2025 GAME2 Fiyat Tahmini: Oyun Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Giriş: GAME2'nin Piyasadaki Konumu ve Yatırım Değeri

GameBuild (GAME2), yeni nesil oyun altyapısı olarak, kuruluşundan bu yana oyunculara, geliştiricilere ve reklamverenlere güçlü araçlar sunmaktadır. 2025 yılı itibarıyla GAME2'nin piyasa değeri 46.681.445 ABD Doları'na ulaşmış; yaklaşık 18.356.840.358 dolaşımdaki token ile fiyatı 0,002543 ABD Doları civarında seyretmektedir. Blokzincir tabanlı oyunlarda "oyunun kurallarını değiştiren" varlık olarak tanımlanan GAME2, oyun ve kitlesel fonlama sektörlerinde giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, 2025-2030 yılları arasında GAME2'nin fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler dikkate alınarak kapsamlı biçimde analiz edilecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. GAME2 Fiyat Geçmişi ve Mevcut Piyasa Durumu

GAME2 Tarihsel Fiyat Gelişimi

- 2024: Projenin lansmanı, fiyat 18 Mayıs'ta tüm zamanların en yüksek seviyesi olan 0,013 ABD Doları'na ulaştı

- 2025: Piyasa düzeltmesi, fiyat 23 Haziran'da tüm zamanların en düşük seviyesi olan 0,002358 ABD Doları'na geriledi

GAME2 Güncel Piyasa Durumu

24 Ekim 2025 itibarıyla GAME2, 0,002543 ABD Doları seviyesinden işlem görmekte ve 24 saatlik işlem hacmi 50.525,36 ABD Doları'dır. Token, son 24 saatte %3,43 ve son 1 saatte %2,12 artış ile kısa vadede pozitif bir ivme sergilemiştir. Ancak uzun vadeli performans negatif olup, son 30 günde %14,28 ve son 1 yılda %21,15 değer kaybetmiştir.

GAME2'nin piyasa değeri şu anda 46.681.445 ABD Doları'dır ve kripto para sıralamasında 651. sırada yer almaktadır. Dolaşımdaki arzı 18.356.840.358 GAME2 olup, bu rakam toplam arzın %85,7'sini (21.419.639.000 GAME2) oluşturmaktadır. Tam seyreltilmiş piyasa değeri ise 54.470.142,99 ABD Doları'dır.

Son günlerdeki yükselişe rağmen, GAME2 hâlâ 18 Mayıs 2024'te ulaşılan 0,013 ABD Doları'lık zirvenin oldukça altında işlem görmektedir. Mevcut fiyat, bu zirveden %80,44 oranında daha düşüktür. Genel kripto piyasasında hakim olan korku seviyesi, GAME2 yatırımcılarının da temkinli olduğunu göstermektedir.

Mevcut GAME2 piyasa fiyatını görmek için tıklayın

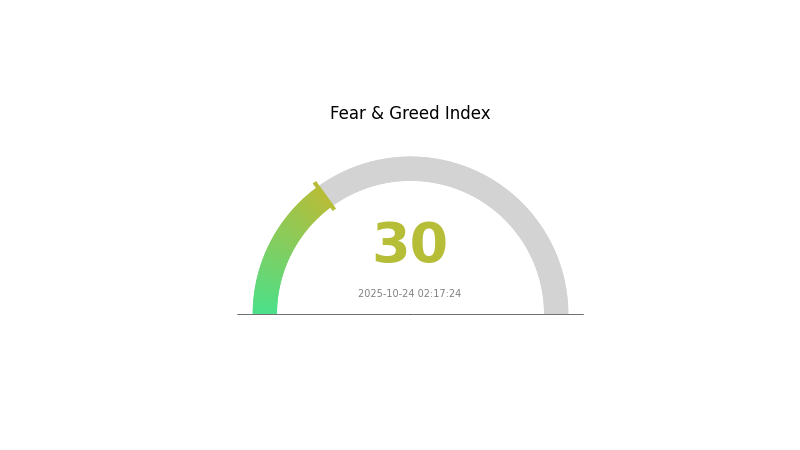

GAME2 Piyasa Duyarlılığı Göstergesi

2025-10-24 Korku ve Açgözlülük Endeksi: 30 (Korku)

Mevcut Korku & Açgözlülük Endeksi'ni görüntüleyin

Kripto piyasasında mevcut durum korku seviyesinde; Korku ve Açgözlülük Endeksi 30'dur. Yatırımcılar, son piyasa dalgalanmaları ve olumsuz haberler nedeniyle daha temkinli davranıyor olabilir. Bu dönemde bazı yatırımcılar, "Diğerleri korkuyorken açgözlü ol" sözüyle alım fırsatı olarak görebilir. Yine de, detaylı araştırma yapmak ve riskleri dikkatle yönetmek esastır. Kripto fiyatlarını etkileyebilecek piyasa trendlerini ve temel gelişmeleri yakından takip edin.

