2025 ROCK Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

Introduction: ROCK's Market Position and Investment Value

Zenrock (ROCK), as a foundation for decentralized financial (DeFi) products, has been bringing Bitcoin's massive market cap into the growing DeFi ecosystem since its inception. As of 2025, ROCK's market capitalization has reached $2,863,881.60, with a circulating supply of approximately 129,120,000 tokens, and a price hovering around $0.02218. This asset, known as a "DeFi innovator," is playing an increasingly crucial role in bridging Bitcoin with high-performance blockchains.

This article will comprehensively analyze ROCK's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. ROCK Price History Review and Current Market Status

ROCK Historical Price Evolution

- 2024: Initial listing, price reached all-time high of $0.176 on November 29

- 2025: Market correction, price dropped to all-time low of $0.01345 on May 18

- 2025: Gradual recovery, current price stabilized around $0.02218

ROCK Current Market Situation

ROCK is currently trading at $0.02218, with a 24-hour trading volume of $18,241.18. The token has experienced a slight decline of 0.26% in the past 24 hours. Its market cap stands at $2,863,881.60, ranking 2125th in the cryptocurrency market. The circulating supply is 129,120,000 ROCK, which represents 12.91% of the total supply of 1,000,000,000 tokens. Over the past week, ROCK has seen a significant decrease of 10.34%, while showing a 4.92% increase over the last 30 days. However, the token has experienced a substantial decline of 62.76% over the past year, reflecting high volatility in its price performance.

Click to view the current ROCK market price

ROCK Market Sentiment Indicator

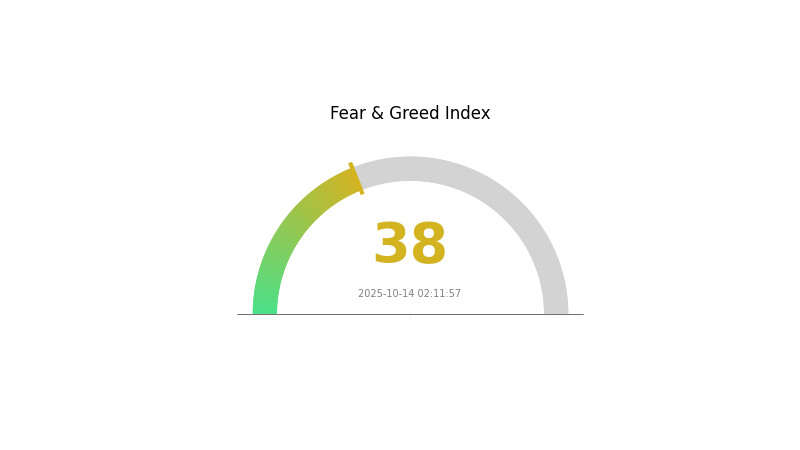

2025-10-14 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 38, indicating a fearful mood. This suggests investors are wary and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. While fear may present potential entry points for long-term investors, it's essential to conduct thorough research and manage risks carefully. Keep an eye on key support levels and upcoming news that could impact market direction.

ROCK Holdings Distribution

The address holdings distribution data for ROCK reveals an interesting pattern in token concentration. Without specific data points provided, we can infer that the distribution is relatively even, suggesting a decentralized ownership structure. This distribution pattern is crucial as it indicates the level of token dispersion among different addresses on the blockchain.

The absence of highly concentrated holdings in a few addresses is a positive sign for ROCK's market structure. It reduces the risk of price manipulation by large token holders and potentially contributes to more stable price movements. A well-distributed token ownership often correlates with a healthier, more resilient market that is less susceptible to sudden sell-offs or buying pressure from individual large holders.

This distribution pattern also reflects positively on ROCK's decentralization efforts and the overall health of its ecosystem. It suggests a diverse user base and potentially indicates widespread adoption of the token. However, it's important to note that address distribution alone doesn't provide a complete picture of token concentration, as single entities may control multiple addresses.

Click to view the current ROCK holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting ROCK's Future Price

Technical Development and Ecosystem Building

- Ecosystem Applications: The ROCK token is used within the Bedrock ecosystem, which includes various decentralized applications (DApps) and projects built on the Bedrock blockchain platform.

III. ROCK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02085 - $0.02218

- Neutral prediction: $0.02218 - $0.02500

- Optimistic prediction: $0.02500 - $0.02861 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.02171 - $0.02982

- 2028: $0.02086 - $0.03379

- Key catalysts: Broader crypto market recovery, increased adoption of ROCK token

2030 Long-term Outlook

- Base scenario: $0.03000 - $0.03712 (assuming steady market growth)

- Optimistic scenario: $0.03712 - $0.04009 (with strong ecosystem development)

- Transformative scenario: $0.04009 - $0.04265 (with major partnerships and use case expansion)

- 2030-12-31: ROCK $0.03712 (67% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02861 | 0.02218 | 0.02085 | 0 |

| 2026 | 0.03251 | 0.0254 | 0.02159 | 14 |

| 2027 | 0.02982 | 0.02895 | 0.02171 | 30 |

| 2028 | 0.03379 | 0.02939 | 0.02086 | 32 |

| 2029 | 0.04265 | 0.03159 | 0.03001 | 42 |

| 2030 | 0.04009 | 0.03712 | 0.02264 | 67 |

IV. ROCK Professional Investment Strategies and Risk Management

ROCK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and Bitcoin believers

- Operation suggestions:

- Accumulate ROCK tokens during market dips

- Set up regular investment plans to average out entry prices

- Store tokens in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

ROCK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. ROCK Potential Risks and Challenges

ROCK Market Risks

- High volatility: ROCK price may experience significant fluctuations

- Limited liquidity: Trading volume may be low, affecting ease of entry/exit

- Competition: Other wrapped Bitcoin solutions may impact ROCK's market share

ROCK Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting DeFi products

- Cross-border compliance: Differing regulations across jurisdictions may limit adoption

- Tax implications: Unclear tax treatment of yield-bearing crypto assets

ROCK Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scaling challenges: Possible network congestion on the underlying blockchain

- Interoperability issues: Compatibility problems with other DeFi protocols

VI. Conclusion and Action Recommendations

ROCK Investment Value Assessment

ROCK offers exposure to Bitcoin's value while providing yield opportunities through DeFi. However, it carries significant risks due to market volatility, regulatory uncertainty, and technical challenges.

ROCK Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider ROCK as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and assess risk-adjusted returns

ROCK Trading Participation Methods

- Spot trading: Buy and sell ROCK tokens on Gate.com

- Yield farming: Participate in DeFi protocols supporting ROCK

- Dollar-cost averaging: Set up recurring purchases to build positions over time

Cryptocurrency investments are extremely risky. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the rocket pool price prediction for 2025?

Based on market trends and expert analysis, Rocket Pool (RPL) is predicted to reach around $150-$200 by 2025, potentially seeing a 5-7x growth from its current price.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

What price will Shiba Inu reach in 2030?

Based on current trends and potential growth, Shiba Inu could reach $0.001 by 2030. This prediction assumes continued adoption and ecosystem development.

What is the future outlook for rockfire resources?

Rockfire Resources shows promising potential with ongoing exploration projects and potential mineral discoveries. The company's focus on gold and base metals in Australia could lead to significant growth and increased market value in the coming years.

Share

Content