2025 TLOS Fiyat Tahmini: Telos Blockchain’e Yönelik Piyasa Analizi ve Büyüme Potansiyeli

Giriş: TLOS’un Piyasa Konumu ve Yatırım Değeri

Telos (TLOS), merkeziyetsiz uygulamalar için kurumsal düzeyde güçlü bir blockchain altyapısı sunarak, 2018’den bu yana önemli başarılar elde etti. 2025 yılı itibarıyla Telos’un piyasa değeri 10.972.414 $, dolaşımdaki arzı yaklaşık 270.123.443 adet ve fiyatı 0,04062 $ civarında seyrediyor. “Benzersiz hızı ve gelişmiş yönetişimiyle” öne çıkan bu varlık, hızlı ve ölçeklenebilir dağıtık uygulamalar geliştirmede giderek daha önem taşıyor.

Bu makalede, Telos’un 2025-2030 yılları arasındaki fiyat eğilimleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar kapsamında detaylı şekilde incelenecek; yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir stratejiler sunulacaktır.

I. TLOS Fiyat Geçmişi ve Güncel Piyasa Durumu

TLOS Tarihsel Fiyat Gelişimi

- 2024: TLOS, 29 Şubat’ta 0,622416 $ ile tüm zamanların en yüksek değerine ulaşarak önemli bir kilometre taşı geride bıraktı.

- 2025: Piyasa düşüşüyle birlikte TLOS, 10 Temmuz’da 0,02799574 $ ile en düşük seviyesine indi.

TLOS Güncel Piyasa Durumu

8 Ekim 2025’te TLOS, 0,04062 $ seviyesinden işlem görüyor ve 24 saatlik hacmi 92.545,96 $. Token son 24 saatte %10,32 oranında değer kaybetti. Piyasa değeri 10.972.414 $ olup, kripto para piyasasında 1.368. sırada yer alıyor. Dolaşımdaki arz 270.123.443 TLOS (%76,05 toplam arz). Fiyat, son bir haftada %15,40; son 30 günde %32,93 oranında düşüş gösterdi. Şu anki fiyat, tüm zamanların en yüksek seviyesinin %93,48 altında, en düşük seviyesinin ise %45,09 üzerinde.

Güncel TLOS piyasa fiyatını görüntüleyin

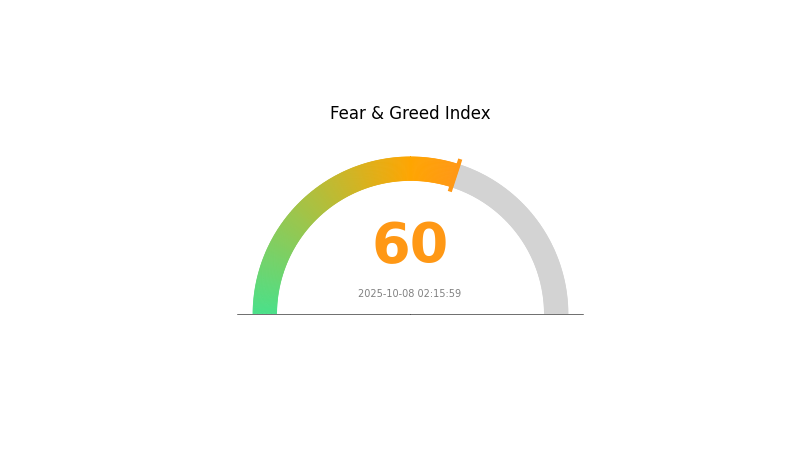

TLOS Piyasa Duyarlılık Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto para piyasası, Korku ve Açgözlülük Endeksi’nin 60 seviyesine ulaşmasıyla olumlu bir hava sergiliyor ve “Açgözlülük” eğilimi gösteriyor. Bu durum, yatırımcıların piyasaya olan güveninin ve yükseliş beklentisinin arttığını yansıtıyor. Yine de, yalnızca piyasa duyarlılığına dayanarak aceleci kararlar vermekten kaçınmak gerekir. Her zaman detaylı araştırma yapmalı ve dengeli bir yatırım stratejisi izlenmelidir. Piyasa trendlerini takip ederek stratejinizi buna göre şekillendirin.

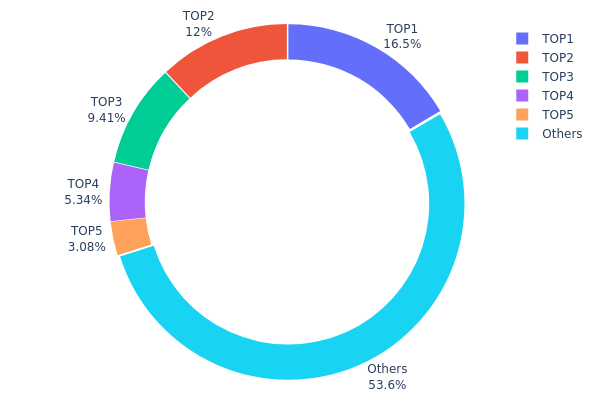

TLOS Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, TLOS tokenlarının cüzdanlar arasında nasıl paylaşıldığı konusunda kritik bilgiler sunuyor. Analiz, TLOS ekosisteminde orta düzeyde merkezileşme olduğunu gösteriyor. İlk beş adres toplam arzın %46,35’ini tutarken, en büyük sahip %16,53’ünü kontrol ediyor.

Bu dağılım, genel olarak dengeli bir paylaşımı işaret etse de büyük sahiplerin etkisi belirgin. Her biri toplam arzın %3 ila %16’sını elinde bulunduran ana paydaşlar, ağda çeşitli bir güç dağılımına yol açıyor. Diğer yandan, tokenların %53’ten fazlasının küçük yatırımcılar arasında dağılması, merkeziyetsizlik seviyesinin sağlıklı olduğunu gösteriyor.

Mevcut dağılım, büyük adreslerin piyasa üzerinde etkili olabilme potansiyeli nedeniyle fiyat oynaklığını orta seviyede tutabilir. Fakat baskın bir adres bulunmaması, tek taraflı piyasa manipülasyonu riskini azaltıyor. Bu dağılım, kurumsal ve bireysel yatırımcıların dengeli payı ile olgunlaşan bir ekosistem ve TLOS ağının uzun vadeli istikrarına katkı anlamına geliyor.

Güncel TLOS Varlık Dağılımını görüntüleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xad01...eb5cbf | 1.910.00K | 16,53% |

| 2 | 0x69e4...c75673 | 1.387.50K | 12,00% |

| 3 | 0xa851...0c1f5c | 1.087.22K | 9,41% |

| 4 | 0x32f9...c296df | 616.88K | 5,33% |

| 5 | 0xfe6f...61dd28 | 356.42K | 3,08% |

| - | Diğerleri | 6.195.70K | 53,65% |

II. TLOS Fiyatını Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Büyümesi

- Ekosistem Uygulamaları: TLOS, Telos ekosisteminin yerel token’ı olarak ağda işlemler, yönetişim ve likiditede temel rol oynar.

Makroekonomik Ortam

- Piyasa Duyarlılığı: Yatırımcı psikolojisi, TLOS fiyat hareketlerinde belirleyici etkendir. Kripto piyasasının genel duygu durumu, token’ın değerini doğrudan etkileyebilir.

Arz Mekanizması

- Güncel Etki: En güncel verilere göre, TLOS’un piyasa değeri 1,84 milyon $, token başına fiyatı ise 0,91433988 $. 24 saatlik işlem hacmi yaklaşık 1,57 milyon $ olup piyasada aktif bir katılımı işaret ediyor.

III. TLOS Fiyat Tahmini (2025-2030)

2025 Görünümü

- Temkinli tahmin: 0,03456 $ - 0,03800 $

- Nötr tahmin: 0,03800 $ - 0,04200 $

- İyimser tahmin: 0,04200 $ - 0,04432 $ (belirgin piyasa toparlanması ve güçlü benimseme gerektirir)

2027-2028 Görünümü

- Piyasa aşaması: Artan oynaklık ile olası büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 0,03164 $ - 0,04897 $

- 2028: 0,04108 $ - 0,05677 $

- Temel katalizörler: Teknolojik yenilikler, yeni kullanım alanları ve genel kripto piyasası eğilimleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,04500 $ - 0,05300 $ (istikrarlı büyüme ve kabul ile)

- İyimser senaryo: 0,05300 $ - 0,05672 $ (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,05672 $ - 0,06000 $ (çığır açan uygulamalar ve yaygın entegrasyon ile)

- 31 Aralık 2030: TLOS 0,05301 $ (büyüme sonrası olası denge noktası)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Dalgalanma |

|---|---|---|---|---|

| 2025 | 0,04432 | 0,04066 | 0,03456 | 0 |

| 2026 | 0,04419 | 0,04249 | 0,02762 | 4 |

| 2027 | 0,04897 | 0,04334 | 0,03164 | 6 |

| 2028 | 0,05677 | 0,04616 | 0,04108 | 13 |

| 2029 | 0,05455 | 0,05146 | 0,03705 | 26 |

| 2030 | 0,05672 | 0,05301 | 0,03499 | 30 |

IV. TLOS İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

TLOS Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Sabırlı ve yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- TLOS’a düzenli ve kademeli yatırım yapın

