2025 QANX Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: QANX'in Piyasa Konumu ve Yatırım Potansiyeli

QANplatform (QANX), kuantum dirençli hibrit blokzincirlerin öncüsü olarak, 2021'de başladığı yolculuktan bu yana blokzincir sektöründe önemli bir ivme kazandı. 2025 itibarıyla QANX’in piyasa değeri $44.591.000 seviyesinde olup, dolaşımdaki yaklaşık 1.700.000.000 token ile fiyatı $0,02623 civarında seyrediyor. "Kuantum dirençli blokzincir çözümü" olarak bilinen bu varlık; akıllı sözleşmeler, DApp’ler, DeFi uygulamaları, token’lar, NFT’ler ve Metaverse alanında gün geçtikçe daha kritik bir rol oynuyor.

Bu makalede, 2025-2030 yılları arasında QANX’in fiyat eğilimleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörlerle birlikte analiz edilerek, profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler sunulacaktır.

I. QANX Fiyat Geçmişi ve Güncel Piyasa Durumu

QANX Fiyatının Tarihsel Seyri

- 2021: İlk çıkış, 28 Kasım’da $0,203412 ile zirve yaptı

- 2023: Piyasa gerilemesi, 13 Ocak’ta $0,00011724 ile en düşük seviyeye indi

- 2025: Kademeli toparlanma, güncel fiyat $0,02623

QANX’in Güncel Piyasa Görünümü

24 Ekim 2025 tarihinde QANX $0,02623 seviyesinden işlem görüyor; 24 saatlik işlem hacmi $49.210,27. Son 24 saatte %4,12’lik artış kaydedildi. QANX’in piyasa değeri $44.591.000; kripto piyasasında 671. sırada. Dolaşımdaki miktar 1.700.000.000 QANX olup, bu miktar toplam arzın %51’ini (2.099.550.000 QANX) oluşturuyor. Tam seyreltilmiş değer ise $87.433.324,59.

Kısa vadede QANX pozitif bir ivme yakaladı; son saatte %1,51, son haftada %3,42 değer kazandı. Fakat son 30 günde %10,24’lük bir kayıpla orta vadeli volatiliteye işaret ediyor. Yıl başından bu yana ise %1,32’lik hafif bir gerileme söz konusu.

Güncel QANX piyasa fiyatını görüntüleyin

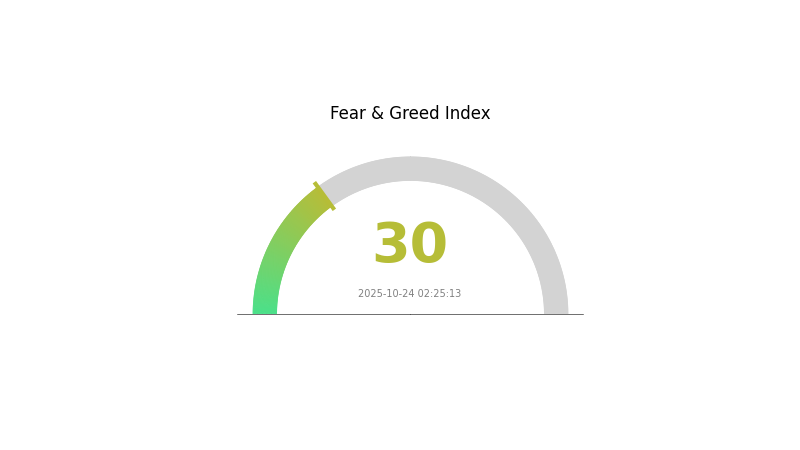

QANX Piyasa Duyarlılık Endeksi

24 Ekim 2025 Korku ve Açgözlülük Endeksi: 30 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; endeks 30 seviyesinde. Bu, yatırımcıların temkinli hareket ettiğini gösteriyor. Böylesi dönemlerde bazı yatırımcılar, “kriz anında alım yapılır” yaklaşımıyla fırsat kollarken, diğerleri daha fazla düşüş beklentisiyle temkinli davranıyor. Dalgalı kripto piyasasında yatırım kararlarınızı almadan önce kapsamlı araştırma yapmanız ve risk toleransınızı iyi belirlemeniz büyük önem taşır.

