Monitoring and Early-Warning Systems

In this module, learners will explore the specific metrics that must be observed, the architecture of reliable alerting systems, the data sources and oracles required to support such visibility, and the role of both on-chain and off-chain information in building robust early-warning systems.

Key Metrics for Stablecoin Monitoring

A comprehensive monitoring strategy begins with identifying which metrics provide meaningful and timely indicators of system health. The most direct signal is the deviation of the stablecoin’s market price from its target peg. Even a small and sustained deviation, such as a price of $0.997 instead of $1.000, can indicate imbalance between supply and demand, potential reserve strain, or impaired liquidity. It is essential to track not only the spot price on a single venue but also the volume-weighted average price across multiple trading pairs and exchanges, both centralized and decentralized.

Beyond price data, volume metrics reveal significant behavioural changes. A sudden surge in trading volume, particularly in sell orders, may indicate investor panic or coordinated exits. Similarly, a sharp increase in on-chain redemption activity, whether through smart contracts or off-chain settlement requests, can signal emerging liquidity risk. Tracking the rate of redemptions per unit time helps detect these patterns before the system becomes overwhelmed.

The composition and movement of reserves also demand close attention. For fiat-backed stablecoins, reserve changes reported through issuer dashboards or attestation feeds should be matched against changes in circulating supply. Any mismatch or unexplained fluctuation suggests a breakdown in either internal controls or disclosure practices. In crypto-collateralized models, collateralization ratios, liquidation queues, and debt ceilings are continuously monitored to assess solvency risk.

Stablecoin supply changes are another important indicator. Unusual minting or burning activity, especially if not aligned with clear market demand, can distort pricing and erode trust. Additionally, wallet concentration data may show whether the stablecoin supply is overly held by a small number of entities, increasing systemic fragility. In all cases, metrics must be timestamped, consistent across platforms, and subject to historical trend analysis to separate noise from actionable signals.

Oracles and Data Reliability

Stablecoins rely heavily on oracles for price feeds, reserve valuations, and sometimes even control flow logic within smart contracts. Oracles are external data sources that deliver information from the off-chain world into on-chain environments. The integrity, latency, and redundancy of these feeds are critical to maintaining stablecoin parity and ensuring that automated responses do not trigger prematurely or fail to execute in time.

Oracle systems must balance multiple requirements. Data must be accurate and reflect fair market value, ideally across multiple liquidity venues. Timeliness is crucial, especially during volatility spikes, where stale prices can result in incorrect liquidations or false-positive peg deviation alerts. For high-frequency systems, the use of time-weighted average prices (TWAP) helps smooth out short-term volatility but may introduce delay in recognizing fast-moving crises.

Decentralized oracle networks, such as those used by major DeFi protocols, aggregate data from multiple sources and use consensus mechanisms to prevent manipulation. While these systems are more resilient than single-point or manually updated oracles, they are not immune to attack vectors such as flash loan manipulation or collusion. Centralized oracles, often used by custodial stablecoin issuers, may be faster but depend on trusted providers and require additional governance safeguards.

Oracle redundancy is necessary to avoid reliance on a single provider or data stream. A well-designed monitoring system cross-verifies price feeds across oracles and flags inconsistencies. In addition to price data, oracles may deliver reserve data, exchange rates for foreign currency reserves, or even macroeconomic indicators relevant to hybrid or algorithmic stablecoins. Each feed must be validated and secured against tampering, latency spikes, and downtime.

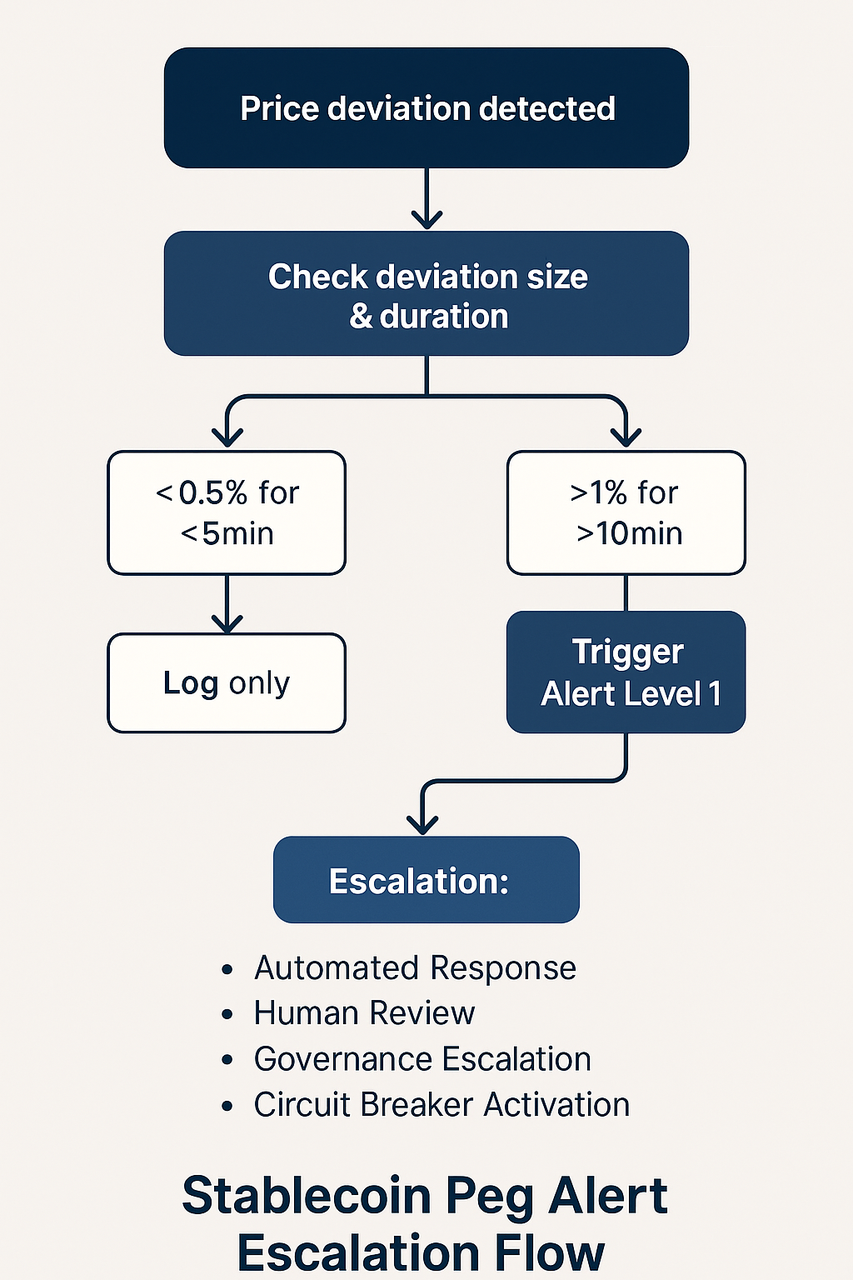

Building Alert Systems and Escalation Rules

Monitoring becomes actionable only when alerts are well-designed, threshold-based, and integrated with escalation protocols. Alerts serve as the system’s nervous response to detect early signs of failure or drift. A peg deviation of 0.1% for one minute may not trigger a concern, but the same deviation persisting for ten minutes or expanding to 0.5% can indicate a liquidity imbalance or impaired arbitrage.

Alert rules should be calibrated based on historical volatility, average trading volume, and the expected behaviour of the stablecoin under normal conditions. They must also account for variance across exchanges. For example, decentralized exchanges may show higher volatility due to thinner liquidity, while centralized exchanges often reflect more stable pricing.

Escalation logic should define multiple alert levels. A first-level alert might be purely observational, logging the event and notifying analysts. A second-level alert might trigger automated responses such as increased oracle frequency or rebalancing of liquidity pools. A third-level alert, reserved for critical events, might halt redemptions, trigger circuit breakers, or escalate directly to a governance council or operations team.

Time thresholds, volume thresholds, and cross-market confirmation rules all play a role in refining alert accuracy. False positives erode trust in monitoring systems, while false negatives delay critical interventions. Alerts should be timestamped, archived, and auditable. In high-assurance environments, they may also be signed and stored on-chain for forensic purposes.

Dashboards displaying alert status, trigger history, and current peg deviation metrics should be accessible to operational stakeholders. In many cases, visual indicators such as coloured risk levels and historical charts enhance real-time decision-making. However, visual dashboards must be backed by reliable backend logic and automated data ingestion from validated sources.

Integrating On-Chain and Off-Chain Monitoring Systems

Robust monitoring frameworks require integration of both on-chain and off-chain data sources. On-chain data includes token transfer volumes, collateral ratios, smart contract event logs, and protocol-specific metrics such as mint and burn transactions. These data points are transparent, accessible via blockchain explorers, and can be queried in near real time using indexing services or custom analytics tools.

Off-chain data, by contrast, includes order book depth on centralized exchanges, reserve attestations, fiat redemption queues, and macroeconomic factors affecting reserve valuation. For fiat-backed stablecoins, reserve reports published by custodians or audit firms are essential off-chain inputs. While these may only be updated daily or weekly, they provide critical context for evaluating the health of the backing system.

Successful monitoring platforms aggregate these inputs into a unified view. This may involve bridging traditional financial data pipelines with blockchain analytics tools. In practice, many stablecoin issuers operate proprietary dashboards that combine on-chain metrics, price feeds, and reserve data into a real-time console for internal use and public transparency. Some protocols also expose public APIs that allow third-party risk analysts to build their own monitoring systems.

Cross-source validation improves confidence in the observed metrics. For example, a reported decrease in circulating supply should correspond with on-chain burn transactions and a reserve ledger update. Discrepancies between these domains may indicate reporting lag, data manipulation, or operational error. Alerting systems should detect these mismatches and escalate them as anomalies, even in the absence of a peg deviation.

Practical Frameworks and Simulation

To internalize the monitoring architecture, it is useful to simulate the behaviour of a basic alert system. Assume a fiat-backed stablecoin that is trading on three major exchanges and has a stated peg of $1.00. Monitoring agents retrieve price data every sixty seconds and calculate a moving average. If the price on two or more exchanges falls below $0.993 for five consecutive readings, a level-one alert is issued. If the deviation exceeds $0.985 and lasts more than ten minutes, a level-three alert is triggered, and automated systems pause minting while escalating the incident to human operators.

This simplified framework reflects real-world practice. Stablecoin issuers typically maintain incident response playbooks that tie alert thresholds to predefined actions. These may include rebalancing liquidity across exchanges, communicating with market makers, or publishing public notices. In DeFi environments, the same alerts may trigger on-chain governance votes or activate smart contract-based pause functions.

Simulations are often conducted during periods of normal operation to test system responsiveness. These dry-run events help identify misconfigured thresholds, missing data sources, or alert delivery failures. For institutional-grade stablecoins, regulators or audit firms may also request periodic demonstrations of alerting infrastructure as part of operational due diligence.