2025 SLC Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: SLC'nin Piyasadaki Konumu ve Yatırım Değeri

Dünyanın en büyük gürültü istihbarat platformu konumundaki Silencio Network (SLC), kuruluşundan bu yana kayda değer ilerlemeler göstermiştir. 2025 yılı itibarıyla Silencio Network'ün piyasa değeri 3.516.964,88 ABD Doları'na ulaşırken, dolaşımdaki arz yaklaşık 13.082.000.000 token seviyesindedir ve fiyatı yaklaşık 0,00026884 ABD Doları civarındadır. "Gürültü kirliliği çözümü" olarak anılan bu varlık, gayrimenkul, seyahat ve şehir planlaması gibi alanlarda giderek daha önemli rol üstlenmektedir.

Bu makale; Silencio Network'ün 2025-2030 dönemine ait fiyat trendlerini, tarihsel desenleri, piyasa arz ve talebini, ekosistem gelişimini ve makroekonomik faktörleri bir arada ele alarak yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunacaktır.

I. SLC Fiyat Geçmişi ve Güncel Piyasa Durumu

SLC Tarihsel Fiyat Gelişimi

- 2025 Ocak: SLC, 0,000916 ABD Doları ile tüm zamanların en yüksek seviyesine ulaştı ve proje adına önemli bir kilometre taşı kaydedildi.

- 2025 Mayıs: Token, 0,00007979 ABD Doları ile tüm zamanların en düşük seviyesini gördü ve piyasa düzeltmesi yaşandı.

- 2025 Ekim: SLC fiyatı toparlanma emareleri göstererek, mevcutta 0,00026884 ABD Doları seviyesinden işlem görmektedir.

SLC Güncel Piyasa Görünümü

13 Ekim 2025 itibarıyla SLC, 0,00026884 ABD Doları fiyatından işlem görüyor, 24 saatlik işlem hacmi ise 44.315,39 ABD Doları. Token, son 24 saatte %6,71 yükselerek kısa vadede olumlu bir ivme yakaladı. Ancak uzun vadede SLC, son yedi günde %17,09, son 30 günde ise %9,17 düşüş yaşadı. Piyasa değeri 3.516.964,88 ABD Doları olan SLC, küresel kripto para piyasasında 1.994. sırada yer alıyor. Dolaşımdaki arz 13.082.000.000 SLC ve toplam arz 100.000.000.000 olup, mevcut piyasa yalnızca toplam potansiyel arzın %13,08'ini yansıtmaktadır.

Güncel SLC piyasa fiyatını görüntülemek için tıklayın

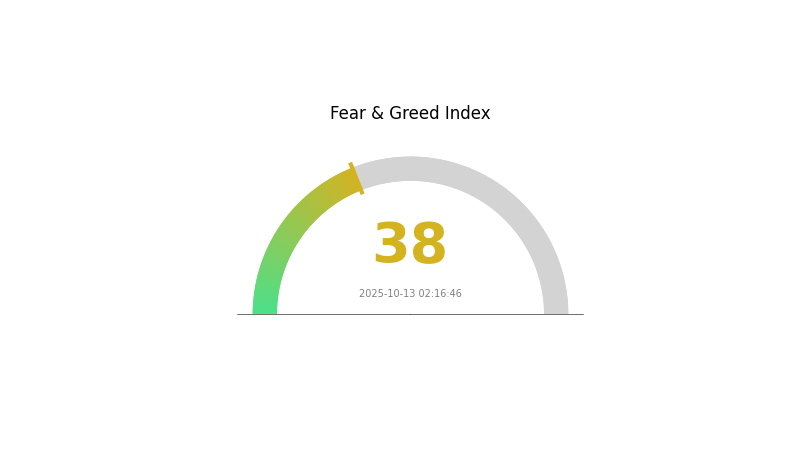

SLC Piyasa Duyarlılığı Göstergesi

2025-10-13 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görüntülemek için tıklayın

Kripto para piyasası şu anda korku döneminde ve duyarlılık endeksi 38 seviyesinde bulunuyor. Bu, yatırımcıların temkinli davrandığını gösteriyor. Böyle zamanlarda güncel kalmak ve rasyonel karar vermek önemlidir. Piyasa döngülerinin doğal olduğunu unutmayın; korku dönemleri, uzun vadeli bakış açısına sahip olanlar için alım fırsatları sunabilir. Ancak, yatırım kararı öncesinde daima kendi araştırmanızı yapmalı ve risk toleransınızı göz önünde bulundurmalısınız.