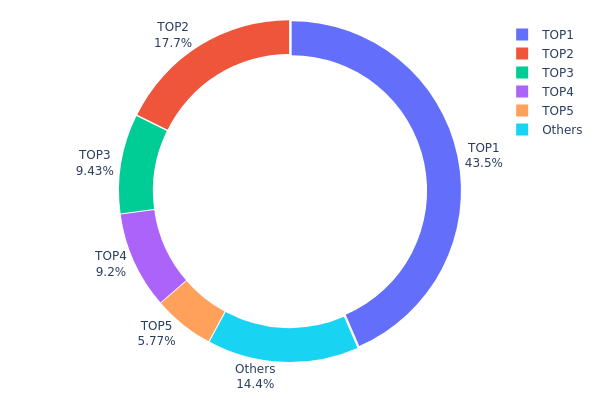

GAME2 Varlık Dağılımı

GAME2'nin adres bazlı varlık dağılımı verileri, sahipliğin yüksek oranda yoğunlaştığını gösteriyor. En büyük adres, toplam arzın %43,46'sını elinde bulundururken; ilk 5 adresin toplamda tüm GAME2 tokenlarının %85,57'sini kontrol ettiği görülüyor. Bu yoğunlaşma, token dağılımında ciddi bir dengesizliğe işaret ediyor.

Bu düzeydeki sahiplik konsantrasyonu, piyasa istikrarı ve olası fiyat manipülasyonu risklerini artırıyor. Arzın neredeyse yarısı tek bir cüzdan tarafından kontrol edildiğinde, büyük ölçekli alım-satım işlemlerinin fiyat üzerinde ani ve ciddi etkiler yaratma olasılığı yükselir. Ayrıca, ilk 5 adreste yüksek yoğunlaşma, merkeziyetsizliği sınırlayarak, token'ın merkezi karar alma veya manipülasyona karşı direncini azaltır.

Bu dağılım modeli; zincir üstünde düşük istikrar ve yüksek merkezileşme ile karakterize bir piyasa yapısına işaret eder. GAME2 ekosistemi şu anda, az sayıda büyük yatırımcının eylemlerine karşı kırılgan kalabilir ve bu durum uzun vadeli sürdürülebilirlik ile geniş kullanıcı tabanına hitap edebilme potansiyelini olumsuz etkileyebilir.

Mevcut GAME2 Varlık Dağılımı'nı görüntüleyin

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xd874...f3a4df | 9.309.764,70K | 43,46% |

| 2 | 0x9af4...ec9f13 | 3.795.534,39K | 17,71% |

| 3 | 0xb1f0...35fb30 | 2.020.798,11K | 9,43% |

| 4 | 0x2448...21f7c1 | 1.971.444,93K | 9,20% |

| 5 | 0xffa8...44cd54 | 1.236.231,30K | 5,77% |

| - | Diğerleri | 3.085.865,58K | 14,43% |

II. GAME2'nin Gelecekteki Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Ekonomik sistem istikrarı: Oyun içi ekonomik sistemin istikrarı, GAME2 fiyatı için kritik önemdedir. Ani fiyat sıçramaları bu istikrarı bozabilir.

- Tarihsel örüntüler: Fiyat dalgalanmaları, arz-talep ilişkisi ve genel ekonomik ilkelerle şekillenmiştir.

- Mevcut etki: Güncel arz değişikliklerinin, arz-talep dinamikleri doğrultusunda fiyatı öngörülebilir bir aralıkta etkilemesi beklenmektedir.

Makroekonomik Ortam

- Enflasyona karşı koruma: GAME2 fiyatı, enflasyon oranlarından etkilenir. Enflasyon oranı (Mevcut fiyat seviyesi - Temel fiyat seviyesi) / Temel fiyat seviyesi şeklinde hesaplanır ve enflasyonist ortamlarda varlığın performansını değerlendirmek için kullanılır.

Teknik Gelişim ve Ekosistem Oluşumu

- Teknoloji doğrulaması: Ekibin teknik ve iş hipotezlerini test edebilme kapasitesi, GAME2'nin uzun vadeli büyüme potansiyeli için önemlidir.

- Ekosistem uygulamaları: GameFi sektöründeki gelişmeler ve trendler, GAME2'nin geleceğini doğrudan etkiler. Proje şu anda temel prensiplerini kanıtlama aşamasındadır.

III. 2025-2030 GAME2 Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,00238 - 0,00256 ABD Doları

- Neutr tahmin: 0,00256 - 0,00276 ABD Doları

- İyimser tahmin: 0,00276 - 0,00297 ABD Doları (piyasa duyarlılığı olumlu ve benimseme artarsa)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan volatiliteyle birlikte büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,00310 - 0,00463 ABD Doları

- 2028: 0,00254 - 0,00504 ABD Doları

- Ana katalizörler: Blokzincir tabanlı oyunların yaygınlaşması, teknolojik ilerlemeler ve piyasa genişlemesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00448 - 0,00557 ABD Doları (istikrarlı piyasa büyümesi ve proje gelişimi ile)

- İyimser senaryo: 0,00557 - 0,00667 ABD Doları (hızlı benimseme ve güçlü piyasa koşulları ile)

- Dönüştürücü senaryo: 0,00667 - 0,00780 ABD Doları (yenilikçi gelişmeler ve ana akım kabulü ile)

- 2030-12-31: GAME2 0,00780 ABD Doları (en elverişli koşullarda olası zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00297 | 0,00256 | 0,00238 | 0 |

| 2026 | 0,00362 | 0,00276 | 0,0016 | 8 |

| 2027 | 0,00463 | 0,00319 | 0,0031 | 25 |

| 2028 | 0,00504 | 0,00391 | 0,00254 | 53 |

| 2029 | 0,00667 | 0,00448 | 0,00273 | 76 |

| 2030 | 0,0078 | 0,00557 | 0,0034 | 119 |

IV. GAME2 Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GAME2 Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Risk toleransı yüksek, uzun vadeli bakış açısına sahip yatırımcılar

- Operasyonel öneriler:

- Piyasa geri çekilmelerinde GAME2 token biriktirin

- Önemli fiyat hareketleri için alarm kurun

- Token'ları güvenli, saklamaya tabi olmayan cüzdanda saklayın

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüşleri tespit edin

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını takip edin

- Dalgalı ticaret için ana noktalar:

- Fiyat hareketlerini teyit için işlem hacmini izleyin

- Zarar-durdur emirleri ile aşağı yönlü riski yönetin

GAME2 Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Saldırgan yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlığına bölün

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet tavsiye edilir

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama aktif edin, güçlü şifre kullanın

V. GAME2 İçin Potansiyel Riskler ve Zorluklar

GAME2 Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık rastlanan güçlü fiyat dalgalanmaları

- Sınırlı likidite: Büyük işlemler için likidite sorunları yaşanabilir

- Piyasa duyarlılığı: Yatırımcı psikolojisiyle ani değişimlere açık

GAME2 Düzenleyici Riskler

- Belirsiz düzenleyici ortam: GameBuild'i etkileyebilecek yeni yasal düzenlemeler ihtimali

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal çerçeveler

- Vergi etkileri: Kripto varlıkların vergilendirilmesindeki değişimler

GAME2 Teknik Riskler

- Akıllı kontrat açıkları: Kodda potansiyel zafiyetler ve istismar riski

- Ağ tıkanıklığı: Yüksek işlem yoğunluğunda gecikme ihtimali

- Teknolojik eskime: Yeni blokzincir teknolojilerinin gerisinde kalma riski

VI. Sonuç ve Eylem Tavsiyeleri

GAME2 Yatırım Değeri Analizi

GAME2, blokzincir oyun altyapısı sektöründe yüksek riskli ve yüksek potansiyelli bir yatırım sunar. Uzun vadeli değer önerisi oyun sektörünün büyümesine dayanırken, kısa vadede piyasa oynaklığı ve düzenleyici belirsizlikler temel riskler arasında yer alır.

GAME2 Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Zaman içinde küçük ve düzenli yatırımlar yaparak pozisyon oluşturmayı değerlendirin

✅ Deneyimli yatırımcılar: Net giriş/çıkış stratejileriyle dengeli bir yaklaşım uygulayın

✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, büyük pozisyonlar için OTC işlemleri düşünün

GAME2 Ticaret Yöntemleri

- Spot ticaret: Gate.com üzerinden GAME2 token alım-satımı

- Limit emirleri: Belirlenen alım/satım fiyatıyla işlemleri otomatikleştirin

- Dolar maliyeti ortalaması: Oynaklığı azaltmak için düzenli ve sabit tutarlı yatırımlar yapın

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcılar, kendi risk toleranslarına uygun karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Trump coin için 2026 tahmini nedir?

Mevcut piyasa analizine ve %5 fiyat değişimi varsayımına göre, Trump coin'in 2026 yılı tahmini yaklaşık 0,00 ABD Doları'dır.

Game alınmalı mı satılmalı mı?

Mevcut teknik sinyallere göre game satılmalı. Genel görünüm, kripto para için düşüş yönlüdür.

Pepe'nin 2025 fiyat tahmini nedir?

Pepe'nin fiyatının Ekim 2025'e kadar 0,000007655 ABD Doları'na ulaşması, aralığın ise 0,000005333 ile 0,000007655 ABD Doları arasında olması öngörülüyor.

Hamster token'ın fiyatı artabilir mi?

Evet, hamster token fiyatı yükselebilir. Tahminler, Temmuz 2025'e kadar piyasa koşullarına bağlı olarak 0,0015-0,0019 ABD Doları aralığına ulaşabileceğini gösteriyor.

2025 VIRTUAL Fiyat Tahmini: Dijital varlık için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

2025 LOT Fiyat Tahmini: Blockchain Oyun Tokenlerinin Geleceğinde Yol Haritası

2025 BIGTIME Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 GEMS Fiyat Tahmini: Bu oyun token’ı yeni zirvelere ulaşacak mı?

2025 MBX Fiyat Tahmini: MBX Token’ın Piyasa Trendleri ve Gelecekteki Değerleme Potansiyellerinin Analizi

2025 ACE Fiyat Tahmini: Kripto Para Piyasasında Gelecek Trendler ve Olası Büyüme Faktörlerinin Analizi

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi