Foundations: Stablecoins, Value Models, and Risk Taxonomy

This module lays the foundation for understanding how stablecoins function and why risk management is critical in their design and maintenance. It introduces the different types of stablecoin architectures and provides a structured overview of the risk categories associated with them. The goal is to enable learners to build a stable conceptual model that informs all future modules. By the end of this module, learners should be able to classify stablecoins by design, understand their core use cases, and identify where key risks originate within different operational models.

Understanding Stablecoins and Their Core Function

A stablecoin is a digital asset designed to maintain a fixed value relative to a reference asset. In most cases, this reference asset is the U.S. dollar, but some stablecoins are also pegged to other fiat currencies, baskets of assets, or commodities such as gold. Unlike volatile cryptocurrencies, the defining feature of a stablecoin is its attempt to provide price stability while preserving the programmable, transferable, and open-access nature of crypto tokens.

Stablecoins serve several core purposes in the digital economy. They act as a settlement layer for cryptocurrency exchanges, enable cross-border remittances without relying on banking intermediaries, and provide a stable unit of account for decentralized finance (DeFi) applications. In environments with unstable local currencies or capital controls, stablecoins have also emerged as informal alternatives to traditional banking systems. Their growth has been driven by demand for liquidity, interoperability across blockchain platforms, and the increasing use of programmable finance.

The stability of these tokens, however, is not guaranteed. Instead, it relies on the underlying design mechanisms, reserve assets, market incentives, and governance frameworks that each issuer or protocol implements. This raises questions of how trust is engineered in the absence of formal deposit insurance, central bank backing, or regulatory guarantees. The remainder of this module unpacks the structural models used to design stablecoins and introduces the major categories of risk each model must navigate.