SLC Varlık Dağılımı

Adres varlık dağılımı grafiği, SLC tokenlarının farklı cüzdanlara ne oranda dağıldığını gösterir. Mevcut verilere göre, belirli adreslerde yüksek yoğunlukta SLC bulunmamaktadır. Bu durum, SLC varlıklarının ağ genelinde merkeziyetsiz bir şekilde dağıldığını göstermektedir.

Başlıca adreslerde büyük sahiplerin veya "balinaların" olmaması, SLC için daha dengeli bir piyasa yapısı sağlar. Bu dağılım, hiçbir adresin piyasa fiyatını manipüle edecek kadar token tutmaması sayesinde dalgalanmanın azalmasına ve manipülasyon riskinin düşmesine katkı sağlar. Ayrıca, mevcut adres dağılımı SLC ekosisteminde sağlıklı bir merkeziyetsizlik düzeyini yansıtmakta olup, blokzincir prensipleriyle uyum göstererek token'ın zincir üstü yapısında daha fazla istikrar sağlayabilir.

Güncel SLC Varlık Dağılımı'nı görüntülemek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|

II. Gelecekteki SLC Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Dengesi: Büyük üreticilerin üretimi azaltması ve stokları eritmesiyle birlikte gelecekte talebin toparlanması, depolama fiyatlarının yeniden yükselişini destekleyecek.

- Tarihsel Desen: SLC NAND fiyatları dip yaptıktan sonra, 2023 sonunda müşteri alım isteği belirgin şekilde yükselmiştir.

- Güncel Etki: SLC NAND fiyatlarının 2024'te ılımlı bir artış göstermesi beklenmekte olup, bu artış DRAM'e göre daha düşük kalacaktır.

Kurumsal ve Büyük Oyuncu Dinamikleri

- Kurumsal Benimseme: Kurumların yapay zekâya yatırımlarının artması, depolama çözümlerine talebi artırıyor.

Makroekonomik Ortam

- Enflasyona Karşı Korumalı Özellik: SLC tokenları, dijital varlık olarak enflasyona karşı potansiyel bir koruma aracı olabilir; ancak bu özellik mevcut bilgilerde kesin olarak belirtilmemiştir.

Teknolojik Gelişim ve Ekosistem İnşası

- Yapay Zekâ Gelişmeleri: Özellikle büyük dil modellerinin gelişimi, depolama sektöründe talebi artırıyor; bu da SLC NAND flash bellek için olumlu olabilir.

- NVIDIA Çip Üretimi: NVIDIA'nın yeni nesil Blackwell çiplerinin kitlesel üretimi, depolama çözümlerine olan talebi destekleyecek.

- Ekosistem Uygulamaları: SLC token ile ilişkili Silencio Network, gürültü istihbarat platformlarıyla şehir yaşamını dönüştürmeyi hedefliyor; bu da benimsenmeyi ve değeri artırabilir.

III. 2025-2030 SLC Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,00024 - 0,00026 ABD Doları

- Tarafsız tahmin: 0,00026 - 0,00028 ABD Doları

- İyimser tahmin: 0,00028 - 0,00033 ABD Doları (olumlu piyasa koşulları gerektirir)

2026-2027 Görünümü

- Piyasa fazı beklentisi: Potansiyel büyüme evresi

- Fiyat aralığı tahmini:

- 2026: 0,00018 - 0,00035 ABD Doları

- 2027: 0,00027 - 0,00040 ABD Doları

- Ana katalizörler: Yükselen benimseme oranı ve teknolojik gelişmeler

2028-2030 Uzun Vadeli Tahmin

- Temel senaryo: 0,00036 - 0,00050 ABD Doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00050 - 0,00060 ABD Doları (güçlü piyasa performansı halinde)

- Dönüştürücü senaryo: 0,00060 ABD Doları üzeri (son derece olumlu koşullarda)

- 2030-12-31: SLC 0,00055 ABD Doları (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00033 | 0,00027 | 0,00024 | 0 |

| 2026 | 0,00035 | 0,0003 | 0,00018 | 11 |

| 2027 | 0,0004 | 0,00033 | 0,00027 | 21 |

| 2028 | 0,00044 | 0,00036 | 0,00025 | 34 |

| 2029 | 0,0006 | 0,0004 | 0,00029 | 49 |

| 2030 | 0,00055 | 0,0005 | 0,00028 | 86 |

IV. SLC Yatırımı İçin Profesyonel Stratejiler ve Risk Yönetimi

SLC Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Gürültü kirliliği çözümlerine uzun vadeli ilgi duyan yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde SLC token biriktirin

- Proje gelişimi için en az 2-3 yıl elde tutun

- Token'larınızı güvenli bir Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç seviyelerini tespit edin

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım noktalarını belirleyin

- Swing trade için ipuçları:

- Proje gelişmelerini ve iş ortaklıklarını izleyin

- Risk yönetimi için zarar durdur emirleri kullanın

SLC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-8’i

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto varlığa dağıtın

- Zarar durdur emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. SLC İçin Potansiyel Riskler ve Zorluklar

SLC Piyasa Riskleri

- Volatilite: Küçük ölçekli tokenlarda yüksek fiyat dalgalanmaları

- Likitide: Sınırlı işlem hacmi, giriş/çıkış pozisyonlarını zorlaştırabilir

- Rekabet: Yeni çevresel veri projeleri ortaya çıkabilir

SLC Regülasyon Riskleri

- Veri gizliliği: Akıllı telefonlardan veri toplanmasına yönelik yasal düzenlemeler

- Token sınıflandırması: Utility token’ların yasal statüsünün belirsizliği

- Sınır ötesi kısıtlamalar: Kripto paraya yönelik düzenlemeler ülkeden ülkeye değişebilir

SLC Teknik Riskler

- Ölçeklenebilirlik: Büyük veri toplama süreçlerinde yönetim zorlukları

- Veri doğruluğu: Farklı cihazlardan güvenilir gürültü ölçümü sağlamak

- Akıllı sözleşme açıkları: Token kontratlarında güvenlik riskleri

VI. Sonuç ve Eylem Tavsiyeleri

SLC Yatırım Değeri Değerlendirmesi

SLC, büyüyen çevresel veri pazarında uzun vadeli potansiyel sunarken, erken aşama ve piyasa volatilitesi nedeniyle kısa vadede risk taşımaktadır.

SLC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Çeşitlendirilmiş portföyde küçük bir pozisyon alın

✅ Deneyimli yatırımcılar: Orta ölçekli pozisyon için düzenli alım (dolar maliyeti ortalaması) uygulayın

✅ Kurumsal yatırımcılar: Erken aşama blokzincir çevre yatırımı potansiyelini değerlendirin

SLC İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com ve seçili borsalarda işlem yapılabilir

- staking: Pasif gelir için mevcut staking programlarına katılın

- Proje katılımı: Silencio uygulaması üzerinden veri sağlayarak SLC token kazanın

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli, profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

SSS

2025 yılında kripto için fiyat tahmini nedir?

Bitcoin’in 60.000 ABD Doları, Ethereum’un 3.000 ABD Doları ve Solana’nın 100 ABD Doları seviyesine ulaşması bekleniyor. Diğer kripto paraların da ciddi büyüme göstermesi öngörülüyor.

2030 için XRP fiyat tahmini nedir?

Analist projeksiyonlarına göre, küresel varlıkların %10’u XRP Ledger’da tokenlaştırılırsa, XRP 2030’da 473.000 ABD Doları’na ulaşabilir. Bu tahmin, teknolojinin yaygın benimsenmesi varsayımına dayanmaktadır.

SLC’nin dolar cinsinden değeri nedir?

Ekim 2025 itibarıyla SLC yaklaşık 0,00035 ABD Doları’ndan işlem görmektedir. Fiyat son dönemde hafif dalgalanmalar göstermekte olup, son bir haftada küçük bir artış kaydedilmiştir.

SLP’nin geleceğe dönük tahmini nedir?

Mevcut piyasa eğilimlerine göre SLP’nin 2035’te 8,03 ABD Doları’na, 2040’ta ise 16,70 ABD Doları’na ulaşması beklenmektedir.

2025 CFX Fiyat Tahmini: Conflux Network Token’ın Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

2025 GRT Fiyat Tahmini: Graph Protocol'un gelecekteki değer eğrisinin ve piyasa potansiyelinin detaylı analizi

2025 XLM Fiyat Öngörüsü: Stellar'ın Değişen Kripto Ekosistemindeki Potansiyel Yükselişi

2025 TLOS Fiyat Tahmini: Telos Blockchain’e Yönelik Piyasa Analizi ve Büyüme Potansiyeli

2025 SYS Fiyat Tahmini: Piyasa Trendleri, Teknik Unsurlar ve Kurumsal Benimseme Potansiyelinin Analizi

2025 REI Fiyat Tahmini: Gayrimenkul Token Ekonomisi için Piyasa Analizi ve Büyüme Tahmini

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak