2025 BLY Fiyat Tahmini: Bluey Token’ın Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: BLY'nin Piyasa Konumu ve Yatırım Değeri

Blocery (BLY), tarım ve gıda tedarik zinciri yönetimi için blokzincir tabanlı bir platform olarak sektörde faaliyet göstermeye başladığından bu yana önemli gelişmeler kaydetmiştir. 2025 yılı itibarıyla Blocery'nin piyasa değeri 3.050.774,98 ABD doları seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 974.999.995,64 token ve fiyatı 0,003129 ABD doları civarında seyretmektedir. "Gıda tedarik zinciri yenilikçisi" olarak bilinen bu varlık, tarım ve gıda endüstrisinde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Blocery'nin 2025-2030 yılları arasındaki fiyat trendleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde incelenerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulmaktadır.

I. BLY Fiyat Geçmişi ve Güncel Piyasa Durumu

BLY Tarihsel Fiyat Seyri

- 2020: Proje başlatıldı, 23 Kasım'da fiyat tüm zamanların en düşük seviyesi olan 0,0010071 ABD dolarına indi

- 2021: Boğa piyasası zirvesi, 5 Nisan'da fiyat tüm zamanların en yüksek seviyesi olan 0,724004 ABD dolarına ulaştı

- 2022-2025: Uzun süreli ayı piyasası, fiyat zirveden ciddi şekilde geriledi

BLY Güncel Piyasa Durumu

14 Ekim 2025 itibarıyla BLY, 0,003129 ABD dolarından işlem görmektedir ve piyasa değeri 3.050.774,99 ABD dolarıdır. Token son 24 saatte %3,43 değer kazanırken, son 30 günde %20,66 ve son bir yılda %38,03 gerilemiştir. BLY'nin mevcut fiyatı, zirve fiyatının %99,57 altındadır ve bu, uzun soluklu bir ayı trendini ifade eder. Toplam arzın %97,5’i dolaşımdadır (974.999.995,64 BLY). Tam seyreltilmiş piyasa değeri 3.129.000 ABD doları olup, bu durum arz kaynaklı fiyat enflasyonunun sınırlı olacağını göstermektedir.

Mevcut BLY piyasa fiyatını görüntülemek için tıklayın

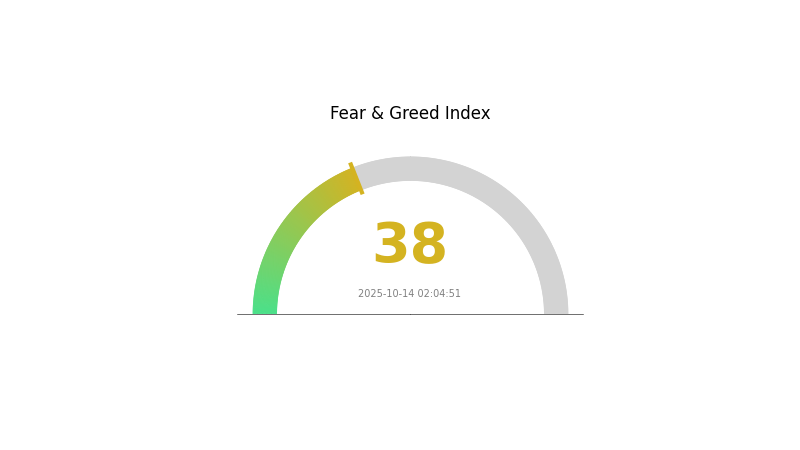

BLY Piyasa Duyarlılığı Göstergesi

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Mevcut Korku & Açgözlülük Endeksini görüntüleyin

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 38 seviyesinde bulunuyor. Bu durum, yatırımcıların piyasa koşullarına karşı temkinli ve tedirgin olduğunu gösteriyor. Böyle dönemlerde, bazı yatırımcılar "diğerleri açgözlü iken kork, korku varken açgözlü ol" ilkesini benimseyerek düşük fiyatlardan varlık biriktirme fırsatı arıyor. Ancak, bu volatil piyasada yatırım kararı almadan önce kapsamlı araştırma yapmak ve temkinli davranmak gereklidir.

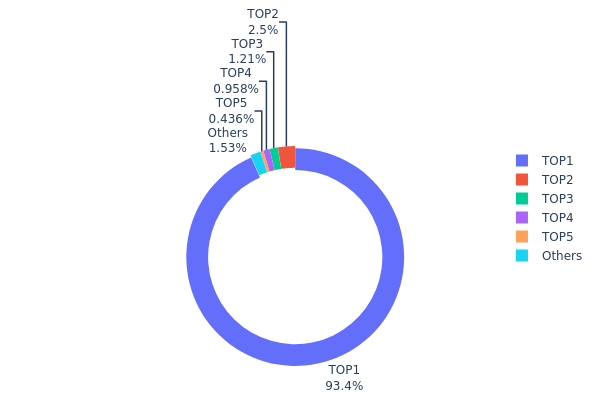

BLY Varlık Dağılımı

BLY adres dağılımı, sahipliğin son derece yoğunlaşmış olduğunu göstermektedir. En büyük adres, toplam arzın %93,36’sına denk gelen 933.659,96K BLY tokenını elinde tutmaktadır. Bu aşırı yoğunlaşma, merkezileşme ve olası piyasa manipülasyonu risklerini artırmaktadır. İkinci büyük adresin varlığı %2,50 iken, diğer üst adreslerde oranlar daha azdır.

Böyle dengesiz bir dağılım, BLY'nin piyasa dinamiklerini ciddi şekilde etkileyebilir. Hakim adres, fiyat hareketlerinde önemli ölçüde rol oynayabilir; bu da volatiliteyi ve ani büyük satışları tetikleyebilir. Yoğunlaşma, kripto projelerinde temel olan merkezsizliğin de zayıflamasına neden olur.

Piyasa açısından bu tablo, fiyat manipülasyonu riski ve üst adresler dışında düşük likiditeye işaret eder. Ayrıca, daha geniş kullanıcı tabanında token dağılımının az olması, yaygın benimsenmeyi ve organik fiyat oluşumunu engelleyebilir.

Mevcut BLY Varlık Dağılımını görüntüleyin

| İlk | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x6eb8...9629b8 | 933.659,96K | 93,36% |

| 2 | 0xbcd5...5eab40 | 25.000,00K | 2,50% |

| 3 | 0x9642...2f5d4e | 12.062,91K | 1,20% |

| 4 | 0x5066...6bb3d1 | 9.581,30K | 0,95% |

| 5 | 0xe303...ad2087 | 4.363,83K | 0,43% |

| - | Diğerleri | 15.332,00K | 1,56% |

II. BLY'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Yarılanma: BLY, belirli dönemlerde blok ödüllerinin %50 azalmasını sağlayan yarılanma süreçleri yaşamaktadır.

- Tarihsel Model: Önceki yarılanmalar, arz enflasyonunun azalması nedeniyle fiyat artışlarına yol açmıştır.

- Güncel Etki: Yaklaşan yarılanmanın BLY fiyatında yukarı yönlü baskı oluşturması beklenmektedir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük finans kuruluşları BLY pozisyonlarını artırmaktadır.

- Kurumsal Katılım: Birçok Fortune 500 şirketi BLY'yi bilançosuna eklemiştir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının olası faiz değişiklikleri, BLY'nin yatırım olarak cazibesini etkileyebilir.

- Enflasyon Korumalı Özellikler: BLY, son ekonomik döngülerde enflasyona karşı dayanıklılık göstermiştir.

Teknik Gelişim ve Ekosistem Büyümesi

- Katman 2 Çözümleri: İşlem hızını artırmak ve ücretleri düşürmek için Katman 2 ölçeklendirme çözümleri uygulanıyor.

- Akıllı Sözleşme Geliştirmeleri: Daha karmaşık DeFi uygulamalarına olanak sağlamak için akıllı sözleşme fonksiyonları geliştiriliyor.

- Ekosistem Uygulamaları: BLY ağı üzerinde kurulan DApp ve DeFi protokollerinin sayısı giderek artıyor.

III. 2025-2030 BLY Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,00278 - 0,00313 ABD doları

- Tarafsız tahmin: 0,00313 - 0,00382 ABD doları

- İyimser tahmin: 0,00382 - 0,00451 ABD doları (olumlu piyasa duyarlılığı ve proje gelişmeleri ile)

2026-2027 Görünümü

- Piyasa beklentisi: Benimsenmenin arttığı potansiyel büyüme evresi

- Fiyat aralığı tahmini:

- 2026: 0,00225 - 0,0042 ABD doları

- 2027: 0,00297 - 0,00413 ABD doları

- Temel tetikleyiciler: Proje kilometre taşları, piyasa döngüleri ve genel kripto benimsenmesi

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00407 - 0,00459 ABD doları (istikrarlı piyasa büyümesi ve proje geliştirme varsayımıyla)

- İyimser senaryo: 0,00489 - 0,00625 ABD doları (güçlü ekosistem genişlemesi ve piyasa penetrasyonu ile)

- Dönüştürücü senaryo: 0,00625+ ABD doları (oldukça olumlu piyasa koşulları ve çığır açan yenilikler ile)

- 31 Aralık 2030: BLY 0,00625 ABD doları (güncel projeksiyonlara göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,00451 | 0,00313 | 0,00278 | 0 |

| 2026 | 0,0042 | 0,00382 | 0,00225 | 22 |

| 2027 | 0,00413 | 0,00401 | 0,00297 | 28 |

| 2028 | 0,00452 | 0,00407 | 0,00285 | 30 |

| 2029 | 0,00489 | 0,00429 | 0,00335 | 37 |

| 2030 | 0,00625 | 0,00459 | 0,00427 | 46 |

IV. BLY Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BLY Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde BLY token biriktirin

- Fiyat hedefleri belirleyerek periyodik gözden geçirin

- Tokenları güvenli bir donanım cüzdanında saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası giriş/çıkış noktalarını belirlemek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım ve aşırı satım koşullarını izleyin

