2025 GEMS Fiyat Tahmini: Bu oyun token’ı yeni zirvelere ulaşacak mı?

Giriş: GEMS'in Piyasadaki Konumu ve Yatırım Değeri

GEMS (GEMS), kapsamlı bir kripto güç merkezi olarak kuruluşundan bu yana yüksek potansiyele sahip kripto tokenlara özel erişim sunuyor. 2025 yılı itibarıyla GEMS'in piyasa değeri 128.006.588 $'a ulaşmış durumda; dolaşımdaki miktar yaklaşık 612.237.364 token ve fiyatı 0,20908 $ civarında seyrediyor. "Kripto Fırsatlarının Kapısı" olarak bilinen bu varlık, kripto para ekosisteminde token lansmanları, topluluk oluşturma ve varlık yönetiminde giderek daha kritik bir rol üstleniyor.

Bu makalede, GEMS'in 2025-2030 yılları arasındaki fiyat eğilimleri kapsamlı şekilde analiz edilecek; tarihi fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir arada değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacak.

I. GEMS Fiyat Geçmişi ve Güncel Piyasa Durumu

GEMS Tarihsel Fiyat Gelişimi

- 2024: GEMS piyasaya sürüldü, ilk fiyatı 0,0660727 $

- 2024: 22 Ağustos 2024'te tüm zamanların en yüksek seviyesi olan 0,4284 $'a ulaştı

- 2025: 3 Nisan 2025'te tüm zamanların en düşük seviyesi olan 0,0134 $'a indi

GEMS Güncel Piyasa Durumu

20 Ekim 2025 tarihi itibarıyla GEMS'in fiyatı 0,20908 $ ve 24 saatlik işlem hacmi 113.660,20 $. Token, son 24 saatte %3,17 artış gösterdi. GEMS, kripto para piyasasında şu anda 362. sırada yer alıyor ve piyasa değeri 128.006.588,00 $. Dolaşımdaki miktar 612.237.363,70 GEMS olup, bu rakam toplam arzın %72,99'u (toplam arz: 838.793.459,25 GEMS). Tam seyreltilmiş piyasa değeri 175.374.936,46 $. Son bir yılda GEMS'in değeri %26,66 azaldı.

Mevcut GEMS piyasa fiyatını görüntülemek için tıklayın

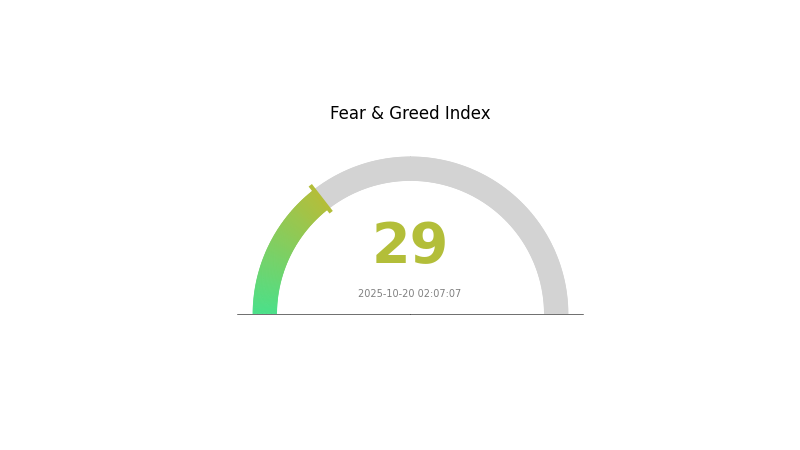

GEMS Piyasa Duyarlılık Göstergesi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksi'ni görüntülemek için tıklayın

Kripto piyasası şu anda korku seviyesinde; Korku ve Açgözlülük Endeksi 29. Bu, yatırımcılar arasında temkinli bir ruh haline işaret ediyor ve uzun vadeli bakış açısına sahip olanlar için alım fırsatı sunabilir. Ancak piyasa duyarlılığının hızlı değişebileceği göz ardı edilmemeli. Yatırımcılar dikkatli olmalı, kapsamlı araştırma yapmalı ve portföylerini çeşitlendirerek riskleri azaltmalı. Her zaman olduğu gibi, kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

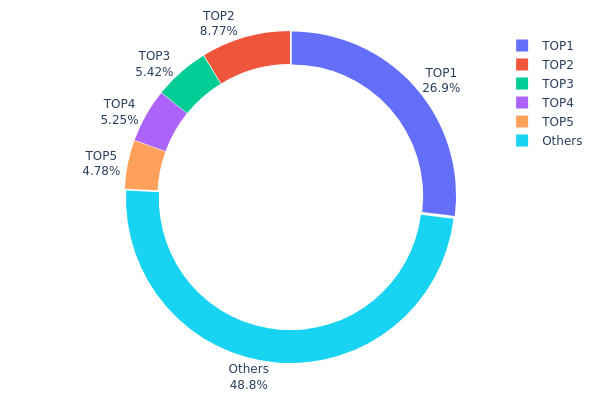

GEMS Varlık Dağılımı

Adres varlık dağılımı verileri, GEMS tokenlarının farklı cüzdan adreslerinde yoğunlaşmasına dair önemli bilgiler sunar. Analiz, üst sıralardaki adreslerde yüksek token yoğunlaşmasını gösteriyor. En büyük varlık sahibi toplam arzın %26,94'ünü elinde tutarken, ilk 5 adres GEMS tokenlarının %51,15'ini kontrol ediyor.

