Meteora: Building a Dynamic and Sustainable Liquidity Engine for Solana DeFi

What Is Meteora?

(Image source: MeteoraAG)

Meteora is a high-performance DeFi protocol built within the Solana ecosystem, backed by YZi Labs with participation from IDG Capital. The project aims to establish a sustainable, composable, and long-term on-chain liquidity infrastructure that allows capital to move intelligently rather than remain idle.

Originally launched as Mercurial Finance, the project rebranded to Meteora in 2023 and has since become a core liquidity backbone for Solana, powering trading routes on major aggregators such as Jupiter. To date, Meteora has raised more than $55 million in funding, solidifying its position as one of the cornerstone protocols of Solana DeFi.

A Capital Layer Built for Movement

Meteora’s vision is rooted in the idea that liquidity in DeFi should not be static. Instead, capital should adapt in real time to market conditions, optimize returns, and improve execution quality for users.

To achieve this, Meteora is built around three primary modules:

- DLMM (Dynamic Liquidity Market Maker)

- DAMM (Dynamic Automated Market Maker)

- Dynamic Vaults

Together, these systems create Solana’s most flexible liquidity engine, enabling liquidity providers (LPs) to deploy capital with precision, maximize returns during volatile market conditions, and enhance trading execution across the ecosystem.

DLMM: A New Approach to Market Making

At the heart of Meteora lies DLMM, a liquidity model that reimagines traditional AMMs. Instead of spreading liquidity evenly across the entire price curve, DLMM introduces a pricing bin system that allows LPs to concentrate liquidity within specific ranges.

For example, if an LP believes SOL will trade between $100 and $110, they can choose to deploy liquidity exclusively within that band. This delivers several advantages:

- Higher utilization of capital

- Significantly increased trading fee returns

- Reduced idle liquidity outside relevant price areas

By enabling ranged liquidity placement, Meteora provides a more efficient and strategic approach to liquidity deployment compared to legacy AMMs.

Dynamic Vaults: Automated and Intelligent Yield Optimization

Dynamic Vaults represent Meteora’s innovation in automated liquidity optimization. Instead of leaving idle capital unused, the system reallocates funds across DeFi lending platforms—including Solend, MarginFi, Kamino, and others—in search of the highest available yield.

These vaults generate dual revenue streams:

- Trading fees from DLMM pools

- Lending return from external DeFi protocols

The system automatically rebalances, compounds earnings, and adjusts allocation to adapt to changing market conditions. Users benefit from yield maximization without needing to manually rebalance or move capital across protocols.

Alpha Vault: Protecting Fair Market Launches

To address the long-standing problem of bots and price sniping during early token listings, Meteora introduced Alpha Vault—a model designed to ensure a fair and stable launch environment.

By unlocking liquidity in controlled phases and enforcing lock-in periods, Alpha Vault:

- Reduces extreme price volatility

- Prevents bot-driven distortions

- Enables genuine long-term participants to enter at reasonable prices

This system contributes to healthier token launches and a more sustainable liquidity structure during the earliest phases of market discovery.

M3M3: A Sustainable Hold-to-Earn Incentive System

Meteora introduces M3M3, a reward mechanism designed to encourage long-term participation. Users who stake MET tokens into liquidity pools earn a share of transaction revenue while benefiting from automatic compounding over time.

Key advantages include:

- Reinforced liquidity stability

- Sustainable reward emissions

- Economic alignment between token holders and the protocol

By turning passive holding into active contribution, M3M3 strengthens both liquidity depth and the broader value cycle of the protocol.

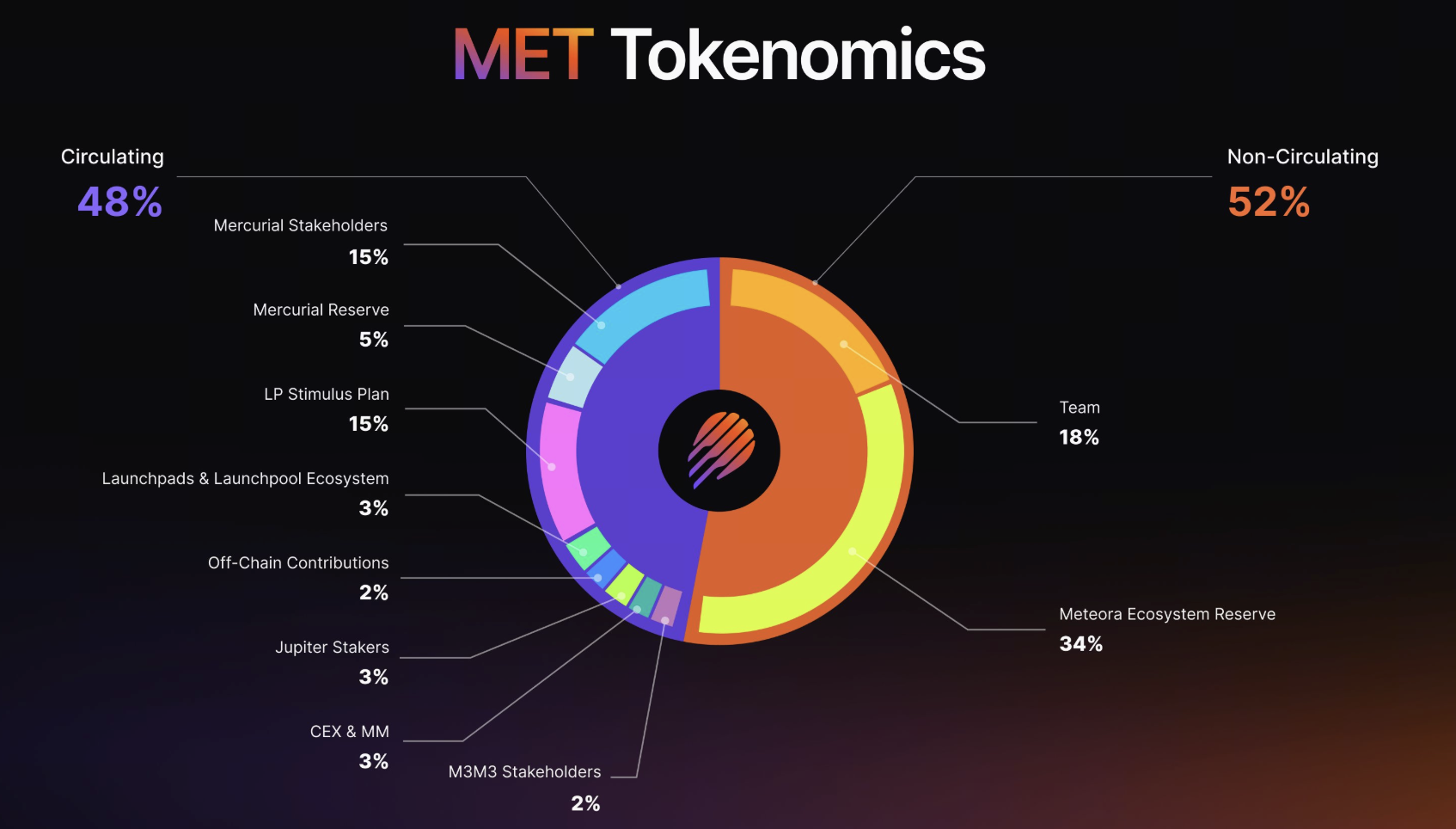

Tokenomics Overview

Meteora introduces a liquidity allocator model designed to avoid traditional airdrop sell pressure. Instead of distributing tokens directly, users receive MET–SOL liquidity positions, allowing them to earn trading fees from real economic activity.

- Total supply: 1,000,000,000 MET

- Initial circulating supply: 48% (480,000,000 MET)

Immediate Distribution (48%)

- Legacy stakeholders – 20%

- LP and user incentives – 15%

- Jupiter stakers – 3%

- Launchpad & Launchpool – 3%

- Advisors & off-chain contributors – 2%

- M3M3 participants – 2%

- CEX liquidity & market support – 3%

Long-Term Vesting (52%, linear over 6 years)

- Core team – 18%

- Treasury and reserves – 34%

(Image source: MeteoraAG)

This structure reflects a long-term and community-aligned distribution philosophy, ensuring incentives remain tied to the protocol’s ongoing growth and stability.

Token Utility

MET serves multiple roles within the Meteora ecosystem:

- Protocol governance – Token holders can vote on fee models, product decisions, and governance parameters.

- Liquidity incentives – LPs and vault participants earn MET rewards.

- Revenue distribution – A portion of protocol fees is used to repurchase and redistribute MET.

- Ecosystem development – Tokens support new project launches and partnership growth.

Conclusion

Meteora is not just another decentralized exchange—it is becoming the liquidity heart of Solana’s DeFi ecosystem. With DLMM’s precision-based market making, Dynamic Vaults’ automated yield generation, and a token model designed for sustainability and participation, Meteora is laying the foundation for a more efficient, composable, and long-lasting capital layer within the rapidly expanding Solana ecosystem.

As liquidity becomes increasingly dynamic in Web3, Meteora is positioning itself as one of the key systems powering the next generation of decentralized finance.

Related Articles

Brevis Project Analysis: Redefining Blockchain Infrastructure

Meteora ($MET): Revolutionizing Solana DeFi with Dynamic Liquidity

Limitless: The Next-Gen Prediction Market Platform

What is Kite AI? Redefining the Blockchain Foundation for the AI Economy

OpenMind Redefines the Robotics Future with an Open-Source AI-Native Robot OS