Types of Stablecoin Architectures

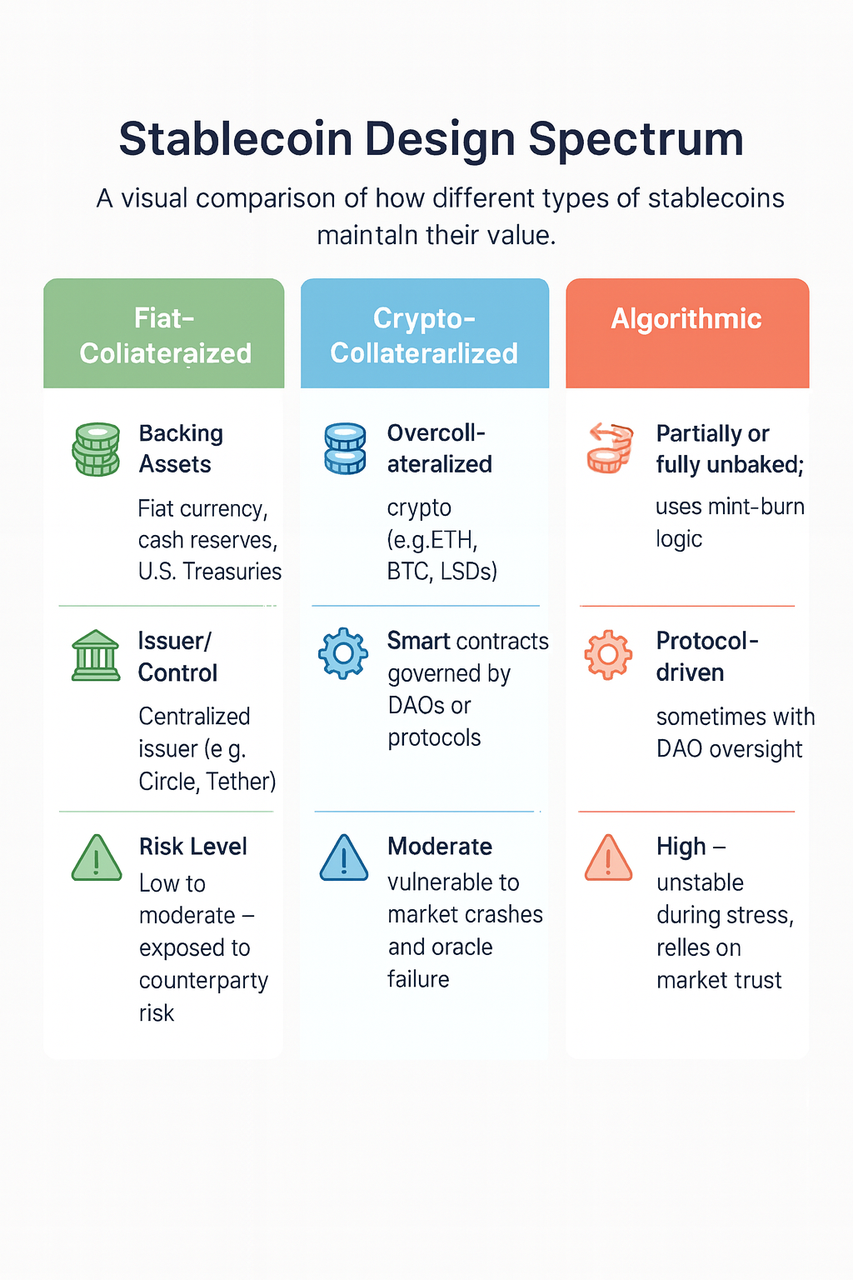

Stablecoins differ fundamentally in how they maintain their peg. The three most widely implemented models are fiat-collateralized, crypto-collateralized, and algorithmic. Each represents a distinct trade-off between trust, transparency, capital efficiency, and systemic resilience.

Fiat-collateralized stablecoins are issued by centralized entities that hold reserves in traditional financial assets. These reserves are typically composed of cash, short-term government bonds, or other low-risk instruments held in bank accounts or custodial trusts. The issuer commits to redeeming each token for a fixed amount of fiat currency. This model is relatively simple and has gained wide adoption due to its predictability and clarity of redemption. However, it introduces centralized custody risk, regulatory exposure, and the need for third-party audits or attestations to maintain user confidence.

Crypto-collateralized stablecoins take a different approach. These are often managed by smart contracts and require users to deposit digital assets as overcollateralization. The value of the collateral exceeds the value of the issued stablecoins to account for market volatility. When collateral value falls below a certain threshold, automated liquidation mechanisms are triggered. This model offers greater transparency since reserves are verifiable on-chain. Nevertheless, it is sensitive to market fluctuations and relies heavily on oracle accuracy and the timely execution of liquidations to avoid insolvency.

Algorithmic stablecoins attempt to maintain their peg without full collateral backing. Instead, they use economic incentives, mint-and-burn mechanisms, and sometimes seigniorage-style modules to expand or contract supply. These systems are often designed to be more capital-efficient, but their resilience depends on market trust and game-theoretic assumptions about user behavior. In stressed conditions, such mechanisms have failed to maintain their peg, sometimes with catastrophic consequences, as seen in the case of TerraUSD.

Some stablecoins combine elements of these models, incorporating partial collateral, algorithmic stabilization, and discretionary governance. These hybrid models aim to strike a balance between decentralization and control, but they often introduce complexity that can obscure systemic risks. The choice of architecture shapes how a stablecoin responds to shocks and what mechanisms are available to manage emerging threats.

Stablecoin Use Cases and Functional Roles

Stablecoins play several roles within digital economies and are now integral to both retail and institutional crypto adoption. Their most visible application is as a trading pair on centralized and decentralized exchanges. By offering a stable quote asset, they enable users to manage volatility and settle trades without converting back into fiat.

Beyond exchanges, stablecoins function as a key infrastructure layer in DeFi protocols. They are used as collateral, borrowed assets, liquidity pool constituents, and accounting units in smart contracts. This makes their reliability central to the solvency and functionality of other financial primitives.

In emerging markets, stablecoins are increasingly used for payments and remittances, where local currencies are volatile or capital controls are stringent. The low cost, instant settlement, and censorship-resistance of blockchain networks make stablecoins a viable alternative to traditional remittance channels, especially when paired with mobile wallets.

For institutions, stablecoins offer programmable liquidity that can be integrated into treasury operations, payment flows, or cross-border settlements. In some cases, they also serve as a testbed for central bank digital currency (CBDC) experiments or public-private partnerships in digital payments.

As the use of stablecoins expands, so does the scale of associated risks. Every use case introduces specific threat vectors. For example, their use as collateral in leveraged protocols amplifies the consequences of a depeg. In payments, reliability and convertibility become non-negotiable. The following section introduces the risk taxonomy that practitioners must understand to build robust monitoring and defense strategies.

Risk Taxonomy in Stablecoin Systems

Understanding the full range of risks associated with stablecoins requires a systematic taxonomy that covers financial, technical, operational, and governance dimensions. These risks are not hypothetical. Many have already materialized in past incidents and have led to loss of funds, market contagion, and systemic instability.

Market risk refers to the potential for adverse price movements in collateral assets or secondary markets. For crypto-collateralized stablecoins, a sudden drop in the value of deposited collateral can trigger forced liquidations or insolvency. In fiat-backed models, market risk is lower, provided reserves are held in low-volatility instruments.

Liquidity risk arises when a stablecoin cannot meet redemption requests or when market depth is insufficient to facilitate large trades without significant price impact. This often becomes critical during stress events, when redemption queues form or when stablecoins trade at a discount on secondary markets.

Credit and counterparty risk relate to the financial health of entities holding or managing reserves. If a custodian bank, payment processor, or issuer experiences insolvency, reserve access may be frozen or impaired. This risk is amplified in jurisdictions with weak regulatory oversight or where issuer structures are opaque.

Reserve risk focuses on the composition, duration, and legal structure of the backing assets. Some stablecoins use commercial paper, corporate bonds, or repos that may become illiquid or lose value during crises. Maturity mismatches can also create redemption bottlenecks.

Smart contract risk stems from vulnerabilities in the code managing stablecoin issuance, collateralization, or liquidity controls. These risks are relevant for decentralized stablecoins and may include bugs, exploits, or governance flaws in upgradable contracts.

Oracle risk is tied to the reliability and latency of data feeds that determine collateral valuations or trigger stabilizing mechanisms. Inaccurate or delayed price data can result in undercollateralization or improper minting and burning events.

Governance risk relates to the structure and transparency of decision-making processes. In many stablecoin protocols, emergency powers, parameter changes, and pausing mechanisms are governed by multisig committees or DAOs. Weak governance may lead to delayed responses or exploitation.

Legal and regulatory risk involves the likelihood of enforcement actions, license revocations, or prohibitions by financial regulators. Issuers that operate without clear compliance frameworks may face legal constraints that directly affect their ability to issue or redeem tokens.

Operational risk includes failures in internal processes, human error, system outages, or communication breakdowns that impair stablecoin functioning. These risks are often underestimated but can become critical in real-time systems handling billions in value.

This taxonomy provides a framework to evaluate any stablecoin and anticipate how risks may compound. In practice, multiple risks interact. For example, an oracle failure may trigger a liquidity crisis, which then exposes governance bottlenecks and regulatory scrutiny.

Lessons from Historical Depegging Events

The collapse of TerraUSD (UST) in May 2022 remains the most prominent example of an algorithmic stablecoin losing its peg. UST used a mint-and-burn mechanism tied to a volatile asset (LUNA) to maintain parity with the U.S. dollar. When market confidence eroded, redemptions surged, and the price of LUNA collapsed under reflexive selling pressure. The system entered a death spiral, wiping out over $40 billion in market value and triggering regulatory investigations globally.

Several design weaknesses became clear. The lack of fully-backed reserves, reliance on endogenous collateral, and insufficient liquidity provisioning meant the protocol had no credible defense against a large-scale redemption. Moreover, the governance process was unable to respond quickly to market stress. This case demonstrated that algorithmic stability mechanisms, if not backed by credible reserves and clear market incentives, may fail catastrophically under pressure.

Other incidents, such as temporary depegs of USDC and TUSD during periods of banking stress or market volatility, show that even fiat-backed models are not immune to liquidity and counterparty risks. In each case, transparency, timely communication, and the strength of reserve assets played a critical role in restoring trust.

Practical Checklist for Stablecoin Evaluation

Evaluating a stablecoin requires a structured approach that draws on the risk taxonomy discussed above. While each model has different parameters, certain red flags can serve as early indicators of instability. Absence of regular attestation reports or delays in audit releases suggest issues with reserve transparency. Concentration of reserves in unregulated or offshore jurisdictions increases credit and legal risk. Redemption frictions, such as withdrawal limits or prolonged delays, may indicate liquidity stress.

Other warning signs include rapid changes in circulating supply without corresponding reserve updates, opaque governance structures, or unexplained smart contract modifications. For algorithmic models, the absence of credible backstop mechanisms or reliance on endogenous assets should be treated with caution. Price tracking tools that show persistent deviations from peg across major markets also warrant scrutiny.

This checklist is not exhaustive but forms a starting point for institutional risk teams, protocol developers, or regulators assessing stablecoin robustness.