Predicción del precio de CTC en 2025: Análisis de tendencias del mercado y potencial de crecimiento futuro

Introducción: Posición de mercado y valor de inversión de CTC

Creditcoin (CTC), la plataforma global de red de crédito, ha avanzado notablemente desde su inicio en 2020. A fecha de 2025, Creditcoin ha alcanzado una capitalización de mercado de 280 272 929 $, con una oferta en circulación aproximada de 486 416 053 tokens y un precio que ronda los 0,5762 $. Este activo, conocido como “facilitador de préstamos entre blockchains”, desempeña un papel cada vez más relevante en la consolidación de un mercado de préstamos en criptomonedas seguro y transparente.

En este artículo encontrarás un análisis pormenorizado de las tendencias de precio de Creditcoin entre 2025 y 2030, atendiendo a patrones históricos, oferta y demanda, evolución del ecosistema y factores macroeconómicos. Todo ello se orienta a ofrecer predicciones profesionales de precio y estrategias de inversión útiles para inversores.

I. Revisión histórica del precio de CTC y situación actual del mercado

Evolución histórica del precio de CTC

- 2021: Máximo histórico de 8,67 $ el 14 de marzo, reflejando un hito importante

- 2023: Caída generalizada del mercado, mínimo histórico de 0,128298 $ el 19 de octubre