- Dalgalı ticaret için önemli noktalar:

- Potansiyel zararları sınırlamak için zarar durdur emirleri kullanın

- Belirlenen seviyelerde kar alımı yapın

BLY Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Koruyucu yatırımcılar: %1-3

- Orta seviye yatırımcılar: %3-5

- Agresif yatırımcılar: %5-10

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla kripto para arasında dağıtın

- Zarar durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate web3 cüzdanı

- Yazılım cüzdanı seçeneği: Resmi Blocery cüzdanı (mevcutsa)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, özel anahtarları çevrimdışı saklayın

V. BLY İçin Potansiyel Riskler ve Zorluklar

BLY Piyasa Riskleri

- Yüksek oynaklık: Kripto para piyasalarında fiyatlar ani şekilde değişebilir

- Sınırlı likidite: BLY'nin işlem hacmi büyük kripto paralara kıyasla düşük olabilir

- Piyasa duyarlılığı: Genel kripto piyasası eğilimlerinden etkilenir

BLY Düzenleyici Riskler

- Belirsiz düzenlemeler: Kripto para düzenlemeleri ülkeden ülkeye değişir ve zamanla farklılaşabilir

- Uyum güçlükleri: Gelişen düzenleyici gerekliliklere uyumda zorluk yaşanabilir

- Vergi sonuçları: Kripto para işlemlerinin vergilendirilmesi konusunda belirsizlik veya karmaşıklık olabilir

BLY Teknik Riskler

- Akıllı sözleşme açıkları: Kodda güvenlik zafiyetleri ortaya çıkabilir

- Ağ tıkanıklığı: Ethereum ağındaki sorunlar işlem hızını ve maliyetleri etkileyebilir

- Teknolojik eskime: Daha yeni blokzincir teknolojilerinin gerisinde kalma olasılığı

VI. Sonuç ve Eylem Önerileri

BLY Yatırım Değeri Değerlendirmesi

BLY, blokzincir teknolojisiyle tarımsal tedarik zinciri sektöründe kendine özgü bir değer sunmaktadır. Ancak, piyasa oynaklığı ve mevzuat belirsizlikleri nedeniyle kısa vadede önemli risklerle karşı karşıyadır. Proje ekosistemini ve kullanıcı tabanını başarıyla genişletirse, uzun vadede potansiyel taşımaktadır.

BLY Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük ve kademeli yatırımlar yapmayı değerlendirin ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın ve çeşitlendirilmiş kripto portföyünüzde yer verin

BLY Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden BLY token alıp satabilirsiniz

- Staking: Blocery platformu sunuyorsa staking programlarına katılabilirsiniz

- DeFi entegrasyonu: BLY token ile ilgili merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcıların kendi risk toleransları doğrultusunda dikkatli karar vermeleri ve profesyonel finans danışmanlarına başvurmaları önerilir. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

2030’da Bluzelle coin fiyatı ne olabilir?

Piyasa trendleri ve büyüme potansiyeli dikkate alındığında, Bluzelle (BLY) 2030’da 5 ila 7 ABD doları aralığına ulaşabilir. Bu tahmin, merkeziyetsiz depolama çözümlerinin benimsenmeye devam etmesi ve Bluzelle’in teknolojik gelişmeleri üzerine kuruludur.

Hisse senedi fiyat tahmini için en iyi yapay zeka hangisi?

Hisse senedi fiyat tahmininde en etkili araçlar arasında LSTM, transformer tabanlı modeller ve topluluk yöntemleri yer almaktadır.

2025’te kripto için fiyat tahmini nedir?

Mevcut piyasa eğilimleri ve uzman analizleri, 2025’te kripto fiyatlarında kayda değer artışlar öngörmektedir. Birçok analist Bitcoin’de 100.000 ila 150.000 ABD doları aralığını tahmin etmekte, diğer büyük kripto paraların da bunu takip edeceğini belirtmektedir.

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin (BTC), en yüksek gelecek fiyat tahminine sahip kripto para olarak öne çıkıyor; bazı analistler 2030’a kadar 500.000 ABD doları veya daha fazlasına ulaşabileceğini öngörüyor.

2025 XLM Fiyat Tahmini: Olgunlaşan Kripto Ekosisteminde Stellar Lumens’in Potansiyel Büyüme Yolu

2025 DGB Fiyat Tahmini: DigiByte Kripto Para Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 SOUL Fiyat Tahmini: Dijital Varlık İçin Piyasa Trendleri ve Gelecek Perspektiflerinin Analizi

2025 NANO Fiyat Tahmini: Dijital Para Biriminin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 QANX Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 DKA Fiyat Tahmini: Piyasa Eğilimleri ve Olası Büyüme Faktörlerinin Analizi

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım

Web3'te Hashing Kavramı: Kapsamlı Bir Blockchain Rehberi

Ethereum Gas Ücretlerini Anlamak: Tam Kapsamlı Rehber