2025 POL Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: POL'un Piyasadaki Konumu ve Yatırım Potansiyeli

Polygon Ekosistem Tokenı (POL), Ethereum ölçeklendirme ve altyapı geliştirme alanında kilit bir oyuncu olarak, kuruluşundan bu yana önemli aşamalar kaydetti. 2025 yılı itibarıyla POL'un piyasa değeri 2,11 milyar dolara ulaştı; dolaşımdaki arz yaklaşık 10,52 milyar token ve fiyatı 0,2004 dolar civarında seyrediyor. Sıkça "Ethereum Ölçeklendirme Çözümü" olarak anılan bu varlık, Ethereum'un kapasitesini genişletmede ve güçlü bir ekosistem oluşturulmasında kritik bir rol üstleniyor.

Bu makalede, POL'un 2025-2030 dönemindeki fiyat trendleri; tarihsel hareketler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde analiz edilerek, yatırımcılara uzman fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. POL Fiyat Geçmişi ve Güncel Piyasa Durumu

POL'un Tarihsel Fiyat Yolculuğu

- 2023: POL, 16 Kasım'da 0,0921 dolar ile tarihindeki en düşük seviyeye gerileyerek önemli bir dip yaşadı.

- 2024: Token, 22 Nisan'da 1,5711 dolar ile zirveye ulaşarak güçlü bir yükseliş gösterdi.

- 2025: Piyasa düzeltme sürecine girerek fiyatı zirveden mevcut seviyeye düştü.

POL Güncel Piyasa Görünümü

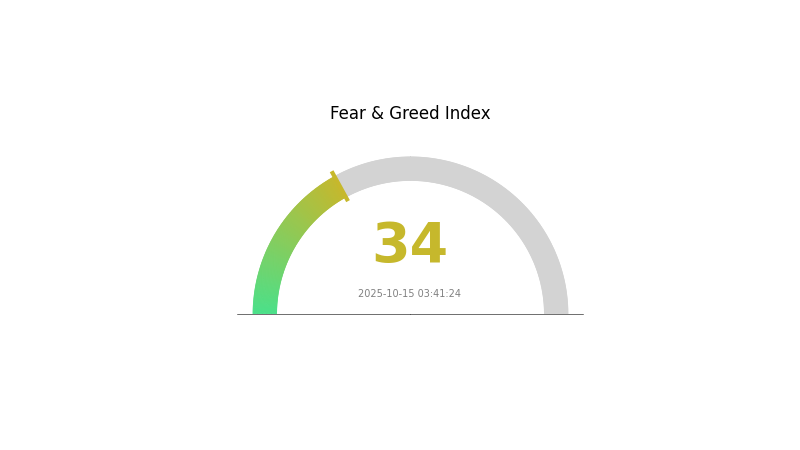

15 Ekim 2025 itibarıyla POL, 0,2004 dolardan işlem görüyor ve son 24 saatte %1,42 oranında değer kaybetti. Token, farklı dönemlerde ciddi aşağı yönlü baskı yaşadı; son bir haftada %15,62 ve son bir ayda %26,22 geriledi. Mevcut fiyat, tüm zamanların en yüksek seviyesinden %87,25 oranında düşüş anlamına geliyor ve süregelen ayı piyasasını gösteriyor. POL'un piyasa değeri 2.107.909.533 dolar ile kripto para piyasasında 59. sırada yer alıyor. Son 24 saatlik işlem hacmi 2.368.754 dolar ve bu, orta seviye bir piyasa aktivitesine işaret etmekte. VIX endeksi 34 seviyesinde ve piyasa hissiyatı "Korku" olarak tanımlanıyor; bu durum yatırımcı davranışını ve fiyat hareketlerini etkileyebilir.

Güncel POL piyasa fiyatını görüntüle

POL Piyasa Duyarlılık Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasındaki duyarlılık "Korku" bölgesinde ve Korku ve Açgözlülük Endeksi 34 seviyesinde. Bu, yatırımcıların temkinli olduğuna işaret ederken, uzun vadeli bakış açısına sahip olanlar için alım fırsatları doğurabilir. Ancak piyasa duygusunun hızla değişebileceğini unutmayın. Her zaman kapsamlı araştırma yapın, portföyünüzü çeşitlendirin ve sadece kaybetmeyi göze alabileceğiniz kadar yatırım yapın. Piyasa gelişmelerini yakından takip edin ve Gate.com gibi araçlarla bu dalgalı piyasada bilinçli kararlar alın.

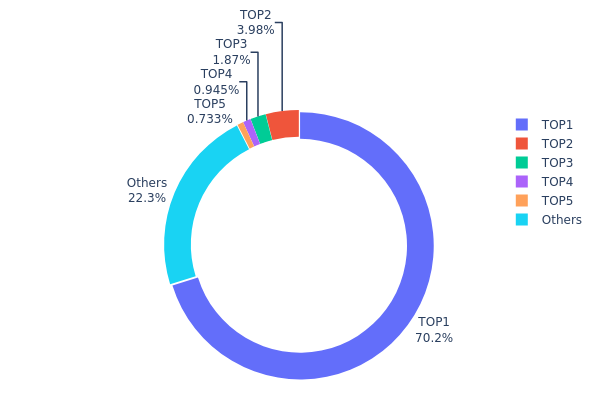

POL Varlık Dağılımı

POL adres varlık dağılımı verileri, sahiplikte yüksek bir yoğunlaşmayı gösteriyor. En büyük adres, toplam arzın %70,20'sini yani 7.384.082,55K POL tokenını elinde tutuyor. Bu yoğunlaşma, piyasa dinamikleri üzerinde önemli etkiler yaratabilir. İkinci ve üçüncü en büyük sahipler sırasıyla %3,98 ve %1,87'lik paya sahipken, ilk 5 adresin geri kalanı her biri %1'in altında.

Böyle bir yoğun dağılım, merkezileşme ve olası piyasa manipülasyonu risklerini beraberinde getiriyor. Lider adresin fiyat hareketlerine ve likiditeye etkisi oldukça yüksek. Bu yoğunlaşma, büyük satışların gerçekleşmesi halinde volatiliteyi artırabilir ve projenin merkeziyetsizlik iddialarını zayıflatabilir. Ayrıca, adil token dağılımı konusunda soru işaretleri doğurabilir.

Piyasa yapısı açısından bu dağılım, ekosistemin henüz olgunlaşmadığını ve yaygın benimsenmenin sınırlı olduğunu gösteriyor olabilir. Büyük miktarda tokenın proje içi aktörler veya erken yatırımcılar tarafından tutulduğunu gösterebilir. Yatırımcılar için bu dağılım, temkinli olmayı gerektirir ve büyük adres hareketlerinin olası piyasa etkileri dikkatle izlenmelidir.

Güncel POL Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...001010 | 7.384.082,55K | 70,20% |

| 2 | 0x4c56...989ff4 | 418.277,98K | 3,98% |

| 3 | 0x0d50...df1270 | 197.073,19K | 1,87% |

| 4 | 0x79b4...c2cf38 | 99.358,51K | 0,94% |

| 5 | 0x7d34...c4777e | 77.152,59K | 0,73% |

| - | Others | 2.342.565,84K | 22,28% |

II. POL Fiyatını Gelecekte Etkileyecek Temel Unsurlar

Arz Mekanizması

- Mevcut Etki: Polygon 2.0 yükseltmesinin hayata geçirilmesi, POL tokenlarının arz dinamiklerini değiştirebilir.

Kurumsal ve Balina Hareketleri

- Kurumsal Kullanım: Tether, Ağustos 2025'te Polygon üzerinde USDT ve altın destekli XAUt0'u devreye alarak zincirler arası likiditeyi artırdı.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma: POL'un enflasyonist ortamlardaki performansı fiyatını etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Polygon 2.0 Yükseltmesi: Ağın kapasitesini artırması ve fiyatı olumlu etkilemesi bekleniyor.

- Ekosistem Uygulamaları: QuickSwap ve Polymarket gibi başlıca DApp'ler sayesinde Polygon'un Kilitli Toplam Değeri (TVL) yıl başından bu yana %43 artışla 1,23 milyar dolara çıktı.

III. POL 2025-2030 Fiyat Öngörüleri

2025 Beklentisi

- Temkinli tahmin: 0,13607 - 0,18000 dolar

- Tarafsız tahmin: 0,18000 - 0,22000 dolar

- İyimser tahmin: 0,22000 - 0,27014 dolar (olumlu piyasa koşulları ve benimsenmenin artması halinde)

2027-2028 Beklentisi

- Piyasa evresi: Artan volatiliteyle büyüme potansiyeli

- Fiyat aralığı:

- 2027: 0,17986 - 0,29977 dolar

- 2028: 0,25361 - 0,36153 dolar

- Temel faktörler: Teknolojik yenilikler, güçlü piyasa kabulü ve olası iş birlikleri

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,31566 - 0,35828 dolar (istikrarlı büyüme ve benimsenme varsayımıyla)

- İyimser senaryo: 0,35828 - 0,45000 dolar (hızlı benimsenme ve olumlu regülasyon ortamında)

- Dönüştürücü senaryo: 0,45000 - 0,49442 dolar (çığır açıcı kullanım alanları ve ana akım entegrasyon ile)

- 2030-12-31: POL 0,49442 dolar (iyimser tahmine göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,27014 | 0,2001 | 0,13607 | 0 |

| 2026 | 0,24452 | 0,23512 | 0,12226 | 17 |

| 2027 | 0,29977 | 0,23982 | 0,17986 | 19 |

| 2028 | 0,36153 | 0,2698 | 0,25361 | 34 |

| 2029 | 0,40089 | 0,31566 | 0,29357 | 57 |

| 2030 | 0,49442 | 0,35828 | 0,24363 | 78 |

IV. POL için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

POL Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Polygon ekosistemine güvenen uzun vadeli yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde POL biriktirin

- Potansiyel büyümeyi yakalamak için en az 1-2 yıl boyunca elde tutun

- Güvenli, gözetimsiz cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri belirlemek için 50 ve 200 günlük ortalamaları kullanın

- RSI: Aşırı alım/aşırı satım sinyallerini takip edin

- Swing trade için temel noktalar:

- Teknik göstergelere göre net giriş/çıkış noktaları belirleyin

- Zarar durdur emirleriyle aşağı yönlü riski yönetin

POL Risk Yönetimi Çerçevesi

(1) Portföy Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyoneller: Kripto portföyünün %15'ine kadar

(2) Riskten Koruma Yöntemleri

- Çeşitlendirme: Birden fazla Layer 2 projeye yatırım yapın

- Opsiyon işlemleri: Düşüşe karşı koruma için satış opsiyonu kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Büyük varlıklar için donanım cüzdanları

- Güvenlik önlemleri: 2FA etkinleştirin, benzersiz şifreler kullanın, düzenli güvenlik denetimleri yapın

V. POL için Olası Riskler ve Zorluklar

POL Piyasa Riskleri

- Yüksek volatilite: Kripto piyasasında sık görülen ani fiyat dalgalanmaları

- Rekabet: Yeni Layer 2 çözümleri POL'un pazar payını azaltabilir

- Piyasa duyarlılığı: Genel kripto piyasası POL fiyatını etkileyebilir

POL Düzenleyici Riskler

- Belirsiz regülasyon ortamı: Layer 2 çözümleri için yeni düzenlemeler gelebilir

- Sınır ötesi uyum: Farklı ülkelerdeki düzenlemeler benimsenmeyi etkileyebilir

- Vergi mevzuatı: Kripto varlıklar için değişen vergiler yatırımcı getirilerini etkileyebilir

POL Teknik Riskler

- Akıllı sözleşme açıkları: Polygon ekosisteminde olası istismar riskleri

- Ölçeklenebilirlik sorunları: Ağın ölçeklenmesinde beklenmedik teknik zorluklar

- İşbirliği riskleri: Ethereum veya diğer ağlarla köprü kurarken yaşanabilecek problemler

VI. Sonuç ve Yol Haritası

POL Yatırım Potansiyeli Değerlendirmesi

POL, Layer 2 ölçeklendirme çözümleri alanında yüksek riskli ve yüksek getirili bir yatırım fırsatı sunuyor. Uzun vadeli değer, Polygon ekosisteminin büyümesi ve Ethereum'un ölçeklenebilirliğine bağlı; kısa vadede ise volatilite ve rekabet baskısı önemli riskler oluşturuyor.

POL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini anlamak için küçük ve düzenli yatırım yapın ✅ Tecrübeli yatırımcılar: Uzun vadeli tutma ve aktif alım-satımı dengeleyin ✅ Kurumsal yatırımcılar: POL portföyüne ek olarak ekosistem yatırımları ve stratejik ortaklıkları değerlendirin

POL Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com'da doğrudan POL satın alın

- Staking: Polygon ağında doğrulama yaparak pasif gelir elde edin

- DeFi entegrasyonu: POL'u Polygon ekosistemindeki farklı DeFi protokollerinde kullanın

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre hareket etmeli ve profesyonel danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

Sıkça Sorulan Sorular

POL 1$ seviyesine ulaşır mı?

Mevcut piyasa trendleri doğrultusunda POL'un kısa vadede 1 dolara ulaşması düşük olasılıktır. Ancak, kripto piyasalarının yüksek volatilitesi nedeniyle uzun vadeli fiyat hareketleri belirsizliğini korur.

Polygon 2025'te kaç dolar olacak?

Piyasa trendlerine göre Polygon (MATIC) 2025 yılında 2,50 dolar seviyesine ulaşabilir. Ancak kripto piyasalarının dalgalanmasına bağlı olarak bu tahmin değişebilir.

POL coin'in geleceği nasıl?

POL'un geleceği, Polygon ekosisteminin büyümesi ve genel kripto piyasasındaki gelişmelere bağlı olarak olumlu görünmektedir. 2025-2030 döneminde daha fazla benimsenme ve değer artışı beklenmektedir.

Polygon 10$ seviyesini görür mü?

Polygon, sürdürülebilir büyüme ve yoğun benimsenme ile 2031 yılına kadar 10 dolara ulaşabilir; ancak bu garanti değildir.

AVAX Nedir: Avalanche'ın Yerel Kripto Parası Üzerine Kapsamlı Bir Rehber

2025 MNT Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 yılında Cronos (CRO) token ekonomik modeli nasıl işler?

RAY vs LRC: Kripto Ekosisteminde Merkeziyetsiz Finans Alanında Üstünlük Yarışı

Celestia'nın zincir üstü veri analizi, TIA token eğilimlerini nasıl ortaya koyuyor?

Kripto para sektöründe rekabet analizi gerçekleştirmek için izlenmesi gereken temel adımlar nelerdir?

Arbitrum (ARB) iyi bir yatırım mı?: 2024 yılı için riskler, potansiyel getiriler ve piyasa görünümüne dair kapsamlı bir analiz

ASTER ve UNI: İki Önde Gelen Merkeziyetsiz Borsa Protokolünün Kapsamlı Karşılaştırması

SKY Nedir: Açık Gökyüzünü Anlamak ve Dünyamızdaki Önemi Hakkında Kapsamlı Bir Rehber

PAXG nedir: Kripto Paranın Fiziki Altın Token’ı Üzerine Kapsamlı Bir Rehber

PUMP nedir: Kripto para dünyasının bu fenomenini ve dijital piyasalar üzerindeki etkilerini anlamak için hazırlanmış kapsamlı bir rehber