Bu seviyede yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı açısından risk yaratıyor. Tokenların yarısından fazlası yalnızca beş adreste bulunduğunda, bu büyük sahiplerin alım-satım kararı önemli fiyat hareketlerine yol açabilir. Ayrıca, bu yoğunlaşma GEMS ekosisteminin merkeziyetsizliğini olumsuz etkileyebilir; az sayıda varlık sahibi, projenin yönüne dair ciddi oy gücü ve etkiye sahip olur.

Öte yandan tokenların %48,85'i diğer adresler arasında dağılmış durumda; bu, daha geniş bir dağılımı ve çeşitli sahip profilini gösteriyor. Mevcut dağılımda merkeziyet riskleri bulunsa da, "Diğerleri" kategorisinin varlığı, tokenın daha geniş dolaşımla birlikte zamanla merkeziyetsizliğin artma potansiyeline işaret ediyor.

Mevcut GEMS Varlık Dağılımı'nı görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xafb9...e5dcc9 | 225.822,38K | 26,94% |

| 2 | 0x85b0...1f1d2a | 73.472,79K | 8,76% |

| 3 | 0x60af...39010f | 45.457,00K | 5,42% |

| 4 | 0x6e00...47e91c | 44.000,00K | 5,25% |

| 5 | 0x0ac0...a9c248 | 40.069,31K | 4,78% |

| - | Diğerleri | 409.238,27K | 48,85% |

II. GEMS'in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Sabit Arz: GEMS'in toplam arzı sabittir, bu da zamanla kıtlık yaratarak fiyat istikrarını destekleyebilir.

- Tarihsel Model: Sınırlı arz, pek çok kripto parada tarihsel olarak fiyat artışına zemin hazırlamıştır.

- Mevcut Etki: Sabit arz, özellikle talep arttığında GEMS'in değerini desteklemeye devam edebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özellikleri: GEMS, diğer dijital varlıklar gibi enflasyona karşı potansiyel bir koruma aracı olarak değerlendirilebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: GEMS'in GameFi ekosisteminde kullanılması bekleniyor; blokzincir tabanlı oyun projelerinin büyümesi ve popülaritesi talebi artırabilir.

III. GEMS 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,13003 $ - 0,20973 $

- Tarafsız tahmin: 0,20973 $ - 0,24224 $

- İyimser tahmin: 0,24224 $ - 0,27475 $ (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa dönemi beklentisi: Artan benimsenmeyle olası büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 0,15856 $ - 0,31412 $

- 2028: 0,18399 $ - 0,34957 $

- Başlıca katalizörler: Teknolojik ilerleme, kurumsal ilginin yükselmesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,32811 $ - 0,40849 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,40849 $ - 0,48888 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,48888 $ - 0,55000 $ (çığır açan benimseme ve kullanım örnekleri varsayımıyla)

- 2030-12-31: GEMS 0,433 $ (yıl içindeki olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,27475 | 0,20973 | 0,13003 | 0 |

| 2026 | 0,35609 | 0,24224 | 0,18168 | 15 |

| 2027 | 0,31412 | 0,29916 | 0,15856 | 43 |

| 2028 | 0,34957 | 0,30664 | 0,18399 | 46 |

| 2029 | 0,48888 | 0,32811 | 0,3117 | 56 |

| 2030 | 0,433 | 0,40849 | 0,23284 | 95 |

IV. GEMS Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GEMS Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Sabırlı ve yüksek risk toleransı olanlar

- Uygulama önerileri:

- Piyasa gerilemelerinde GEMS biriktirin

- Kısmi kâr almak için hedef fiyatlar belirleyin

- Güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirler

- RSI (Göreli Güç Endeksi): Aşırı alım ve aşırı satım durumlarını ölçer

- Dalgalı alım-satımda temel noktalar:

- GEMS'in genel kripto piyasasıyla korelasyonunu izleyin

- Aşağı yönlü riski yönetmek için net zararı durdur emirleri kullanın

GEMS Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara bölmek

- Zararı durdur emirleri: Olası kayıpları sınırlandırmak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı kullanın

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. GEMS Potansiyel Riskler ve Zorluklar

GEMS Piyasa Riskleri

- Yüksek oynaklık: GEMS fiyatı önemli dalgalanmalara açık

- Piyasa duyarlılığı: Genel kripto trendlerinden etkilenir

- Likidite riski: Kısıtlı işlem hacmi fiyat istikrarını azaltabilir

GEMS Düzenleyici Riskler

- Düzenlemelerde değişiklik: Kripto düzenlemelerinin etkisi

- Sınır ötesi uyum: Farklı ülkelerde değişen yasal statü

- Vergi sonuçları: Kripto vergilendirmesinde belirsizlik

GEMS Teknik Riskler

- Akıllı sözleşme zafiyetleri: Açık veya hata riski

- Ağ tıkanıklığı: Ethereum blokzincirindeki sınırlamalar işlemleri etkileyebilir

- Teknolojik eskime: Yeni blokzincir çözümlerinin gerisinde kalma riski

VI. Sonuç ve Eylem Önerileri

GEMS Yatırım Değeri Değerlendirmesi

GEMS, kripto token lansmanı ve alım-satım ekosisteminde benzersiz bir fırsat sunuyor ve uzun vadeli büyüme potansiyeline sahip. Ancak, yatırımcılar kısa vadeli oynaklık ve düzenleyici belirsizliklere dikkat etmelidir.

GEMS Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, GEMS ekosistemini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Hem tutma hem de alım-satım stratejileriyle dengeli yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve GEMS'i çeşitlendirilmiş kripto portföyünün bir parçası olarak değerlendirin

GEMS Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com'da GEMS alıp satın

- Staking: GEMS tarafından sunuluyorsa staking programlarına katılın

- DeFi entegrasyonu: GEMS tokenlarıyla ilgili merkeziyetsiz finans fırsatlarını keşfedin

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

1000 Gems kaç dolar?

20 Ekim 2025 tarihi itibarıyla 1000 Gems yaklaşık 2.500 $ değerindedir. Gems fiyatı, Web3 ekosisteminin artan benimsenmesiyle son yıllarda istikrarlı şekilde yükseldi.

Gem tokenları için fiyat tahmini nedir?

Piyasa eğilimleri ve uzman analizlerine göre, GEM tokenlarının 2025 sonunda 0,15-0,20 $ seviyelerine ulaşması bekleniyor; 2026 yılında ise daha fazla büyüme potansiyeli mevcut.

Doge 10 dolara ulaşır mı?

Doge'un yakın vadede 10 dolara ulaşması muhtemel görünmüyor. Doge büyük bir büyüme gösterse de, 10 dolarlık fiyat için devasa bir piyasa değeri gerekir; mevcut piyasa koşulları ve Doge'un enflasyonist yapısı dikkate alındığında bu olasılık düşük.

2030'da 1 Bitcoin kaç dolar olacak?

Mevcut eğilimler ve uzman tahminlerine göre, 1 Bitcoin'in 2030 yılında yaklaşık 500.000 $ ile 1.000.000 $ arasında olabileceği öngörülüyor. Ancak bu rakamlar spekülatiftir ve piyasa oynaklığına tabidir.

2025 MBX Fiyat Tahmini: MBX Token’ın Piyasa Trendleri ve Gelecekteki Değerleme Potansiyellerinin Analizi

2025 WNCG Fiyat Tahmini: Wrapped NCG Token’ın piyasa trendleri, teknik göstergeleri ve büyüme potansiyeli üzerine kapsamlı analiz

2025 AXS Fiyat Tahmini: Boğa Koşusu Analizi ve Oyun Token Pazarında Stratejik Yatırım Fırsatları

2025 UDSPrice Tahmini: Piyasa Trendleri ve Gelecek Değerlemeleri Etkileyen Ana Faktörlerin Analizi

2025 ORBR Fiyat Tahmini: Uzun Vadeli Yatırımcılar İçin Büyüme Potansiyeli ile Piyasa Faktörlerinin Analizi

ALICE (ALICE) iyi bir yatırım mı?: Bu oyun token’ının günümüz kripto piyasasındaki potansiyeli ve risklerinin analizi

Küresel Blok Zinciri Benimsemesi İçin Yeni Bir Dönem: Sei × Xiaomi Önyüklü Kripto Cüzdanının Akıllı Telefon Ekosistemini Nasıl Dönüştüreceği

Do Kwon 15 Yıla Mahkum Edildi: Kripto Tarihindeki En Sert Kararlardan Birinin İçinde

BeatSwap'ı Açıklıyoruz: BTX Çoklu Platform Lansmanı ve Web3 IP Ekonomisinin Geleceği

Fungible Token ile NFT: Farklarını, Değerini ve 2025 Pazar Görünümünü Anlamak

ETH Gas Maliyetlerini Düşürmek İçin Akıllı Stratejiler