2025 VIRTUAL Fiyat Tahmini: Dijital varlık için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

Giriş: VIRTUAL'ın Piyasa Konumu ve Yatırım Potansiyeli

Virtual Protocol (VIRTUAL), oyun sektöründe yapay zekâya öncülük eden bir platform olarak kuruluşundan bu yana kayda değer ilerleme göstermiştir. 2025 yılı itibarıyla VIRTUAL’ın piyasa değeri $503.115.141 seviyesine ulaşırken, yaklaşık 655.695.479 dolaşımdaki token ile fiyatı $0,7673 civarında seyretmektedir. "AI Gaming Enabler" olarak anılan bu varlık, demokratik yapay zekâ ile oyunları desteklemede giderek daha kritik bir rol üstleniyor.

Bu makale, VIRTUAL’ın 2025 ila 2030 arasındaki fiyat hareketlerini kapsamlı biçimde inceleyecek; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ile yatırımcılara pratik stratejiler sunacaktır.

I. VIRTUAL Fiyat Geçmişi ve Güncel Piyasa Durumu

VIRTUAL Tarihsel Fiyat Seyri

- 2024: Proje başlatıldı; fiyat $0,132 düzeyinde dalgalandı

- 2025 Ocak: Tüm zamanların zirvesi $5,1428

- 2025 Temmuz: Piyasa düzeltmesiyle fiyat $0,01973 ile en düşük seviyeye indi

VIRTUAL Güncel Piyasa Görünümü

17 Ekim 2025 tarihiyle VIRTUAL, $0,7673 seviyesinden işlem görmektedir ve kripto piyasasında 153. sıradadır. Son 24 saatte %1,63’lük hafif bir düşüş yaşanırken işlem hacmi $10.458.202 olarak kaydedilmiştir. VIRTUAL’ın piyasa değeri $503.115.141 olup toplam piyasa payının %0,019’unu oluşturmaktadır.

Mevcut fiyat, 2 Ocak 2025’teki $5,1428’lik zirvenin oldukça altında; 5 Temmuz 2024’teki $0,01973’lük en düşük seviyenin ise epey üzerindedir. Son hafta VIRTUAL %27,13 oranında sert bir gerileme yaşadı ve satış baskısı arttı. 30 günlük performans ise %38,62’lik daha derin bir düşüş gösteriyor.

Buna rağmen VIRTUAL, son bir yılda %623,96’lık büyüme sergileyerek uzun vadeli yatırımcı ilgisinin güçlü kaldığını gösteriyor. Kısa vadeli dalgalanmalara rağmen projenin uzun vadeli cazibesi belirgin.

Dolaşımdaki VIRTUAL token miktarı 655.695.479 olup, toplam 1 milyar arzın %65,57’sini temsil etmektedir. Bu yüksek dolaşım oranı, tokenların piyasada iyi dağıtıldığını gösterir.

Mevcut VIRTUAL piyasa fiyatını görmek için tıklayın

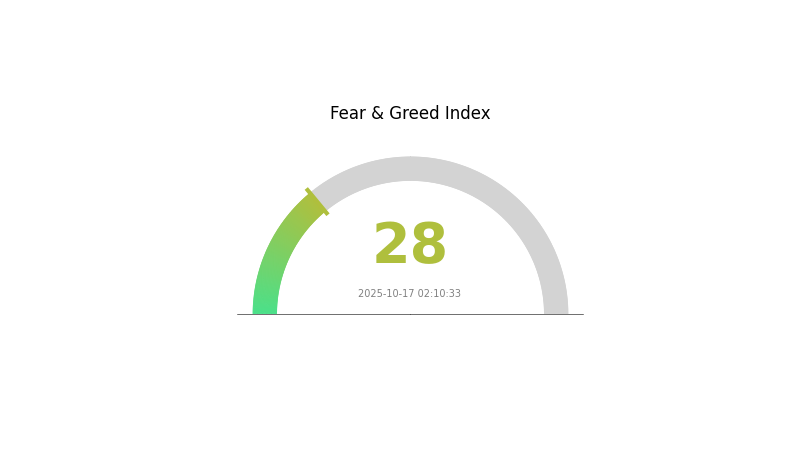

VIRTUAL Piyasa Duyarlılık Göstergesi

17 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasasında şu anda hakim olan duygu korku; Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu, yatırımcıların temkinli davrandığını gösterirken, “başkaları korktuğunda açgözlü ol” prensibini benimseyenler için potansiyel alım fırsatı anlamına gelebilir. Ancak, yatırım kararından önce detaylı inceleme yapmalı ve kendi risk profilinizi gözetmelisiniz. Piyasa duygusu hızla değişebilir; geçmiş performans, gelecekteki sonuçların garantisi değildir.