- Piyasa dalgalanmalarını aşmak için en az 3-5 yıl tutun

- Token’ları saklama hizmeti olmayan bir cüzdanda güvenli şekilde muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Trend ve destek/direnç noktalarını tespit etmek için kullanılır

- RSI: Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Teknik göstergelere göre net giriş-çıkış noktaları belirleyin

- Zarar durdurma emirleri ile riskleri sınırlayın

TLOS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlığa dağıtın

- Zarar durdurma emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Alternatifleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı alternatifi: Resmi Telos cüzdanı

- Güvenlik önlemleri: 2FA etkinleştirin, güçlü şifreler oluşturun ve özel anahtarları güvenli şekilde yedekleyin

V. TLOS İçin Olası Riskler ve Zorluklar

TLOS Piyasa Riskleri

- Yüksek oynaklık: TLOS fiyatı ciddi dalgalanmalara açık

- Sınırlı likidite: Büyük hacimli işlemlerde zorluk yaşanabilir

- Rekabet: Diğer akıllı sözleşme platformları Telos’un önüne geçebilir

TLOS Düzenleme Riskleri

- Belirsiz düzenleyici ortam: Olası olumsuz mevzuat riskleri

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen düzenlemeler

- Vergilendirme etkileri: Kripto varlık vergilendirmesinde sürekli değişen yaklaşım

TLOS Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hata riski

- Ölçeklenebilirlik zorlukları: Ağ trafiği arttıkça karşılaşılabilecek sorunlar

- Merkezileşme endişeleri: Blok üreticilerinin yoğunlaşması riski

VI. Sonuç ve Eylem Önerileri

TLOS Yatırım Değeri Analizi

Telos, kurumsal düzeyde bir blockchain platformu olarak uzun vadede ciddi potansiyel sunarken, akıllı sözleşme alanındaki rekabet ve piyasa oynaklığı nedeniyle kısa vadede önemli riskler barındırıyor.

TLOS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Projeyi tanımak için küçük ve düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş bir kripto portföyünde orta düzeyde pay ayırmayı değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme ile Telos’u yüksek risk-yüksek getiri potansiyeli olan bir yatırım olarak analiz edin

TLOS Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com’da TLOS alıp satabilirsiniz

- Staking: Telos staking’e katılarak ödül elde edebilirsiniz

- DApp kullanımı: Telos ekosistemindeki uygulamalarla etkileşime geçin

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alamayacağınız tutarda yatırım yapmayın.

Sıkça Sorulan Sorular

TLOS kripto nedir?

TLOS, Telos blockchain’inin yerel kripto parasıdır; ölçeklenebilirlik ve yönetişime odaklanır, dApp’ler ile akıllı sözleşmelerde işlem, ağ güvenliği ve karar süreçlerinde kullanılır.

Telos iyi bir yatırım mı?

Telos (TLOS), yatırım açısından olumlu bir potansiyel sergiliyor. Tahminler yükseliş eğilimine işaret ediyor ve önümüzdeki yıllarda güçlü fiyat beklentileri bulunuyor.

En yüksek fiyat tahminine sahip kripto hangisidir?

Bitcoin (BTC), 2025 yılında en yüksek fiyat beklentisine sahip kripto para. Yatırımcılar için ilk tercihler arasında yer alıyor ve istikrarlı trendi bu öngörüyü destekliyor.

Hangi yapay zeka kripto fiyatlarını tahmin edebilir?

Incite AI, kripto fiyatlarını tahmin etmekte önde gelen bir araçtır. Gelişmiş algoritmalarıyla piyasa trendlerini analiz ederek kullanıcı dostu arayüzü üzerinden kesin içgörüler sunar.

2025 CFX Fiyat Tahmini: Conflux Network Token’ın Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

2025 GRT Fiyat Tahmini: Graph Protocol'un gelecekteki değer eğrisinin ve piyasa potansiyelinin detaylı analizi

2025 XLM Fiyat Öngörüsü: Stellar'ın Değişen Kripto Ekosistemindeki Potansiyel Yükselişi

2025 SLC Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 SYS Fiyat Tahmini: Piyasa Trendleri, Teknik Unsurlar ve Kurumsal Benimseme Potansiyelinin Analizi

2025 REI Fiyat Tahmini: Gayrimenkul Token Ekonomisi için Piyasa Analizi ve Büyüme Tahmini

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi