2025 XLM Fiyat Öngörüsü: Stellar'ın Değişen Kripto Ekosistemindeki Potansiyel Yükselişi

Giriş: XLM’in Piyasadaki Konumu ve Yatırım Değeri

Stellar (XLM), sınır ötesi işlemler için merkeziyetsiz bir protokol olarak 2014’teki kuruluşundan bu yana önemli başarılara imza atmıştır. 2025 yılı itibarıyla Stellar’ın piyasa değeri 10,86 milyar ABD dolarına ulaşırken, dolaşımdaki arzı yaklaşık 32 milyar XLM ve fiyatı ise 0,34 ABD doları civarında seyretmektedir. Sıklıkla “kripto paraların Swift’i” olarak nitelendirilen bu varlık, hızlı ve düşük maliyetli uluslararası para transferlerinde giderek daha kritik bir rol oynamaktadır.

Bu makalede, Stellar’ın 2025-2030 dönemindeki fiyat trendleri; geçmiş hareketler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler temelinde kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. XLM Fiyat Geçmişi ve Güncel Piyasa Durumu

XLM’in Tarihsel Fiyat Seyri

- 2014: Stellar (XLM) piyasaya sürüldü, başlangıç fiyatı yaklaşık 0,002 ABD doları

- 2018: Boğa piyasası zirvesi, XLM 3 Ocak’ta tüm zamanların en yüksek seviyesi olan 0,875563 ABD dolarına ulaştı

- 2020: Piyasa toparlanması, XLM fiyatında belirgin bir yükseliş

- 2022: Ayı piyasası eğilimi, XLM genel kripto piyasasıyla birlikte değer kaybetti

XLM’in Güncel Piyasa Görünümü

15 Ekim 2025 itibarıyla XLM, 0,33934 ABD doları fiyatıyla işlem görüyor ve 10,86 milyar ABD doları piyasa değeriyle küresel kripto para sıralamasında 18. sırada yer alıyor. 24 saatlik işlem hacmi 5.538.150 ABD doları olup, bu piyasanın orta düzeyde hareketli olduğuna işaret ediyor. XLM, son 24 saatte %1,47 oranında hafif bir düşüş yaşasa da, son bir yılda %263,09’luk güçlü bir artış kaydetmiş durumda. Mevcut fiyatı, tüm zamanların en yüksek seviyesinin %61,24 altında bulunuyor ve bu da büyüme için alan olduğunu yansıtıyor. Dolaşımdaki arz 31.999.747.324 XLM ile toplam arzın %63,99’una denk geliyor; bu da XLM’in yüksek bir dolaşım oranına sahip olduğunu gösteriyor.

Güncel XLM piyasa fiyatını görmek için tıklayın

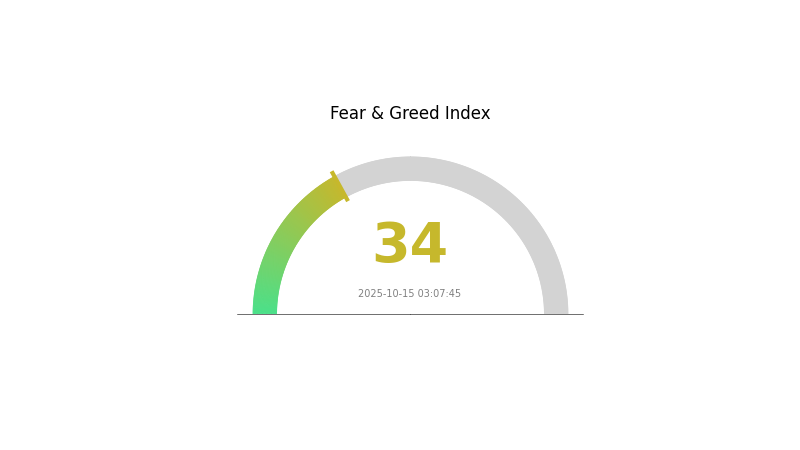

XLM Piyasa Duyarlılığı Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

XLM’in kripto piyasasındaki duyarlılık şu anda Korku ve Açgözlülük Endeksi’nde 34 puanla “Korku” bölgesinde yer alıyor. Bu durum, yatırımcılar arasında temkinli bir hava olduğunu ve XLM’in değerinin düşük kalabileceğini gösteriyor. Tarihsel olarak, böyle korku dönemleri çoğunlukla piyasa toparlanmalarının öncesinde görülmüştür. Yine de, yatırımcıların dikkatli davranması ve karar öncesinde kapsamlı araştırma yapması gerekir. Gate.com, bu koşullarda piyasayı doğru analiz edebilmek için kapsamlı araçlar ve analizler sunar.

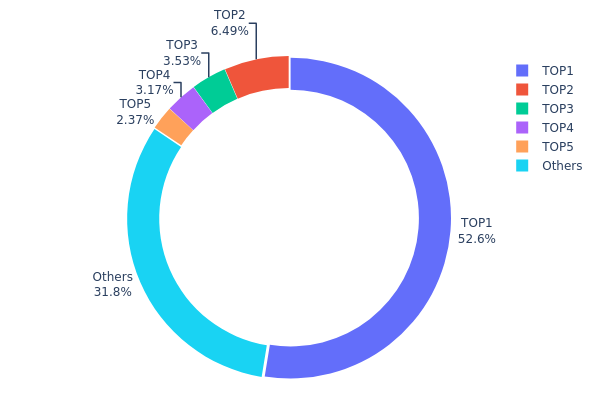

XLM Varlık Dağılımı

XLM’in adres bazlı sahiplik dağılımı, oldukça yüksek bir merkezileşme gösteriyor. En büyük adres, toplam arzın %52,57’sini elinde tutarken, sonraki dört en büyük adres de toplamda %15,56’lık bir paya sahip. Bu yoğunlaşmış yapı, piyasa manipülasyonu ve fiyat oynaklığı bakımından risk oluşturuyor.

Dağılım verileri, az sayıda kuruluşun XLM ekosistemi üzerinde büyük bir etkiye sahip olduğunu gösteriyor. Toplam arzın yarısından fazlası tek bir adreste olduğu için, büyük transferler veya satışlar piyasa istikrarını tehdit edebilir. Bu merkezileşme, kripto paralarda beklenen merkeziyetsizlik ilkesine de meydan okuyor. Bununla birlikte, XLM’in %31,87’si diğer adreslere dağılmış durumda ve bu da kısmen de olsa çeşitlilik sağlayarak riskleri azaltabilir.

Güncel XLM Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | GALAXY...ZILUTO | 554.421.152,03K | 52,57% |

| 2 | GDUY7J...LDERI4 | 68.461.825,55K | 6,49% |

| 3 | GDKIJJ...CCWNMX | 37.265.991,80K | 3,53% |

| 4 | GBFZPA...ZJJFNP | 33.459.507,10K | 3,17% |

| 5 | GB6NVE...4MY4AQ | 25.008.201,71K | 2,37% |

| - | Diğerleri | 335.822.342,69K | 31,87% |

II. XLM’in Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Maksimum Arz: XLM’in ilk maksimum arzı 105 milyar tokendi. Ancak Stellar Foundation, 2019 yılında 55 milyar tokenı yakarak arzı önemli ölçüde azalttı.

- Güncel Etki: Arzdaki bu azalma, kıtlık etkisi oluşturarak uzun vadede fiyatı yukarı çekebilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Adaptasyon: Stellar ağı, sınır ötesi işlemler ve dijital varlık ihracı için pek çok şirket tarafından benimseniyor; bu da XLM talebini artırabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: Merkeziyetsiz dijital varlık olan XLM, bazı ekonomik koşullarda enflasyona karşı koruma aracı olarak değerlendirilebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Ağ Yükseltmeleri: Stellar, 2025 sonrası ağ hızını ve işlem kapasitesini artıracak teknik güncellemeler planlıyor.

- Ekosistem Uygulamaları: Stellar ağı, çeşitli merkeziyetsiz uygulama ve projeleri destekleyerek genel kullanım alanını ve potansiyel değerini artırıyor.

III. 2025-2030 Dönemi için XLM Fiyat Tahmini

2025 Öngörüsü

- İhtiyatlı tahmin: 0,25678 - 0,30000 ABD doları

- Tarafsız tahmin: 0,30000 - 0,35000 ABD doları

- İyimser tahmin: 0,35000 - 0,43585 ABD doları (olumlu piyasa havası ve artan benimseme koşuluyla)

2027-2028 Öngörüsü

- Piyasa dönemi beklentisi: Artan volatilite ile büyüme aşaması

- Fiyat aralığı tahmini:

- 2027: 0,25014 - 0,623 ABD doları

- 2028: 0,50369 - 0,65151 ABD doları

- Temel tetikleyiciler: Teknolojik yenilikler, artan iş birlikleri ve genel piyasa trendleri

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,59950 - 0,71040 ABD doları (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,71040 - 0,82131 ABD doları (güçlü piyasa ve artan kullanım ile)

- Dönüştürücü senaryo: 0,82131 - 1,04429 ABD doları (büyük atılımlar ve yaygın benimseme ile)

- 2030-12-31: XLM 1,04429 ABD doları (iyimser projeksiyona göre zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,43585 | 0,33787 | 0,25678 | 0 |

| 2026 | 0,55708 | 0,38686 | 0,2592 | 14 |

| 2027 | 0,623 | 0,47197 | 0,25014 | 39 |

| 2028 | 0,65151 | 0,54749 | 0,50369 | 61 |

| 2029 | 0,82131 | 0,5995 | 0,32972 | 76 |

| 2030 | 1,04429 | 0,7104 | 0,53991 | 109 |

IV. XLM İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

XLM Yatırım Yöntemleri

(1) Uzun vadeli tutma stratejisi

- Kimler için uygun: Yüksek risk toleranslı, uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde XLM biriktirin

- Fiyat hedefi koyun ve portföyünüzü periyodik olarak yeniden dengeleyin

- XLM’i güvenli donanım cüzdanlarında muhafaza edin

(2) Aktif al-sat stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım koşullarını tespit edin

- Dalgalı işlemlerde dikkat edilmesi gerekenler:

- Zararı durdur emirleriyle kayıpları sınırlayın

- Belirlenen direnç seviyelerinde kâr alın

XLM Risk Yönetimi Çerçevesi

(1) Varlık dağılımı ilkeleri

- Ihtiyatlı yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %15’ine kadar

(2) Riskten korunma çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlık arasında dağıtın

- Zararı durdur emirleri: Olası kayıpları sınırlamak için otomatik satış emirleri oluşturun

(3) Güvenli saklama yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli saklama için kağıt cüzdan

- Güvenlik önlemleri: Özel anahtarlarınızı asla paylaşmayın, iki faktörlü kimlik doğrulama kullanın

V. XLM İçin Potansiyel Riskler ve Zorluklar

XLM Piyasa Riskleri

- Yüksek oynaklık: XLM fiyatı önemli dalgalanmalara maruz kalabilir

- Rekabet: Sınır ötesi ödemeler için yeni blokzincir platformlarının ortaya çıkması

- Benimseme zorlukları: Geleneksel finansal kurumların entegrasyonunun yavaş olması

XLM Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Kripto paralara yönelik daha sıkı düzenlemeler olasılığı

- Sınır ötesi uyum: Farklı ülkelerde farklı düzenlemeler

- Menkul kıymet sınıflandırması: XLM’in menkul kıymet olarak yeniden sınıflandırılması ihtimali

XLM Teknik Riskler

- Ağ tıkanıklığı: Yüksek işlem dönemlerinde ölçeklenebilirlik sorunları

- Akıllı sözleşme açıkları: Akıllı sözleşme uygulamalarındaki güvenlik riskleri

- Siber güvenlik tehditleri: Stellar ağına yönelik saldırı veya sızma riskleri

VI. Sonuç ve Eylem Önerileri

XLM Yatırım Değeri Analizi

XLM, sınır ötesi ödemeler ve varlık tokenizasyonunda uzun vadeli potansiyele sahip olsa da, kısa vadede volatilite ve düzenleyici belirsizliklerle karşı karşıyadır.

XLM Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlarla başlayın

✅ Deneyimli yatırımcılar: Hem uzun vadeli tutma hem de aktif al-sat kombinasyonunu değerlendirin

✅ Kurumsal yatırımcılar: Stellar teknolojisinin entegrasyonu ve stratejik iş birliklerini araştırın

XLM İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden XLM alım-satımı

- Staking: Pasif gelir için XLM staking programlarına katılım

- DeFi entegrasyonu: Stellar ekosisteminde geliştirilen merkeziyetsiz finans uygulamalarını keşfetmek

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk profillerine göre dikkatlice vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

XLM 2025’te ne kadar yükselebilir?

XLM’in mevcut piyasa eğilimleri ve analizlere göre 2025’te en yüksek 1,29 ABD dolarına ulaşması öngörülüyor.

XLM 10 ABD dolarına ulaşabilir mi?

XLM’in kısa vadede 10 ABD dolarına çıkması beklenmiyor. Bunun için büyük piyasa değişiklikleri ve yaygın benimseme gereklidir. Mevcut tahminler, XLM’in 0,50 ile 1 ABD doları arasında işlem göreceğini öngörüyor.

XLM gerçekçi olarak ne kadar yükselebilir?

Piyasa koşulları ve benimseme oranına bağlı olarak XLM uzun vadede 10 ABD dolarına ulaşabilir. Ancak, kripto paraların oynaklığı nedeniyle kesin bir üst fiyat tahmini yapmak zordur.

XLM’in 2030 yılındaki fiyat tahmini nedir?

XLM’in 2030’da piyasa koşulları ve teknolojik gelişmelere bağlı olarak en yüksek 1,062 ABD doları, en düşük ise 0,738 ABD doları seviyelerine ulaşması beklenmektedir.

2025 CFX Fiyat Tahmini: Conflux Network Token’ın Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

2025 GRT Fiyat Tahmini: Graph Protocol'un gelecekteki değer eğrisinin ve piyasa potansiyelinin detaylı analizi

2025 SLC Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 SYS Fiyat Tahmini: Piyasa Trendleri, Teknik Unsurlar ve Kurumsal Benimseme Potansiyelinin Analizi

2025 TLOS Fiyat Tahmini: Telos Blockchain’e Yönelik Piyasa Analizi ve Büyüme Potansiyeli

2025 REI Fiyat Tahmini: Gayrimenkul Token Ekonomisi için Piyasa Analizi ve Büyüme Tahmini

Ethereum Gas Ücretlerini Anlamak: Maliyet Kontrolü İçin Rehber

Yapay Zekâ ile Sanat Oluşturma: NFT Üretimi İçin En İyi Araçlar

Konsorsiyum Blockchain'i Anlamak: Temel Özellikler ve Avantajlar

Delegated Proof of Stake (DPoS) Kavramının İncelenmesi

Kripto Kopya Ticaretinde En İyi Platformlar: Başlangıç Seviyesine Uygun Alternatifler