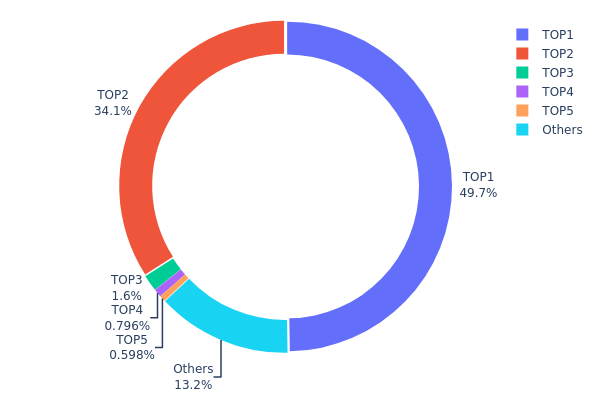

VIRTUAL Varlık Dağılımı

Adres bazlı varlık dağılımı, VIRTUAL’da oldukça yoğun bir sahiplik yapısı olduğunu gösteriyor. İlk iki adres toplam arzın %83,79’unu elinde tutarken; en büyük adres %49,73, ikinci en büyük adres %34,06 paya sahip. Bu aşırı yoğunlaşma, piyasa manipülasyonu ve oynaklık riskini artırıyor.

Böylesi bir dağılım, büyük sahiplerin satış veya transfer yapması durumunda ciddi fiyat dalgalanmalarına yol açabilir. Aynı zamanda düşük merkezsizlik seviyesi, token’ın dayanıklılığı ve yönetişimini olumsuz etkileyebilir. Kalan %16,21’lik pay ise diğer adreslere dağılırken, üçüncü en büyük sahip sadece %1,59’luk bir dilime sahiptir.

Bu dağılım, zincir üstünde istikrarsız bir yapı ve yüksek piyasa riski anlamına gelir. Büyük adres hareketlerini ve bunların VIRTUAL piyasasına etkisini yakından izlemek önem taşır.

Güncel VIRTUAL Varlık Dağılımı için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x3154...0f2c35 | 497.390,79K | 49,73% |

| 2 | 0x3767...0cb081 | 340.652,95K | 34,06% |

| 3 | 0xf977...41acec | 15.976,71K | 1,59% |

| 4 | 0x0d32...465fa2 | 7.958,17K | 0,79% |

| 5 | 0xf1c4...ce71c8 | 5.984,94K | 0,59% |

| - | Diğerleri | 132.036,44K | 13,24% |

II. VIRTUAL’ın Gelecek Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Halving: VIRTUAL’ın arzı düzenli aralıklarla yarıya iner; Bitcoin’deki halving mekanizmasıyla benzerlik gösterir.

- Tarihsel Etki: Önceki yarılanmalar, arz daralması ve kıtlık nedeniyle fiyat artışlarını tetiklemiştir.

- Güncel Etki: Yaklaşan halving, arzın sıkışmasıyla VIRTUAL fiyatında yukarı yönlü baskı oluşturacak beklentisi taşımaktadır.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük finans kuruluşları VIRTUAL varlıklarını artırarak ana akımda kabul gördüğünü gösteriyor.

- Kurumsal Benimseme: Bazı önemli şirketler, VIRTUAL’ı ödeme aracı olarak kabul ediyor veya bilançolarına ekliyor.

- Ulusal Politikalar: Bazı ülkeler VIRTUAL’ı yasal ödeme aracı olarak değerlendirmekte; bu da küresel kullanım ve değeri artırabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının faiz kararları gibi uygulamaları, yatırımcı risk iştahını ve VIRTUAL fiyatını etkileyebilir.

- Enflasyon Koruma Özellikleri: VIRTUAL, tıpkı altın gibi enflasyona karşı koruma aracı olarak görülüyor ve ekonomik belirsizlikte talebi artabiliyor.

- Jeopolitik Etkenler: Küresel siyasi gelişmeler ve gerilimler, VIRTUAL’ın güvenli liman olarak cazibesini artırabilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ölçeklenebilirlik İyileştirmeleri: VIRTUAL ağında kapasite ve işlem hızı artırıcı yenilikler, kullanım ve benimsenme oranını yükseltmektedir.

- Akıllı Sözleşme Yetkinliği: Akıllı sözleşme desteği, VIRTUAL’ın kullanım alanlarını genişletirken ekosisteme daha fazla geliştirici çeker.

- Ekosistem Uygulamaları: Ağda geliştirilen merkeziyetsiz uygulama (DApp) sayısının artışı, hem değer teklifini hem kullanıcı tabanını büyütüyor.

III. VIRTUAL 2025-2030 Fiyat Tahmini

2025 Öngörüsü

- Temkinli tahmin: $0,73728 - $0,768

- Tarafsız tahmin: $0,768 - $0,94

- İyimser tahmin: $0,94 - $1,10592 (olumlu piyasa ve artan benimseme gerektirir)

2027-2028 Öngörüsü

- Piyasa fazı: Artan volatiliteyle büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: $0,88084 - $1,27108

- 2028: $0,62038 - $1,5748

- Ana katalizörler: Teknolojik ilerleme, yaygın kabul ve düzenleyici netlik

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: $1,19017 - $1,45311 (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: $1,45311 - $1,58389 (güçlü performans ve artan işlevsellik şartıyla)

- Dönüştürücü senaryo: $1,58389+ (kitlelerin benimsemesi ve finansal sistem entegrasyonu gibi olağanüstü olumlu koşullarda)

- 2030-31-12: VIRTUAL $1,45311 (%89 artış, 2025 seviyesine göre)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,10592 | 0,768 | 0,73728 | 0 |

| 2026 | 1,293 | 0,93696 | 0,77768 | 22 |

| 2027 | 1,27108 | 1,11498 | 0,88084 | 45 |

| 2028 | 1,5748 | 1,19303 | 0,62038 | 55 |

| 2029 | 1,52231 | 1,38392 | 1,19017 | 80 |

| 2030 | 1,58389 | 1,45311 | 0,92999 | 89 |

IV. VIRTUAL Profesyonel Yatırım Stratejileri ve Risk Yönetimi

VIRTUAL Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- Operasyonel tavsiyeler:

- Piyasa düşüşlerinde VIRTUAL token biriktirin

- Kısmi kâr için fiyat hedefleri belirleyin

- Tokenları güvenli, saklamasız cüzdanlarda muhafaza edin

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç seviyeleri için

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Swing trade için öncelikler:

- AI oyun sektöründeki gelişmeleri yakından izleyin

- Riskleri sınırlamak için stop-loss emirlerini kesin uygulayın

VIRTUAL Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: %5-10

- Profesyonel yatırımcı: %15’e kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: VIRTUAL’ı diğer kripto varlıklarla dengeleyin

- Opsiyon stratejileri: Düşüş riskine karşı koruyucu put opsiyonlarını değerlendirin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki faktörlü doğrulama etkinleştirin, güçlü şifreler kullanın

V. VIRTUAL’ın Potansiyel Riskleri ve Zorlukları

VIRTUAL Piyasa Riskleri

- Yüksek volatilite: Fiyatlar kısa sürede sert şekilde dalgalanabilir

- Spekülatif yapı: Piyasa duyarlılığı ve beklentilerle belirlenir

- Rekabet: Diğer AI oyun projeleri güçlü rakip olarak öne çıkabilir

VIRTUAL Düzenleyici Riskler

- Belirsiz regülasyonlar: Yapay zekâ ve oyun mevzuatı benimsemeyi etkileyebilir

- Sınır ötesi uyum: Farklı ülkelerde çelişkili kurallar söz konusu olabilir

- Token sınıflandırması: VIRTUAL’ın menkul kıymet olarak değerlendirilme olasılığı

VIRTUAL Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya hata riski

- Ölçeklenebilirlik sorunları: Ağ kullanımının artmasıyla performans sıkıntıları yaşanabilir

- AI entegrasyonu karmaşıklığı: Oyunlarda AI uygulamasında teknik engeller

VI. Sonuç ve Eylem Önerileri

VIRTUAL Yatırım Değeri Analizi

VIRTUAL, yükselen AI oyun sektöründe yüksek riskli ve yüksek getiri potansiyelli bir yatırım fırsatı sunar. Uzun vadeli potansiyeli dikkat çekici olsa da, kısa vadeli dalgalanma ve regülasyon belirsizlikleri önemli riskler barındırıyor.

VIRTUAL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Ayrıntılı araştırma sonrası küçük, uzun vadeli pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: Stratejik ortaklıkları ve kapsamlı due diligence süreçlerini değerlendirin

VIRTUAL Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve başlıca borsalarda mevcut

- Vadeli işlem alım-satımı: Deneyimli yatırımcılar için, kaldıraç yönetimine dikkat edilerek

- Stake etme: Varsa ekosistem büyümesine stake programlarıyla katılım

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Her yatırımcı, kendi risk toleransına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Virtual Protocol ne kadar yükselebilir?

Virtual Protocol’ün 14 Kasım 2025’te $0,5948 seviyesine ulaşması beklenmektedir; bu, değer kaybı potansiyeline işaret eder.

VeChain’in 2025 fiyat tahmini nedir?

Makine öğrenimi hesaplamalarına göre VeChain’in 2025 yılında minimum $0,024 ve ortalama $0,025 seviyelerine ulaşacağı öngörülmektedir.

Virtual coin neden değer kaybediyor?

Virtual coin, piyasadaki genel düşüş ve Ether fiyatlarının tarife endişeleriyle gerilemesi nedeniyle değer kaybediyor.

Virtuals, Coinbase’de listelenecek mi?

2025 itibarıyla Virtuals, Coinbase’de listelenmemiştir. Binance vadeli işlemlerde listelemiş olsa da Coinbase, Virtuals için henüz bir listeleme planı açıklamamıştır.

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

2025 NETMIND Fiyat Tahmini: Gelişen yapay zekâ ekosisteminde piyasa trendleri, teknolojiye adaptasyon ve büyüme potansiyeli üzerine analiz

2025 LOT Fiyat Tahmini: Blockchain Oyun Tokenlerinin Geleceğinde Yol Haritası

2025 SKYAI Fiyat Tahmini: Yükselen Yapay Zekâ Teknolojisi İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 FAI Fiyat Tahmini: FAI Token’ın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 OGPU Fiyat Tahmini: GPU Teknolojisindeki Piyasa Eğilimleri ve Teknolojik Gelişmelerin Analizi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması