2025 NETMIND Fiyat Tahmini: Gelişen yapay zekâ ekosisteminde piyasa trendleri, teknolojiye adaptasyon ve büyüme potansiyeli üzerine analiz

Giriş: NETMIND’in Piyasadaki Konumu ve Yatırım Potansiyeli

NetMind Token (NETMIND), yapay genel zekâ (AGI) altyapısını geliştirmeye odaklanan merkeziyetsiz bir hesaplama platformu olarak, kuruluşundan bu yana AI ve blokzincir kesişiminde güçlü bir ilerleme sergilemektedir. 2025 yılı itibarıyla NETMIND’in piyasa değeri 16.773.489 ABD dolarıdır; dolaşımdaki miktarı yaklaşık 53.418.755 token ve fiyatı 0,314 dolar civarındadır. “AI erişilebilirliğini sağlayan varlık” olarak tanımlanan NETMIND, yapay zekânın demokratikleşmesi ve herkes için erişilebilir olması konusunda giderek daha kritik bir rol üstlenmektedir.

Bu makale, NETMIND’in 2025-2030 fiyat eğilimlerini detaylı biçimde analiz edecek; tarihsel seyir, piyasa arz ve talep dengesi, ekosistem gelişimi ve makroekonomik etkenleri göz önünde bulundurarak profesyonel fiyat tahminleri ve yatırımcılar için uygulanabilir stratejiler sunacaktır.

I. NETMIND Fiyat Geçmişi ve Güncel Piyasa Durumu

NETMIND Tarihsel Fiyat Gelişimi

- 2024: Projenin lansmanı, fiyat 2 Aralık’ta tüm zamanların en yüksek seviyesi olan 4,997 dolara ulaştı

- 2025: Piyasa düzeltmesiyle fiyat 1 Ekim’de tüm zamanların en düşük seviyesi olan 0,2712 dolara geriledi

NETMIND Güncel Piyasa Durumu

6 Ekim 2025 tarihi itibarıyla NETMIND, 0,314 dolardan işlem görmektedir. Bu, son 24 saatte %2,78 oranında bir düşüşe işaret etmektedir. NETMIND’in piyasa değeri 16.773.489 ABD doları olup, küresel kripto para piyasasında 1.186’ncı sırada yer almaktadır. Son 24 saatteki işlem hacmi ise 185.974,99 dolardır.

Son dönemdeki düşüşe rağmen NETMIND, kısa vadede %9,76’lık bir toparlanma göstermiştir. Ancak, token son 30 gün içinde %55,15 oranında değer kaybetmiş ve son bir yılda %88,039’luk ciddi bir düşüş yaşamıştır.

Mevcut fiyat, 2 Aralık 2024’te kaydedilen tüm zamanların en yüksek seviyesi olan 4,997 doların %93,72 altında bulunuyor. Dolaşımdaki miktar 53.418.755,37 NETMIND olup, bu rakam toplam arzın %36,2’sini oluşturmaktadır (toplam arz: 147.571.163 token).

Güncel NETMIND piyasa fiyatını görüntülemek için tıklayın

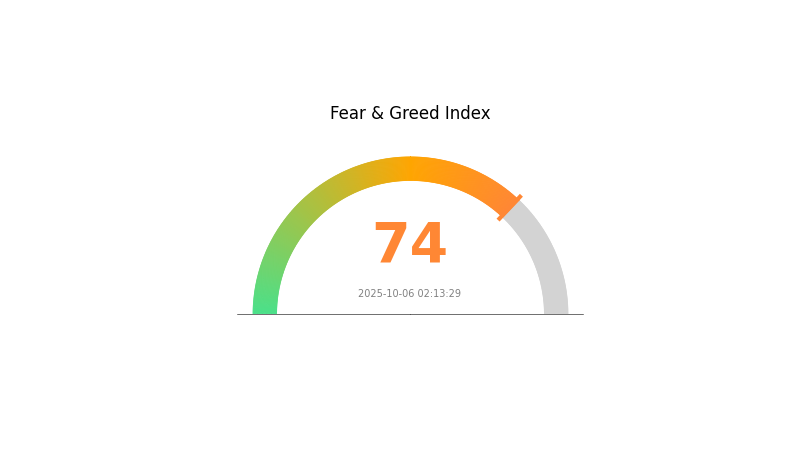

NETMIND Piyasa Duyarlılığı Endeksi

06 Ekim 2025 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto para piyasasında şu anda güçlü bir iyimserlik hakim. Korku ve Açgözlülük Endeksi 74 seviyesine ulaşarak yatırımcıların aşırı güven duyduğu ve piyasanın aşırı alım bölgesine yaklaştığına işaret ediyor. Yükseliş eğilimi kısa vadede fiyatları yukarı taşıyabilir, ancak yatırımcıların temkinli olması ve kâr alımını değerlendirmesi önem taşır. Tarihsel olarak aşırı açgözlülük, piyasa düzeltmelerinden önce gözlemlenmiştir. Bu nedenle çeşitlendirme ve risk yönetimi, dalgalı piyasa koşullarında her zamankinden daha önemlidir.

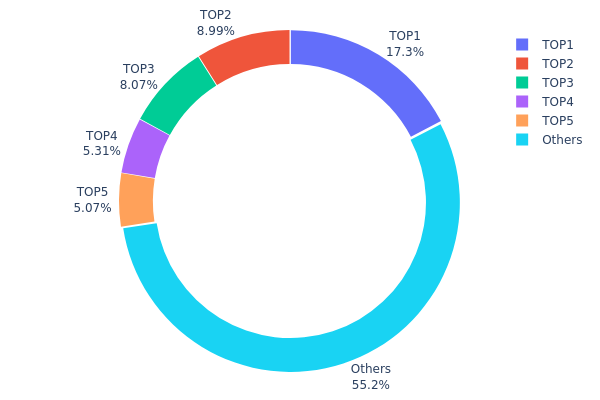

NETMIND Varlık Dağılımı

NETMIND’in adres varlık dağılımı grafiği, üst düzey sahipler arasında orta düzeyde bir yoğunlaşma olduğunu gösteriyor. En büyük adres toplam arzın %17,33’ünü elinde bulundururken, sonraki dört adres sırasıyla %5 ile %9 arasında varlık tutuyor. İlk beş adres, NETMIND tokenlarının %44,73’ünü kontrol ediyor; kalan %55,27 ise diğer adresler arasında dağılmış durumda.

Bu dağılım, belirgin ancak aşırı olmayan bir merkezileşmeye işaret eder. Büyük sahiplerin piyasa dinamikleri ve fiyat hareketleri üzerinde etkisi olabilir. Ancak tokenların yarısından fazlası geniş bir küçük yatırımcı tabanına yayılmıştır; bu da merkeziyetsizliği güçlendirir. Bu denge, tekil bir aktörün piyasa manipülasyonu riskini azaltırken, piyasa istikrarını da destekler.

Mevcut varlık yapısı, NETMIND’in olgunlaşan bir piyasaya sahip olduğunu ve hem büyük hem de küçük katılımcıların varlığının sürdürülebilirlik ve zincir üzerindeki istikrar açısından olumlu bir gösterge olduğunu ortaya koymaktadır.

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xc8d3...4b90d5 | 2.188,20K | 17,33% |

| 2 | 0x1ab4...8f8f23 | 1.134,57K | 8,98% |

| 3 | 0x118e...be1a2b | 1.018,16K | 8,06% |

| 4 | 0x0d07...b492fe | 670,00K | 5,30% |

| 5 | 0x2e8f...725e64 | 639,86K | 5,06% |

| - | Diğerleri | 6.972,66K | 55,27% |

II. NETMIND’in Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Arz ve Talep: NMT tokenlarının fiyatı, piyasa arz-talep dengesiyle şekillenir ve bu durum önemli fiyat dalgalanmalarına neden olabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Katılım: Delphi Digital gibi kripto girişim sermayesi şirketlerinin AI projelerine yatırım yapması, NETMIND için kurumsal ilginin potansiyel göstergesidir.

Makroekonomik Ortam

- Para Politikası Etkisi: Genel ekonomik şartlar ve makroekonomik eğilimler NETMIND’in fiyatını etkiler.

- Jeopolitik Faktörler: Jeopolitik olaylar, NETMIND ile diğer varlıklar arasındaki döviz kurlarını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Blokzincir Teknolojisi: NETMIND’in özgün blokzincir altyapısı ve ekosistemi, yatırımcı ve kullanıcı ilgisini artırarak token fiyatının yükselmesine katkı sağlar.

- GPU Teknolojisi: Platformun temelinde yer alan GPU teknolojisi, gelişim ve potansiyel fiyat artışı açısından kritik bir rol üstlenir.

- Ekosistem Uygulamaları: NETMIND ekosisteminde geliştirilen AI projeleri ve uygulamaları, varlığın değerini ve benimsenmesini doğrudan etkileyebilir.

III. NETMIND 2025-2030 Fiyat Tahminleri

2025 Beklentisi

- Temkinli tahmin: 0,18556 - 0,3145 dolar

- Tarafsız tahmin: 0,3145 - 0,3318 dolar

- İyimser tahmin: 0,3318 - 0,3491 dolar (olumlu piyasa koşulları gerektirir)

2026-2028 Beklentisi

- Piyasa dönemi beklentisi: Kademeli büyüme fazı

- Fiyat aralığı öngörüleri:

- 2026: 0,19244 - 0,37825 dolar

- 2027: 0,29822 - 0,52898 dolar

- 2028: 0,3536 - 0,62765 dolar

- Başlıca katalizörler: Artan benimseme, teknolojik ilerleme ve genel kripto piyasasında toparlanma

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,53482 - 0,62575 dolar (istikrarlı piyasa büyümesi varsayımı)

- İyimser senaryo: 0,62575 - 0,71667 dolar (güçlü piyasa performansı varsayımı)

- Dönüştürücü senaryo: 0,71667 - 0,6758 dolar (son derece olumlu piyasa şartlarında)

- 31 Aralık 2030: NETMIND 0,62575 dolar (yıl sonu düzeltmesi öncesinde potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,3491 | 0,3145 | 0,18556 | 0 |

| 2026 | 0,37825 | 0,3318 | 0,19244 | 5 |

| 2027 | 0,52898 | 0,35502 | 0,29822 | 13 |

| 2028 | 0,62765 | 0,442 | 0,3536 | 40 |

| 2029 | 0,71667 | 0,53482 | 0,28346 | 70 |

| 2030 | 0,6758 | 0,62575 | 0,60697 | 99 |

IV. NETMIND Profesyonel Yatırım Stratejisi ve Risk Yönetimi

NETMIND Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcı kitlesi: AI ve merkeziyetsiz hesaplama alanında uzun vadeli potansiyel görenler

- Uygulanabilir öneriler:

- Piyasa gerilemelerinde NETMIND token biriktirin

- Kısmi kâr için fiyat hedefleri belirleyin

- Tokenları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirleyin

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım koşullarını takip edin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Zarar durdur emirleri ile potansiyel kayıpları sınırlayın

- Belirlenen direnç seviyelerinde kâr alımı yapın

NETMIND Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: AI ve hesaplama tokenları arasında dağıtım

- Opsiyon işlemleri: Düşüş riskine karşı satım opsiyonları kullanımı

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutum için kağıt cüzdan

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. NETMIND Potansiyel Riskler ve Zorluklar

NETMIND Piyasa Riskleri

- Yüksek oynaklık: Yeni nesil teknoloji tokenlarında sıkça rastlanan sert fiyat dalgalanmaları

- Rekabet: Diğer AI ve merkeziyetsiz hesaplama projeleri pazar payı kazanabilir

- Piyasa duyarlılığı: Genel kripto piyasa eğilimleri NETMIND’in performansını doğrudan etkileyebilir

NETMIND Düzenleyici Riskler

- Belirsiz mevzuat: AI tokenlarını etkileyebilecek yeni düzenlemelerin potansiyeli

- Sınır ötesi uyum: Farklı ülkelerde değişen yasal düzenlemeler

- Veri gizliliği riskleri: Kullanıcı verisi işleyen AI projelerinde artan denetim

NETMIND Teknik Riskler

- Akıllı sözleşme açıkları: Tokenın altyapı kodunda istismar riski

- Ölçeklenebilirlik sorunları: Artan ağ talebinin karşılanmasında muhtemel kısıtlar

- Teknolojik eskime: AI’daki hızlı gelişmeler NETMIND’in teknolojik güncelliğini aşabilir

VI. Sonuç ve Eylem Önerileri

NETMIND Yatırım Değeri Analizi

NETMIND, yükselen AI ve merkeziyetsiz hesaplama sektöründe yüksek riskli ve yüksek getirili bir yatırım fırsatı sunar. Uzun vadeli potansiyeli oldukça büyük olsa da, kısa vadeli oynaklık ile mevzuat belirsizlikleri önemli riskler taşır.

NETMIND Yatırım Önerileri

✅ Yeni başlayanlar: Düzenli ve küçük yatırımlarla zaman içinde pozisyon oluşturun ✅ Tecrübeli yatırımcılar: Hem uzun vadeli tutma hem de aktif alım-satım stratejisini dengeleyin ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak NETMIND’i çeşitlendirilmiş AI ve blokzincir portföyünde değerlendirin

NETMIND Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden NETMIND tokenlarının doğrudan alım-satımı

- Stake etme: Pasif gelir için olası stake programlarına katılım

- DeFi entegrasyonu: NETMIND için sunulacak merkeziyetsiz finans seçeneklerini keşfedin

Kripto para yatırımları oldukça yüksek risk içerir; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

NetMind coin’in güncel değeri nedir?

Ekim 2025 itibarıyla NetMind coin 0,3186 dolardan işlem görmektedir. Fiyat son dönemde hafif bir düşüşle son 24 saatte %4,2 azalmıştır.

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin, en yüksek fiyat tahminine sahiptir ve 140.652 dolara ulaşması beklenmektedir. Chainlink ise 62,60 dolarlık yüksek tahminle onu takip etmektedir.

NMT coin nedir?

NMT, Solana blokzincirinde çalışan ve hızlı, düşük maliyetli işlemleriyle bilinen bir kripto paradır. NetMind.AI ile bağlantılı olup Web3 uygulamaları odaklıdır.

2025’te kripto için fiyat tahminleri nedir?

Bitcoin’in 100.000 dolara ulaşması bekleniyor, Ethereum 5.000 dolara yükselebilir ve Solana’nın 2025’e kadar 100 dolara ulaşacağı öngörülmektedir.

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

2025 FAI Fiyat Tahmini: FAI Token’ın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 OGPU Fiyat Tahmini: GPU Teknolojisindeki Piyasa Eğilimleri ve Teknolojik Gelişmelerin Analizi

2025 AGENT Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 ARC Fiyat Tahmini: Yükseliş Eğilimleri ve Algorand'ın Yönetim Token'ının Geleceğini Belirleyen Temel Etkenler

HBAR'ın AUD Fiyat Performansı

Nostr Merkeziyetsiz Sosyal Medya Protokolü’nü Yakından İncelemek

DeFi Likidite Madenciliği Hakkında Keşif: Başlangıç Seviyesinde Kapsamlı Rehber

Verimli Ticaret İçin En İyi Kripto Borsa Toplayıcılarına Nihai Rehber

Bored Ape Yacht Club NFT Koleksiyonu Hakkında Kapsamlı Rehber

Polygon Ağına Varlık Transferi için Kolay Rehber