicción del precio de RAI en 2025: análisis del crecimiento potencial y de los factores de mercado para el token Reflexer

¿Es crvUSD (CRVUSD) una buena inversión?: Análisis del potencial y los riesgos de la stablecoin de Curve

Predicción del precio de COOK para 2025: análisis de tendencias de mercado y potencial de crecimiento en el ecosistema de finanzas descentralizadas

Guía para participar y reclamar recompensas del airdrop de SEI

Estrategias efectivas para el trading algorítmico en criptomonedas

Comprender la valoración de Bitcoin con el modelo Stock-to-Flow

Comprender cómo la velocidad de las transacciones influye en la eficiencia de la blockchain

Gestión de identidad Web3 con dominios ENS