- 2025: Fase de recuperación, precio actual en 0,5762 $, con signos de mejora

Situación actual de mercado de CTC

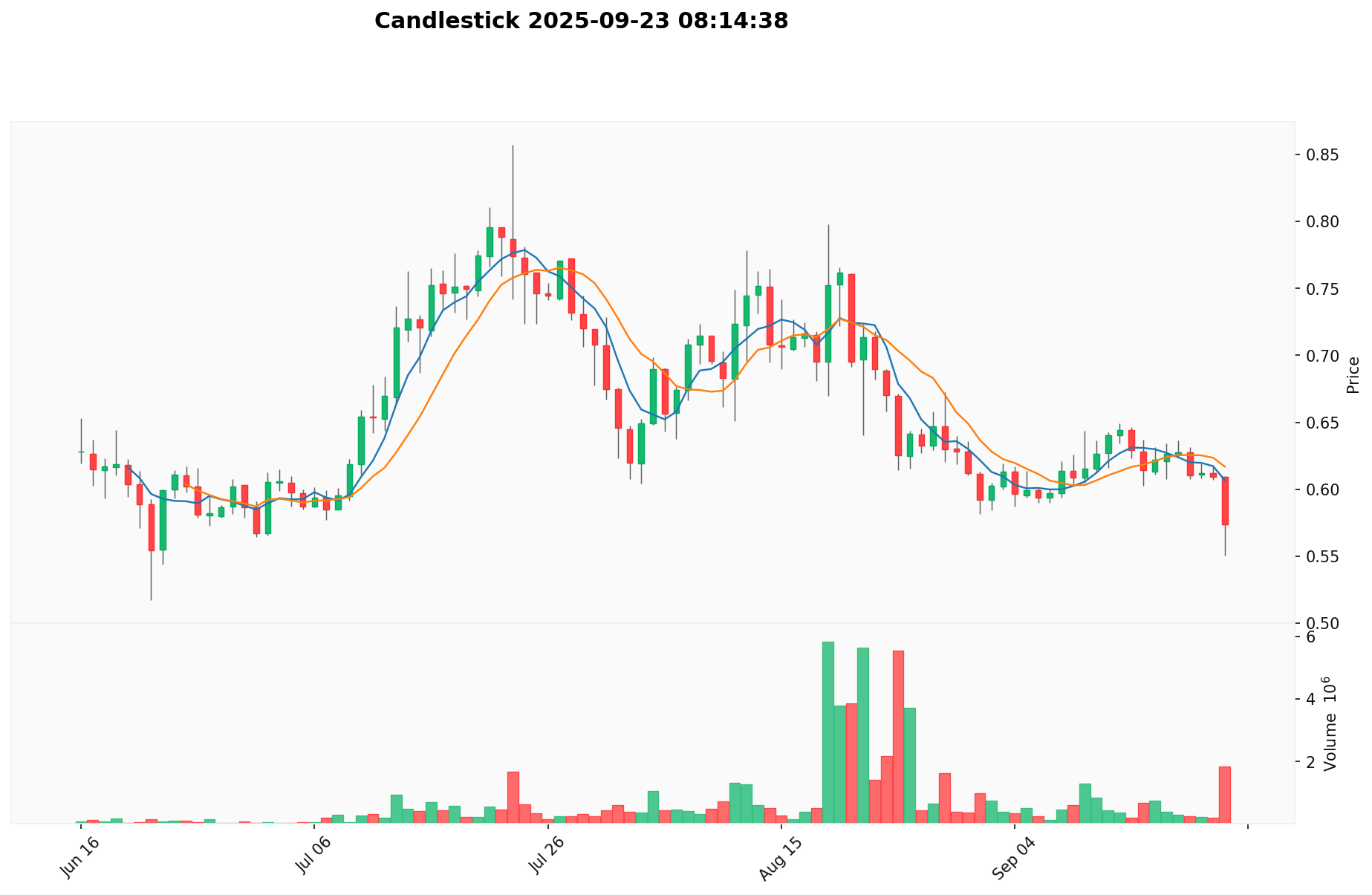

Al 23 de septiembre de 2025, Creditcoin (CTC) cotiza a 0,5762 $, con un volumen negociado en 24 horas de 658 865,90 $. El activo acumula una subida del 1,1 % en las últimas 24 horas, lo que señala un impulso positivo a corto plazo. Sin embargo, en periodos más amplios, CTC ha retrocedido un 6,11 % en la última semana y un 13,37 % en los últimos 30 días, evidenciando presión bajista reciente.

En estos momentos, la capitalización de mercado de CTC asciende a 280 272 929,74 $, situándose en la posición 242 del ranking global de criptomonedas. Su oferta en circulación es de 486 416 053 CTC, equivalente al 81,07 % del suministro total de 549 916 158 CTC. El límite máximo es de 600 000 000 CTC.

El precio actual está muy por debajo del máximo histórico de 8,67 $ registrado el 14 de marzo de 2021, pero considerablemente por encima del mínimo histórico de 0,128298 $ del 19 de octubre de 2023. Se observa, por tanto, recuperación desde su punto más bajo, aunque aún queda un largo recorrido para volver a su anterior techo.

El balance anual muestra una tendencia positiva, con una subida del 28,71 % respecto al año anterior. Esto apunta a una recuperación gradual y mayor interés en el proyecto aun con las últimas correcciones a corto plazo.

Consulta el precio actual de CTC aquí

Indicador de sentimiento de mercado de CTC

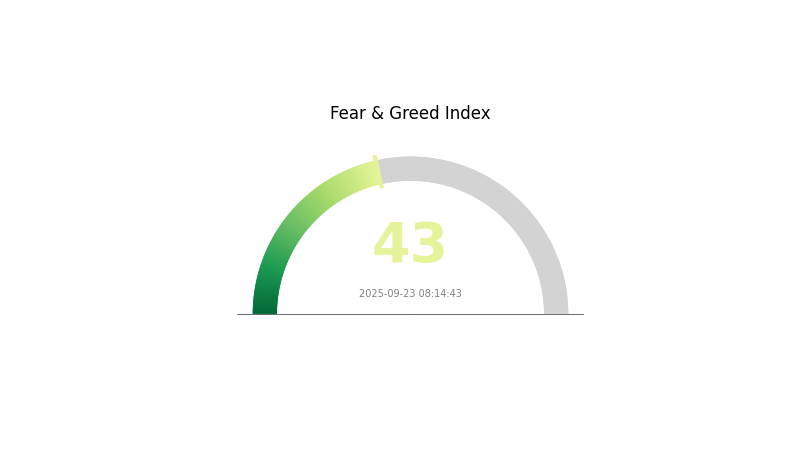

23 de septiembre de 2025, Índice de Miedo y Codicia: 43 (Miedo)

Consulta el Índice de Miedo y Codicia de CTC aquí

El sentimiento en el mercado cripto sigue siendo precavido, ya que el Índice de Miedo y Codicia se sitúa en 43, señalando predominio del miedo. Esto implica que los inversores están indecisos y podrían preferir posiciones más seguras. En estos escenarios, traders experimentados tienden a ver oportunidades de compra siguiendo estrategias contrarias. Es fundamental investigar a fondo y considerar la tolerancia al riesgo antes de invertir. Mantente informado y opera con criterio en Gate.com.

Distribución de tenencias de CTC

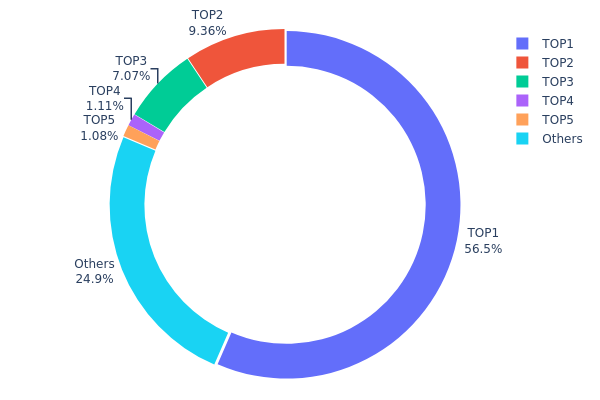

La concentración de tokens entre direcciones principales es elevada; la dirección dominante posee el 56,50 % del suministro total. Las cinco direcciones más relevantes acumulan en conjunto el 75,09 % de CTC, quedando el restante 24,91 % repartido entre otras direcciones.

Este nivel de concentración genera riesgos apreciables de manipulación de mercado y volatilidad de precio. El control por parte de la dirección dominante puede influir notablemente en la liquidez y los movimientos del token, pudiendo desencadenar oscilaciones abruptas si se movilizan grandes tenencias.

El análisis de la estructura del mercado revela un bajo grado de descentralización en CTC. Esta concentración puede debilitar la resiliencia frente a shocks y afectar la estabilidad general. Es recomendable que inversores y traders analicen estos patrones antes de valorar el comportamiento y potencial a largo plazo del activo.

Consulta la distribución actual de tenencias de CTC aquí

| Top | Dirección | Cantidad en tenencia | Tenencia (%) |

|---|---|---|---|

| 1 | 0xca4d...ee7527 | 310 548,31K | 56,50 % |

| 2 | 0x43fd...a20a8a | 51 433,57K | 9,35 % |

| 3 | 0x611f...dfb09d | 38 878,14K | 7,07 % |

| 4 | 0xf819...c873aa | 6 076,63K | 1,10 % |

| 5 | 0xa312...4ab647 | 5 915,74K | 1,07 % |

| - | Otros | 136 711,87K | 24,91 % |

II. Factores clave que incidirán en el precio futuro de CTC

Mecanismo de suministro

- Halving: CTC realiza ciclos de halving periódicos reduciendo recompensas y nueva emisión de monedas.

- Patrones históricos: Los halvings anteriores han propiciado subidas de precio por la menor inflación de suministro.

- Impacto actual: El próximo halving podría ejercer presión alcista sobre CTC.

Entorno macroeconómico

- Política monetaria: Los grandes bancos centrales tienden a mantener políticas expansivas, lo que favorece a CTC como activo alternativo.

- Protección frente a la inflación: CTC muestra correlaciones con la inflación, atrayendo inversores que buscan cobertura ante la depreciación monetaria.

Desarrollo técnico y crecimiento del ecosistema

- Layer 2 Scaling: Las soluciones Layer 2 aumentan la velocidad de transacción y reducen las comisiones.

- Contratos inteligentes: El desarrollo de funcionalidades amplía la utilidad de CTC en DeFi y aplicaciones descentralizadas.

- Aplicaciones de ecosistema: Crecen los DApps y proyectos DeFi en la blockchain de CTC, reforzando su valor global.

III. Predicción de precio de CTC 2025-2030

Perspectivas para 2025

- Estimación conservadora: 0,53642 $ - 0,5768 $

- Estimación neutral: 0,5768 $ - 0,70 $

- Estimación optimista: 0,70 $ - 0,80175 $ (con sentimiento de mercado favorable)

Perspectivas 2027-2028

- Posible ciclo alcista en el mercado

- Rango estimado de precios:

- 2027: 0,78577 $ - 1,17453 $

- 2028: 0,51042 $ - 1,12093 $

- Catalizadores principales: mayor adopción, evolución tecnológica y crecimiento del mercado cripto

Perspectiva a largo plazo 2029-2030

- Escenario base: 1,00 $ - 1,13514 $ (si el mercado crece de forma estable)

- Escenario optimista: 1,13514 $ - 1,33947 $ (si el mercado muestra gran fortaleza)

- Escenario transformador: 1,33947 $+ (en condiciones extremadamente favorables)

- 31 de diciembre de 2030: CTC a 1,13514 $ (un 97 % más que en 2025)

| Año | Precio máximo previsto | Precio medio previsto | Precio mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,80175 | 0,5768 | 0,53642 | 0 |

| 2026 | 0,96499 | 0,68928 | 0,4756 | 19 |

| 2027 | 1,17453 | 0,82713 | 0,78577 | 43 |

| 2028 | 1,12093 | 1,00083 | 0,51042 | 73 |

| 2029 | 1,2094 | 1,06088 | 0,67896 | 84 |

| 2030 | 1,33947 | 1,13514 | 0,76054 | 97 |

IV. Estrategias de inversión profesional y gestión de riesgos para CTC

Metodología de inversión en CTC

(1) Estrategia de tenencia a largo plazo

- Indicada para inversores con alta tolerancia al riesgo y visión a largo plazo

- Recomendaciones prácticas:

- Acumula CTC en correcciones de mercado

- Fija objetivos de precio y sigue tu estrategia

- Almacena CTC en hardware wallets o soluciones de custodia seguras

(2) Estrategia de trading activo

- Herramientas técnicas recomendadas:

- Medias móviles: Para identificar tendencias y puntos clave de entrada/salida

- RSI (Índice de Fuerza Relativa): Para detectar zonas de sobrecompra o sobreventa

- Aspectos clave de swing trading:

- Monitoriza el sentimiento de mercado y catalizadores informativos

- Configura stop-loss para limitar el riesgo

Marco de gestión de riesgos CTC

(1) Principios de asignación de activos

- Inversores conservadores: 1-3 % de la cartera

- Inversores agresivos: 5-10 % de la cartera

- Inversores profesionales: hasta un 15 % de la cartera

(2) Soluciones de cobertura

- Diversificación: distribuye tu inversión entre distintas criptomonedas y clases de activos

- Estrategia con opciones: emplea opciones put para protegerte de caídas

(3) Medidas de almacenamiento seguro

- Recomendación de hardware wallet: Gate Web3 Wallet

- Almacenamiento en frío: dispositivos offline para grandes tenencias

- Precauciones: activa autenticación de dos factores, usa contraseñas robustas y extrema precaución ante intentos de phishing

V. Riesgos y desafíos potenciales para CTC

Riesgos de mercado

- Alta volatilidad: los precios en cripto pueden variar drásticamente

- Riesgo de liquidez: CTC podría sufrir falta de liquidez en situaciones de estrés

- Riesgo de correlación: movimientos fuertemente ligados al conjunto del mercado cripto

Riesgos regulatorios

- Incertidumbre normativa: las reglas globales cambiantes pueden afectar la adopción de CTC

- Dificultad de cumplimiento: retos para adaptarse a nuevas exigencias regulatorias

- Restricciones internacionales: diferencias legales pueden limitar la expansión global de CTC

Riesgos técnicos

- Vulnerabilidades en contratos inteligentes: posibilidad de errores o exploits

- Cuestiones de escalabilidad: dificultad para manejar mayores volúmenes de transacciones

- Problemas de interoperabilidad: obstáculos para integrarse con otras blockchains

VI. Conclusión y recomendaciones

Evaluación del valor de inversión de CTC

Creditcoin (CTC) presenta potencial como plataforma global crediticia, aunque se enfrenta a riesgos por la volatilidad y la regulación. Su éxito dependerá de la adopción y el desarrollo tecnológico en el segmento de préstamos blockchain.

Recomendaciones para invertir en CTC

✅ Principiantes: Empieza con importes modestos y da prioridad a la formación

✅ Inversores experimentados: Adopta estrategias equilibradas, revisando y ajustando tu cartera de forma periódica

✅ Institucionales: Realiza una "due diligence" rigurosa y contempla CTC como parte de una estrategia diversificada

Formas de operar con CTC

- Trading spot: Compra y venta de CTC en el mercado spot de Gate.com

- Trading de futuros: Opera contratos futuros para exposición apalancada

- Staking: Participa en programas de staking de CTC cuando estén disponibles en la plataforma

La inversión en criptomonedas supone un riesgo muy elevado y este artículo no constituye una recomendación financiera. Toma decisiones con cautela, ajustándote a tu tolerancia al riesgo y consulta siempre a un asesor profesional. Nunca inviertas más de lo que puedas asumir perder.

Preguntas frecuentes

¿Qué criptomoneda puede multiplicar por mil?

No es posible predecirlo con certeza, pero los proyectos emergentes en IA, DeFi e infraestructura Web3 podrían experimentar grandes subidas. Investiga siempre a fondo antes de invertir.

¿Qué es CTC en el ámbito cripto?

CTC es el token nativo de la red Creditcoin, una blockchain orientada a facilitar préstamos internacionales y crear historiales crediticios.

¿Tiene futuro la criptomoneda de Simon’s Cat?

La criptomoneda de Simon’s Cat tiene potencial. El auge de las meme coins y los NFT puede impulsarla, especialmente si explora casos de uso innovadores o alianzas en el entorno digital de mascotas.

¿Las monedas Hamster pueden llegar a 1 $?

Es improbable pero posible. El éxito requeriría adopción masiva y fuerte crecimiento, aunque el mercado cripto sigue siendo muy volátil e impredecible.

Compartir

Contenido