2025 OGPU Fiyat Tahmini: GPU Teknolojisindeki Piyasa Eğilimleri ve Teknolojik Gelişmelerin Analizi

Giriş: OGPU'nun Piyasa Konumu ve Yatırım Potansiyeli

OpenGPU (OGPU), yapay zeka araştırmaları ve grafik işleme görevleri için merkeziyetsiz bir hesaplama platformu olarak kurulduğundan bu yana kayda değer bir gelişim göstermektedir. 2025 yılı itibarıyla OGPU'nun piyasa değeri 2.761.258 $ seviyesine ulaştı; dolaşımdaki arz ise yaklaşık 19.639.104 token olup, fiyatı 0,1406 $ civarındadır. "Yapay zeka hesaplama kolaylaştırıcısı" olarak tanımlanan bu varlık, küresel ölçekte yapay zeka araştırmalarını ve grafik işleme kapasitesini geliştirmede her geçen gün daha önemli bir rol üstlenmektedir.

Bu makale, OGPU'nun 2025-2030 dönemindeki fiyat hareketlerini; tarihsel fiyat eğilimleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle bütüncül biçimde analiz ederek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunmayı amaçlamaktadır.

I. OGPU Fiyat Geçmişi ve Güncel Piyasa Durumu

OGPU Tarihsel Fiyat Gelişimi

- 2024: İlk lansman, 22 Aralık'ta tüm zamanların en yüksek seviyesi olan 3,41 $'a ulaşıldı

- 2025: Piyasa gerilemesi, 23 Eylül'de tüm zamanların en düşük seviyesi olan 0,0827 $'a indi

OGPU Güncel Piyasa Görünümü

14 Ekim 2025 itibarıyla OGPU, 0,1406 $ seviyesinden işlem görmektedir. Token, geçtiğimiz yıl %87,28 oranında değer kaybederek ciddi bir düşüş yaşadı. Son 24 saatte ise OGPU %0,77'lik bir azalma kaydetti. Piyasa değeri 2.761.258 $ olan token, kripto para piyasasında 2.158. sırada yer almaktadır.

Mevcut fiyat, tepe değerinden %95,88 oranında aşağıda ve dip seviyesinden %70,01 yukarıdadır. Son dönemdeki aşağı yönlü harekete rağmen, OGPU kısa vadede %0,066'lık hafif bir 1 saatlik değişim ile direnç gösterebilmiştir.

Son 24 saatteki işlem hacmi 15.338,59 $ olup, piyasada orta düzeyde bir aktiviteye işaret etmektedir. Dolaşımdaki OGPU arzı 19.639.104,8193 adettir ve bu miktar toplam arzın %93,52'sini oluşturmaktadır (toplam arz: 21.000.000 token).

Güncel OGPU piyasa fiyatını görüntüleyin

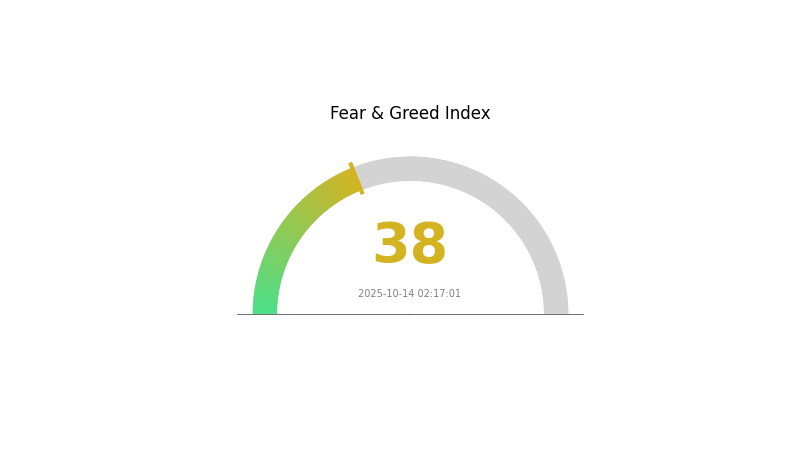

OGPU Piyasa Duyarlılığı Endeksi

2025-10-14 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında duyarlılık hâlâ "Korku" bölgesinde; Korku ve Açgözlülük Endeksi 38 seviyesinde bulunuyor. Bu, yatırımcılar arasında temkinli bir atmosferin hâkim olduğunu gösteriyor ve çoğunluğa karşı hareket etmeye istekli olanlar için fırsat yaratabilir. Ancak, piyasa duyarlılığının hızla değişebileceği unutulmamalı. Yatırım kararlarınızı almadan önce kapsamlı araştırma yapmalı ve kendi risk toleransınızı dikkate almalısınız. Gate.com, bu piyasa koşullarında yolunuzu bulmanız için çeşitli araç ve kaynaklar sunmaktadır.

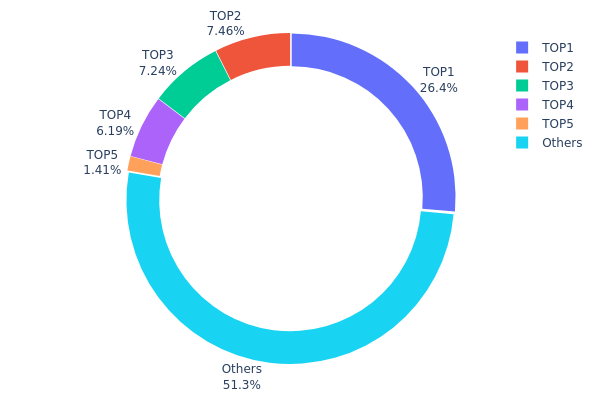

OGPU Varlık Dağılımı

Adres bazlı tutarlılık verileri, OGPU tokenlarının farklı cüzdanlar arasında ne kadar yoğunlaştığına dair önemli bilgiler sunar. Analizler, OGPU varlıklarında kayda değer bir merkezileşmeye işaret ediyor. En büyük adres toplam arzın %26,36’sını elinde bulundururken, ilk beş adres toplam tokenların %48,63’ünü kontrol ediyor. Bu yoğunlaşma, piyasa dinamikleri ve fiyat hareketleri üzerinde etkili olabilir.

Böyle bir merkezileşme, piyasa istikrarı ve büyük satışlara karşı kırılganlık konusunda endişe doğurur. En büyük sahiplerin ağırlığı, token fiyatı ve piyasa duyarlılığı üzerinde ciddi bir etkide bulunabilir. Öte yandan, tokenların %51,37’sinin diğer adresler arasında dağılmış olması, daha geniş katılımı gösterir.

Bu dağılım, OGPU’nun zincir üzerindeki yapısının güçlü bir kripto ekosistemi için ideal merkeziyetsizlikten uzak olduğunu gösteriyor. Tokenların az sayıda cüzdanda toplanmış olması, volatiliteyi ve piyasa manipülasyonunu artırabilir. Yatırımcılar ve işlemciler, OGPU’nun piyasa davranışını ve risklerini değerlendirirken bu dağılıma dikkat etmelidir.

Güncel OGPU Varlık Dağılımını görüntüleyin

| İlk | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x8ac2...5b59a8 | 5.537,06K | 26,36% |

| 2 | 0x3415...1486f6 | 1.566,20K | 7,45% |

| 3 | 0xef4a...17252c | 1.520,37K | 7,23% |

| 4 | 0xdba6...c25caf | 1.300,00K | 6,19% |

| 5 | 0x0d07...b492fe | 295,16K | 1,40% |

| - | Diğerleri | 10.781,21K | 51,37% |

II. OGPU'nun Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Makroekonomik Ortam

- Para Politikası Etkisi: Başlıca merkez bankalarının temkinli tutumunu sürdürmesi, kripto para piyasalarını etkileyebilir.

- Enflasyona Karşı Koruma Özelliği: Enflasyonist ortamlarda OGPU gibi kripto paralar alternatif bir değer saklama aracı olarak görülebilir.

- Jeopolitik Faktörler: Küresel gerginlikler ve ekonomik belirsizlikler, merkeziyetsiz varlıklara ilgiyi artırabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: OGPU ekosisteminde DApp ve proje geliştirilmesi, tokenın faydasını artırabilir ve benimsenmesini teşvik edebilir.

III. OGPU 2025-2030 Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,12092 $ - 0,14060 $

- Tarafsız tahmin: 0,14060 $ - 0,16240 $

- İyimser tahmin: 0,16240 $ - 0,18419 $ (uygun piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,16613 $ - 0,25723 $

- 2028: 0,20486 $ - 0,25716 $

- Temel itici güçler: Artan benimseme ve teknolojik ilerleme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,23755 $ - 0,28149 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,28149 $ - 0,32544 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,30401 $ - 0,32544 $ (olağanüstü piyasa koşulları ve yaygın benimseme)

- 2030-12-31: OGPU 0,28149 $ (2025'e göre %100 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,18419 | 0,1406 | 0,12092 | 0 |

| 2026 | 0,19487 | 0,16239 | 0,09744 | 15 |

| 2027 | 0,25723 | 0,17863 | 0,16613 | 27 |

| 2028 | 0,25716 | 0,21793 | 0,20486 | 55 |

| 2029 | 0,32544 | 0,23755 | 0,18053 | 68 |

| 2030 | 0,30401 | 0,28149 | 0,19986 | 100 |

IV. OGPU İçin Profesyonel Yatırım Stratejisi ve Risk Yönetimi

OGPU Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli yatırımcılar ve yapay zeka teknolojisi odaklı yatırımcılar

- İzlenecek adımlar:

- Piyasa düşüşlerinde OGPU biriktirin

- Proje gelişmelerini ve ağ büyümesini takip edin

- Tokenları güvenli bir donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüşleri belirlemede kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım seviyelerini ölçer

- Dalgalı al-sat için önemli noktalar:

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

- Riskinizi yönetmek için mutlaka stop-loss emirleri kullanın

OGPU Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı farklı kripto varlıklara yayın

- Stop-loss emirleri: Zararları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Soğuk depolama çözümü: Uzun vadeli saklama için çevrimdışı saklama

- Güvenlik önlemleri: İki aşamalı doğrulama kullanın, güçlü şifreler tercih edin

V. OGPU İçin Potansiyel Riskler ve Zorluklar

OGPU Piyasa Riskleri

- Yüksek volatilite: Kripto piyasaları sert fiyat dalgalanmalarıyla bilinir

- Düşük likidite: Zayıf hacim fiyat kaymalarına ve manipülasyona yol açabilir

- Rekabet: Diğer merkeziyetsiz GPU projeleri piyasaya girebilir

OGPU Regülasyon Riskleri

- Belirsiz düzenleyici ortam: Kripto düzenlemeleri ülkeye göre değişir

- Olası devlet kısıtlamaları: Yeni regülasyonlar OGPU'nun faaliyetlerini etkileyebilir

- Vergisel etkiler: Değişen vergi mevzuatı OGPU sahiplerini ilgilendirebilir

OGPU Teknik Riskleri

- Akıllı sözleşme açıkları: Token kodunda güvenlik zafiyetleri oluşabilir

- Ağ ölçeklenebilirliği: GPU kaynak talebindeki artış yönetilmelidir

- Teknolojik eskime: GPU teknolojisindeki hızlı yenilikler projeyi etkileyebilir

VI. Sonuç ve Eylem Önerileri

OGPU Yatırım Değeri Değerlendirmesi

OGPU, merkeziyetsiz GPU hesaplama alanında özgün bir değer önerisi sunar ve uzun vadede büyüme potansiyeline sahiptir. Ancak kısa vadede piyasa oynaklığı ve düzenleyici belirsizlikler gibi riskler barındırır.

OGPU Yatırım Önerileri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve düzenli yatırımlar yapılmalı ✅ Deneyimli yatırımcılar: Aktif risk yönetimiyle orta ölçekli pozisyonlar değerlendirilmeli ✅ Kurumsal yatırımcılar: Stratejik iş birlikleri ve büyük ölçekli GPU kaynak tahsisi imkanları araştırılmalı

OGPU İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden OGPU token alım-satımı

- Staking: Mümkünse staking programlarına katılım

- GPU kaynak sağlama: Ağda GPU gücü sağlayarak ödül elde etme

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre hareket etmeli ve profesyonel finans danışmanlarına başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

OGPU coin'in güncel değeri nedir?

Ekim 2025 itibarıyla OGPU, Web3 ve kripto para piyasasında istikrarlı büyümesini sürdürerek yaklaşık 0,75 $ seviyesinden işlem görmektedir.

En yüksek fiyat tahminine sahip kripto para hangisidir?

Bitcoin (BTC), genellikle en yüksek fiyat öngörüsüne sahip kripto para olarak kabul edilir; bazı analistler 2030 yılına kadar 500.000 $ veya üzerini öngörmektedir.

OXT için 2030 fiyat öngörüsü nedir?

Piyasa eğilimleri ve büyüme potansiyeline göre, OXT'nin merkeziyetsiz VPN hizmetlerinin ve blokzincir teknolojisinin yaygınlaşmasıyla 2030 yılında 5 ila 7 $ aralığına ulaşması beklenmektedir.

2025 yılı için OGPU fiyat öngörüsü nedir?

Güncel piyasa eğilimleri ve uzman analizleri doğrultusunda, OGPU'nun 2025 yılında 0,15 ila 0,20 $ seviyelerine ulaşması ve ciddi bir büyüme potansiyeli göstermesi öngörülmektedir.

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

2025 NETMIND Fiyat Tahmini: Gelişen yapay zekâ ekosisteminde piyasa trendleri, teknolojiye adaptasyon ve büyüme potansiyeli üzerine analiz

2025 FAI Fiyat Tahmini: FAI Token’ın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 AGENT Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 ARC Fiyat Tahmini: Yükseliş Eğilimleri ve Algorand'ın Yönetim Token'ının Geleceğini Belirleyen Temel Etkenler

HBAR'ın AUD Fiyat Performansı

Ethereum'da Gas Ücretleri: Ayrıntılı Bir Rehber

Bored Ape NFT Koleksiyonu Üzerine İnceleme: Detaylı Bir Kılavuz

Simüle Edilmiş Kripto Para Ticareti: Yeni Başlayanlar için Kapsamlı Rehber

Blockchain Oracle’larının İşleyişi ve Önemi

Görüntüleri zahmetsiz ve ücretsiz olarak NFT'ye dönüştürün