2025 BIGTIME Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: BIGTIME’ın Piyasa Konumu ve Yatırım Değeri

Big Time (BIGTIME), çok oyunculu bir çevrimiçi rol yapma oyunu token’ı olarak piyasaya sunulduğundan bu yana önemli aşamalar kaydetti. 2025 yılı itibarıyla BIGTIME’ın piyasa değeri 62.189.706 dolar seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 1.908.245.059 token ve fiyatı yaklaşık 0,03259 dolar civarında seyrediyor. “Web3 oyun token’ı” olarak tanımlanan bu varlık, blokzincir oyun sektöründe giderek daha önemli bir rol üstleniyor.

Bu makalede, BIGTIME’ın 2025-2030 yılları arasındaki fiyat eğilimleri, geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında detaylı şekilde ele alınacak; yatırımcılar için profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. BIGTIME Fiyat Geçmişi ve Güncel Piyasa Durumu

BIGTIME Tarihsel Fiyat Gelişimi

- 2023: BIGTIME, 12 Ekim 2023’te tüm zamanların en yüksek seviyesi olan 500 dolara ulaştı

- 2025: BIGTIME, 10 Ekim 2025’te tüm zamanların en düşük seviyesi olan 0,01757 doları gördü

- 2025: Piyasa döngüsü, fiyatın zirveden bugünkü 0,03259 dolar seviyesine belirgin bir şekilde gerilemesine yol açtı

BIGTIME Güncel Piyasa Durumu

BIGTIME, şu an 0,03259 dolar seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 279.199,73 dolar. Token, son 24 saatte %0,88’lik hafif bir düşüş yaşadı. BIGTIME’ın piyasa değeri 62.189.706,50 dolar ile kripto para piyasasında 542. sırada yer alıyor. Dolaşımdaki arz 1.908.245.059,79 BIGTIME token, toplam arz ise 5.000.000.000 token’dır. Son bir yılda BIGTIME, değerinde %77,25’lik ciddi bir azalma yaşadı. Token, kısa vadede karma bir performans sergiliyor; son saatte %0,45 artış, son bir haftada ise %9,46 düşüş gösterdi. Uzun vadeli trend ise son 30 günde %37,26’lık bir gerilemeyle düşüş yönünde.

Güncel BIGTIME piyasa fiyatını görüntüleyin

BIGTIME Piyasa Duyarlılık Göstergesi

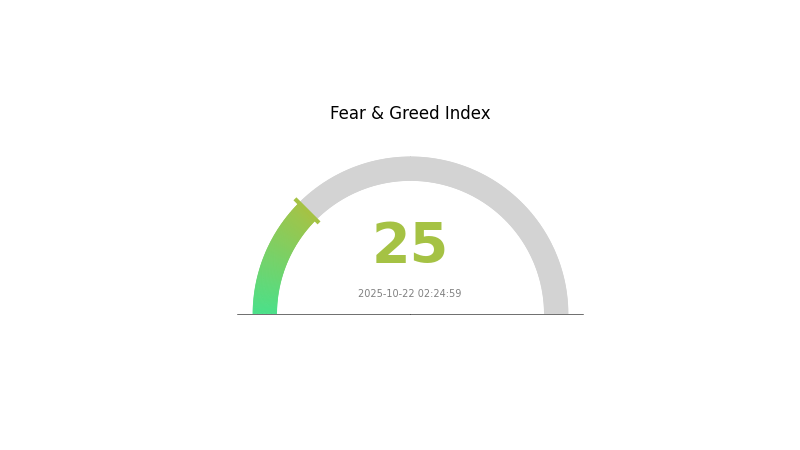

22 Ekim 2025 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntüleyin

Kripto para piyasası şu anda aşırı korku döneminden geçiyor; Korku ve Açgözlülük Endeksi 25 gibi düşük bir değerde bulunuyor. Bu, yatırımcılar arasında olumsuz bir hava olduğunu ve karşıt strateji izleyenler için fırsatlar oluşabileceğini gösteriyor. Aşırı korku dönemlerinde, varlıklar düşük değerlenebilir ve uzun vadeli yatırımcılar için alım fırsatları meydana gelebilir. Ancak bu dalgalı ortamda herhangi bir yatırım kararı almadan önce kapsamlı araştırma yapmalı ve temkinli hareket etmelisiniz.

BIGTIME Varlık Dağılımı

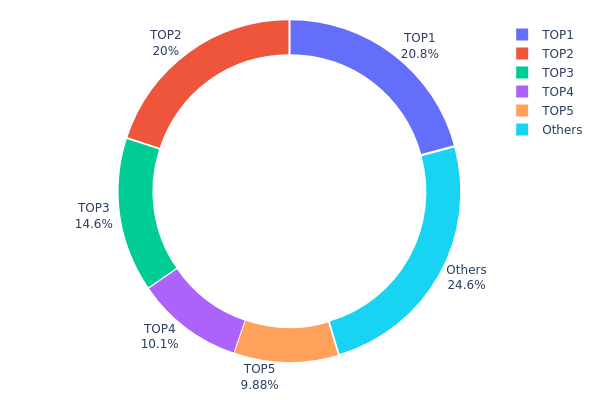

Adres bazlı varlık dağılımı verileri, BIGTIME token ekosisteminde belirgin bir yoğunlaşma olduğunu gösteriyor. En büyük beş adres, toplam arzın %75,38’ini elinde bulundururken, en büyük adresin payı %20,77. Bu derece yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat oynaklığı açısından endişe yaratıyor.

Böyle bir dağılım yapısı, piyasa dinamiklerini ciddi şekilde etkileyebilir. Büyük sahipler, yüksek hacimli işlemlerle token fiyatını etkileyebilir; bu da volatilitenin artmasına ve piyasa istikrarının azalmasına neden olur. Ayrıca, bu yoğunlaşma, projenin merkeziyetsizlik hedeflerine zarar verebilir; çünkü az sayıda adres, token dolaşımı üzerinde büyük bir etkiye sahip.

Zincir üstü yapısal açıdan, mevcut dağılım BIGTIME için düşük bir merkeziyetsizlik seviyesine işaret ediyor. Token’ların %24,62’si daha küçük adreslerde olsa da, birkaç büyük adresin hakimiyeti, ağ dayanıklılığını artırmak ve sistemik riskleri azaltmak adına daha yaygın bir dağılıma ihtiyaç olduğunu ortaya koyuyor.

Güncel BIGTIME Varlık Dağılımı’nı görüntüleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x533f...c2c098 | 1.038.745,74K | 20,77% |

| 2 | 0x0a1b...1f5030 | 1.000.000,05K | 20,00% |

| 3 | 0x3691...b29967 | 730.000,05K | 14,60% |

| 4 | 0x549a...5ac1f5 | 507.395,85K | 10,14% |

| 5 | 0x4695...fd7d37 | 493.901,76K | 9,87% |

| - | Diğerleri | 1.229.956,55K | 24,62% |

II. BIGTIME’ın Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Oyun İçi Ekonomi: BIGTIME token arzı, özellikle SPACE sistemi ve zaman kumsaati NFT’leri gibi oyun dinamiklerinden etkilenir.

- Mevcut Etki: BIGTIME token üretimi arttıkça, piyasadaki satış baskısı da artıyor ve bu durum iç ekonominin sürdürülebilirliğini zorlaştırıyor.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekonomik Dolaşım Sistemi: BIGTIME token’ları oyun oynanışıyla üretilir ve oyun içinde çeşitli kullanım alanlarına sahiptir, böylece sürdürülebilir bir ekonomik ekosistem hedeflenir.

- NFT Mekanikleri: Time guardian ve kumsaati NFT’leri, yeni oyuncu girişini kontrol ederek fiyatı destekleyici bariyerler oluşturur ve varlık dağılım hızını düzenleyerek token fiyatını olumlu etkileyebilir.

III. 2025-2030 BIGTIME Fiyat Tahmini

2025 Tahmini

- Ihtiyatlı tahmin: 0,02766 - 0,03254 dolar

- Tarafsız tahmin: 0,03254 - 0,04035 dolar

- İyimser tahmin: 0,04035 - 0,04816 dolar (uygun piyasa koşulları ve benimsemenin artması halinde)

2027-2028 Tahmini

- Piyasa evresi öngörüsü: Benimsemenin artmasıyla büyüme dönemi

- Fiyat aralığı tahminleri:

- 2027: 0,03305 - 0,06279 dolar

- 2028: 0,04455 - 0,077 dolar

- Başlıca katalizörler: Teknolojik ilerlemeler, daha geniş piyasa kabulü ve yeni ortaklıklar

2029-2030 Uzun Vadeli Görünüm

- Baz senaryo: 0,066 - 0,07425 dolar (istikrarlı piyasa büyümesi ve benimseme varsayımıyla)

- İyimser senaryo: 0,0825 - 0,08242 dolar (benimsemenin hızlanması ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: 0,08242 - 0,09 dolar (çığır açan kullanım alanları ve ana akım entegrasyonla)

- 31 Aralık 2030: BIGTIME 0,07425 dolar (2025’ten %127 artış, önemli büyüme potansiyelini gösteriyor)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,04816 | 0,03254 | 0,02766 | 0 |

| 2026 | 0,05407 | 0,04035 | 0,0226 | 23 |

| 2027 | 0,06279 | 0,04721 | 0,03305 | 44 |

| 2028 | 0,077 | 0,055 | 0,04455 | 68 |

| 2029 | 0,0825 | 0,066 | 0,04752 | 102 |

| 2030 | 0,08242 | 0,07425 | 0,04009 | 127 |

IV. BIGTIME Profesyonel Yatırım Stratejisi ve Risk Yönetimi

BIGTIME Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygunluk: Uzun vadeli yatırımcılar ve oyun meraklıları

- Öneriler:

- Piyasa düşüşlerinde BIGTIME token biriktirin

- Big Time oyun platformunun gelişimini ve benimsenmesini takip edin

- Token’ları donanım cüzdanında veya güvenilir bir platformda güvenli şekilde saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Eğilimleri ve olası giriş/çıkış noktalarını belirlemek için kullanılabilir

- Göreceli Güç Endeksi (RSI): Aşırı alım veya satım durumunu gösterebilir

- Dalgalı işlemler için anahtar noktalar:

- Net stop-loss ve kâr alma seviyeleri belirleyin

- Oyun güncellemelerini ve kullanıcı etkileşimini yakından izleyin

BIGTIME Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: BIGTIME’ı diğer kripto varlıklar ve geleneksel yatırımlarla dengeleyin

- Stop-loss emirleri: Kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı kimlik doğrulama kullanın, güçlü şifreler belirleyin ve özel anahtarları çevrimdışı saklayın

V. BIGTIME İçin Potansiyel Riskler ve Zorluklar

BIGTIME Piyasa Riskleri

- Volatilite: Kripto oyun sektöründe yüksek fiyat dalgalanmaları yaygındır

- Rekabet: Yeni blokzincir oyunları Big Time’ın pazar payını etkileyebilir

- Kullanıcı benimsemesi: Oyuncu tabanının yavaş büyümesi token değerini olumsuz etkileyebilir

BIGTIME Regülasyon Riskleri

- Belirsiz düzenlemeler: Küresel çapta kripto oyun düzenlemelerindeki değişiklikler

- Vergisel etkiler: Oyun içi varlıklar ve token alım-satım işlemleri için değişen vergi mevzuatı

- KYC/AML gereklilikleri: Daha sıkı kimlik doğrulama erişimi zorlaştırabilir

BIGTIME Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmesinde olası güvenlik açıkları

- Ölçeklenebilirlik sorunları: Oyun platformunda kullanıcı artışına yanıt vermekte yaşanabilecek zorluklar

- Birlikte çalışabilirlik: Diğer blokzincir ağları veya oyunlarla entegrasyon sorunları

VI. Sonuç ve Eylem Önerileri

BIGTIME Yatırım Değeri Değerlendirmesi

BIGTIME, blokzincir oyun sektöründe uzun vadeli büyüme potansiyeliyle öne çıkıyor. Ancak yatırımcılar, kısa vadede yüksek volatilite ve regülasyon belirsizliklerine karşı dikkatli olmalı.

BIGTIME Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, blokzincir oyunları hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Risk toleransına göre dengeli yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Big Time projesi ve ekibi hakkında kapsamlı inceleme yapın

BIGTIME İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com’da BIGTIME token alım-satımı yapın

- Staking: Big Time platformu tarafından sunuluyorsa staking programlarına katılın

- Oyun içi alım: Oyun oynayarak ve eşya ticaretiyle BIGTIME token elde edin

Kripto para yatırımları yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatlice karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırım yapmayın.

SSS

BIGTIME kripto fiyat tahmini nedir?

2025 yılı itibarıyla BIGTIME fiyat tahminleri, oyun gelir modeli ve token kullanımına bağlı olarak 0,40 – 0,55 dolar aralığındadır. Piyasa eğilimleri orta düzeyde dalgalanma göstermektedir.

BIGTIME yükselecek mi?

Evet, BIGTIME’ın yükselmesi beklenmektedir. Tahminler, 2030’da 1,57 dolara ve 2040’ta 5,76 dolara ulaşabileceğini ve önemli büyüme potansiyeline sahip olduğunu göstermektedir.

Big Time “pay-to-win” mi?

Hayır, Big Time “pay-to-win” değildir. Ücretsiz oynanış ve isteğe bağlı satın alma seçenekleriyle oyuncular, para harcamadan adil şekilde rekabet edebilir.

Big Time’ın güncel değeri nedir?

Ekim 2025 itibarıyla Big Time (BIGTIME), token başına 0,03249 dolar değerindedir; piyasa değeri 61,99 milyon dolar ve 24 saatlik işlem hacmi 296.620 dolardır.

2025 ISLAND Fiyat Tahmini: Kripto Cennet Vahasında Geleceğe Yolculuk

2025 POLIS Fiyat Tahmini: Star Atlas Yönetim Token’ı için Temel Faktörler ve Piyasa Trendlerinin Analizi

VIC ve SAND: Metaverse Gelişimi İçin İki Lider Blockchain Oyun Ekosisteminin Karşılaştırılması

2025 VOXEL Fiyat Tahmini: Gelecekteki Piyasa Analizi ve Metaverse Ekonomisinde Yatırım Fırsatları

2025 GEMS Fiyat Tahmini: Bu oyun token’ı yeni zirvelere ulaşacak mı?

2025 MBX Fiyat Tahmini: MBX Token’ın Piyasa Trendleri ve Gelecekteki Değerleme Potansiyellerinin Analizi

SKY Nedir: Açık Gökyüzünü Anlamak ve Dünyamızdaki Önemi Hakkında Kapsamlı Bir Rehber

PAXG nedir: Kripto Paranın Fiziki Altın Token’ı Üzerine Kapsamlı Bir Rehber

PUMP nedir: Kripto para dünyasının bu fenomenini ve dijital piyasalar üzerindeki etkilerini anlamak için hazırlanmış kapsamlı bir rehber

2025 HTX Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yıla Yönelik Piyasa Beklentileri

2025 PI Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Uzman Analizi ve Piyasa Öngörüsü