2025 ALEX Fiyat Tahmini: Merkeziyetsiz Borsa Tokeninde Yükselen Eğilimler ve Büyümeyi Harekete Geçiren Temel Unsurlar

Giriş: ALEX’in Piyasadaki Konumu ve Yatırım Potansiyeli

Alex Lab (ALEX), Stacks blockchain üzerinde önde gelen bir DeFi protokolü olarak, 2021’deki kuruluşundan bu yana önemli gelişmeler kaydetmiştir. 2025 yılı itibarıyla ALEX’in piyasa değeri 3.704.911 ABD doları seviyesine ulaşmış, dolaşımdaki token miktarı yaklaşık 871.129.045’e çıkmış ve fiyatı 0,004253 ABD doları civarında seyretmektedir. “BitFi öncüsü” olarak bilinen bu varlık, Bitcoin ile merkeziyetsiz finans arasında köprü kurmada giderek daha kritik bir rol üstlenmektedir.

Bu makalede, ALEX’in 2025-2030 dönemi fiyat eğilimleri; tarihsel veriler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler üzerinden kapsamlı biçimde analiz edilecek, profesyonel fiyat tahminleri ve yatırım stratejileri yatırımcılarla paylaşılacaktır.

I. ALEX Fiyat Geçmişi ve Güncel Piyasa Durumu

ALEX’in Tarihsel Fiyat Gelişimi

- 2022: Ocak’ta ana ağ lansmanı, 1 Nisan 2024’te fiyat 0,54577 ABD doları ile zirveye ulaştı

- 2024: Piyasa döngüsünde değişim, fiyat tüm zamanların en yüksek seviyesinden geriledi

- 2025: Ayı trendi devam etti, fiyat 10 Ekim 2025’te 0,003162 ABD doları ile en düşük seviyesine indi

ALEX’in Mevcut Piyasa Durumu

13 Ekim 2025 itibarıyla ALEX, 0,004253 ABD doları seviyesinden işlem görüyor ve son 24 saatte %5,11 artış kaydetti. Token, 24 saatlik işlem aralığında 0,00394 ile 0,004988 ABD doları arasında dalgalandı. Son kısa vadeli yükselişe rağmen, ALEX uzun vadede ciddi kayıplar yaşadı; son bir haftada %13,71 ve son bir ayda %14,48 geriledi. En belirgin düşüş ise yıllık performansta; geçen yıla göre %95,43 azalma yaşandı.

Piyasa değeri şu anda 3.704.911,83 ABD doları olup, ALEX küresel kripto para piyasasında 1.957’nci sırada yer alıyor. Dolaşımdaki ALEX token miktarı 871.129.045,4021761 ve toplam arz 1.000.000.000’dur; dolaşımdaki oran ise %87,11. Tam seyreltilmiş piyasa değeri 4.253.000,00 ABD doları olup, arzın daha fazla genişleyebileceğine işaret etmektedir.

Güncel ALEX piyasa fiyatını görüntülemek için tıklayın

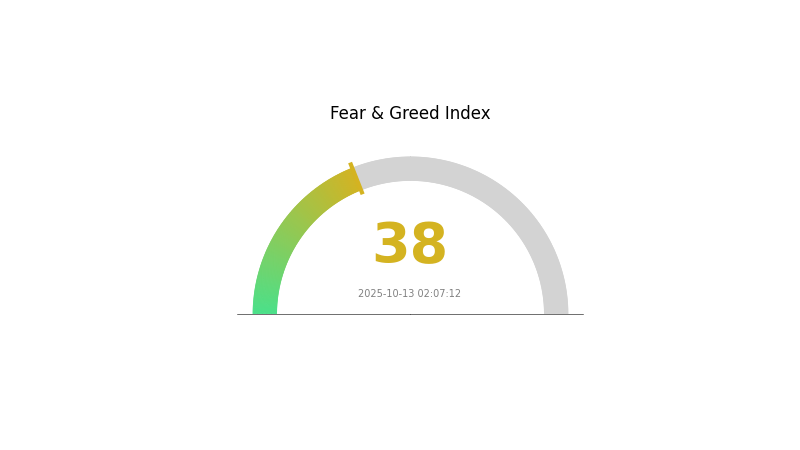

ALEX Piyasa Duyarlılığı Göstergesi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 38 puanda ve piyasa hâkim ruh hali korku. Yatırımcılar temkinli davranıyor ve potansiyel alım fırsatlarını kolluyor. Bu dönemlerde güncel kalmak ve maliyet ortalaması stratejilerini değerlendirmek önemlidir. Piyasa döngülerinin doğal olduğunu ve korkunun genellikle toparlanma öncesi geldiğini unutmayın. Temel destek seviyelerini ve alandaki gelişmeleri izlemeye devam edin. Her yatırım kararınızda kapsamlı araştırma yapmayı ihmal etmeyin.

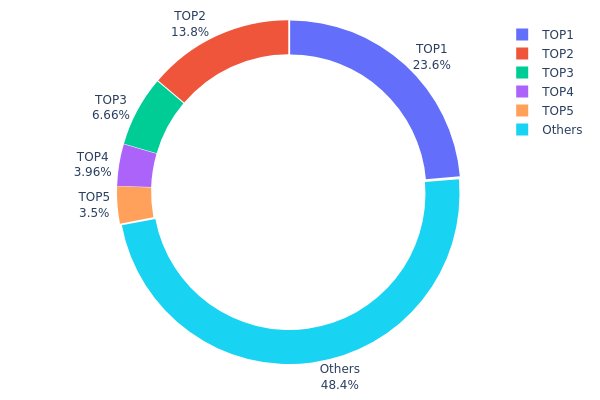

ALEX Varlık Dağılımı

ALEX token’larının adres bazında dağılımı, varlıkların büyük bölümünün az sayıda adreste yoğunlaştığını gösteriyor. En büyük adres toplam arzın %23,64’ünü, ikinci en büyük adres ise %13,83’ünü elinde bulunduruyor. İlk 5 adres, ALEX token’larının %51,58’ini kontrol ederek yüksek merkezileşme düzeyine işaret ediyor.

Bu yoğunlaşma, piyasada manipülasyon ve fiyat oynaklığı risklerini artırır. Arzın yarısından fazlası sadece beş adreste toplandığı için, bu cüzdanlardan yapılan büyük işlemler ALEX’in piyasa dinamiklerini ciddi şekilde etkileyebilir. Dengesiz dağılım, token yönetişiminde birkaç büyük sahibi lehine orantısız etki oluşturabilir.

Bununla birlikte, ALEX token’larının %48,42’si diğer adresler arasında dağılmış durumda ve bu daha geniş bir katılımı işaret ediyor. Ancak mevcut dağılım, düşük merkeziyetsizlik düzeyini gösteriyor ve piyasa istikrarı ile yoğunlaşma riskinin azaltılması için dağıtım mekanizmalarının geliştirilmesi gerektiğini ortaya koyuyor.

Güncel ALEX Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | SP33XE...NEYCYY | 148.984,44K | 23,64% |

| 2 | SP102V...-v2-01 | 87.184,35K | 13,83% |

| 3 | SP3DXB...RQNKJ8 | 41.998,05K | 6,66% |

| 4 | SM3868...WKP2PR | 24.941,61K | 3,95% |

| 5 | SP3AP6...T6103Q | 22.076,63K | 3,50% |

| - | Diğerleri | 304.971,03K | 48,42% |

II. ALEX’in Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Enflasyon ve Para Politikası: Merkez bankası politikaları ve enflasyon oranları, ALEX’in fiyatını önemli ölçüde etkiler.

- Tarihsel Eğilim: Geçmiş arz değişimleri, fiyat hareketleriyle yakından ilişkilidir.

- Mevcut Etki: Beklenen para politikaları, arz-talep dengesini şekillendirebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumların Benimsemesi: Şirketlerin ALEX’i çeşitli uygulamalarda kullanmaya başlaması talebi artırabilir.

- Ulusal Politikalar: Kripto varlıklara yönelik devlet düzenlemeleri ve politikalar belirleyici rol oynayacaktır.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle büyük ekonomilerdeki merkez bankası hamleleri, ALEX’in değerini etkileyecektir.

- Enflasyona Karşı Koruma: ALEX’in mevcut ekonomik ortamda enflasyona karşı performansı.

- Jeopolitik Etkenler: Uluslararası gerilimler ve çatışmalar, yatırımcıların ALEX’e bakışını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Yapay Zeka Entegrasyonu: Yapay zeka teknolojisinin blokzincirle birleşmesi, ALEX’in kullanımını ve değerini artırabilir.

- Ekosistem Uygulamaları: ALEX ekosisteminde geliştirilen DApp ve projeler, benimsemeyi ve fiyatı yükseltebilir.

III. 2025-2030 ALEX Fiyat Tahmini

2025 Öngörüsü

- Temkinli tahmin: 0,00311 - 0,00426 ABD doları

- Nötr tahmin: 0,00426 - 0,00501 ABD doları

- İyimser tahmin: 0,00501 - 0,00576 ABD doları (sürekli piyasa büyümesi ve artan benimseme gerektirir)

2027-2028 Öngörüsü

- Piyasa aşaması: Konsolidasyon sonrası kademeli büyüme potansiyeli

- Fiyat tahmini:

- 2027: 0,00543 - 0,00600 ABD doları

- 2028: 0,00554 - 0,00816 ABD doları

- Kilit katalizörler: Teknolojik yenilikler, yeni kullanım alanları, genel kripto piyasasının toparlanması

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,00665 - 0,00777 ABD doları (istikrarlı piyasa büyümesi ve benimseme ile)

- İyimser senaryo: 0,00777 - 0,00947 ABD doları (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,00947+ ABD doları (çığır açıcı uygulamalar ve yaygın entegrasyon ile)

- 2030-12-31: ALEX 0,00947 ABD doları (oldukça olumlu senaryoda olası zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı |

|---|---|---|---|---|

| 2025 | 0,00576 | 0,00426 | 0,00311 | 0 |

| 2026 | 0,00631 | 0,00501 | 0,00446 | 17 |

| 2027 | 0,006 | 0,00566 | 0,00543 | 33 |

| 2028 | 0,00816 | 0,00583 | 0,00554 | 37 |

| 2029 | 0,00854 | 0,007 | 0,00665 | 64 |

| 2030 | 0,00947 | 0,00777 | 0,00396 | 82 |

IV. ALEX için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ALEX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli yatırımcılar ve Bitcoin meraklıları

- İşlem önerileri:

- Piyasa düşüşlerinde ALEX token biriktirin

- ALEX token stake ederek ek ödüller kazanın

- Token’ları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI: Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı alım-satım için anahtar noktalar:

- Teknik göstergelere dayalı net giriş-çıkış noktaları belirleyin

- Zarar-durdur emirleri kullanarak risk yönetin

ALEX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları birden fazla kripto para arasında dağıtmak

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 Wallet önerilir

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. ALEX için Potansiyel Riskler ve Zorluklar

ALEX Piyasa Riskleri

- Fiyat oynaklığı: ALEX ciddi fiyat dalgalanmalarına maruz kalabilir

- Piyasa duyarlılığı: Bitcoin piyasasındaki değişiklikler, ALEX’in performansını etkileyebilir

- Likidite riski: Düşük işlem hacmi, pozisyon açıp kapamayı zorlaştırabilir

ALEX Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen mevzuatlar, ALEX’in faaliyetlerini etkileyebilir

- Uyum gereklilikleri: Artan uyum maliyetleri kârlılığı düşürebilir

- Sınır ötesi kısıtlamalar: Uluslararası işlemlerde olası sınırlamalar

ALEX Teknik Riskler

- Akıllı sözleşme açıkları: Protokolde olası güvenlik zafiyetleri

- Ölçeklenebilirlik sorunları: Artan işlem hacmini karşılamada kısıtlar

- Entegrasyon sorunları: Bitcoin ağ güncellemeleriyle uyumda potansiyel problemler

VI. Sonuç ve Eylem Önerileri

ALEX Yatırım Potansiyeli Değerlendirmesi

ALEX, Bitcoin DeFi alanında uzun vadeli büyüme potansiyeliyle özgün bir fırsat sunmaktadır. Kısa vadede ise fiyat oynaklığı ve düzenleyici belirsizlikler önemli riskler teşkil etmektedir.

ALEX Yatırım Önerileri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük ve düzenli yatırımlar yapın

✅ Deneyimli yatırımcılar: Portföyünüzde ALEX’i Bitcoin maruziyetinin bir parçası olarak dengeli şekilde değerlendirin

✅ Kurumsal yatırımcılar: Detaylı araştırma gerçekleştirin ve büyük işlemler için OTC piyasasını düşünün

ALEX Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve diğer desteklenen borsalarda işlem yapılabilir

- Staking: Ek ödüller için ALEX staking programlarına katılım sağlanabilir

- DeFi protokolleri: Stacks blockchain üzerinde ALEX tabanlı DeFi uygulamalarını kullanın

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze aldığınızdan fazlasını yatırmayın.

Sıkça Sorulan Sorular

Alex Lab iyi bir yatırım mı?

Alex Lab’ın potansiyeli mevcut; 1.000 ABD doları ile şu anda 190.339 ALEX token alınabiliyor. Uzun vadeli sürdürülebilirlik belirsiz olsa da, mevcut piyasa eğilimleri umut verici bir yatırım fırsatı gösterebilir.

Hangi kripto para için en yüksek fiyat tahmini var?

Bitcoin için 2025’te en yüksek fiyat tahmini yapılmakta; öngörüler 122.937 ABD dolarına kadar yükseliyor. Chainlink ise 59,67 ABD doları ile dikkat çekici bir artışla ikinci sırada.

Alex ne kadar pahalı?

13 Ekim 2025 itibarıyla Alex’in fiyatı 0,004317 ABD doları ve son 24 saatte %4,44’lük bir artış göstermiştir.

ALEX kripto nedir?

ALEX, Stacks Blockchain üzerinde açık kaynaklı bir Bitcoin DeFi platformudur. Token lansmanları sağlar ve kullanıcılara sabit oranlı, sabit vadeli seçenekler sunar.

GNO vs STX: Akıllı Sözleşme Geliştirmede İki Blockchain Ekosisteminin Karşılaştırılması

2025 BARD Fiyat Tahmini: Google'un yapay zeka sohbet botu için potansiyel büyüme ve piyasa trendlerinin analizi

2025 ECHO Fiyat Tahmini: ECHO Token'ın Büyüme Potansiyeli ve Piyasa Trendleri Analizi

Gate Wrapped BTC (GTBTC) iyi bir yatırım mı?: Bu kripto para türevinin riskleri ile potansiyel getirilerini değerlendiriyoruz

2025 ROCK Fiyat Tahmini: Kripto Para Birimi Piyasasındaki Trendler ve Olası Büyüme Faktörlerinin Değerlendirilmesi

TAPPROTOCOL ve TRX: Merkeziyetsiz uygulamalar için iki blockchain platformunu karşılaştırma

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak