2025 SOUL Price Prediction: Analyzing Market Trends and Future Prospects for the Digital Asset

Introduction: SOUL's Market Position and Investment Value

Phantasma (SOUL), as a next-generation messaging protocol built on blockchain technology, has made significant strides since its inception in 2018. As of 2025, Phantasma's market capitalization has reached $2,119,189, with a circulating supply of approximately 132,119,034 tokens, and a price hovering around $0.01604. This asset, often referred to as a "decentralized content delivery system," is playing an increasingly crucial role in secure and private messaging and data sharing.

This article will comprehensively analyze Phantasma's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SOUL Price History Review and Current Market Status

SOUL Historical Price Evolution

- 2020: SOUL hit its all-time low of $0.00960482 on March 16, amid the global market crash

- 2021: SOUL reached its all-time high of $3.96 on December 1, during the bull market peak

- 2025: SOUL has experienced a significant downturn, with the price dropping to $0.01604

SOUL Current Market Situation

As of October 15, 2025, SOUL is trading at $0.01604, representing a substantial decline of 99.59% from its all-time high. The token has seen negative price movements across all time frames, with a 14.27% decrease in the last 24 hours and a 32.49% drop over the past week. The 30-day and 1-year price changes are -45.41% and -70.75% respectively, indicating a prolonged bearish trend.

SOUL's market capitalization currently stands at $2,119,189, ranking it 2326th in the cryptocurrency market. The token has a circulating supply of 132,119,034.54 SOUL, which is 106.44% of its total supply of 124,129,197 SOUL. The fully diluted valuation is $1,991,032, suggesting that the market cap is currently higher than the theoretical maximum market cap if all tokens were in circulation.

Trading volume in the last 24 hours is $109,486, which is relatively low compared to its market capitalization. This low liquidity could contribute to increased price volatility.

Click to view the current SOUL market price

SOUL Market Sentiment Indicator

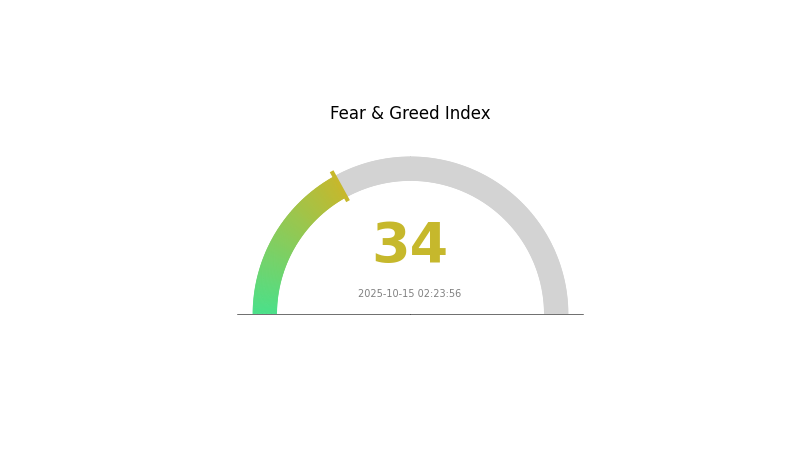

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the sentiment index at 34. This cautious atmosphere may present opportunities for strategic investors. While some may be hesitant, others see this as a potential buying opportunity. It's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and be prepared for potential market movements in either direction.

SOUL Holdings Distribution

The address holdings distribution data for SOUL reveals an interesting pattern in token concentration. Unfortunately, the specific data table is currently empty, which limits our ability to provide a detailed analysis. However, we can discuss the general implications of such distributions.

In a typical scenario, a healthy token distribution would show a balanced spread across various address tiers. This balance is crucial for maintaining market stability and reducing the risk of price manipulation. Without concrete data, it's challenging to assess SOUL's current centralization characteristics or determine if there's an excessive concentration of tokens in a few hands.

The absence of distribution data could indicate either a highly decentralized structure where no single address holds a significant portion, or it might suggest a lack of transparency in token allocation. For a comprehensive understanding of SOUL's market structure and potential volatility, it would be essential to obtain and analyze the actual distribution data.

Click to view the current SOUL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting SOUL's Future Price

Supply Mechanism

- Halving: Potential reduction in new SOUL supply could impact price

- Historical Pattern: Previous supply changes have influenced price movements

- Current Impact: Upcoming supply changes may lead to increased scarcity and price appreciation

Macroeconomic Environment

- Monetary Policy Impact: Major central banks' policies, including potential rate cuts, could affect SOUL's value

- Inflation Hedging Properties: SOUL may be viewed as a store of value during inflationary periods

- Geopolitical Factors: Global tensions and economic policies significantly impact price movements

Technological Development and Ecosystem Building

- Blockchain Upgrades: Improvements in scalability and efficiency could drive adoption

- Ecosystem Applications: Growth of DApps and projects built on SOUL's network may increase utility and demand

III. SOUL Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01203 - $0.01604

- Neutral forecast: $0.01604 - $0.01837

- Optimistic forecast: $0.01837 - $0.02069 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.01218 - $0.02398

- 2028: $0.01644 - $0.02904

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.0252 - $0.03074 (assuming steady market growth)

- Optimistic scenario: $0.03074 - $0.04366 (assuming strong market performance)

- Transformative scenario: $0.04366+ (under extremely favorable conditions)

- 2030-12-31: SOUL $0.04366 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02069 | 0.01604 | 0.01203 | 0 |

| 2026 | 0.0191 | 0.01837 | 0.01304 | 14 |

| 2027 | 0.02398 | 0.01873 | 0.01218 | 16 |

| 2028 | 0.02904 | 0.02136 | 0.01644 | 33 |

| 2029 | 0.03629 | 0.0252 | 0.01764 | 57 |

| 2030 | 0.04366 | 0.03074 | 0.01691 | 91 |

IV. Professional Investment Strategies and Risk Management for SOUL

SOUL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term horizon

- Operation suggestions:

- Accumulate SOUL during market dips

- Set price targets for partial profit-taking

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders

- Take profits at predetermined levels

SOUL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2%

- Aggressive investors: 3-5%

- Professional investors: 5-10%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for SOUL

SOUL Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Low liquidity: Limited trading volume may impact price stability

- Market sentiment: Susceptible to rapid shifts in investor sentiment

SOUL Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting SOUL

- Cross-border compliance: Varying regulations across different jurisdictions

- Taxation: Evolving tax laws may impact SOUL holders

SOUL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Network scalability: Challenges in handling increased transaction volume

- Technological obsolescence: Risk of being outpaced by newer blockchain technologies

VI. Conclusion and Action Recommendations

SOUL Investment Value Assessment

SOUL presents a high-risk, high-potential investment opportunity. While its innovative messaging protocol offers long-term value, short-term volatility and regulatory uncertainties pose significant risks.

SOUL Investment Recommendations

✅ Beginners: Consider small, experimental positions with strict risk management ✅ Experienced investors: Implement dollar-cost averaging strategy with defined exit points ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

SOUL Trading Participation Methods

- Spot trading: Purchase SOUL directly on Gate.com

- Staking: Explore potential staking options if available

- DeFi integration: Participate in decentralized finance protocols supporting SOUL, if applicable

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Solana 2025?

Solana's price is predicted to reach around $364 by 2025, with potential to rise to $482. This forecast is based on continued adoption and technological advancements in Solana's ecosystem.

How much is the soul coin worth?

As of 2025, the soul coin is estimated to be worth around $0.15 to $0.20, showing steady growth in the crypto market.

What crypto has the highest price prediction?

As of 2025, Ethereum has the highest price prediction among major cryptocurrencies, based on market trends and technological advancements.

What is Shiba's future price prediction?

Shiba Inu's price is projected to reach $0.000025 by 2030. With its substantial market cap, SHIB shows strong growth potential and investment interest in the coming years.

Share

Content