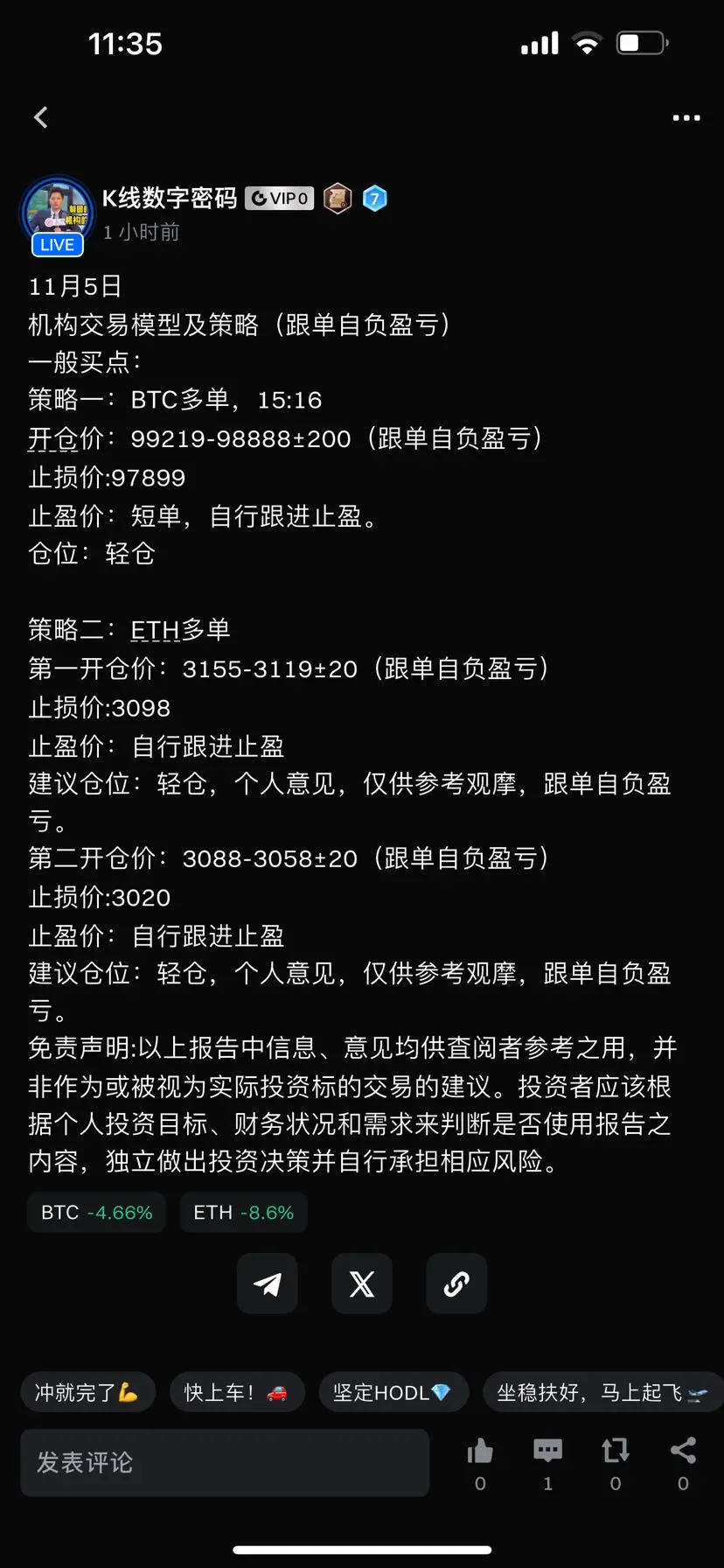

5 de noviembre

Modelos y estrategias de trading institucional (los seguidores asumen la responsabilidad de ganancias y pérdidas)

Puntos de compra generales:

Estrategia uno: posición larga en BTC, 15:16

Precio de apertura: 99219-98888±200 (las pérdidas y ganancias son responsabilidad del que sigue la orden)

Precio de stop-loss:97899

Precio de venta: posición corta, seguimiento de la toma de ganancias por cuenta propia.

Posición: ligera

Estrategia dos: Posición larga en ETH

Precio de apertura inicial: 3155-3119±20 (los seguidores asumen ganancias y pérdidas)

Precio de stop-loss:3098

Precio de to

Ver originalesModelos y estrategias de trading institucional (los seguidores asumen la responsabilidad de ganancias y pérdidas)

Puntos de compra generales:

Estrategia uno: posición larga en BTC, 15:16

Precio de apertura: 99219-98888±200 (las pérdidas y ganancias son responsabilidad del que sigue la orden)

Precio de stop-loss:97899

Precio de venta: posición corta, seguimiento de la toma de ganancias por cuenta propia.

Posición: ligera

Estrategia dos: Posición larga en ETH

Precio de apertura inicial: 3155-3119±20 (los seguidores asumen ganancias y pérdidas)

Precio de stop-loss:3098

Precio de to