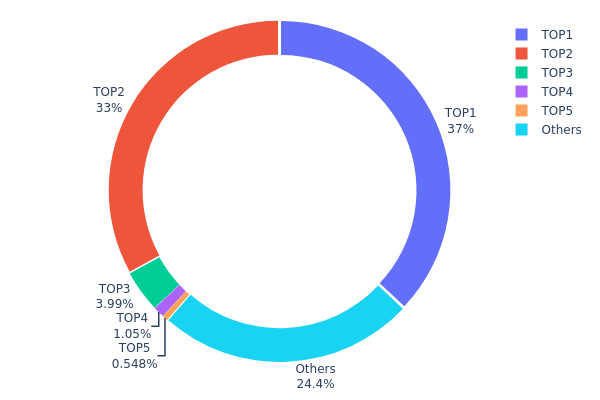

QANX Varlık Dağılımı

QANX’in adres dağılımı, sahiplikte yüksek yoğunlaşmaya işaret ediyor. En büyük iki adres, toplam arzın %70,01’ini elinde bulunduruyor; en büyüğü (yakım adresi) %37,01, ikinci en büyük ise %33,00 oranında paya sahip. Bu yoğunlaşma, piyasa manipülasyonu ve fiyat dalgalanması risklerini artırıyor.

İlk beş adres, QANX token’larının %75,59’unu elinde tutarken; kalan %24,41 diğer sahipler arasında dağıtılıyor. Bu dengesizlik merkeziyetsizliği sınırlandırıyor ve piyasa dinamiklerini etkileyebilir. Yakım adresinin (%37,01) varlığı, kıtlık yaratıp fiyatı etkileyebilir; fakat projenin tokenomik yaklaşımına dair soru işaretleri de oluşturuyor.

Büyük sahiplerin hareketleri, fiyat oynaklığını tetikleyebilir ve zincir üstü istikrarı azaltabilir. Birkaç büyük adresin eylemleri, token piyasasını belirgin şekilde etkileyebilir.

Güncel QANX Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 1.233.783,00K | 37,01% |

| 2 | 0x3e9d...33a32a | 1.100.000,00K | 33,00% |

| 3 | 0xaaa9...cc3aaa | 133.158,63K | 3,99% |

| 4 | 0xc882...84f071 | 35.023,84K | 1,05% |

| 5 | 0xd7f3...904cd8 | 18.275,10K | 0,54% |

| - | Diğerleri | 813.092,42K | 24,41% |

II. QANX’in Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Mevcut Etki: Arz-talep dengesi, QANX’in fiyat hareketlerinde doğrudan belirleyicidir.

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: Fon giriş ve çıkışları, QANX’in fiyatında önemli rol oynar.

Makroekonomik Koşullar

- Para Politikası Etkisi: Enflasyon ve faiz politikaları, QANX fiyatını makro düzeyde etkiler.

Teknoloji ve Ekosistem Gelişimi

- Piyasa Benimsenmesi: QANX’in yaygın kullanımı veya kritik teknolojik gelişmeler fiyatı pozitif etkileyebilir.

- Ekosistem Uygulamaları: QANplatform ağı içindeki DApp ve projeler, QANX’in değerini şekillendirir.

III. 2025-2030 QANX Fiyat Tahminleri

2025 Beklentisi

- Temkinli tahmin: $0,02176 - $0,02622

- Tarafsız tahmin: $0,02622 - $0,02858

- İyimser tahmin: $0,02858 - $0,03094 (pozitif piyasa ve proje gelişimi gerektirir)

2027-2028 Beklentisi

- Piyasa evresi: Artan volatiliteyle birlikte potansiyel büyüme dönemi

- Fiyat aralığı:

- 2027: $0,01894 - $0,04133

- 2028: $0,01932 - $0,05304

- Kilit tetikleyiciler: Teknoloji gelişimi, yaygın benimseme ve genel kripto piyasası trendleri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: $0,04546 - $0,05410 (istikrarlı büyüme ve benimseme varsayımı)

- İyimser senaryo: $0,06273 - $0,07736 (önemli proje başarıları ve olumlu piyasa koşulları)

- Dönüştürücü senaryo: $0,07736+ (çığır açıcı yenilikler ve aşırı elverişli şartlarla)

- 2030-12-31: QANX $0,07736 (potansiyel tepe fiyat, piyasa koşullarına bağlı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,03094 | 0,02622 | 0,02176 | 0 |

| 2026 | 0,0403 | 0,02858 | 0,02372 | 8 |

| 2027 | 0,04133 | 0,03444 | 0,01894 | 31 |

| 2028 | 0,05304 | 0,03788 | 0,01932 | 44 |

| 2029 | 0,06273 | 0,04546 | 0,02773 | 73 |

| 2030 | 0,07736 | 0,0541 | 0,04652 | 106 |

IV. QANX Yatırım Stratejileri ve Risk Yönetimi

QANX Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Risk toleransı yüksek, uzun vadeli bakış açısına sahip olanlar

- Operasyon önerileri:

- Piyasa gerilemelerinde QANX biriktirin

- Fiyat hedefleri belirleyip portföyü düzenli aralıklarla dengeleyin

- QANX’i güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Trend ve potansiyel dönüş noktalarını tespit edin

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım sinyalleri için kullanın

- Kısa vadeli işlemlerde dikkat edilmesi gerekenler:

- QANX’in büyük kripto varlıklarla korelasyonunu takip edin

- Zararları sınırlamak için kesin stop-loss emirleri uygulayın

QANX Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto varlıklara yayarak riskleri azaltın

- Stop-loss emirleri: Potansiyel zararları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Büyük varlıklar için ağdan bağımsız cihazlar kullanın

- Güvenlik: İki faktörlü kimlik doğrulamayı açın, güçlü şifreler oluşturun

V. QANX İçin Potansiyel Riskler ve Zorluklar

QANX Piyasa Riskleri

- Volatilite: Kripto piyasalarında aşırı fiyat oynaklığı

- Likidite: Sınırlı hacim, pozisyon açma/kapamada zorluk yaratabilir

- Rekabet: Diğer kuantum dirençli blokzincir projeleri pazar payı kazanabilir

QANX Düzenleyici Riskler

- Belirsiz mevzuat: Devlet politikalarındaki değişiklikler QANX’in benimsenmesini etkileyebilir

- Uyum sorunları: Gelecekte uyum gerekliliklerinde potansiyel zorluklar

- Uluslararası sınırlamalar: Küresel düzenlemeler QANX’in yayılımını kısıtlayabilir

QANX Teknik Riskler

- Akıllı sözleşme açıkları: QANX platformunda olası yazılım hataları

- Ölçeklenebilirlik zorlukları: Ağ yükü arttıkça performans sınırları

- Kuantum bilişimde ilerlemeler: QANX’in kuantum direncini güncelleme ihtiyacı doğabilir

VI. Sonuç ve Eylem Önerileri

QANX’in Yatırım Değeri Değerlendirmesi

QANX, uzun vadede kuantum dirençli blokzincir platformu olarak değer sunar; ancak kısa vadede piyasa oynaklığı ve teknik belirsizlikler risk oluşturur.

QANX Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, teknoloji odaklı öğrenmeye yönelin

✅ Deneyimli yatırımcılar: QANX’i çeşitlendirilmiş portföyde değerlendirin

✅ Kurumsal yatırımcılar: QANX’in teknolojisi ve ekibiyle ilgili kapsamlı inceleme yapın

QANX İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden QANX alıp tutun

- DeFi staking: Varsa QANX staking programlarına katılın

- Düzenli alım yöntemi: Piyasa zamanlaması riskini azaltmak için belirli aralıklarla küçük yatırım yapın

Kripto para yatırımları son derece yüksek risk içerir. Bu makalenin amacı yatırım tavsiyesi vermek değildir. Yatırımcılar, kendi risk toleranslarına uygun şekilde dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden daha fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

QNT $1.000 seviyesine ulaşır mı?

Mevcut tahminlere göre QNT 2025’e kadar $1.000 seviyesine ulaşmayacak gibi görünüyor. Ancak bazı analistler, benimsenme ve ağ büyümesine paralel olarak 2030’da bu hedefin mümkün olabileceğini öngörüyor.

QANX kripto nedir?

QANX, merkeziyetsiz borsalar için ERC20/BEP20 token olup, özelleştirilebilir kilitleme ve hak ediş özellikleri barındırır. QANplatform blokzincir ekosistemiyle ilişkilidir.

2030’da 1 QNT’nin değeri ne olur?

Mevcut tahminlere göre, 1 QNT 2030’da $550 ile $900 arasında değerlendirilebilir. Bu aralık, Quant teknolojisinin benimsenmesi ve piyasa büyüme potansiyeline göre şekillenmektedir.

2025 için QuantumCoin fiyat tahmini nedir?

Piyasa analizlerine göre QuantumCoin’in 2025 fiyat tahmini yaklaşık $0,068806 olup, önümüzdeki yıllarda büyüme potansiyeli sunmaktadır.

2025 XLM Fiyat Tahmini: Olgunlaşan Kripto Ekosisteminde Stellar Lumens’in Potansiyel Büyüme Yolu

2025 DGB Fiyat Tahmini: DigiByte Kripto Para Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 SOUL Fiyat Tahmini: Dijital Varlık İçin Piyasa Trendleri ve Gelecek Perspektiflerinin Analizi

2025 NANO Fiyat Tahmini: Dijital Para Biriminin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 DKA Fiyat Tahmini: Piyasa Eğilimleri ve Olası Büyüme Faktörlerinin Analizi

2025 BLY Fiyat Tahmini: Bluey Token’ın Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım

Web3'te Hashing Kavramı: Kapsamlı Bir Blockchain Rehberi

Ethereum Gas Ücretlerini Anlamak: Tam Kapsamlı Rehber