2025 MNT Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: MNT'nin Piyasadaki Konumu ve Yatırım Değeri

On-chain finans alanında sürdürülebilirliğe öncülük eden Mantle (MNT), kuruluşundan bu yana kayda değer başarılara imza atmıştır. 2025 itibarıyla Mantle'ın piyasa değeri 6,54 milyar ABD dolarına ulaşırken, dolaşımdaki arzı yaklaşık 3,25 milyar tokena ve fiyatı ise 2,01 ABD doları seviyesine ulaşmıştır. "Yeni nesil bankacılığın belkemiği" olarak tanımlanan bu varlık, blokzincir tabanlı finansal hizmetlerde dönüşüm yaratmada giderek daha önemli bir rol üstlenmektedir.

Bu makalede, Mantle'ın 2025-2030 dönemi fiyat trendleri; tarihsel örüntüler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ile birlikte profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik yatırım stratejileriyle kapsamlı bir şekilde analiz edilecektir.

I. MNT Fiyat Geçmişi ve Güncel Piyasa Durumu

MNT'nin Tarihsel Fiyat Gelişimi

- 2023: İlk lansman, fiyat 0,25 ABD dolarından başladı

- 2023: 31 Temmuz'da tüm zamanların en düşük seviyesi olan 0,0658 ABD dolarına geriledi

- 2025: 9 Ekim'de tüm zamanların en yüksek seviyesi olan 2,9 ABD dolarına ulaştı

MNT Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla MNT, 2,0095 ABD dolarından işlem görmekte olup, kripto para piyasasında 28. sırada yer almakta ve piyasa değeri 6,54 milyar ABD dolarıdır. Token, son 24 saatte %2,34 düşüş yaşamış, işlem hacmi ise 25,24 milyon ABD doları olmuştur. MNT'nin fiyatı, altı gün önce ulaşılan 2,9 ABD doları zirvesine göre %30,71 daha düşük, ancak tüm zamanların en düşük seviyesine göre %2.954,86 daha yüksektir.

Token son dönemde belirgin bir volatilite göstermiş, son bir saatte %4,38 artış, son bir haftada ise %13,96 düşüş kaydetmiştir. Ancak MNT, uzun vadede güçlü bir büyüme göstererek son 30 günde %24,04, son bir yılda ise %214,56 oranında değer kazanmıştır.

Dolaşımdaki MNT arzı 3,25 milyar, toplam arzı 6,22 milyar olup dolaşım oranı %52,3 seviyesindedir. Tam seyreltilmiş piyasa değeri 12,5 milyar ABD dolarıdır; bu da tüm arzın dolaşıma girmesi halinde daha fazla büyüme potansiyeline işaret eder.

Güncel MNT piyasa fiyatını görmek için tıklayın

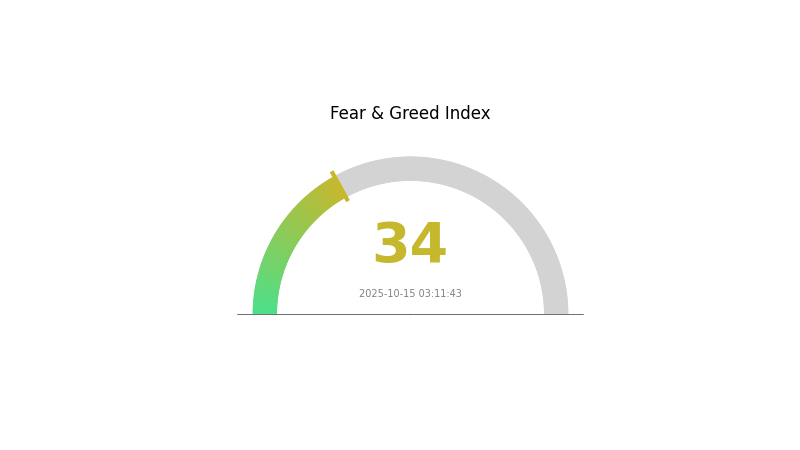

MNT Piyasa Duyarlılığı Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto para piyasasında duyarlılık temkinli bir seyir izliyor; Korku ve Açgözlülük Endeksi 34 seviyesinde ve yatırımcılar arasında korku hâkim. Bu seviye, piyasa katılımcılarının temkinli davrandığını ve ani hareketlerden kaçındıklarını gösteriyor. Korku dönemlerinde bazı yatırımcılar bunu varlıkları daha düşük fiyattan biriktirmek için fırsat olarak görse de, bu dalgalı piyasa ortamında yatırım kararı almadan önce kapsamlı araştırma yapmak ve kendi risk toleransınızı göz önünde bulundurmak önemlidir.

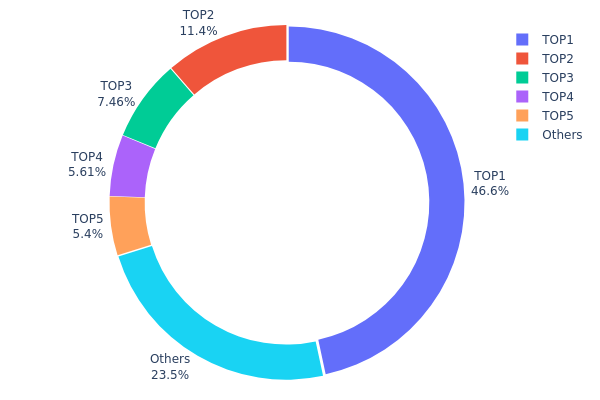

MNT Varlık Dağılımı

MNT adres varlık dağılımı verileri, oldukça yoğun bir sahiplik yapısına işaret ediyor. En büyük adres, toplam arzın %46,62'sini elinde tutuyor ve bu da 2.900.022,41K MNT tokene karşılık geliyor. Bu düzeydeki yoğunlaşma, daha merkeziyetsiz kripto paralarda görülen dağılımın çok üzerinde.

İlk beş adres, toplam MNT arzının %76,44'ünü kontrol ederken, kalan %23,56'lık kısım diğer adreslere dağılmıştır. Tokenlerin az sayıda cüzdanda bu kadar yoğun olması, potansiyel piyasa manipülasyonu ve fiyat dalgalanması riskini artırır. Büyük sahiplerden herhangi biri yüklü satış veya transfer yaparsa, piyasada ani dalgalanmalar görülebilir.

Piyasa açısından bu yoğunluk, MNT için merkeziyetsizliğin görece düşük olduğunu gösteriyor. Bu durum doğrudan bir sorun yaratmasa da, zincir üstü yönetişim ve genel piyasa istikrarı birkaç büyük sahip tarafından kolayca etkilenebilir. Yatırımcılar ve piyasa katılımcıları, MNT'nin piyasa dinamiklerini ve uzun vadeli görünümünü değerlendirirken bu yoğunlaşmayı dikkate almalıdır.

Güncel MNT Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7860...7db73d | 2.900.022,41K | 46,62% |

| 2 | 0x2ebf...ae277f | 706.717,70K | 11,36% |

| 3 | 0x5a07...dc5e78 | 463.932,76K | 7,45% |

| 4 | 0xc54c...15a8fb | 349.042,01K | 5,61% |

| 5 | 0xe1ab...b09215 | 335.994,17K | 5,40% |

| - | Diğerleri | 1.463.607,76K | 23,56% |

II. MNT'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Deflasyonist Model: MNT, Mantle zinciri için gas token olarak kullanılır ve ekosistem geliştikçe zincir üstü etkileşimlerle birlikte sürekli tüketilir.

- Tarihsel Örüntü: Arzın sıkılaşması fiyat artışlarını tetiklemiş ve yakın dönemde 1,93 ABD dolarına yükseliş bu mekanizmaya bağlanmıştır.

- Mevcut Etki: Birden fazla token stake senaryosu ile devam eden arz azalmasının, MNT'nin değerini artırması bekleniyor.

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Varlıklar: Mantle Index Four (MI4) fonu toplam 400 milyon ABD doları büyüklüğünde olup, MNT'yi BTC, ETH ve SOL ile birlikte portföyünde bulunduruyor.

- Kurumların Benimsemesi: Mantle, reel dünyadaki varlıkların tokenizasyonuna odaklanan ve USD1 stablecoin projesiyle iş birliği yapan Tokenization-as-a-Service platformunu başlattı.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özellikleri: MNT, diğer dijital varlıklar gibi, enflasyona karşı korunma amacıyla da değerlendirilebilir.

Teknik Gelişim ve Ekosistem İnşası

- Performans ve Veri Erişilebilirliği Güncellemesi: 25 Ağustos 2025'te hayata geçirildi, veri senkronizasyonu optimize edildi ve EigenDA entegrasyonu sağlandı.

- Ethereum Prague Yükseltmesi Desteği: 15 Ağustos 2025'te başlatıldı ve Ethereum'un en son güncellemesiyle uyumluluk sağlandı.

- Ekosistem Uygulamaları: Mantle Network, Ethereum'un ağ tıkanıklığı, yüksek gas ücretleri ve düşük işlem hızı gibi sorunlarına Layer 2 ölçeklenme çözümü olarak yanıt vermektedir.

III. 2025-2030 MNT Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 1,65 - 1,80 ABD doları

- Tarafsız tahmin: 1,80 - 2,00 ABD doları

- İyimser tahmin: 2,00 - 2,09 ABD doları (olumlu piyasa duyarlılığı ve proje gelişmeleri gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimsemeyle olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 1,49 - 2,23 ABD doları

- 2028: 1,58 - 2,81 ABD doları

- Başlıca katalizörler: Teknolojik gelişmeler, artan kullanım alanları ve genel piyasa eğilimleri

2030 Uzun Vadeli Görünüm

- Temel senaryo: 2,65 - 3,11 ABD doları (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 3,11 - 3,67 ABD doları (güçlü piyasa performansı ve proje başarısı halinde)

- Dönüştürücü senaryo: 3,67+ ABD doları (oldukça elverişli koşullar ve çığır açıcı yeniliklerle)

- 31 Aralık 2030: MNT 3,11 ABD doları (yıl sonu olası ortalama fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2,08894 | 1,9707 | 1,65539 | -1 |

| 2026 | 2,2937 | 2,02982 | 1,29909 | 1 |

| 2027 | 2,22661 | 2,16176 | 1,49161 | 7 |

| 2028 | 2,80856 | 2,19419 | 1,57981 | 9 |

| 2029 | 3,72704 | 2,50137 | 1,92606 | 24 |

| 2030 | 3,67477 | 3,11421 | 2,64708 | 54 |

IV. MNT Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MNT Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Blockchain finansına maruz kalmak isteyen muhafazakâr yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde MNT biriktir

- Kısmi kar realizasyonu için fiyat hedefleri belirle

- Tokenları güvenli, saklayıcı olmayan bir cüzdanda tut

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç noktalarını belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım koşullarını takip et

- Swing trade için önemli noktalar:

- Başlıca proje duyuruları ve güncellemelerini takip et

- Genel kripto piyasa duyarlılığını izle

MNT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Muhafazakâr yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı DeFi ve Layer 2 projelerine yayıp riski azalt

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygula

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama kullan, özel anahtarlarını asla paylaşma

V. MNT Potansiyel Riskler ve Zorluklar

MNT Piyasa Riskleri

- Volatilite: Kripto piyasalarında yaygın yüksek fiyat dalgalanmaları

- Likitide: Aşırı piyasa koşullarında yaşanabilecek olası sorunlar

- Rekabet: Diğer Layer 2 çözümleri pazar payı elde edebilir

MNT Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen küresel kripto düzenlemeleri

- Uyum zorlukları: Finansal düzenleyicilerle yaşanabilecek olası sorunlar

- Vergilendirme etkileri: Kripto varlıklar için değişen vergi mevzuatı

MNT Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hata riski

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe performansı koruma zorluğu

- Birlikte çalışabilirlik sorunları: Diğer blokzincir ağlarıyla uyumluluk

VI. Sonuç ve Eylem Önerileri

MNT Yatırım Değeri Değerlendirmesi

Mantle (MNT), sürdürülebilir bir zincir üstü finans merkezi olarak güçlü hazinesi ve ekosistem iş birlikleri ile öne çıkıyor. Ancak yatırımcıların, kripto alanındaki yüksek volatilite ve düzenleyici belirsizliklerin farkında olması gerekir.

MNT Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, projeyi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ile stratejik işlem arasında dengeli yaklaşımı değerlendirin ✅ Kurumsal yatırımcılar: MNT'yi çeşitlendirilmiş bir kripto portföyünün parçası olarak değerlendirin ve kapsamlı inceleme yapın

MNT İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden MNT token alıp tutun

- Staking: Pasif gelir için MNT staking programlarına katılın

- DeFi entegrasyonu: Mantle Network'ün DeFi ekosisteminde ek fırsatları keşfedin

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli hareket etmeli ve profesyonel finansal danışmanlara danışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

MNT'nin geleceği nedir?

MNT'nin geleceği umut vaat ediyor ve önemli büyüme potansiyeli taşıyor. Piyasa eğilimleri, artan benimsemeye işaret ederken; uzun vadeli tahminler Mantle token'ın değerinde kayda değer artış olabileceğini gösteriyor.

MNT iyi bir coin mi?

MNT, büyüme potansiyeli olan bir blokzincir projesi olarak öne çıkmaktadır. Performansı ve piyasa eğilimleri iyi bir yatırım olabileceğini gösterse de, tüm kripto paralarda olduğu gibi dikkatli değerlendirme gereklidir.

2030'da MNT fiyat tahmini nedir?

Mevcut projeksiyonlara göre, 2030 yılında MNT'nin fiyatı 0,0184660 - 0,0186782 ABD doları aralığında beklenmektedir. Ancak, kripto para piyasalarında volatilite yüksektir ve tahminler kesin değildir.

MNT alınır mı?

MNT, risk toleransı yüksek yatırımcılar için alınabilir. Yenilikçi teknolojisi ve büyüyen ekosistemi gelecekte büyüme potansiyelini desteklese de, dikkatli araştırma yapılmalıdır.

AVAX Nedir: Avalanche'ın Yerel Kripto Parası Üzerine Kapsamlı Bir Rehber

2025 POL Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 yılında Cronos (CRO) token ekonomik modeli nasıl işler?

RAY vs LRC: Kripto Ekosisteminde Merkeziyetsiz Finans Alanında Üstünlük Yarışı

Celestia'nın zincir üstü veri analizi, TIA token eğilimlerini nasıl ortaya koyuyor?

Kripto para sektöründe rekabet analizi gerçekleştirmek için izlenmesi gereken temel adımlar nelerdir?

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak