2025 BARD Fiyat Tahmini: Google'un yapay zeka sohbet botu için potansiyel büyüme ve piyasa trendlerinin analizi

Giriş: BARD’ın Piyasadaki Yeri ve Yatırım Potansiyeli

Bitcoin’in kullanımını dönüştürmeye odaklanan merkeziyetsiz finans projesi Lombard (BARD), kurulduğu günden itibaren DeFi sektöründe dikkat çekici bir gelişim göstermektedir. 2025 yılı itibarıyla BARD’ın piyasa değeri 140.175.000 $’a ulaşmış, yaklaşık 225.000.000 token dolaşıma girmiştir ve fiyatı 0,623 $ civarında seyretmektedir. “Bitcoin DeFi etkinleştiricisi” olarak öne çıkan bu varlık, Bitcoin sahiplerinin getiri elde etmesi ve DeFi fırsatlarından yararlanmasında giderek daha kritik bir rol üstlenmektedir.

Bu makalede, BARD’ın 2025-2030 yılları arasındaki fiyat hareketleri; geçmiş performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar doğrultusunda profesyonel fiyat tahminleri ve pratik yatırım stratejileriyle ele alınacaktır.

I. BARD Fiyat Geçmişi ve Mevcut Piyasa Durumu

BARD Fiyatının Tarihsel Seyri

- 2025 (23 Eylül): BARD, 1,5345 $ ile tüm zamanların en yüksek değerine ulaşarak proje için önemli bir dönüm noktası kaydetti.

- 2025 (10 Ekim): Token, 0,2373 $ ile en düşük seviyesini görerek yüksek piyasa oynaklığını gösterdi.

- 2025 (Güncel): BARD, 20 Ekim 2025 itibarıyla 0,623 $ civarında istikrar kazanarak toparlanma sürecine girmiştir.

BARD Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla BARD, 0,623 $ seviyesinde işlem görmektedir ve son 24 saatte %0,08 oranında hafif bir yükseliş kaydetmiştir. Token’ın piyasa değeri 140.175.000 $ olup küresel kripto para sıralamasında 344. sıradadır. Toplam arzı 1.000.000.000 olan BARD’ın dolaşımdaki miktarı 225.000.000’dur ve dolaşımdaki oranı %22,5’tir.

Son dönemde BARD’da ciddi oynaklık yaşanmıştır; 7 günlük performansında %7,17 gerileme, 30 günlük değişimde ise %32,12 düşüş görülmektedir. Yıllık bazda ise %61,35’lik sert bir değer kaybı, BARD’ın geçtiğimiz yıl karşılaştığı zorlu piyasa koşullarının göstergesidir.

Son düşüşlere rağmen, BARD’ın 24 saatlik işlem hacmi 91.606,63857 $ ile piyasada aktif bir katılım olduğunu göstermektedir. Şu anki fiyat, zirveden %59,37 aşağıda, dip seviyeye göre ise %162,54 yukarıda olup, token’ın konsolidasyon sürecinde olduğunu göstermektedir.

Güncel BARD piyasa fiyatını görmek için tıklayın

BARD Piyasa Duyarlılığı Göstergesi

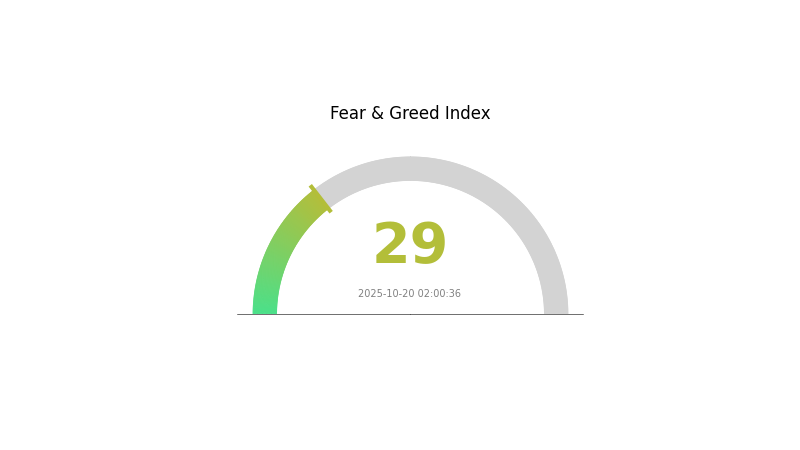

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim ve duyarlılık endeksi 29 seviyesinde bulunuyor. Bu temkinli ortam, yatırımcıların son dönemdeki oynaklık veya dışsal riskler nedeniyle dikkatli hareket ettiğini gösteriyor. Böyle zamanlarda, bazı yatırımcılar “sokakta kan varken al” yaklaşımıyla stratejik alım fırsatları arayabilir. Yine de, kapsamlı araştırma yapmak ve riskleri dikkatlice yönetmek çok önemlidir. Unutmayın, piyasa psikolojisi hızlı değişebilir ve geçmiş performans geleceği garanti etmez.

BARD Varlık Dağılımı

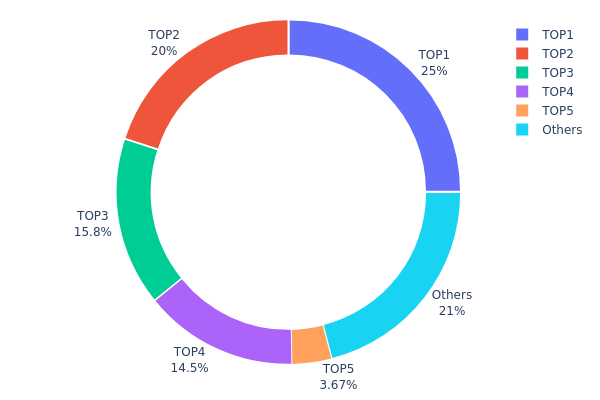

Adres bazlı varlık dağılımı grafiği, BARD token’larının adresler arasında nasıl yoğunlaştığına dair önemli veriler sunar. Mevcut verilere göre, token’larda üst adreslerde ciddi bir yoğunlaşma gözlenmektedir. İlk beş adres, toplam BARD arzının %79,01’ini elinde tutmakta olup, en büyük sahip tek başına tüm token’ların %25’ine sahip.

Bu yüksek yoğunlaşma, merkeziyetçilik ve olası piyasa manipülasyonu risklerini artırmaktadır. Sadece ilk iki adres, arzın %45’ini kontrol ediyor; büyük işlemler gerçekleşirse fiyat oynaklığı artabilir. Ayrıca, bu büyük sahipler yönetim kararlarını veya işlem desenlerini etkileyebilir.

Buna rağmen, token’ların %20,99’u diğer adreslere dağılmış durumda; bu, daha geniş bir dağılımın işareti olsa da mevcut yapı, merkeziyetsizliğin düşük düzeyde olduğunu ve token’ın uzun vadeli istikrarı ile manipülasyona karşı direncinin sınırlı olabileceğini gösteriyor.

Güncel BARD Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x2a7b...079b59 | 250.000,00K | 25,00% |

| 2 | 0xa7b8...5a338b | 200.000,00K | 20,00% |

| 3 | 0xfcd7...ee5574 | 158.330,02K | 15,83% |

| 4 | 0xc4ed...3989f1 | 145.121,87K | 14,51% |

| 5 | 0x9b6e...32525b | 36.700,00K | 3,67% |

| - | Diğerleri | 209.848,11K | 20,99% |

II. BARD’ın Gelecek Fiyatını Belirleyen Temel Unsurlar

Arz Mekanizması

- Sabit Arz: BARD’ın toplam arzı değişmez; bu durum kıtlık yaratarak uzun vadede fiyatı artırabilir.

- Tarihsel Eğilimler: Sınırlı arz, kripto paralarda geçmişte genellikle yüksek fiyat oynaklığına yol açmıştır.

- Mevcut Etki: Sabit arz, talebin artmasıyla fiyat istikrarı ve değerlenmeye destek olabilir.

Makroekonomik Ortam

- Enflasyon Karşıtı Özellikler: BARD, diğer dijital varlıklar gibi enflasyon riskine karşı koruma aracı olarak değerlendirilebilir.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlik ve jeopolitik gerilimler, BARD gibi alternatif varlıklara olan yatırımcı ilgisini etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: BARD ekosisteminde DApp ve projelerin büyümesi, token’a olan talep ve kullanım alanını artırabilir.

III. 2025-2030 Dönemi BARD Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,36745 $ - 0,50 $

- Varsayılan tahmin: 0,50 $ - 0,70 $

- İyimser tahmin: 0,70 $ - 0,89683 $ (olumlu piyasa duyarlılığı durumunda)

2027-2028 Görünümü

- Piyasa aşaması: Potansiyel büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,51348 $ - 0,86961 $

- 2028: 0,64517 $ - 0,95926 $

- Başlıca katalizörler: Benimsenmenin artması, teknolojik gelişmeler

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,90408 $ - 1,03518 $ (istikrarlı yükseliş)

- İyimser senaryo: 1,03518 $ - 1,16627 $ (güçlü piyasa performansı)

- Dönüştürücü senaryo: 1,16627 $ - 1,27327 $ (olağanüstü piyasa koşulları ve yaygın benimseme)

- 2030-12-31: BARD 1,27327 $ (potansiyel zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,89683 | 0,6228 | 0,36745 | 0 |

| 2026 | 0,89658 | 0,75982 | 0,72942 | 21 |

| 2027 | 0,86961 | 0,8282 | 0,51348 | 32 |

| 2028 | 0,95926 | 0,8489 | 0,64517 | 36 |

| 2029 | 1,16627 | 0,90408 | 0,60574 | 45 |

| 2030 | 1,27327 | 1,03518 | 0,76603 | 66 |

IV. BARD Yatırım Stratejileri ve Risk Yönetimi

BARD Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Bitcoin DeFi alanına temkinli şekilde dahil olmak isteyenler

- İşlem önerileri:

- Piyasa düşüşlerinde BARD biriktirin

- BARD token’larını stake ederek getiri elde edin

- Token’ları güvenli ve saklama dışı cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izlemek için

- Dalgalı işlemde önemli hususlar:

- Teknik göstergelere göre net giriş/çıkış noktaları belirleyin

- Aşağı yönlü riski azaltmak için zarar-durdur emirleri kullanın

BARD Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Aggresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı DeFi projelerine dağıtın

- Opsiyon stratejileri: Satım opsiyonu ile aşağı yönlü riski sınırlandırın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı doğrulama ve güçlü şifre kullanımı

V. BARD’ın Karşılaşabileceği Riskler ve Zorluklar

BARD Piyasa Riskleri

- Yüksek oynaklık: Fiyatlarda büyük dalgalanmalar olabilir

- Likidite riski: Düşük işlem hacmi pozisyondan çıkışı zorlaştırabilir

- Korelasyon riski: BARD’ın performansı genel kripto piyasa psikolojisine bağlı olabilir

BARD Regülasyon Riskleri

- Belirsiz düzenleyici ortam: DeFi alanında yeni regülasyonlar gündeme gelebilir

- Sınır ötesi uyum: Yasal mevzuatlar ülkeden ülkeye değişebilir

- Vergisel etkiler: DeFi token ve getiri vergilendirmesinde değişiklikler olabilir

BARD Teknik Riskleri

- Akıllı kontrat açıkları: Protokolde güvenlik açıkları veya hatalar olabilir

- Ölçeklenebilirlik sorunları: Ethereum ağındaki yoğunluk kullanıcı deneyimini olumsuz etkileyebilir

- Birlikte çalışabilirlik: Diğer DeFi protokolleriyle uyum sorunları yaşanabilir

VI. Sonuç ve Eylem Tavsiyeleri

BARD Yatırım Değeri Analizi

BARD, Bitcoin’in DeFi alanında kullanımına erişim sunar ve uzun vadede büyüme potansiyeli taşır. Ancak, kısa vadede oynaklık ve regülasyon belirsizlikleriyle karşı karşıyadır.

BARD Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp DeFi kavramlarını öğrenmeye odaklanın

✅ Deneyimli yatırımcılar: Bitcoin portföyünüzün bir kısmını BARD’a ayırmayı değerlendirin

✅ Kurumsal yatırımcılar: BARD’ı çeşitlendirilmiş DeFi portföyünde analiz edin

BARD İşlem Katılım Yöntemleri

- Spot işlem: Gate.com’da BARD alıp satabilirsiniz

- Stake etme: Lombard ekosisteminde getiri elde etme imkânı

- Likidite sağlama: BARD’ı merkeziyetsiz borsalara sunarak ek ödüller kazanabilirsiniz

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybedebileceğinizden fazlasını asla yatırmayın.

SSS

BAT 1000 $’a ulaşır mı?

BAT’ın yakın gelecekte 1000 $ seviyesine ulaşması oldukça düşük ihtimaldir. Mevcut fiyat ve piyasa değeri göz önüne alındığında, bu kadar büyük bir artış kripto piyasasında görülmemiş bir durum olurdu.

2025’te hangi kripto ralli bekleniyor?

2025 yılı kripto rallisinde Bitcoin’in öncülüğü bekleniyor; fiyatın coin başına 150.000 $’a ulaşabileceği öngörülüyor. Ayrıca Ethereum ve Solana’da da önemli büyüme bekleniyor.

2025’te 1 Pi coin’in değeri ne olacak?

Piyasa eğilimleri ve uzman görüşlerine göre, 1 Pi coin 2025’te benimsenme ve ekosistem gelişimine bağlı olarak yaklaşık 0,50 $ ile 1 $ arasında bir değere sahip olabilir.

2030’da XRP’nin fiyatı ne olur?

Mevcut piyasa dinamikleri ve analizlere göre, XRP’nin fiyatı 2030’da finans sektöründe artan benimseme ve iş ortaklıklarının etkisiyle 10 $ - 15 $ aralığına ulaşabilir.

GNO vs STX: Akıllı Sözleşme Geliştirmede İki Blockchain Ekosisteminin Karşılaştırılması

2025 ECHO Fiyat Tahmini: ECHO Token'ın Büyüme Potansiyeli ve Piyasa Trendleri Analizi

Gate Wrapped BTC (GTBTC) iyi bir yatırım mı?: Bu kripto para türevinin riskleri ile potansiyel getirilerini değerlendiriyoruz

2025 ROCK Fiyat Tahmini: Kripto Para Birimi Piyasasındaki Trendler ve Olası Büyüme Faktörlerinin Değerlendirilmesi

2025 ALEX Fiyat Tahmini: Merkeziyetsiz Borsa Tokeninde Yükselen Eğilimler ve Büyümeyi Harekete Geçiren Temel Unsurlar

TAPPROTOCOL ve TRX: Merkeziyetsiz uygulamalar için iki blockchain platformunu karşılaştırma

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025